- Net loss of $37.2 million or $(0.58) per share, adjusted net

loss of $59.3 million or $(0.92) per share, adjusted EBITDA of

$107.5 million

- Since the end of 1Q' 2024, we have successfully progressed

our SOTP strategy:

Delek US (DK):

- Entered into an agreement to sell our retail assets for $385

million

- Signed a fuel supply agreement with FEMSA for ten

years

Delek Logistics (DKL):

- DK & DKL agreed to amend and extend intercompany

contracts for a period of up to seven years

- DK executed a drop-down of Wink to Webster ("W2W") into

DKL

- DKL signed an agreement to acquire H2O Midstream, further

adding to its third party cash flows

- DKL announced the final investment decision (FID) on a new

gas processing plant

- Paid $16.0 million of dividends and increased regular

quarterly dividend to $0.255 per share in July

Delek US Holdings, Inc. (NYSE: DK) (“Delek US”, "Company") today

announced financial results for its second quarter ended June 30,

2024.

“We are excited about the significant progress we have made on

our `Sum of the Parts' efforts,” said Avigal Soreq, President and

Chief Executive Officer of Delek US. “We concluded the strategic

review of our retail assets. Following the review, we have

announced the sale of our retail business to FEMSA. Delek US &

Delek Logistics executed on `win-win' contract amendments and

extensions as well as drop-down of our interest in the Wink to

Webster pipeline. A combination of our retail sale, drop-down of

our interest in the Wink to Webster pipeline, and amendments &

extensions of contracts between DK & DKL will allow for a cash

infusion of over $500mm in DK with little to no loss in standalone

DK EBITDA. At the same time, a combination of contract

extensions, acquisition of Wink to Webster interest, new processing

plant and acquisition of H2O Midstream will enable DKL to continue

to have among the best combination of cash flow growth and

distributions amongst its peers.”

"Looking ahead, we will continue to execute on our priorities of

running safe and reliable operations, making further progress on

our strategic initiatives, and delivering shareholder value while

maintaining our financial strength and flexibility,” Soreq

concluded.

For the intercompany transactions, Barclays was the exclusive

financial advisor and Bradley Arant Boult Cummings LLP was the

legal advisor to Delek US.

Delek US Results

Three Months Ended June

30,

Six Months Ended June

30,

($ in millions, except per share

data)

2024

2023

2024

2023

Net (loss) income attributable to Delek

US

$

(37.2

)

$

(8.3

)

$

(69.8

)

$

56.0

Diluted (loss) income per share

$

(0.58

)

$

(0.13

)

$

(1.09

)

$

0.84

Adjusted net (loss) income

$

(59.3

)

$

65.2

$

(85.5

)

$

157.9

Adjusted net (loss) income per share

$

(0.92

)

$

1.00

$

(1.33

)

$

2.36

Adjusted EBITDA

$

107.5

$

259.4

$

266.2

$

544.0

Refining Segment

The refining segment Adjusted EBITDA was $42.1 million in the

second quarter 2024 compared with $212.4 million in the same

quarter last year, which reflects other inventory impacts of $14.6

million and $96.5 million for second quarter 2024 and 2023,

respectively. The decrease over 2023 is primarily due to lower

refining crack spreads, partially offset by higher sales volume.

During the second quarter 2024, Delek US's benchmark crack spreads

were down an average of 21.1% from prior-year levels.

Logistics Segment

The logistics segment Adjusted EBITDA in the second quarter 2024

was $100.6 million compared with $90.9 million in the prior year

quarter. The increase over last year's second quarter was driven by

strong contributions from Delaware Gathering systems in addition to

annual rate increases.

Retail Segment

For the second quarter 2024, Adjusted EBITDA for the retail

segment was $12.4 million compared with $15.0 million in the

prior-year period. The decrease over 2023 is primarily due to

decreased sales as a result of remodeling activities and decreased

margins.

Corporate and Other

Activity

Adjusted EBITDA from Corporate, Other and Eliminations was a

loss of $(47.6) million in the second quarter 2024 compared with a

loss of $(58.9) million in the prior-year period. The decreased

losses were driven by lower employee related expenses.

Shareholder

Distributions

On July 31, 2024, the Board of Directors approved the regular

quarterly dividend of $0.255 per share that will be paid on August

19, 2024 to shareholders of record on August 12, 2024.

Liquidity

As of June 30, 2024, Delek US had a cash balance of $657.9

million and total consolidated long-term debt of $2,461.7 million,

resulting in net debt of $1,803.8 million. As of June 30, 2024,

Delek Logistics Partners, LP (NYSE: DKL) ("Delek Logistics") had

$5.1 million of cash and $1,566.3 million of total long-term debt,

which are included in the consolidated amounts on Delek US' balance

sheet. Excluding Delek Logistics, Delek US had $652.8 million in

cash and $895.4 million of long-term debt, or a $242.6 million net

debt position.

Second Quarter 2024 Results |

Conference Call Information

Delek US will hold a conference call to discuss its second

quarter 2024 results on Tuesday, August 6, 2024 at 11:00 a.m.

Central Time. Investors will have the opportunity to listen to the

conference call live by going to www.DelekUS.com and clicking on

the Investor Relations tab. Participants are encouraged to register

at least 15 minutes early to download and install any necessary

software. Presentation materials accompanying the call will be

available on the investor relations tab of the Delek US website

approximately ten minutes prior to the start of the call. For those

who cannot listen to the live broadcast, the online replay will be

available on the website for 90 days.

Investors may also wish to listen to Delek Logistics’ (NYSE:

DKL) second quarter 2024 earnings conference call that will be held

on Tuesday August 6, 2024 at 11:30 a.m. Central Time and review

Delek Logistics’ earnings press release. Market trends and

information disclosed by Delek Logistics may be relevant to the

logistics segment reported by Delek US. Both a replay of the

conference call and press release for Delek Logistics will be

available online at www.deleklogistics.com.

About Delek US Holdings,

Inc.

Delek US Holdings, Inc. is a diversified downstream energy

company with assets in petroleum refining, logistics, pipelines,

renewable fuels and convenience store retailing. The refining

assets consist primarily of refineries operated in Tyler and Big

Spring, Texas, El Dorado, Arkansas and Krotz Springs, Louisiana

with a combined nameplate crude throughput capacity of 302,000

barrels per day. Pipeline assets include an ownership interest in

the 650-mile Wink to Webster long-haul crude oil pipeline. The

convenience store retail segment operates approximately 250

convenience stores in West Texas and New Mexico.

The logistics operations include Delek Logistics Partners, LP

(NYSE: DKL). Delek Logistics Partners, LP is a growth-oriented

master limited partnership focused on owning and operating

midstream energy infrastructure assets. Delek US Holdings, Inc. and

its subsidiaries owned approximately 72.6% (including the general

partner interest) of Delek Logistics Partners, LP at June 30,

2024.

