0001227654false00012276542025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2025

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-31921 | 36-3972986 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

9900 West 109th Street

Suite 100

Overland Park, KS 66210

(Address of principal executive offices)

(913) 344-9200

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | CMP | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition.

On February 10, 2025, Compass Minerals International, Inc. issued a press release regarding its fiscal 2025 first quarter financial results. A copy of the press release is attached as Exhibit 99.1.

The information contained in Item 2.02 and Exhibit 99.1 of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Exhibit Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| COMPASS MINERALS INTERNATIONAL, INC. |

| | |

Date: February 10, 2025 | By: | /s/ Peter Fjellman |

| | Peter Fjellman |

| | Title: Chief Financial Officer |

| | |

FOR IMMEDIATE RELEASE

Compass Minerals Reports Fiscal 2025 First-Quarter Results

OVERLAND PARK, Kan. (Feb. 10, 2025) - Compass Minerals (NYSE: CMP), a leading global provider of essential minerals, today reported fiscal 2025 first-quarter results.

Unless otherwise noted, it should be assumed that time periods referenced below are on a fiscal-year basis.

MANAGEMENT COMMENTARY

"This quarter we began to see results from our back-to-basics strategy and initiatives to reduce inventory volumes, improve our cost structure, and enhance profitability. Our efforts are expected to further strengthen our future financial performance, leveraging our exceptional set of unique assets that are virtually irreplaceable, enjoy durable competitive advantages and have strong leadership positions in their respective marketplaces," said Edward C. Dowling Jr., president and CEO.

"We made good progress on our goals of reducing our North American salt inventory volumes and improving the cost structure in our Plant Nutrition business. Despite a slow start to the winter deicing season, we saw salt inventory volumes decline 10% year over year through December and we still have a significant portion of the deicing season in front of us. We're well positioned to continue to reduce inventory levels in coming months, and our ability to toggle production at Goderich and Cote Blanche mines provides the flexibility to adjust production to meet increased demand next year if we see a stronger winter season. In Plant Nutrition, the efforts we are making to manage costs are taking root, which is enabling us to increase adjusted EBITDA guidance for the segment despite a decline in expected pricing due to softness in the MOP market. We will continue to focus on systems and processes where we can improve profitability and financial performance."

"We have a number of cost reduction initiatives underway to continue to drive down operating, capital, and general and administrative costs. Through operational and financial discipline and a commitment to continuous improvement, I'm confident we will improve the cash generation capability and unlock the intrinsic value embedded in our business."

Compass Minerals Reports First Quarter Earnings

Page 2 of 18

QUARTERLY FINANCIAL RESULTS

| | | | | | | | | | | | | | | | |

| | | | | | |

| (in millions, except per share data) | | Three Months Ended

Dec. 31, 2024 | | Three Months Ended

Dec. 31, 2023 | | |

| Revenue | | $ | 307.2 | | | $ | 341.7 | | | |

| Operating earnings (loss) | | 0.5 | | | (53.6) | | | |

Adjusted operating earnings* | | 1.4 | | | 24.8 | | | |

Adjusted EBITDA* | | 32.1 | | | 62.2 | | | |

| Net loss | | (23.6) | | | (75.3) | | | |

| Net loss per diluted share | | (0.57) | | | (1.83) | | | |

Adjusted net (loss) earnings* | | (22.9) | | | 3.1 | | | |

Adjusted net (loss) earnings* per diluted share | | (0.55) | | | 0.07 | | | |

*Non-GAAP financial measure. Reconciliations to the most directly comparable GAAP financial measure are provided in tables at the end of this press release.

SALT BUSINESS COMMENTARY

Reducing North American highway deicing salt inventory volumes has been a focus for Compass Minerals, which led to the company's decision to curtail production at Goderich mine and to a lesser extent Cote Blanche mine in 2024. The company is gaining traction on this initiative with North American highway deicing inventory volumes down 10% year over year despite a delayed start to the winter deicing season. The curtailment of production at Goderich mine resulted in higher cost production per ton, due to lower fixed cost absorption, being inventoried throughout 2024. As the company begins to sell this higher cost 2024 inventory, there is an impact to cost per ton that is reflected in the results below. Compass Minerals' view is the benefits to the company from reducing excess inventory, including harvesting working capital tied up inventory and contributing to a rebalancing of supply across the market, outweigh the transient production cost per ton impacts from curtailing production.

Winter weather was late in arriving in the first quarter, with minimal snow event activity occurring in the company's served markets in October and November. With customer inventories full following last year's exceptionally mild deicing season, the slow start to winter weather resulted in lower sales volumes during the first quarter of fiscal 2025 compared to prior year.

The factors above contributed to operating earnings declining 42% year over year to $29.4 million and adjusted EBITDA decreasing to $47.8 million, down 28% from the prior-year period. Adjusted EBITDA per ton declined 17% to $19.17.

