0000790051false00007900512024-12-182024-12-180000790051us-gaap:CommonStockMember2024-12-182024-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

FORM 8-K

_____________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

_____________________________________________________

Date of Report (Date of earliest event reported): December 18, 2024

www.carlisle.com

CARLISLE COMPANIES INCORPORATED

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-09278 | | 31-1168055 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

16430 North Scottsdale Road, Suite 400, Scottsdale, Arizona 85254

(Address of principal executive offices, including zip code)

480-781-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common stock, $1 par value | | CSL | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.01. Completion of Acquisition or Disposition of Assets.

On December 18, 2024, Carlisle Companies Incorporated, a Delaware corporation (the “Company”), completed the transaction contemplated by the Securities Purchase Agreement, dated as of October 17, 2024 (the “Agreement”), by and between the Company, PFB Intermediate, LLC, a Delaware limited liability company (the “Seller”), PFB Holdco, Inc., a Delaware corporation (“PFB”), and, solely for purposes of Section 6.6 of the Agreement, PFB Custom Homes Group, LLC, a Delaware limited liability company.

Pursuant to the Agreement, the Company acquired from the Seller all of the equity interests of PFB in exchange for cash consideration in the amount of $259,547,682, subject to certain customary purchase price adjustments.

The material terms of the Agreement were previously reported in Item 1.01 of the Current Report on Form 8-K filed on October 18, 2024 with the U.S. Securities and Exchange Commission.

Item 7.01. Regulation FD Disclosure.

On December 18, 2024, the Company issued a press release announcing the closing of the transaction contemplated by the Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”).

The information in this Item 7.01 of this Report, including Exhibit 99.1, is being furnished herewith and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | | | | |

| Exhibit Number | | Exhibit Title |

| | | | Securities Purchase Agreement, dated as of October 17, 2024, by and between Carlisle Companies Incorporated, PFB Intermediate, LLC, PFB Holdco, LLC and PFB Custom Homes Group, LLC (incorporated by reference to Exhibit 2.1 to Carlisle Companies Incorporated’s Current Report on Form 8-K filed October 18, 2024 (File No. 001-09278)) |

| | | | Press release of Carlisle Companies Incorporated, dated December 18, 2024 |

| 104 | | | Cover page interactive data file (embedded within the inline XBRL document) |

| * | Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule will be furnished supplementally to the U.S. Securities and Exchange Commission upon request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | CARLISLE COMPANIES INCORPORATED |

| | | |

| Date: | December 18, 2024 | By: | /s/ Kevin P. Zdimal |

| | | Kevin P. Zdimal |

| | | Vice President and Chief Financial Officer |

12/18/24

Carlisle Companies Completes Purchase of Plasti-Fab

SCOTTSDALE, ARIZONA, December 18, 2024 - Carlisle Companies Incorporated (NYSE: CSL) today announced that it has completed the previously announced purchase of the expanded polystyrene “EPS” insulation segment of PFB Holdco, Inc., a portfolio company of The Riverside Company, composed of the Plasti-Fab and Insulspan brands (collectively referred to as “Plasti-Fab”) for $259.5 million in cash.

Plasti-Fab, headquartered in Calgary, Alberta, is a leading vertically integrated provider of EPS insulation products in Canada and the Midwestern United States with eight manufacturing locations across Canada and three in the United States serving the commercial, residential, and infrastructure construction markets.

The acquisition of Plasti-Fab is consistent with Carlisle’s Vision 2030 strategy, leveraging Carlisle’s mergers and acquisitions “M&A” engine and fulfilling its four core M&A tenets including an embedded organic growth story, identified hard cost synergies, a strong and experienced management team, and an ability to drive integration success utilizing the Carlisle M&A playbook.

About Carlisle Companies Incorporated

Carlisle Companies Incorporated is a leading supplier of innovative building envelope products and solutions for more energy efficient buildings. Through its building products businesses – Carlisle Construction Materials (“CCM”) and Carlisle Weatherproofing Technologies (“CWT”) – and family of leading brands, Carlisle delivers innovative, labor reducing and environmentally responsible products and solutions to customers through the Carlisle Experience. Carlisle is committed to generating superior shareholder returns and maintaining a balanced capital deployment approach, including investments in our businesses, strategic acquisitions, share repurchases and continued dividend increases. Leveraging its culture of continuous improvement as embodied in the Carlisle Operating System (“COS”), Carlisle has committed to achieving net-zero greenhouse gas emissions by 2050.

Contact: Mehul Patel

Vice President, Investor Relations

Carlisle Companies Incorporated

(310) 592-9668

mpatel@carlisle.com

v3.24.4

Cover Page Statement

|

Dec. 18, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 18, 2024

|

| Entity Registrant Name |

CARLISLE COMPANIES INCORPORATED

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-09278

|

| Entity Tax Identification Number |

31-1168055

|

| City Area Code |

480

|

| Local Phone Number |

781-5000

|

| Entity Address, Address Line One |

16430 North Scottsdale Road

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Scottsdale

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85254

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000790051

|

| Amendment Flag |

false

|

| Common stock, $1 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, $1 par value

|

| Trading Symbol |

CSL

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementEquityComponentsAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

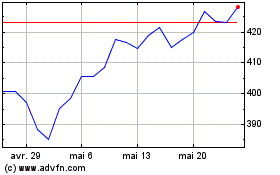

Carlisle Companies (NYSE:CSL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Carlisle Companies (NYSE:CSL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025