Safe Harbor Provisions Regarding

Forward-Looking Statements

This press release contains forward-looking statements that are

based upon current expectations and involve a number of risks and

uncertainties. Statements concerning current estimates,

expectations and projections about future results, performance,

prospects, opportunities, plans, actions and events and other

statements, concerns, or matters that are not historical facts are

“forward-looking statements,” as that term is defined under the

federal securities laws. These statements contain words such as

“possible,” “believe,” “should,” “could,” “would,” “predict,”

“plan,” “estimate,” “intend,” “may,” “anticipate,” “will,” “if",

“potential,” “expect” or similar expressions, as well as statements

in the future tense. These forward-looking statements include, but

are not limited to, statements regarding throughput at the

Company’s refineries; crude oil prices, discounts and quality and

our ability to benefit therefrom; cost reductions; growth;

scheduled turnaround activity; projected capital expenditures and

investments into our business; liquidity and EBITDA impacts from

strategic and intercompany transactions; the performance and

execution of our midstream growth initiatives, including the

Permian Gathering System, the Red River joint venture and the Wink

to Webster long-haul crude oil pipeline, and the flexibility,

benefits and the expected returns therefrom; projected benefits of

the Delaware Gathering Acquisition, renewable identification

numbers ("RINs") waivers and tax credits and the value and benefit

therefrom; cash and liquidity; emissions reductions; opportunities

and anticipated performance and financial position.

Investors are cautioned that the following important factors,

among others, may affect these forward-looking statements. These

factors include, but are not limited to: uncertainty related to

timing and amount of future share repurchases and dividend

payments; risks and uncertainties with respect to the quantities

and costs of crude oil we are able to obtain and the price of the

refined petroleum products we ultimately sell, uncertainties

regarding future decisions by the Organization of Petroleum

Exporting Countries ("OPEC") regarding production and pricing

disputes between OPEC members and Russia; risks and uncertainties

related to the integration by Delek Logistics of the Delaware

Gathering business following its acquisition; Delek US' ability to

realize cost reductions; risks related to Delek US’ exposure to

Permian Basin crude oil, such as supply, pricing, gathering,

production and transportation capacity; gains and losses from

derivative instruments; risks associated with acquisitions and

dispositions; risks and uncertainties with respect to the timing

for closing and the possible benefits of the retail and H20

Midstream transactions; acquired assets may suffer a diminishment

in fair value as a result of which we may need to record a

write-down or impairment in carrying value of the asset; the

possibility of litigation challenging renewable fuel standard

waivers; changes in the scope, costs, and/or timing of capital and

maintenance projects; the ability to grow the Permian Gathering

System; the ability of the Red River joint venture to complete the

expansion project to increase the Red River pipeline capacity;

operating hazards inherent in transporting, storing and processing

crude oil and intermediate and finished petroleum products; our

competitive position and the effects of competition; the projected

growth of the industries in which we operate; general economic and

business conditions affecting the geographic areas in which we

operate; and other risks described in Delek US’ filings with the

United States Securities and Exchange Commission (the “SEC”),

including risks disclosed in our Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q and other filings and reports with

the SEC.

Forward-looking statements should not be read as a guarantee of

future performance or results and will not be accurate indications

of the times at, or by, which such performance or results will be

achieved. Forward-looking information is based on information

available at the time and/or management's good faith belief with

respect to future events, and is subject to risks and uncertainties

that could cause actual performance or results to differ materially

from those expressed in the statements. Delek US undertakes no

obligation to update or revise any such forward-looking statements

to reflect events or circumstances that occur, or which Delek US

becomes aware of, after the date hereof, except as required by

applicable law or regulation.

Non-GAAP Disclosures:

Our management uses certain “non-GAAP” operational measures to

evaluate our operating segment performance and non-GAAP financial

measures to evaluate past performance and prospects for the future

to supplement our financial information presented in accordance

with United States ("U.S.") Generally Accepted Accounting

Principles ("GAAP"). These financial and operational non-GAAP

measures are important factors in assessing our operating results

and profitability and include:

- Adjusting items - certain identified infrequently occurring

items, non-cash items, and items that are not attributable to or

indicative of our on-going operations or that may obscure our

underlying results and trends;

- Adjusted net income (loss) - calculated as net income (loss)

attributable to Delek US adjusted for relevant Adjusting items

recorded during the period;

- Adjusted net income (loss) per share - calculated as Adjusted

net income (loss) divided by weighted average shares outstanding,

assuming dilution, as adjusted for any anti-dilutive instruments

that may not be permitted for consideration in GAAP earnings per

share calculations but that nonetheless favorably impact

dilution;

- Earnings before interest, taxes, depreciation and amortization

("EBITDA") - calculated as net income (loss) attributable to Delek

US adjusted to add back interest expense, income tax expense,

depreciation and amortization;

- Adjusted EBITDA - calculated as EBITDA adjusted for the

relevant identified Adjusting items in Adjusted net income (loss)

that do not relate to interest expense, income tax expense,

depreciation or amortization, and adjusted to include income (loss)

attributable to non-controlling interests;

- Refining margin - calculated as gross margin (which we define

as sales minus cost of sales) adjusted for operating expenses and

depreciation and amortization included in cost of sales;

- Adjusted refining margin - calculated as refining margin

adjusted for other inventory impacts, net inventory LCM valuation

loss (benefit) and unrealized hedging (gain) loss;

- Refining production margin - calculated based on the regional

market sales price of refined products produced, less allocated

transportation, Renewable Fuel Standard volume obligation and

associated feedstock costs. This measure reflects the economics of

each refinery exclusive of the financial impact of inventory price

risk mitigation programs and marketing uplift strategies;

- Refining production margin per throughput barrel - calculated

as refining production margin divided by our average refining

throughput in barrels per day (excluding purchased barrels)

multiplied by 1,000 and multiplied by the number of days in the

period; and

- Net debt - calculated as long-term debt including both current

and non-current portions (the most comparable GAAP measure) less

cash and cash equivalents as of a specific balance sheet date.

We believe these non-GAAP operational and financial measures are

useful to investors, lenders, ratings agencies and analysts to

assess our ongoing performance because, when reconciled to their

most comparable GAAP financial measure, they provide improved

relevant comparability between periods, to peers or to market

metrics through the inclusion of retroactive regulatory or other

adjustments as if they had occurred in the prior periods they

relate to, or through the exclusion of certain items that we

believe are not indicative of our core operating performance and

that may obscure our underlying results and trends. “Net debt,”

also a non-GAAP financial measure, is an important measure to

monitor leverage and evaluate the balance sheet.

