Dynagas LNG Partners LP (NYSE: “DLNG”) (the “Partnership”), an

owner and operator of liquefied natural gas (“LNG”) carriers, today

announced its results for the three months ended March 31, 2024.

Quarter Highlights:

- Net Income and

Earnings per common unit (basic and diluted) of $11.8 million and

$0.23, respectively;

- Adjusted Net

Income(1) of $12.4 million and Adjusted Earnings per common unit(1)

(basic and diluted) of $0.25;

- Adjusted

EBITDA(1) $29.0 million;

- 100% fleet

utilization(2); and

- Declared and

paid a cash distribution of $0.5625 per unit on its Series A

Preferred Units (NYSE: “DLNG PR A”) for the period from November

12, 2023 to February 11, 2024 and $0.71764025 per unit on the

Series B Preferred Units (NYSE: “DLNG PR B”) for the period from

November 22, 2023 to February 21, 2024.

Subsequent Events:

- Declared a

quarterly cash distribution of $0.5625 on the Partnership’s Series

A Preferred Units for the period from February 12, 2024 to May 11,

2024, which was paid on May 13, 2024 to all preferred Series B unit

holders of record as of May 6, 2024;

- Declared a

quarterly cash distribution of $0.69853375 on the Partnership’s

Series B Preferred Units for the period from February 22, 2024 to

May 21, 2024, which was paid on May 22, 2024 to all preferred

Series B unit holders of record as of May 15, 2024; and

- On June 19,

2024, the Partnership entered into definitive documentation with

subsidiaries of China Development Bank Financial Leasing Co. Ltd.

(“CDBL”) for a $345.0 million lease financing agreement of four out

of its six LNG carriers. On June 27, 2024, the new lease facility,

together with available cash, were used to fully prepay the $675

million Credit Facility, which was scheduled to mature in September

2024.

(1) Adjusted Net Income, Adjusted Earnings per

common unit and Adjusted EBITDA are not recognized measures under

U.S. GAAP. Please refer to Appendix B of this press release for the

definitions and reconciliation of these measures to the most

directly comparable financial measures calculated and presented in

accordance with U.S. GAAP and other related information.(2) Please

refer to Appendix B for additional information on how we calculate

fleet utilization.

CEO Commentary:

We are pleased to report the results for the

three months ended March 31, 2024.

For the first quarter of 2024, we reported Net

Income of $11.8 million, earnings per common unit of $0.23,

Adjusted Net Income of $12.4 million and Adjusted EBITDA of $29.0

million.

All six LNG carriers in our fleet are operating

under their respective long-term charters with international gas

companies with an average remaining contract term of 6.6 years.

Barring any unforeseen events, the Partnership will have no

contractual vessel availability until 2028. Our estimated contract

backlog currently stands at approximately $1.07 billion equating to

approximately $178 million per vessel as of June 27, 2024.

We are pleased to announce a new lease financing

agreement with China Development Bank Financial Leasing Co. Ltd for

four of our LNG carriers. This financing, totaling $345.0 million,

along with our available cash reserves, has enabled us to fully

prepay our existing outstanding debt in the amount of $408 million

before its maturity in September 2024. After a protracted period of

strategic deleveraging, we now enjoy significantly lower debt

levels and a flexible financing package with two of our LNG

carriers debt free. This positions us well in the next phase of the

Partnership’s development.

Russian Sanctions

Developments

Due to the ongoing Russian conflicts with

Ukraine, the United States (“U.S.”), European Union (“E.U.”),

Canada and other Western countries and organizations have announced

and enacted numerous sanctions against Russia to impose severe

economic pressure on the Russian economy and government.

As of today’s date:

- Current U.S.

sanctions regimes do not materially affect the business, operations

or financial condition of the Partnership and, to the Partnership’s

knowledge, its counterparties are currently performing their

obligations under their respective time charters in compliance with

applicable U.S. and E.U. rules and regulations.

- On June 24,

2024, the E.U. issued its 14th sanctions package which, for the

first time, targets the LNG sector of the Russian economy. E.U.

laws now prohibit reloading services in the territory of the E.U.

for the purposes of transshipment operations where such services

are used to transship Russian LNG, except in the case of such

transshipments to E.U. member states. That prohibition covers both

ship-to-ship transfers and ship-to-shore transfers and re-loading

operations. Ancillary services related to such transshipments are

also banned. Also, information requirements apply to legal persons

performing unloading operations. Certain limited exemptions apply.

The Partnership is currently in the process of assessing the impact

this new set of sanctions will have on its operations.

- Sanctions

legislation has been changing and the Partnership continues to

monitor such changes as applicable to the Partnership and its

counterparties.