Salt revenue totaled $242.2 million and was down 12% year over year, driven by a 13% year-over-year sales volume decline, partially offset by a 1% increase in average sales price. In the highway deicing business, the company's disciplined approach to pricing throughout the 2025 deicing bid season resulted in only a 1% decrease in average highway deicing selling price despite high inventory levels across the broader market following two mild winters,

Compass Minerals Reports First Quarter Earnings

Page 3 of 18

including one of the mildest winters in the company's served markets in nearly a quarter century. Sales volumes declined 12% due to a combination of low pre-fill activity and mild weather in October and November. Consumer and industrial (C&I) pricing rose 6% year over year to approximately $206 per ton, while sales volumes declined by 14%, primarily due to lower retail deicing demand reflecting the aforementioned mild weather across the company's served markets.

Distribution costs per ton decreased 2% year over year, while all-in product costs (defined at the segment level as sales to external customers less distribution costs less operating earnings) per ton rose 16% from the comparable prior-year quarter due to the production cost dynamics for 2024-produced salt described above.

PLANT NUTRITION BUSINESS COMMENTARY

In Plant Nutrition, the company has been working predominantly on improving the cost structure of the segment. In particular, the ongoing restoration of the pond complex at Ogden is expected to allow for an improvement in the consistency and grade of sulfate of potash (SOP) raw materials going to the plant. Recent results from our pond restoration activities suggest that these initiatives are having a positive impact on the ponds, which is a critical step in improving the Plant Nutrition business. Additional opportunities to improve productivity and increase process efficiencies are also being evaluated and pursued. Results from these actions are beginning to take effect, which is reflected in the quarterly results below.

Plant Nutrition revenue for the quarter totaled $61.4 million, up 24% year over year on strong sales volume. This was led by improved sales volumes, which grew by 27 thousand tons, a 36% improvement year over year. The average segment sales price for the quarter was down 9% year over year to approximately $603 per ton, reflecting supply conditions of potassium-based fertilizers globally. Per-unit distribution costs for the quarter decreased 2% year over year, largely due to increased sales rates absorbing fixed rail transport costs. All-in product costs per ton decreased 10% year over year.

Operating loss per ton in the Plant Nutrition business improved by 1% year over year. This, combined with the increase in sales volumes between periods, resulted in a slight increase in operating loss to $3.1 million for the quarter, compared to operating loss of $2.3 million in the prior-year quarter. Absolute adjusted EBITDA declined to $4.4 million versus $7.2 million last year due to a decline in per-unit adjusted EBITDA attributable to a decrease in DD&A per sales ton.

FORTRESS NORTH AMERICA COMMENTARY

Compass Minerals continues to evaluate various alternatives regarding the path forward for Fortress North America (Fortress). Discussions are ongoing with the U.S. Forest Service

Compass Minerals Reports First Quarter Earnings

Page 4 of 18

(USFS) regarding the evaluation and testing of the company's conditionally qualified technical grade orthophosphate-based aerial fire retardant, Qela.

CASH FLOW AND FINANCIAL POSITION

Net cash used in operating activities amounted to $4.1 million for the three months ended Dec. 31, 2024, compared to $52.3 million in the prior year. Despite a weaker start to the winter deicing season, reduction to inventory levels contributed to an improvement in working capital year over year.

Net cash used in investing activities was $22.2 million for the three months ended Dec. 31, 2024, down $27.1 million year over year principally driven by lower capital spending. Total capital spending for the three months ended Dec. 31, 2024 was $21.8 million.

Net cash provided by financing activities was $53.1 million for the three months ended Dec. 31, 2024, which included net borrowings of $57.5 million. In the prior year, net cash provided by financing activities reflected net borrowings of $108.1 million.

The company ended the quarter with $126.3 million of liquidity, comprised of $45.8 million in cash and cash equivalents and $80.5 million of availability under its $325 million revolving credit facility.

UPDATED FISCAL 2025 OUTLOOK

Given the quickly evolving dynamics surrounding potential tariffs on products imported to the United States from the company's Canadian operations, the company has not included any potential impacts related to tariffs into the guidance below. For fiscal 2025, any impact to adjusted EBITDA is expected to be negligible for the North American highway deicing business as salt for the 2024/2025 season has already been imported and deployed across the company's depot network. Compass Minerals is evaluating the potential impact to the C&I and Plant Nutrition businesses resulting from any potential tariff actions.

| | | | | |

| Salt Segment |

| 2025 Range1 |

Highway deicing sales volumes (thousands of tons) | 7,600 - 8,500 |

Consumer and industrial sales volumes (thousands of tons) | 1,800 - 1,950 |

Total salt sales volumes (thousands of tons) | 9,400 - 10,450 |

| |

Revenue (in millions) | $900 - $1,000 |

Adj. EBITDA (in millions) | $205 - $230 |

(1) Range for fiscal 2025 reflects the company's committed book of business for the period and assumes an average historical sales-to-commitment outcomes.