Non-GAAP measures have important limitations as analytical

tools, because they exclude some, but not all, items that affect

net earnings and operating income. These measures should not be

considered substitutes for their most directly comparable U.S. GAAP

financial measures. Additionally, because Adjusted net income or

loss, Adjusted net income or loss per share, EBITDA and Adjusted

EBITDA, Adjusted Refining Margin and Refining Production Margin or

any of our other identified non-GAAP measures may be defined

differently by other companies in its industry, Delek US'

definition may not be comparable to similarly titled measures of

other companies. See the accompanying tables in this earnings

release for a reconciliation of these non-GAAP measures to the most

directly comparable GAAP measures.

Delek US Holdings, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

($ in millions, except share and per

share data)

June 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

657.9

$

822.2

Accounts receivable, net

771.4

783.7

Inventories, net of inventory valuation

reserves

1,010.4

981.9

Other current assets

61.2

78.2

Total current assets

2,500.9

2,666.0

Property, plant and equipment:

Property, plant and equipment

4,799.4

4,690.7

Less: accumulated depreciation

(2,013.6

)

(1,845.5

)

Property, plant and equipment, net

2,785.8

2,845.2

Operating lease right-of-use assets

133.5

148.2

Goodwill

729.4

729.4

Other intangibles, net

284.3

296.2

Equity method investments

386.9

360.7

Other non-current assets

122.7

126.1

Total assets

$

6,943.5

$

7,171.8

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

1,861.4

$

1,814.3

Current portion of long-term debt

9.5

44.5

Current portion of obligation under

Inventory Intermediation Agreement

—

0.4

Current portion of operating lease

liabilities

51.0

54.7

Accrued expenses and other current

liabilities

642.9

771.2

Total current liabilities

2,564.8

2,685.1

Non-current liabilities:

Long-term debt, net of current portion

2,452.2

2,555.3

Obligation under Inventory Intermediation

Agreement

472.2

407.2

Environmental liabilities, net of current

portion

32.8

110.9

Asset retirement obligations

26.2

43.3

Deferred tax liabilities

262.1

264.1

Operating lease liabilities, net of

current portion

96.0

111.2

Other non-current liabilities

54.4

35.0

Total non-current liabilities

3,395.9

3,527.0

Stockholders’ equity:

Preferred stock, $0.01 par value,

10,000,000 shares authorized, no shares issued and outstanding

—

—

Common stock, $0.01 par value, 110,000,000

shares authorized, 82,085,570 shares and 81,539,871 shares issued

at June 30, 2024 and December 31, 2023, respectively

0.8

0.8

Additional paid-in capital

1,175.8

1,113.6

Accumulated other comprehensive loss

(4.8

)

(4.8

)

Treasury stock, 17,575,527 shares, at

cost, at June 30, 2024 and December 31, 2023, respectively

(694.1

)

(694.1

)

Retained earnings

328.1

430.0

Non-controlling interests in

subsidiaries

177.0

114.2

Total stockholders’ equity

982.8

959.7

Total liabilities and stockholders’

equity

$

6,943.5

$

7,171.8

Delek US Holdings, Inc.

Condensed Consolidated Statements of

Income (Unaudited)

($ in millions, except share and per

share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenues

$

3,421.7

$

4,195.6

$

6,649.3

$

8,119.9

Cost of sales:

Cost of materials and other

3,099.4

3,766.6

5,896.7

7,206.2

Operating expenses (excluding depreciation

and amortization presented below)

185.1

188.7

398.9

359.5

Depreciation and amortization

80.7

82.6

167.1

159.4

Total cost of sales

3,365.2

4,037.9

6,462.7

7,725.1

Operating expenses related to retail and

wholesale business (excluding depreciation and amortization

presented below)

26.3

31.1

52.1

58.1

General and administrative expenses

63.1

75.8

127.5

147.3

Depreciation and amortization

11.4

6.8

20.2

13.4

Asset impairment

22.1

—

22.1

—

Other operating income, net

(79.9

)

(6.1

)

(81.5

)

(16.9

)

Total operating costs and expenses

3,408.2

4,145.5

6,603.1

7,927.0

Operating income

13.5

50.1

46.2

192.9

Interest expense, net

77.7

80.4

165.4

156.9

Income from equity method investments

(30.4

)

(25.5

)

(52.3

)

(40.1

)

Other expense (income), net

—

0.5

(0.7

)

(6.6

)

Total non-operating expense, net

47.3

55.4

112.4

110.2

(Loss) income before income tax (benefit)

expense

(33.8

)

(5.3

)

(66.2

)

82.7

Income tax (benefit) expense

(7.7

)

(3.8

)

(14.9

)

12.0

Net (loss) income

(26.1

)

(1.5

)

(51.3

)

70.7

Net income attributed to non-controlling

interests

11.1

6.8

18.5

14.7

Net (loss) income attributable to

Delek

$

(37.2

)

$

(8.3

)

$

(69.8

)

$

56.0

Basic (loss) income per share

$

(0.58

)

$

(0.13

)

$

(1.09

)

$

0.84

Diluted (loss) income per share

$

(0.58

)

$

(0.13

)

$

(1.09

)

$

0.84

Weighted average common shares

outstanding:

Basic

64,213,899

65,773,609

64,117,943

66,359,537

Diluted

64,213,899

65,773,609

64,117,943

66,835,322

Condensed Cash Flow Data (Unaudited)

($ in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cash flows from operating

activities:

Net cash (used in) provided by operating

activities

$

(48.4

)

$

95.1

$

118.3

$

490.2

Cash flows from investing

activities:

Net cash used in investing activities

(62.5

)

(57.8

)

(104.1

)

(279.9

)

Cash flows from financing

activities:

Net cash provided by (used in) financing

activities

15.4

(80.7

)

(178.5

)

(230.0

)

Net decrease in cash and cash

equivalents

(95.5

)

(43.4

)

(164.3

)

(19.7

)

Cash and cash equivalents at the beginning

of the period

753.4

865.0

822.2

841.3

Cash and cash equivalents at the end of

the period

$

657.9

$

821.6

$

657.9

$

821.6

Significant Transactions During the Quarter Impacting

Results:

Restructuring Costs

In 2022, we announced that we are progressing a business

transformation focused on enterprise-wide opportunities to improve

the efficiency of our cost structure. For the second quarter 2024,

we recorded restructuring costs totaling $22.6 million ($17.5

million after-tax) associated with our business transformation. The

second quarter 2024 included a $22.1 million impairment related to

the decision to temporary idle the Crossett, Arkansas, Cleburne,

Texas and New Albany, Mississippi biodiesel facilities, while we

explore viable and sustainable alternatives. Our decision to idle

these facilities was driven by the decline in the overall biodiesel

market and aligns with our continued operational and cost

optimization efforts. Restructuring costs of $22.1 million are

recorded in asset impairment, $0.1 million are recorded in general

and administrative expenses and $0.4 million are included in

operating expenses in our consolidated statements of income.