The full impact of the commercial and economic

consequences of the Russian conflict with Ukraine is uncertain at

this time. The Partnership cannot provide any assurance that

any further development in sanctions, or escalation of the Ukraine

situation more generally, will not have a significant impact on its

business, financial condition or results of operations. Please

see the section of this press release entitled “Forward Looking

Statements.”Financial Results Overview:

| |

Three Months Ended |

|

(U.S. dollars in thousands, except per unit

data) |

|

March 31, 2024 (unaudited) |

|

|

March 31, 2023 (unaudited) |

| Voyage revenues |

$ |

38,055 |

|

$ |

37,263 |

| Net Income |

$ |

11,750 |

|

$ |

9,600 |

| Adjusted Net Income (1) |

$ |

12,354 |

|

$ |

6,519 |

| Operating income |

$ |

19,337 |

|

$ |

19,344 |

| Adjusted EBITDA(1) |

$ |

29,003 |

|

$ |

23,564 |

| Earnings per common unit |

$ |

0.23 |

|

$ |

0.18 |

| Adjusted Earnings per common

unit (1) |

$ |

0.25 |

|

$ |

0.10 |

| |

|

|

|

|

|

(1) Adjusted Net Income, Adjusted EBITDA and

Adjusted Earnings per common unit are not recognized measures under

U.S. GAAP. Please refer to Appendix B of this press release for the

definitions and reconciliation of these measures to the most

directly comparable financial measures calculated and presented in

accordance with U.S. GAAP.

Three Months Ended March 31, 2024 and

2023 Financial Results

Net Income for the three months ended March 31,

2024 was $11.8 million as compared to $9.6 million for the

corresponding period of 2023, which represents an increase of $2.2

million, or 22.9%. The increase in net income for the three months

ended March 31, 2024 compared to the corresponding period of 2023,

was mainly attributable to the increase in the gain on our interest

rate swap transaction and to the decrease interest and finance

costs.

Adjusted Net Income (a non-GAAP financial

measure) for the three months ended March 31, 2024 was $12.4

million as compared to $6.5 million for the corresponding period of

2023, which represents a net increase of $5.9 million or 90.8%.

This increase was mainly attributable to the increase in the cash

voyage revenues of the Arctic Aurora as explained below.

Voyage revenues for the three months ended March

31, 2024 were $38.1 million as compared to $37.3 million for the

corresponding period of 2023, which represents a net increase of

$0.8 million or 2.1%. This increase was mainly attributable to the

increase in voyage revenues of the Arctic Aurora following its new

time charter party agreement with Equinor ASA, which commenced in

September 2023.

The Partnership reported average daily hire

gross of commissions(1) of approximately $72,770 per day per vessel

in the three-month period ended March 31, 2024, compared to

approximately $62,130 per day per vessel for the corresponding

period of 2023. During both three-month periods ended March 31,

2024 and March 31, 2023, the Partnership’s vessels operated at 100%

utilization.

Vessel operating expenses were $7.7 million,

which corresponds to a daily rate per vessel of $14,103 in the

three-month period ended March 31, 2024, as compared to $7.3

million, or a daily rate per vessel of $13,511 in the corresponding

period of 2023. This increase was mainly attributable to the

increased planned technical maintenance on the Partnership’s

vessels in the three months ended March 31, 2024 compared to the

corresponding period in 2023.

Adjusted EBITDA (a non-GAAP financial measure)

for the three months ended March 31, 2024 was $29.0 million, as

compared to $23.6 million for the corresponding period of 2023. The

increase of $5.4 million, or 22.9%, was mainly attributable to the

abovementioned increase in revenues of the Arctic Aurora which was

partly compensated by the increase in the operating expenses.

Interest and finance costs, net were $8.7

million in the three months ended March 31, 2024 as compared to

$9.2 million in the corresponding period of 2023, which represents

a decrease of $0.5 million, or 5.4% due to the reduction in

interest-bearing debt in the three months ended March 31, 2024,

compared to the corresponding period in 2023, which was partly

offset by the increase in the weighted average interest rate as

compared to the corresponding period of 2023.

For the three months ended March 31, 2024, the

Partnership reported basic and diluted Earnings per common unit and

Adjusted Earnings per common unit, (a non- GAAP financial measure),

of $0.23 and $0.25 respectively, after taking into account the

distributions relating to the Series A Preferred Units and the

Series B Preferred Units on the Partnership’s Net Income/Adjusted

Net Income. Earnings per common unit and Adjusted Earnings per

common unit, basic and diluted, are calculated on the basis of a

weighted average number of 36,802,247 common units outstanding

during the period and in the case of Adjusted Earnings per common

unit after reflecting the impact of certain adjustments presented

in Appendix B of this press release.