Compass Minerals Reports First Quarter Earnings

Page 5 of 18

As described above, mild winter weather for the first two months of the quarter contributed to a softer quarter than had been assumed in the company's original forecast. January saw strong winter weather across portions of the company's served markets and preliminary results for the month suggest the company may be able to partially offset the weather-driven shortfall from the first quarter.

| | | | | |

| Plant Nutrition Segment |

| 2025 Range |

Sales volumes (thousands of tons) | 295 - 315 |

Revenue (in millions) | $180 - $200 |

Adj. EBITDA (in millions) | $17 - $24 |

Plant Nutrition guidance is being increased to reflect revised market and operational conditions and assumptions that could impact the business, with expected pressure in global potash pricing being more than offset by higher sales expectations and lower forecasted production costs for the year.

| | | | | |

| Corporate |

| 2025 Range |

| Total1 |

Adj. EBITDA (in millions) | ($70) - ($61) |

(1) Includes $3 to $5 million in cash expenses related to Fortress.

Projected Corporate segment results in the table above, which are unchanged from the company's initial guidance provided in December of 2024, include corporate expenses in support of the company's core businesses, Fortress financial results, and the results of DeepStore, the company's records and management services business in the U.K.

| | | | | | | | | | | | | | |

| Total Compass Minerals |

| 2025 Adjusted EBITDA |

| Salt | Plant Nutrition | Corporate1 | Total |

Adj. EBITDA (in millions) | $205 - $230 | $17 - $24 | ($70) - ($61) | $152 - $193 |

| | | | |

| 2025 Capital Expenditures |

| | | | Total |

Capital expenditures (in millions) | | | | $75 - $85 |

(1) Includes financial contribution from DeepStore and Fortress.

Total planned capital expenditures for the company in fiscal 2025 have been reduced and are now expected to be within a range of $75 million to $85 million, down from a range of $100

Compass Minerals Reports First Quarter Earnings

Page 6 of 18

million to $110 million provided in the company's original guidance. The company is committed to managing capital expenditures so that they align with the cash generation performance of the business.

| | | | | |

| Other Assumptions |

| ($ in millions) | 2025 Range |

| Depreciation, depletion and amortization | $105 - $115 |

| Interest expense, net | $67 - $72 |

| Effective income tax rate (excl. valuation allowance) | 0% - 5% |

Guidance for the 2025 effective income tax rate reflects the income mix by country with income recognized in foreign jurisdictions offset by losses recognized in the U.S.

CONFERENCE CALL

Compass Minerals will discuss its results on a conference call tomorrow morning, Tuesday, Feb. 11, at 9:30 a.m. ET (8:30 a.m. CT). To access the conference call, please visit the company’s website at investors.compassminerals.com or dial 800-715-9871. Callers must provide the conference ID number 7896827. Outside of the U.S. and Canada, callers may dial 646-307-1963. Replays of the call will be available on the company’s website.

A supporting corporate presentation with 2025 first-quarter results is available at investors.compassminerals.com.

About Compass Minerals

Compass Minerals (NYSE: CMP) is a leading global provider of essential minerals focused on safely delivering where and when it matters to help solve nature’s challenges for customers and communities. The company’s salt products help keep roadways safe during winter weather and are used in numerous other consumer, industrial, chemical and agricultural applications. Its plant nutrition products help improve the quality and yield of crops, while supporting sustainable agriculture. Additionally, it is working to develop a long-term fire-retardant business. Compass Minerals operates 12 production and packaging facilities with nearly 1,900 employees throughout the U.S., Canada and the U.K. Visit compassminerals.com for more information about the company and its products.

| | | | | |

| Investor Contact | Media Contact |

| Brent Collins | Rick Axthelm |

| Vice President, Treasurer & Investor Relations | Chief Public Affairs and Sustainability Officer |