Insurance and Settlement Recoveries

During the second quarter 2024, we received insurance and third

party recoveries related to the fire events that occurred during

2021 and 2022, which unfavorably impacted our results in 2021 and

2022. For the three months ended June 30, 2024, we have recognized

an additional $14.5 million ($11.2 million after-tax) of property

recoveries, which were recorded in other operating income on the

consolidated statement of income. These recoveries are not included

as an Adjusting item in Adjusted net income and Adjusted

EBITDA.

During the second quarter 2024, we received third party

recoveries related to the fire events that occurred during 2021,

which unfavorably impacted our results in 2021. For three months

ended June 30, 2024, we recognized a gain of $10.6 million ($8.2

million after-tax) related to business interruption claims which

were recorded in other operating income on the consolidated

statement of income. Because business interruption losses are

economic in nature rather than recognized, the related recoveries

are included as an Adjusting item in Adjusted net income and

Adjusted EBITDA. We have additional claims that are outstanding and

still pending which could be recognized in future quarters.

Property Settlement

On June 27, 2024, we settled a dispute that was in litigation

related to a property that we historically operated as an asphalt

and marine fuel terminal both as an owner and, subsequently, as a

lessee under an in-substance lease agreement (the “License

Agreement”). The settlement included the purchase of the property

for $10.0 million and $42.0 million for settlement of the

litigation for a total of $52.0 million. As a result of the

termination of the License Agreement, we are no longer obligated to

remove equipment from the property for certain development

activities and as a result we reversed the $17.9 million asset

retirement obligation recorded in connection with the Delek/Alon

Merger, effective July 1, 2017. Additionally, as a result of the

settlement we reduced the non-contingent guarantee and

environmental liability which resulted in a gain of $77.5 million.

The net gain from this settlement totaled $53.4 million and is

recorded in other operating income, net in the condensed

consolidated statements of income.

Other Inventory Impact

"Other inventory impact" is primarily calculated by multiplying

the number of barrels sold during the period by the difference

between current period weighted average purchase cost per barrel

directly related to our refineries and per barrel cost of materials

and other for the period recognized on a first-in, first-out basis

directly related to our refineries. It assumes no beginning or

ending inventory, so that the current period average purchase cost

per barrel is a reasonable estimate of our market purchase cost for

the current period, without giving effect to any build or draw on

beginning inventory. These amounts are based on management

estimates using a methodology including these assumptions. However,

this analysis provides management with a means to compare

hypothetical refining margins to current period average crack

spreads, as well as provides a means to better compare our results

to peers.

Reconciliation of Net Income (Loss)

Attributable to Delek US to Adjusted Net Income (Loss)

Three Months Ended June

30,

Six Months Ended June

30,

$ in millions (unaudited)

2024

2023

2024

2023

Reported net (loss) income attributable

to Delek US

$

(37.2

)

$

(8.3

)

$

(69.8

)

$

56.0

Adjusting items (1)

Inventory LCM valuation (benefit) loss

(1.9

)

(7.9

)

(10.7

)

(9.6

)

Tax effect

0.4

1.8

2.4

2.2

Inventory LCM valuation (benefit) loss,

net

(1.5

)

(6.1

)

(8.3

)

(7.4

)

Other inventory impact

14.6

96.5

13.2

173.6

Tax effect

(3.3

)

(21.8

)

(3.0

)

(39.1

)

Other inventory impact, net (2) (3)

11.3

74.7

10.2

134.5

Business interruption insurance and

settlement recoveries

(10.6

)

(4.7

)

(10.6

)

(9.8

)

Tax effect

2.4

1.1

2.4

2.2

Business interruption insurance and

settlement recoveries, net (2)

(8.2

)

(3.6

)

(8.2

)

(7.6

)

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

0.1

6.7

9.1

(25.5

)

Tax effect

—

(1.5

)

(2.0

)

5.7

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements, net

0.1

5.2

7.1

(19.8

)

Unrealized RINs hedging (gain) loss where

the hedged item is not yet recognized in the financial

statements

0.1

—

6.3

—

Tax effect

—

—

(1.4

)

—

Unrealized RINs hedging (gain) loss where

the hedged item is not yet recognized in the financial statements,

net (4)

0.1

—

4.9

—

Restructuring costs

22.6

4.3

25.8

2.9

Tax effect

(5.1

)

(1.0

)

(5.8

)

(0.7

)

Restructuring costs, net (2)

17.5

3.3

20.0

2.2

Property settlement

(53.4

)

—

(53.4

)

—

Tax effect

12.0

—

12.0

—

Property settlement, net (2)

(41.4

)

—

(41.4

)

—

Total adjusting items (1)

(22.1

)

73.5

(15.7

)

101.9

Adjusted net (loss) income

$

(59.3

)

$

65.2

$

(85.5

)

$

157.9

(1)

All adjustments have been tax effected

using the estimated marginal income tax rate, as applicable.

(2)

See further discussion in the "Significant

Transactions During the Quarter Impacting Results" section.

(3)

Starting with the quarter ended September

30, 2023, we updated our other inventory impact calculation to

exclude the impact of certain pipeline inventories not used in our

refinery operations. The impact to historical non-GAAP financial

measures is immaterial.

(4)

Starting with the quarter ended March 31,

2024, we updated our non-GAAP financial measures to include the

impact of unrealized gains and losses related to RINs where the

hedged item is not yet recognized in the financial statements. The

impact to historical non-GAAP financial measures is immaterial.

Reconciliation of U.S. GAAP Income (Loss) per share to

Adjusted Net Income (Loss) per share

Three Months Ended June

30,

Six Months Ended June

30,

$ per share (unaudited)

2024

2023

2024

2023

Reported diluted (loss) income per

share

$

(0.58

)

$

(0.13

)

$

(1.09

)

$

0.84

Adjusting items,

after tax (per share) (1) (2)

Net inventory LCM valuation (benefit)

loss

(0.02

)

(0.09

)

(0.13

)

(0.11

)

Other inventory impact (3) (4)

0.18

1.14

0.16

2.01

Business interruption insurance and

settlement recoveries (3)

(0.13

)

(0.05

)

(0.13

)

(0.11

)

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

—

0.08

0.11

(0.30

)

Unrealized RINs hedging (gain) loss where

the hedged item is not yet recognized in the financial statements

(5)

—

—

0.08

—

Restructuring costs (3)

0.27

0.05

0.31

0.03

Property settlement (3)

(0.64

)

—

(0.64

)

—

Total adjusting items (1)

(0.34

)

1.13

(0.24

)

1.52

Adjusted net (loss) income per

share

$

(0.92

)

$

1.00

$

(1.33

)

$

2.36

(1)

The adjustments have been tax effected

using the estimated marginal tax rate, as applicable.

(2)

For periods of Adjusted net loss,

Adjustments (Adjusting items) and Adjusted net loss per share are

presented using basic weighted average shares outstanding.

(3)

See further discussion in the "Significant

Transactions During the Quarter Impacting Results" section.