Adjusted Net Income, Adjusted EBITDA and

Adjusted Earnings per common unit are not recognized measures under

U.S. GAAP. Please refer to Appendix B of this press release for the

definitions and reconciliation of these measures to the most

directly comparable financial measures calculated and presented in

accordance with U.S. GAAP.

Amounts relating to variations in period on

period comparisons shown in this section are derived from the

unaudited condensed financial statement contained herein.

(1) Average daily hire gross of commissions is a

non-GAAP financial measure and represents voyage revenue excluding

the non-cash time charter deferred revenue amortization, divided by

the Available Days in the Partnership’s fleet as described in

Appendix B.

Liquidity/ Financing/ Cash Flow

Coverage

During the three months ended March 31, 2024,

the Partnership generated net cash from operating activities of

$11.6 million as compared to $13.7 million in the corresponding

period of 2023, which represents a decrease of $2.1 million, or

15.3% mainly as a result of working capital changes.

As of March 31, 2024, the Partnership reported

total cash of $76.2 million. The Partnership’s outstanding

indebtedness as of March 31, 2024 under the $675 million credit

facility amounted to $408.6 million, gross of unamortized deferred

loan fees, which was repayable within one year.

On June 19, 2024, the Partnership entered into a

sale and leaseback agreement with China Development Bank Financial

Leasing Co. Ltd. (“CDBL”) for four of its vessels, the Ob River,

the Clean Energy, the Amur River, and the Arctic Aurora in an

amount up to $345.0 million (the “Lease Financing”) for the purpose

of refinancing, together with other sources of liquidity, its $675

Million Credit Facility. On June 27, 2024, the Lease Financing

closed and the Partnership utilized the proceeds, together with

available cash, to fully prepay its $675 Million Credit Facility.

According to the agreed terms of the Lease Financing, the

Partnership sold and simultaneously chartered back on a bareboat

basis the OB River, the Clean Energy and the Amur River (“the Three

Vessels”) for a five-year period and the Arctic Aurora for a ten-

year period, starting on June 27, 2024. The financing amount is 65%

and 85% of the Market Price on delivery of the Three Vessels and

the Arctic Aurora, respectively, and is scheduled to be repaid in

twenty and forty consecutive quarterly installments respectively.

The financing’s applicable interest rate is three-month Term SOFR

plus a margin. At the end of the bareboat charter period, the

Partnership will have the obligation to repurchase the vessels for

20% and 15% of the financing amount of the Three Vessels and the

Arctic Aurora, respectively. The Partnership will be required to

maintain a minimum market value of at least 120% of the outstanding

principal balance throughout the charter period.

Vessel Employment

As of June 27, 2024, the Partnership had

estimated contracted time charter coverage(1) for 100%, 100% and

99% of its fleet estimated Available Days (as defined in Appendix

B) for 2024, 2025 and 2026, respectively.

As of the same date, the Partnership’s estimated

contracted revenue backlog (2) (3) was $1.07 billion, with an

average remaining contract term of 6.6

years.

(1) Time charter coverage for the Partnership’s

fleet is calculated by dividing the fleet contracted days on the

basis of the earliest estimated delivery and redelivery dates

prescribed in the Partnership’s current time charter contracts, net

of scheduled class survey repairs by the number of expected

Available Days during that period.

(2) The Partnership calculates its estimated

contracted revenue backlog by multiplying the contractual daily

hire rate by the expected number of days committed under the

contracts (assuming earliest delivery and redelivery and excluding

options to extend), assuming full utilization. The actual amount of

revenues earned and the actual periods during which revenues are

earned may differ from the amounts and periods disclosed due to,

for example, dry-docking and/or special survey downtime,

maintenance projects, off-hire downtime and other factors that

result in lower revenues than the Partnership’s average contract

backlog per day.

(3) The amount of $0.12 billion of the revenue

backlog estimate relates to the estimated portion of the hire

contained in certain time charter contracts with Yamal Trade Pte.

Ltd. which represents the operating expenses of the respective

vessels and is subject to yearly adjustments on the basis of the

actual operating costs incurred within each year. The actual amount

of revenues earned in respect of such variable hire rate may

therefore differ from the amounts included in the revenue backlog

estimate due to the yearly variations in the respective vessels’

operating costs.

Conference Call and Webcast:

As announced, the Partnership’s management team

will host a conference call on Friday, June 28, 2024 at 10:00 a.m.

Eastern Time to discuss the Partnership’s financial results.