| +1.913.344.9111 | +1.913.344.9198 |

| InvestorRelations@compassminerals.com | MediaRelations@compassminerals.com |

Compass Minerals Reports First Quarter Earnings

Page 7 of 18

Forward-Looking Statements and Other Disclaimers

This press release may contain forward-looking statements, including, without limitation, statements about reduction of salt inventory volumes, improvement in Plant Nutrition costs, cash generation capability, the future of Fortress, including ongoing discussions with the USFS, the company's ability to meet or exceed its plan for January or the remainder of fiscal 2025, SOP prices, and the company's outlook for 2025, including its expectations regarding sales volumes, revenue, Adjusted EBITDA, depreciation, depletion, and amortization, interest expense, tax rates, and capital expenditures. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. The company uses words such as “may,” “would,” “could,” “should,” “will,” “likely,” “expect,” “anticipate,” “believe,” “intend,” “plan,” “forecast,” “outlook,” “project,” “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements or forward-looking information. These statements are based on the company’s current expectations and involve risks and uncertainties that could cause the company’s actual results to differ materially. The differences could be caused by a number of factors, including without limitation (i) weather conditions, (ii) inflation, the cost and availability of transportation for the distribution of the company’s products and foreign exchange rates, (iii) pressure on prices and impact from competitive products, (iv) any inability by the company to successfully implement its strategic priorities or its cost-saving or enterprise optimization initiatives, and (v) the risk that the company may not realize the expected financial or other benefits from its ownership of Fortress North America. For further information on these and other risks and uncertainties that may affect the company’s business, see the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the company’s Amended Annual Report on Form 10-K for the period ended Sept. 30, 2024, and its Quarterly Report on Form 10-Q for the quarter ended Dec. 31, 2024, filed or to be filed with the SEC, as well as the company's other SEC filings. The company undertakes no obligation to update any forward-looking statements made in this press release to reflect future events or developments, except as required by law. Because it is not possible to predict or identify all such factors, this list cannot be considered a complete set of all potential risks or uncertainties.

Non-GAAP Measures

In addition to using U.S. generally accepted accounting principles (“GAAP”) financial measures, management uses a variety of non-GAAP financial measures described below to evaluate the company’s and its operating segments’ performance. While the consolidated financial statements provide an understanding of the company’s overall results of operations, financial condition and cash flows, management analyzes components of the consolidated financial statements to identify certain trends and evaluate specific performance areas.

Management uses EBITDA, EBITDA adjusted for items which management believes are not indicative of the company’s ongoing operating performance (“Adjusted EBITDA”) and EBITDA margin to evaluate the operating performance of the company’s core business operations because its resource allocation, financing methods and cost of capital, and income tax positions are managed at a corporate level, apart from the activities of the operating segments, and the operating facilities are located in different taxing jurisdictions, which can cause considerable variation in net earnings. Management also uses adjusted

Compass Minerals Reports First Quarter Earnings

Page 8 of 18

operating earnings, adjusted operating margin, adjusted net earnings, and adjusted net earnings per diluted share, which eliminate the impact of certain items that management does not consider indicative of underlying operating performance. The presentation of these measures should not be construed as an inference that future results will be unaffected by unusual or non-recurring items. Management believes these non-GAAP financial measures provide management and investors with additional information that is helpful when evaluating underlying performance. EBITDA and Adjusted EBITDA exclude interest expense, income taxes and depreciation, depletion and amortization, each of which are an essential element of the company’s cost structure and cannot be eliminated. In addition, Adjusted EBITDA and Adjusted EBITDA margin exclude certain cash and non-cash items, including stock-based compensation, impairment charges and certain restructuring charges. Consequently, any measure that excludes these elements has material limitations. The non-GAAP financial measures used by management should not be considered in isolation or as a substitute for net earnings, operating earnings, cash flows or other financial data prepared in accordance with GAAP or as a measure of overall profitability or liquidity. These measures are not necessarily comparable to similarly titled measures of other companies due to potential inconsistencies in the method of calculation. The calculation of non-GAAP financial measures as used by management is set forth in the following tables. All margin numbers are defined as the relevant measure divided by sales. The company does not provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable financial measures calculated and reported in accordance with GAAP, as the company is unable to estimate significant non-recurring, unusual items and/or distinct non-core initiatives without unreasonable effort. The amounts and timing of these items are uncertain and could be material to the company’s results.

Adjusted operating earnings, adjusted operating earnings margin, adjusted net earnings (loss), and adjusted net earnings (loss) per diluted share are presented as supplemental measures of the company’s performance. Management believes these measures provide management and investors with additional information that is helpful when evaluating underlying performance and comparing results on a year-over-year normalized basis. These measures eliminate the impact of certain items that management does not consider indicative of underlying operating performance. These adjustments are itemized below. Adjusted net earnings (loss) per diluted share is adjusted net earnings (loss) divided by weighted average diluted shares outstanding. You are encouraged to evaluate the adjustments itemized above and the reasons management considers them appropriate for supplemental analysis. In evaluating these measures you should be aware that in the future the company may incur expenses that are the same as or similar to some of the adjustments presented below.

Compass Minerals Reports First Quarter Earnings

Page 9 of 18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Special Items Impacting the Three Months Ended Dec. 31, 2024 (unaudited, in millions, except per share data) |

| Item Description | | Segment | | Line Item | | Amount | | Tax Effect(1) | | After Tax | | EPS Impact |

| | | | | | | | | | | | |

| Product recall costs | | Salt | | Product cost and Other operating expense | | $ | 0.9 | | | $ | (0.2) | | | $ | 0.7 | | | $ | 0.02 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | | | | | | $ | 0.9 | | | $ | (0.2) | | | $ | 0.7 | | | $ | 0.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Special Items Impacting the Three Months Ended Dec. 31, 2023 (unaudited, in millions, except per share data) |

| Item Description | | Segment | | Line Item | | Amount | | Tax Effect(1) | | After Tax | | EPS Impact |