(4)

Starting with the quarter ended September

30, 2023, we updated our other inventory impact calculation to

exclude the impact of certain pipeline inventories not used in our

refinery operations. The impact to historical non-GAAP financial

measures is immaterial.

(5)

Starting with the quarter ended March 31,

2024, we updated our non-GAAP financial measures to include the

impact of unrealized gains and losses related to RINs where the

hedged item is not yet recognized in the financial statements. The

impact to historical non-GAAP financial measures is immaterial.

Reconciliation of Net Income (Loss) attributable to Delek

US to Adjusted EBITDA

Three Months Ended June

30,

Six Months Ended June

30,

$ in millions (unaudited)

2024

2023

2024

2023

Reported net (loss) income attributable

to Delek US

$

(37.2

)

$

(8.3

)

$

(69.8

)

$

56.0

Add:

Interest expense, net

77.7

80.4

165.4

156.9

Income tax expense (benefit)

(7.7

)

(3.8

)

(14.9

)

12.0

Depreciation and amortization

92.1

89.4

187.3

172.8

EBITDA attributable to Delek US

124.9

157.7

268.0

397.7

Adjusting items

Net inventory LCM valuation (benefit)

loss

(1.9

)

(7.9

)

(10.7

)

(9.6

)

Other inventory impact (1) (2)

14.6

96.5

13.2

173.6

Business interruption insurance and

settlement recoveries (1)

(10.6

)

(4.7

)

(10.6

)

(9.8

)

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

0.1

6.7

9.1

(25.5

)

Unrealized RINs hedging (gain) loss where

the hedged item is not yet recognized in the financial statements

(3)

0.1

—

6.3

—

Restructuring costs (1)

22.6

4.3

25.8

2.9

Property settlement (1)

(53.4

)

—

(53.4

)

—

Net income attributable to non-controlling

interest

11.1

6.8

18.5

14.7

Total Adjusting items

(17.4

)

101.7

(1.8

)

146.3

Adjusted EBITDA

$

107.5

$

259.4

$

266.2

$

544.0

(1)

See further discussion in the "Significant

Transactions During the Quarter Impacting Results" section.

(2)

Starting with the quarter ended September

30, 2023, we updated our other inventory impact calculation to

exclude the impact of certain pipeline inventories not used in our

refinery operations. The impact to historical non-GAAP financial

measures is immaterial.

(3)

Starting with the quarter ended March 31,

2024, we updated our non-GAAP financial measures to include the

impact of unrealized gains and losses related to RINs where the

hedged item is not yet recognized in the financial statements. The

impact to historical non-GAAP financial measures is immaterial.

Reconciliation of Segment EBITDA Attributable to Delek US

to Adjusted Segment EBITDA

Three Months Ended June 30,

2024

$ in millions (unaudited)

Refining

Logistics

Retail

Corporate, Other and

Eliminations

Consolidated

Segment EBITDA Attributable to Delek

US

$

17.3

$

100.6

$

12.4

$

(5.4

)

$

124.9

Adjusting

items

Net inventory LCM valuation (benefit)

loss

(1.9

)

—

—

—

(1.9

)

Other inventory impact (1) (2)

14.6

—

—

—

14.6

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

0.1

—

—

—

0.1

Unrealized RINs hedging (gain) loss where

the hedged item is not yet recognized in the financial statements

(3)

0.1

—

—

—

0.1

Restructuring costs (1)

22.5

—

—

0.1

22.6

Business interruption settlement

recoveries (1)

(10.6

)

—

—

—

(10.6

)

Property settlement (1)

—

—

—

(53.4

)

(53.4

)

Net income attributable to non-controlling

interest

—

—

—

11.1

11.1

Total Adjusting items

24.8

—

—

(42.2

)

(17.4

)

Adjusted Segment EBITDA

$

42.1

$

100.6

$

12.4

$

(47.6

)

$

107.5

Three Months Ended June 30,

2023

$ in millions (unaudited)

Refining(4)

Logistics

Retail

Corporate, Other and

Eliminations(4)

Consolidated

Segment EBITDA Attributable to Delek

US

$

121.8

$

90.9

$

15.0

$

(70.0

)

$

157.7

Adjusting items

Net inventory LCM valuation (benefit)

loss

(7.9

)

—

—

—

(7.9

)

Other inventory impact (1) (2)

96.5

—

—

—

96.5

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

6.7

—

—

—

6.7

Restructuring costs

—

—

—

4.3

4.3

Business interruption insurance

recoveries

(4.7

)

—

—

—

(4.7

)

Net income attributable to non-controlling

interest

—

—

—

6.8

6.8

Total Adjusting items

90.6

—

—

11.1

101.7

Adjusted Segment EBITDA

$

212.4

$

90.9

$

15.0

$

(58.9

)

$

259.4

Reconciliation of Segment EBITDA

Attributable to Delek US to Adjusted Segment EBITDA

Six Months Ended June 30,

2024

$ in millions (unaudited)

Refining(4)

Logistics

Retail

Corporate, Other and

Eliminations(4)

Consolidated

Segment EBITDA Attributable to Delek

US

$

122.4

$

200.3

$

18.9

$

(73.6

)

$

268.0

Adjusting items

Net inventory LCM valuation (benefit)

loss

(10.7

)

—

—

—

(10.7

)

Other inventory impact (1) (2)

13.2

—

—

—

13.2

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

9.1

—

—

—

9.1

Unrealized RINs hedging (gain) loss where

the hedged item is not yet recognized in the financial statements

(3)

6.3

—

—

—

6.3

Restructuring costs (1)

22.5

—

—

3.3

25.8

Business interruption settlement

recoveries (1)

(10.6

)

—

—

—

(10.6

)

Property settlement (1)

—

—

—

(53.4

)

(53.4

)

Net income attributable to non-controlling

interest

—

—

—

18.5

18.5

Total Adjusting items

29.8

—

—

(31.6

)

(1.8

)

Adjusted Segment EBITDA

$

152.2

$

200.3

$

18.9

$

(105.2

)

$

266.2

Six Months Ended June 30,

2023

$ in millions (unaudited)

Refining(4)

Logistics

Retail

Corporate, Other and

Eliminations(4)

Consolidated

Segment EBITDA Attributable to Delek

US

$

317.3

$

182.3

$

21.4

$

(123.3

)

$

397.7

Adjusting

items

Net inventory LCM valuation (benefit)

loss

(9.6

)

—

—

—

(9.6

)

Other inventory impact (1) (2)

173.6

—

—

—

173.6

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

(25.5

)

—

—

—

(25.5

)

Restructuring costs

—

—

—

2.9

2.9

Business interruption insurance

recoveries

(9.8

)

—

—

—

(9.8

)

Net income attributable to non-controlling

interest

—

—

—

14.7

14.7

Total Adjusting items

128.7

—

—

17.6

146.3

Adjusted Segment EBITDA

$

446.0

$

182.3

$

21.4

$

(105.7

)

$

544.0

(1)

See further discussion in the "Significant

Transactions During the Quarter Impacting Results" section.