Restructuring charges(2) | | Corporate and Other | | Other operating expense | | $ | 2.5 | | | $ | — | | | $ | 2.5 | | | $ | 0.06 | |

| | | | | | | | | | | | |

Restructuring charges(2) | | Plant Nutrition | | Other operating expense | | 1.1 | | | — | | | 1.1 | | | 0.02 | |

| Impairments | | Corporate and Other | | Loss on impairments | | 74.8 | | | — | | | 74.8 | | | 1.82 | |

| | | | | | | | | | | | |

| Total | | | | | | $ | 78.4 | | | $ | — | | | $ | 78.4 | | | $ | 1.90 | |

(1) There were no substantial income tax benefits related to these items given the U.S. valuation allowances on deferred tax assets. Applicable product recall costs reflect an impact from Canadian taxes.

(2) Restructuring charges do not include certain reductions in stock-based compensation associated with forfeitures stemming from the restructuring activities.

| | | | | | | | | | | | | | | |

Reconciliation for Adjusted Operating Earnings (unaudited, in millions) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Operating earnings (loss) | $ | 0.5 | | | $ | (53.6) | | | | | |

| | | | | | | |

Product recall costs(1) | 0.9 | | | — | | | | | |

Restructuring charges(2) | — | | | 3.6 | | | | | |

Loss on impairments(2) | — | | | 74.8 | | | | | |

| | | | | | | |

| Adjusted operating earnings | $ | 1.4 | | | $ | 24.8 | | | | | |

| Sales | 307.2 | | | 341.7 | | | | | |

| Operating margin | 0.2 | % | | (15.7) | % | | | | |

| Adjusted operating margin | 0.5 | % | | 7.3 | % | | | | |

(1) The company recognized costs related to a recall related to food-grade salt produced at its Goderich Plant.

(2) In connection with the termination of the company's lithium development project, the company incurred severance and related charges for a reduction in workforce and a loss on impairment of long-lived assets, which were determined to be no longer probable of recovery.

Compass Minerals Reports First Quarter Earnings

Page 10 of 18

| | | | | | | | | | | | | | | |

Reconciliation for Adjusted Net (Loss) Earnings (unaudited, in millions) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Net loss | $ | (23.6) | | | $ | (75.3) | | | | | |

| | | | | | | |

Product recall costs(1) | 0.9 | | | — | | | | | |

Restructuring charges(2) | — | | | 3.6 | | | | | |

Loss on impairments(2) | — | | | 74.8 | | | | | |

| | | | | | | |

| | | | | | | |

| Income tax effect | (0.2) | | | — | | | | | |

| Adjusted net (loss) earnings | $ | (22.9) | | | $ | 3.1 | | | | | |

| | | | | | | |

| Net loss per diluted share | $ | (0.57) | | | $ | (1.83) | | | | | |

| Adjusted net (loss) earnings per diluted share | $ | (0.55) | | | $ | 0.07 | | | | | |

| Weighted-average common shares outstanding (in thousands): | | | | | | | |

| Diluted | 41,441 | | 41,205 | | | | |

(1) The company recognized costs related to a recall related to food-grade salt produced at its Goderich Plant. Charges for the three months ended Dec. 31, 2024 were $0.9 million ($0.7 million net of tax).

(2) In connection with the termination of the company's lithium development project, the company incurred severance and related charges for a reduction in workforce and a loss on impairment of long-lived assets, which were determined to be no longer probable of recovery.

Compass Minerals Reports First Quarter Earnings

Page 11 of 18

| | | | | | | | | | | | | | | |

Reconciliation for EBITDA and Adjusted EBITDA (unaudited, in millions) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Net loss | $ | (23.6) | | | $ | (75.3) | | | | | |

| Interest expense | 16.9 | | | 15.9 | | | | | |

| Income tax expense | 9.7 | | | 3.6 | | | | | |

| Depreciation, depletion and amortization | 26.8 | | | 25.5 | | | | | |

| EBITDA | 29.8 | | | (30.3) | | | | | |

| Adjustments to EBITDA: | | | | | | | |

| Stock-based compensation - non-cash | 3.9 | | | 11.9 | | | | | |

| Interest income | (0.4) | | | (0.4) | | | | | |

| (Gain) loss on foreign exchange | (5.2) | | | 1.9 | | | | | |

| | | | | | | |

| | | | | | | |

Product recall costs(1) | 0.9 | | | — | | | | | |

Restructuring charges(2) | — | | | 3.6 | | | | | |

Loss on impairments(2) | — | | | 74.8 | | | | | |

| | | | | | | |

| Other expense, net | 3.1 | | | 0.7 | | | | | |

| Adjusted EBITDA | $ | 32.1 | | | $ | 62.2 | | | | | |

| | | | | | | |

| | | | | | | |

(1) The company recognized costs related to a recall related to food-grade salt produced at its Goderich Plant.

(2) In connection with the termination of the company's lithium development project, the company incurred severance and related charges for a reduction in workforce and a loss on impairment of long-lived assets, which were determined to be no longer probable of recovery.

Compass Minerals Reports First Quarter Earnings

Page 12 of 18

| | | | | | | | | | | | | | | |

Salt Segment Performance (unaudited, in millions, except for sales volumes and prices per short ton) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Sales | $ | 242.2 | | | $ | 274.3 | | | | | |

| Operating earnings | $ | 29.4 | | | $ | 50.9 | | | | | |

| Operating margin | 12.1 | % | | 18.6 | % | | | | |

Adjusted operating earnings(1) | $ | 30.3 | | | $ | 50.9 | | | | | |

Adjusted operating margin(1) | 12.5 | % | | 18.6 | % | | | | |

EBITDA(1) | $ | 46.9 | | | $ | 66.1 | | | | | |

EBITDA(1) margin | 19.4 | % | | 24.1 | % | | | | |

Adjusted EBITDA(1) | $ | 47.8 | | | $ | 66.1 | | | | | |

Adjusted EBITDA(1) margin | 19.7 | % | | 24.1 | % | | | | |

| Sales volumes (in thousands of tons): | | | | | | | |

| Highway deicing | 1,987 | | | 2,266 | | | | | |

| Consumer and industrial | 506 | | | 589 | | | | | |

| Total Salt | 2,493 | | | 2,855 | | | | | |

| Average prices (per ton): | | | | | | | |

| Highway deicing | $ | 69.50 | | | $ | 70.36 | | | | | |

| Consumer and industrial | $ | 205.74 | | | $ | 194.94 | | | | | |

| Total Salt | $ | 97.16 | | | $ | 96.08 | | | | | |

(1) Non-GAAP financial measure. Reconciliations follow in these tables.

| | | | | | | | | | | | | | | |

Reconciliation for Salt Segment Adjusted Operating Earnings (unaudited, in millions) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Reported GAAP segment operating earnings | $ | 29.4 | | | $ | 50.9 | | | | | |

| | | | | | | |

Product recall costs(1) | 0.9 | | | — | | | | | |

| Segment adjusted operating earnings | $ | 30.3 | | | $ | 50.9 | | | | | |

| Segment sales | 242.2 | | | 274.3 | | | | | |

| Segment operating margin | 12.1 | % | | 18.6 | % | | | | |

| Segment adjusted operating margin | 12.5 | % | | 18.6 | % | | | | |

(1) The company incurred costs related to a product recall.

Compass Minerals Reports First Quarter Earnings

Page 13 of 18

| | | | | | | | | | | | | | | |

Reconciliation for Salt Segment EBITDA and Adjusted EBITDA (unaudited, in millions) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Reported GAAP segment operating earnings | $ | 29.4 | | | $ | 50.9 | | | | | |

| Depreciation, depletion and amortization | 17.5 | | | 15.2 | | | | | |

| Segment EBITDA | $ | 46.9 | | | $ | 66.1 | | | | | |

| | | | | | | |

Product recall costs(1) | 0.9 | | | — | | | | | |

| Segment adjusted EBITDA | $ | 47.8 | | | $ | 66.1 | | | | | |

| Segment sales | 242.2 | | | 274.3 | | | | | |

| Segment EBITDA margin | 19.4 | % | | 24.1 | % | | | | |

| Segment adjusted EBITDA margin | 19.7 | % | | 24.1 | % | | | | |

(1) The company incurred costs related to a product recall.

| | | | | | | | | | | | | | | |

Plant Nutrition Segment Performance (unaudited, dollars in millions, except for sales volumes and prices per short ton) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Sales | $ | 61.4 | | | $ | 49.7 | | | | | |

| Operating loss | $ | (3.1) | | | $ | (2.3) | | | | | |

| Operating margin | (5.0) | % | | (4.6) | % | | | | |

Adjusted operating loss(1) | $ | (3.1) | | | $ | (1.2) | | | | | |

Adjusted operating margin(1) | (5.0) | % | | (2.4) | % | | | | |

EBITDA(1) | $ | 4.4 | | | $ | 6.1 | | | | | |

EBITDA(1) margin | 7.2 | % | | 12.3 | % | | | | |

Adjusted EBITDA(1) | $ | 4.4 | | | $ | 7.2 | | | | | |

Adjusted EBITDA(1) margin | 7.2 | % | | 14.5 | % | | | | |

| Sales volumes (in thousands of tons) | 102 | | | 75 | | | | | |

| Average price (per ton) | $ | 602.86 | | | $ | 660.41 | | | | | |

(1) Non-GAAP financial measure. Reconciliations follow in these tables.

| | | | | | | | | | | | | | | |

Reconciliation for Plant Nutrition Segment Adjusted Operating Loss (unaudited, in millions) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Reported GAAP segment operating loss | $ | (3.1) | | | $ | (2.3) | | | | | |

Restructuring charges(1) | — | | | 1.1 | | | | | |

| | | | | | | |

| Segment adjusted operating loss | $ | (3.1) | | | $ | (1.2) | | | | | |

| Segment sales | 61.4 | | | 49.7 | | | | | |

| Segment operating margin | (5.0) | % | | (4.6) | % | | | | |

| Segment adjusted operating margin | (5.0) | % | | (2.4) | % | | | | |

(1) The company incurred severance and related charges related to a reduction of its workforce.