(2)

Starting with the quarter ended September

30, 2023, we updated our other inventory impact calculation to

exclude the impact of certain pipeline inventories not used in our

refinery operations. The impact to historical non-GAAP financial

measures is immaterial.

(3)

Starting with the quarter ended March 31,

2024, we updated our non-GAAP financial measures to include the

impact of unrealized gains and losses related to RINs where the

hedged item is not yet recognized in the financial statements. The

impact to historical non-GAAP financial measures is immaterial.

(4)

During the second quarter 2024, we

realigned our reportable segments for financial reporting purposes

to reflect changes in the manner in which our chief operating

decision maker, or CODM, assesses financial information for

decision-making purposes. The change represents reporting the

operating results of our 50% interest in a joint venture that owns

asphalt terminals located in the southwestern region of the U.S.

within the refining segment. Prior to this change, these operating

results were reported as part of corporate, other and eliminations.

While this reporting change did not change our consolidated

results, segment data for previous years has been restated and is

consistent with the current year presentation.

Refining Segment Selected Financial Information

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Total Refining Segment

(Unaudited)

(Unaudited)

Days in period

91

91

182

181

Total sales volume - refined product

(average barrels per day ("bpd")) (1)

320,514

305,688

313,541

288,795

Total production (average bpd)

311,957

291,715

302,340

279,230

Crude oil

303,177

282,493

288,865

265,441

Other feedstocks

12,877

12,988

17,487

16,642

Total throughput (average bpd)

316,054

295,481

306,352

282,083

Total refining production margin per bbl

total throughput

$

7.07

$

9.29

$

9.72

$

12.68

Total refining operating expenses per bbl

total throughput

$

5.02

$

5.43

$

5.45

$

5.51

Total refining production margin ($ in

millions)

$

203.3

$

249.9

$

542.2

$

647.2

Supply, marketing and other ($ millions)

(2)

(33.6

)

114.6

(99.1

)

96.2

Total adjusted refining margin ($ in

millions)

$

169.7

$

364.5

$

443.1

$

743.4

Total crude slate details

Total crude slate: (% based on amount

received in period)

WTI crude oil

72.0

%

75.9

%

71.7

%

73.2

%

Gulf Coast Sweet crude

7.5

%

4.0

%

6.9

%

4.3

%

Local Arkansas crude oil

3.2

%

3.9

%

3.3

%

4.2

%

Other

17.3

%

16.2

%

18.1

%

18.3

%

Crude utilization (% based on nameplate

capacity) (4)

100.4

%

93.5

%

95.7

%

87.9

%

Tyler, TX Refinery

Days in period

91

91

182

181

Products manufactured (average bpd):

Gasoline

36,539

37,672

36,953

28,276

Diesel/Jet

33,705

33,029

31,905

23,091

Petrochemicals, LPG, NGLs

1,873

3,031

1,928

1,890

Other

1,674

1,829

1,445

1,803

Total production

73,791

75,561

72,231

55,060

Throughput (average bpd):

Crude oil

73,818

72,955

70,805

51,501

Other feedstocks

1,849

3,955

3,161

4,323

Total throughput

75,667

76,910

73,966

55,824

Tyler refining production margin ($ in

millions)

$

69.6

$

97.1

$

173.0

$

164.3

Per barrel of throughput:

Tyler refining production margin

$

10.11

$

13.87

$

12.85

$

16.26

Operating expenses

$

4.83

$

3.78

$

5.05

$

5.29

Crude Slate: (% based on amount received

in period)

WTI crude oil

80.1

%

86.5

%

81.3

%

78.7

%

East Texas crude oil

19.9

%

13.5

%

18.7

%

21.3

%

Capture rate (3)

55.8

%

54.3

%

62.5

%

56.0

%

El Dorado, AR Refinery

Days in period

91

91

182

181

Products manufactured (average bpd):

Gasoline

38,659

34,220

40,100

36,121

Diesel

31,880

27,948

30,958

27,830

Petrochemicals, LPG, NGLs

1,003

1,521

1,293

1,406

Asphalt

9,193

6,641

8,749

7,177

Other

2,089

1,185

1,442

967

Total production

82,824

71,515

82,542

73,501

Throughput (average bpd):

Crude oil

83,312

71,449

81,747

72,040

Other feedstocks

1,421

2,011

2,412

3,278

Total throughput

84,733

73,460

84,159

75,318

Refining Segment Selected Financial

Information (continued)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

El Dorado refining production margin ($ in

millions)

$

21.5

$

40.5

$

92.2

$

133.5

Per barrel of throughput:

El Dorado refining production margin

$

2.79

$

6.06

$

6.02

$

9.79

Operating expenses

$

4.12

$

5.00

$

4.41

$

4.73

Crude Slate: (% based on amount received

in period)

WTI crude oil

66.5

%

68.4

%

66.5

%

65.2

%

Local Arkansas crude oil

11.7

%

16.6

%

11.6

%

15.6

%

Other

21.8

%

15.0

%

21.9

%

19.2

%

Capture rate (3)

15.4

%

23.7

%

29.3

%

33.7

%

Big Spring, TX Refinery

Days in period

91

91

182

181

Products manufactured (average bpd):

Gasoline

34,271

33,582

32,123

36,032

Diesel/Jet

27,086

20,774

24,766

23,194

Petrochemicals, LPG, NGLs

3,287

3,034

4,362

3,083

Asphalt

2,841

1,630

2,464

1,636

Other

5,928

1,907

4,795

2,272

Total production

73,413

60,927

68,510

66,217

Throughput (average bpd):

Crude oil

69,342

59,240

64,395

63,590

Other feedstocks

4,701

3,020

5,053

3,818

Total throughput

74,043

62,260

69,448

67,408

Big Spring refining production margin ($

in millions)

$

60.1

$

65.5

$

136.0

$

185.3

Per barrel of throughput:

Big Spring refining production margin

$

8.92

$

11.55

$

10.76

$

15.18

Operating expenses

$

6.35

$

8.91

$

7.15

$

7.24

Crude Slate: (% based on amount received

in period)

WTI crude oil

70.2

%

66.7

%

71.4

%

71.0

%

WTS crude oil

29.8

%

33.3

%

28.6

%

29.0

%

Capture rate (3)

50.3

%

45.5

%

54.4

%

53.6

%

Krotz Springs, LA Refinery

Days in period

91

91

182

181

Products manufactured (average bpd):

Gasoline

39,037

41,191

38,907

41,517

Diesel/Jet

32,468

31,968

30,356

32,373

Heavy oils

1,033

3,725

1,882

3,618

Petrochemicals, LPG, NGLs

4,924

6,588

5,328

6,730

Other

4,467

240

2,584

214

Total production

81,929

83,712

79,057

84,452

Throughput (average bpd):

Crude oil

76,705

78,848

71,918

78,309

Other feedstocks

4,906

4,002

6,861

5,224

Total throughput

81,611

82,850

78,779

83,533

Krotz Springs refining production margin

($ in millions)

$

52.1

$

46.8

$

140.9

$

164.1

Per barrel of throughput:

Krotz Springs refining production

margin

$

7.02

$

6.21

$

9.83

$

10.85

Operating expenses

$

4.95

$

4.74

$

5.43

$

4.97

Crude Slate: (% based on amount received

in period)

WTI Crude

72.1

%

77.4

%

68.6

%

78.5

%

Gulf Coast Sweet Crude

27.2

%

15.0

%

26.2

%

14.7

%

Other

0.7

%

7.6

%

5.2

%

6.8

%

Capture rate (3)

52.8

%

54.9

%

60.3

%

71.3

%

(1)

Includes sales to other segments which are

eliminated in consolidation.