Compass Minerals Reports First Quarter Earnings

Page 14 of 18

| | | | | | | | | | | | | | | |

Reconciliation for Plant Nutrition Segment EBITDA and Adjusted EBITDA (unaudited, in millions) |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Reported GAAP segment operating loss | $ | (3.1) | | | $ | (2.3) | | | | | |

| Depreciation, depletion and amortization | 7.5 | | | 8.4 | | | | | |

| Segment EBITDA | $ | 4.4 | | | $ | 6.1 | | | | | |

Restructuring charges(1) | — | | | 1.1 | | | | | |

| | | | | | | |

| Segment adjusted EBITDA | $ | 4.4 | | | $ | 7.2 | | | | | |

| Segment sales | 61.4 | | | 49.7 | | | | | |

| Segment EBITDA margin | 7.2 | % | | 12.3 | % | | | | |

| Segment adjusted EBITDA margin | 7.2 | % | | 14.5 | % | | | | |

(1) The company incurred severance and related charges related to a reduction of its workforce.

Compass Minerals Reports First Quarter Earnings

Page 15 of 18

COMPASS MINERALS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in millions, except share and per-share data)

| | | | | | | | | | | | | | | |

| Three Months Ended

Dec. 31, | | |

| 2024 | | 2023 | | | | |

| Sales | $ | 307.2 | | | $ | 341.7 | | | | | |

| Shipping and handling cost | 80.6 | | | 91.3 | | | | | |

| Product cost | 192.3 | | | 179.3 | | | | | |

| Gross profit | 34.3 | | | 71.1 | | | | | |

| Selling, general and administrative expenses | 33.3 | | | 45.7 | | | | | |

| Loss on impairments | — | | | 74.8 | | | | | |

| Other operating expense | 0.5 | | | 4.2 | | | | | |

| Operating earnings (loss) | 0.5 | | | (53.6) | | | | | |

| Other (income) expense: | | | | | | | |

| Interest income | (0.4) | | | (0.4) | | | | | |

| Interest expense | 16.9 | | | 15.9 | | | | | |

| (Gain) loss on foreign exchange | (5.2) | | | 1.9 | | | | | |

| | | | | | | |

| | | | | | | |

| Other expense, net | 3.1 | | | 0.7 | | | | | |

| Loss before income taxes | (13.9) | | | (71.7) | | | | | |

| Income tax expense | 9.7 | | | 3.6 | | | | | |

| Net loss | $ | (23.6) | | | $ | (75.3) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic net loss per common share | $ | (0.57) | | | $ | (1.83) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted net loss per common share | $ | (0.57) | | | $ | (1.83) | | | | | |

Weighted-average common shares outstanding (in thousands):(1) | | | | | | | |

| Basic | 41,441 | | | 41,205 | | | | | |

| Diluted | 41,441 | | | 41,205 | | | | | |

(1)Weighted participating securities include RSUs and PSUs that receive non-forfeitable dividends and consist of 1,116,000 weighted participating securities for the three months ended Dec. 31, 2024, and 777,000 weighted participating securities for the three months ended Dec. 31, 2023.

Compass Minerals Reports First Quarter Earnings

Page 16 of 18

COMPASS MINERALS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in millions)

| | | | | | | | | | | |

| Dec. 31, | | Sept. 30, |

| 2024 | | 2024 |

| ASSETS |

| Cash and cash equivalents | $ | 45.8 | | | $ | 20.2 | |

| Receivables, net | 261.7 | | | 126.1 | |

| Inventories, net | 367.1 | | | 414.1 | |

| | | |

| Other current assets | 23.0 | | | 26.9 | |

| Property, plant and equipment, net | 778.6 | | | 806.5 | |

| | | |

| Intangible and other noncurrent assets | 244.7 | | | 246.3 | |

| Total assets | $ | 1,720.9 | | | $ | 1,640.1 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current portion of long-term debt | $ | 8.7 | | | $ | 7.5 | |

| | | |

| Other current liabilities | 286.1 | | | 209.5 | |

| Long-term debt, net of current portion | 965.7 | | | 910.0 | |

| Deferred income taxes and other noncurrent liabilities | 197.4 | | | 196.5 | |

| Total stockholders' equity | 263.0 | | | 316.6 | |

| Total liabilities and stockholders' equity | $ | 1,720.9 | | | $ | 1,640.1 | |

Compass Minerals Reports First Quarter Earnings

Page 17 of 18

| | | | | | | | | | | |

| COMPASS MINERALS INTERNATIONAL, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (unaudited, in millions) |

| Three Months Ended Dec. 31, |

| 2024 | | 2023 |

Net cash used in operating activities | $ | (4.1) | | | $ | (52.3) | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (21.8) | | | (48.6) | |

| | | |

| | | |

| | | |

| Other, net | (0.4) | | | (0.7) | |

| | | |

| Net cash used in investing activities | (22.2) | | | (49.3) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from revolving credit facility borrowings | 140.3 | | | 102.4 | |

| Principal payments on revolving credit facility borrowings | (100.8) | | | (31.5) | |

| Proceeds from issuance of long-term debt | 19.6 | | | 38.4 | |

| Principal payments on long-term debt | (1.6) | | | (1.2) | |

| | | |

| | | |

| Dividends paid | — | | | (6.4) | |

| Deferred financing costs | (2.4) | | | — | |

| | | |

| Shares withheld to satisfy employee tax obligations | (0.4) | | | (0.8) | |

| Other, net | (1.6) | | | — | |

| | | |

| Net cash provided by financing activities | 53.1 | | | 100.9 | |

| Effect of exchange rate changes on cash and cash equivalents | (1.2) | | | 0.3 | |

| Net change in cash and cash equivalents | 25.6 | | | (0.4) | |

| Cash and cash equivalents, beginning of the year | 20.2 | | | 38.7 | |

| | | |

| Cash and cash equivalents, end of period | $ | 45.8 | | | $ | 38.3 | |

| | | |

| | | |

Compass Minerals Reports First Quarter Earnings

Page 18 of 18

COMPASS MINERALS INTERNATIONAL, INC.

SEGMENT INFORMATION

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended Dec. 31, 2024 | | Salt | | Plant

Nutrition | | Corporate

& Other(1) | | Total |

| Sales to external customers | | $ | 242.2 | | | $ | 61.4 | | | $ | 3.6 | | | $ | 307.2 | |

| Intersegment sales | | — | | | 3.2 | | | (3.2) | | | — | |

| Shipping and handling cost | | 71.3 | | | 9.3 | | | — | | | 80.6 | |

Operating earnings (loss)(2) | | 29.4 | | | (3.1) | | | (25.8) | | | 0.5 | |

| Depreciation, depletion and amortization | | 17.5 | | | 7.5 | | | 1.8 | | | 26.8 | |

| Total assets (as of end of period) | | 1,092.4 | | | 388.1 | | | 240.4 | | | 1,720.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended Dec. 31, 2023 | | Salt | | Plant

Nutrition | | Corporate

& Other(1) | | Total |

| Sales to external customers | | $ | 274.3 | | | $ | 49.7 | | | $ | 17.7 | | | $ | 341.7 | |

| Intersegment sales | | — | | | 3.1 | | | (3.1) | | | — | |

| Shipping and handling cost | | 83.7 | | | 7.0 | | | 0.6 | | | 91.3 | |

Operating earnings (loss)(2)(3) | | 50.9 | | | (2.3) | | | (102.2) | | | (53.6) | |

| Depreciation, depletion and amortization | | 15.2 | | | 8.4 | | | 1.9 | | | 25.5 | |

| Total assets (as of end of period) | | 1,056.6 | | | 469.7 | | | 278.9 | | | 1,805.2 | |

(1) Corporate and other includes corporate entities, records management operations, the Fortress fire retardant business, equity method investments and other incidental operations and eliminations. Operating earnings (loss) for corporate and other includes indirect corporate overhead, including costs for general corporate governance and oversight, as well as costs for the human resources, information technology, legal and finance functions.

(2) Corporate operating results include costs related to a product recall of $0.9 million for the three months ended Dec. 31, 2024. Corporate operating results were also impacted by a net loss of $1.6 million related to an increase in the valuation of the Fortress contingent consideration for the three months ended Dec. 31, 2023.

(3) As a result of the company’s decision to cease the pursuit of the lithium development, the company recognized an impairment of long-lived assets of $74.8 million. The company also recognized restructuring costs of $3.6 million, which impacted operating results for the three months ended Dec. 31, 2023.

v3.25.0.1

Cover Page

|

Feb. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 10, 2025

|

| Entity Registrant Name |

Compass Minerals International, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31921

|

| Entity Tax Identification Number |

36-3972986

|

| Entity Address, Address Line One |

9900 West 109th Street

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Overland Park

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66210

|

| City Area Code |

913

|

| Local Phone Number |

344-9200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

CMP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001227654

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

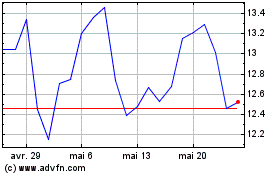

Compass Minerals (NYSE:CMP)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Compass Minerals (NYSE:CMP)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025