(2)

Supply, marketing and other activities

include refined product wholesale and related marketing activities,

asphalt and intermediates marketing activities, optimization of

inventory, the execution of risk management programs to capture the

physical and financial opportunities that extend from our refining

operations and our 50% interest in a joint venture that owns

asphalt terminals. Formally known as Trading & Supply.

(3)

Defined as refining production margin

divided by the respective crack spread. See page 17 for crack

spread information.

(4)

Crude throughput as % of total nameplate

capacity of 302,000 bpd.

Logistics Segment Selected Information

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(Unaudited)

(Unaudited)

Gathering & Processing: (average

bpd)

Lion Pipeline System:

Crude pipelines (non-gathered)

73,320

61,260

73,166

62,131

Refined products pipelines

60,575

44,966

61,904

49,957

SALA Gathering System

13,024

13,041

13,005

13,509

East Texas Crude Logistics System

23,259

30,666

21,481

26,690

Midland Gathering Assets

206,933

221,876

210,196

221,993

Plains Connection System

210,033

255,035

233,438

247,856

Delaware Gathering Assets:

Natural gas gathering and processing

(Mcfd) (1)

76,237

73,309

76,280

74,008

Crude oil gathering (average bpd)

123,927

117,017

123,718

110,408

Water disposal and recycling (average

bpd)

116,916

127,195

118,592

107,848

Wholesale Marketing &

Terminalling:

East Texas - Tyler Refinery sales volumes

(average bpd) (2)

71,082

69,310

68,779

52,158

Big Spring wholesale marketing throughputs

(average bpd)

81,422

75,164

79,019

76,763

West Texas wholesale marketing throughputs

(average bpd)

11,381

9,985

10,678

9,454

West Texas wholesale marketing margin per

barrel

$

2.99

$

7.01

$

2.60

$

6.27

Terminalling throughputs (average bpd)

(3)

159,260

134,323

147,937

113,926

(1)

Mcfd - average thousand cubic feet per

day.

(2)

Excludes jet fuel and petroleum coke.

(3)

Consists of terminalling throughputs at

our Tyler, Big Spring, Big Sandy and Mount Pleasant, Texas

terminals, El Dorado and North Little Rock, Arkansas terminals and

Memphis and Nashville, Tennessee terminals.

Retail Segment Selected Information

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(Unaudited)

(Unaudited)

Number of stores (end of period)

250

247

250

247

Average number of stores

250

247

250

247

Average number of fuel stores

245

242

245

242

Retail fuel sales (thousands of

gallons)

43,126

45,687

82,809

85,651

Average retail gallons sold per average

number of fuel stores (in thousands)

176

189

339

354

Average retail sales price per gallon

sold

$

3.16

$

3.25

$

3.13

$

3.26

Retail fuel margin ($ per gallon) (1)

$

0.31

$

0.34

$

0.30

$

0.31

Merchandise sales (in millions)

$

79.6

$

84.3

$

150.4

$

158.2

Merchandise sales per average number of

stores (in millions)

$

0.3

$

0.3

$

0.6

$

0.6

Merchandise margin %

32.9

%

33.9

%

33.2

%

33.5

%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Same-Store Comparison (2)

(Unaudited)

(Unaudited)

Change in same-store fuel gallons sold

(4.0

)%

(1.5

)%

(1.8

)%

(1.6

)%

Change in same-store merchandise sales

(5.2

)%

0.1

%

(4.7

)%

2.4

%

(1)

Retail fuel margin represents gross margin

on fuel sales in the retail segment, and is calculated as retail

fuel sales revenue less retail fuel cost of sales. The retail fuel

margin per gallon calculation is derived by dividing retail fuel

margin by the total retail fuel gallons sold for the period.

(2)

Same-store comparisons include

period-over-period changes in specified metrics for stores that

were in service at both the beginning of the earliest period and

the end of the most recent period used in the comparison.

Supplemental Information

Schedule of Selected Segment Financial

Data, Pricing Statistics Impacting our Refining Segment, and Other

Reconciliations of Amounts Reported Under U.S. GAAP

Selected Segment Financial Data

Three Months Ended June 30,

2024

$ in millions (unaudited)

Refining

Logistics

Retail

Corporate, Other and

Eliminations

Consolidated

Net revenues (excluding intercompany fees

and revenues)

$

3,097.9

$

107.7

$

216.1

$

—

$

3,421.7

Inter-segment fees and revenues

209.3

156.9

—

(366.2

)

—

Total revenues

$

3,307.2

$

264.6

$

216.1

$

(366.2

)

$

3,421.7

Cost of sales

3,356.4

190.2

176.0

(357.4

)

3,365.2

Gross margin

$

(49.2

)

$

74.4

$

40.1

$

(8.8

)

$

56.5

Three Months Ended June 30,

2023

$ in millions (unaudited)

Refining

Logistics

Retail

Corporate, Other and

Eliminations

Consolidated

Net revenues (excluding intercompany fees

and revenues)

$

3,849.0

$

113.9

$

232.7

$

—

$

4,195.6

Inter-segment fees and revenues

203.5

133.0

—

(336.5

)

—

Total revenues

$

4,052.5

$

246.9

$

232.7

$

(336.5

)

$

4,195.6

Cost of sales

3,996.9

179.0

188.5

(326.5

)

4,037.9

Gross margin

$

55.6

$

67.9

$

44.2

$

(10.0

)

$

157.7

Six Months Ended June 30,

2024

$ in millions (unaudited)

Refining

Logistics

Retail

Corporate, Other and

Eliminations

Consolidated

Net revenues (excluding intercompany fees

and revenues)

$

6,019.5

$

220.2

$

409.6

$

—

$

6,649.3

Inter-segment fees and revenues

396.0

296.5

—

(692.5

)

—

Total revenues

$

6,415.5

$

516.7

$

409.6

$

(692.5

)

$

6,649.3

Cost of sales

6,423.5

370.8

334.7

(666.3

)

6,462.7

Gross margin

$

(8.0

)

$

145.9

$

74.9

$

(26.2

)

$

186.6

Six Months Ended June 30,

2023

$ in millions (unaudited)

Refining

Logistics

Retail

Corporate, Other and

Eliminations

Consolidated

Net revenues (excluding intercompany fees

and revenues)

$

7,449.8

$

232.4

$

437.7

$

—

$

8,119.9

Inter-segment fees and revenues

397.2

258.0

—

(655.2

)

—

Total revenues

$

7,847.0

$

490.4

$

437.7

$

(655.2

)

$

8,119.9

Cost of sales

7,651.4

349.1

358.5

(633.9

)

7,725.1

Gross margin

$

195.6

$

141.3

$

79.2

$

(21.3

)

$

394.8

Pricing Statistics

Three Months Ended June

30,

Six Months Ended June

30,

(average for the period presented)

2024

2023

2024

2023

WTI — Cushing crude oil (per barrel)

$

80.83

$

73.57

$

78.95

$

74.78

WTI — Midland crude oil (per barrel)

$

81.73

$

74.40

$

80.17

$

75.98

WTS — Midland crude oil (per barrel)

$

80.99

$

73.55

$

79.26

$

74.48

LLS (per barrel)

$

83.69

$

75.67

$

81.73

$

77.27

Brent (per barrel)

$

85.06

$

77.74

$

83.42

$

79.94

U.S. Gulf Coast 5-3-2 crack spread (per

barrel) (1)

$

18.12

$

25.54

$

20.55

$

29.04

U.S. Gulf Coast 3-2-1 crack spread (per

barrel) (1)

$

17.72

$

25.42

$

19.80

$

28.32

U.S. Gulf Coast 2-1-1 crack spread (per

barrel) (1)

$

13.29

$

11.32

$

16.29

$

15.23

U.S. Gulf Coast Unleaded Gasoline (per

gallon)

$

2.30

$

2.34

$

2.26

$

2.37

Gulf Coast Ultra low sulfur diesel (per

gallon)

$

2.44

$

2.38

$

2.53

$

2.62

U.S. Gulf Coast high sulfur diesel (per

gallon)

$

1.89

$

1.45

$

1.92

$

1.68

Natural gas (per MMBTU)

$

2.37

$

2.33

$

2.24

$

2.53

(1)

For our Tyler and El Dorado refineries, we

compare our per barrel refining product margin to the Gulf Coast

5-3-2 crack spread consisting of (Argus pricing) WTI Cushing crude,

U.S. Gulf Coast CBOB gasoline and U.S. Gulf Coast Pipeline No. 2

heating oil (ultra low sulfur diesel). For our Big Spring refinery,

we compare our per barrel refining margin to the Gulf Coast 3-2-1

crack spread consisting of (Argus pricing) WTI Cushing crude, U.S.

Gulf Coast CBOB gasoline and Gulf Coast ultra-low sulfur diesel.

For 2023, for our Krotz Springs refinery, we compare our per barrel

refining margin to the Gulf Coast 2-1-1 crack spread consisting of

(Argus pricing) LLS crude oil, (Argus pricing) U.S. Gulf Coast CBOB

gasoline and 50% of (Argus pricing) U.S. Gulf Coast Pipeline No. 2

heating oil (high sulfur diesel) and 50% of (Platts pricing) U.S.

Gulf Coast Pipeline No. 2 heating oil (high sulfur diesel). For

2024, for our Krotz Springs refinery, we compare our per barrel

refining margin to the Gulf Coast 2-1-1 crack spread consisting of

(Argus pricing) LLS crude oil, (Argus pricing) U.S. Gulf Coast CBOB

gasoline and (Platts pricing) U.S. Gulf Coast Pipeline No. 2

heating oil (high sulfur diesel). The Tyler refinery's crude oil

input is primarily WTI Midland and East Texas, while the El Dorado

refinery's crude input is primarily a combination of WTI Midland,

local Arkansas and other domestic inland crude oil. The Big Spring

refinery’s crude oil input is primarily comprised of WTS and WTI

Midland. The Krotz Springs refinery’s crude oil input is primarily

comprised of LLS and WTI Midland.

Other Reconciliations of Amounts Reported Under U.S. GAAP

$ in millions (unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

Reconciliation of gross margin to

Refining margin to Adjusted refining margin

2024

2023

2024

2023

Gross margin

$

(49.2

)

$

55.6

$

(8.0

)

$

195.6

Add back (items included in cost of

sales):

Operating expenses (excluding depreciation

and amortization)

148.6

153.8

314.4

292.9

Depreciation and amortization

57.4

59.8

118.8

116.4

Refining margin

$

156.8

$

269.2

$

425.2

$

604.9

Adjusting

items

Net inventory LCM valuation loss

(benefit)

(1.9

)

(7.9

)

(10.7

)

(9.6

)

Other inventory impact (1) (2)

14.6

96.5

13.2

173.6

Unrealized inventory/commodity hedging

(gain) loss where the hedged item is not yet recognized in the

financial statements

0.1

6.7

9.1

(25.5

)

Unrealized RINs hedging (gain) loss where

the hedged item is not yet recognized in the financial statements

(3)

0.1

—

6.3

—

Total adjusting items

12.9

95.3

17.9

138.5

Adjusted refining margin

$

169.7

$

364.5

$

443.1

$

743.4

(1)

See further discussion in the "Significant

Transactions During the Quarter Impacting Results" section.

(2)

Starting with the quarter ended September

30, 2023, we updated our other inventory impact calculation to

exclude the impact of certain pipeline inventories not used in our

refinery operations. The impact to historical non-GAAP financial

measures is immaterial.

(3)

Starting with the quarter ended March 31,

2024, we updated our non-GAAP financial measures to include the

impact of unrealized gains and losses related to RINs where the

hedged item is not yet recognized in the financial statements. The

impact to historical non-GAAP financial measures is immaterial.

Calculation of Net Debt

June 30, 2024

December 31, 2023

Long-term debt - current portion

$

9.5

$

44.5

Long-term debt - non-current portion

2,452.2

2,555.3

Total long-term debt

2,461.7

2,599.8

Less: Cash and cash equivalents

657.9

822.2

Net debt - consolidated

1,803.8

1,777.6

Less: DKL net debt

1,561.2

1,700.0

Net debt, excluding DKL

$

242.6

$

77.6

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806810970/en/

Investor/Media Relations

Contacts:

investor.relations@delekus.com

Information about Delek US Holdings, Inc. can be found on its

website (www.delekus.com), investor relations webpage

(ir.delekus.com), news webpage (www.delekus.com/news) and its X

account (@DelekUSHoldings).

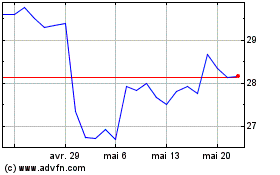

Delek US (NYSE:DK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Delek US (NYSE:DK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024