Conference Call details:

Participants should dial into the call 10

minutes before the scheduled time using the following numbers:

877-405-1226 (US Dial-In), or +1 201-689-7823 (US International

Dial-In). To access the conference call, please quote “Dynagas” to

the operator and/or conference ID 13746983. For additional

participant International Toll- Free access numbers, click

here.

Alternatively, participants can register for the

call using the “call me” option for a faster connection to join the

conference call. You can enter your phone number and let the system

call you right away. Click here for the “call me” option.

Audio Webcast - Slides

Presentation:

There will be a live and then archived webcast

of the conference call and accompanying slides, available on the

Partnership’s website. To listen to the archived audio file, visit

our website http://www.dynagaspartners.com and click on Webcast

under our Investor Relations page. Participants to the live webcast

should register on the website approximately 10 minutes prior to

the start of the webcast.

The slide presentation on the first quarter

ended March 31, 2024 financial results will be available in PDF

format 10 minutes prior to the conference call and webcast,

accessible on the Partnership's website www.dynagaspartners.com on

the webcast page. Participants to the webcast can download the PDF

presentation.

About

Dynagas

LNG

Partners

LP

Dynagas LNG Partners LP. (NYSE: DLNG) is a

master limited partnership that owns and operates liquefied natural

gas (LNG) carriers employed on multi-year charters. The

Partnership’s current fleet consists of six LNG carriers, with an

aggregate carrying capacity of approximately 914,000 cubic

meters.

Visit the Partnership’s website at

www.dynagaspartners.com. The Partnership’s website and its contents

are not incorporated into and do not form a part of this

release.

Contact Information:Dynagas LNG

Partners LP Attention: Michael Gregos Tel. +30 210 8917960 Email:

management@dynagaspartners.com

Investor Relations / Financial Media: Nicolas Bornozis Markella

KaraCapital Link, Inc. 230 Park Avenue, Suite 1540New York, NY

10169 Tel. (212) 661-7566 E-mail: dynagas@capitallink.com

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

The Partnership desires to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and is including this cautionary statement in

connection with this safe harbor legislation. The words “believe,”

“anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,”

“potential,” “project,” “will,” “may,” “should,” “expect,”

“expected,” “pending” and similar expressions identify

forward-looking statements. These forward- looking statements are

not intended to give any assurance as to future results and should

not be relied upon.

The forward-looking statements in this press

release are based upon various assumptions and estimates, many of

which are based, in turn, upon further assumptions, including

without limitation, examination by the Partnership’s management of

historical operating trends, data contained in its records and

other data available from third parties. Although the Partnership

believes that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond the Partnership’s control, the

Partnership cannot assure you that it will achieve or accomplish

these expectations, beliefs or projections.

In addition to these important factors, other

important factors that, in the Partnership’s view, could cause

actual results to differ materially from those discussed, expressed

or implied, in the forward- looking statements include, but are not

limited to, the strength of world economies and currency

fluctuations, general market conditions, including fluctuations in

charter rates, ownership days, and vessel values, changes in supply

of and demand for liquefied natural gas (LNG) shipping capacity,

changes in the Partnership’s operating expenses, including bunker

prices, drydocking and insurance costs, the market for the

Partnership’s vessels, availability of financing and refinancing,

changes in governmental laws, rules and regulations or actions

taken by regulatory authorities, economic, regulatory, political

and governmental conditions that affect the shipping and the LNG

industry, potential liability from pending or future litigation,

and potential costs due to environmental damage and vessel

collisions, general domestic and international political

conditions, potential disruption of shipping routes due to

accidents, political events, or international hostilities,

including the recent escalation of the Israel-Gaza conflict and

potential spillover effects throughout the Middle East, vessel

breakdowns, instances of off-hires, the length and severity of

epidemics and pandemics, such as COVID-19 and its variants, the

impact of public health threats and outbreaks of other highly

communicable diseases, the impact of the discontinuance of the

London Interbank Offered Rate, or, LIBOR and its replacement with

the Secured Overnight Financing Rate, or SOFR on any of our debt

referencing LIBOR in the interest rate, the amount of cash

available for distribution, and other factors. Due to the ongoing

war between Russia and Ukraine, the United States, United Kingdom,

the European Union, Canada, and other Western countries and

organizations have announced and enacted numerous sanctions against

Russia to impose severe economic pressure on the Russian economy

and government. The full impact of the commercial and economic

consequences of the Russian conflict with Ukraine are uncertain at

this time. Although currently there has been no material impact on

the Partnership, potential consequences of the sanctions that could

impact the Partnership’s business in the future include but are not

limited to: (1) limiting and/or banning the use of the SWIFT

financial and payment system that would negatively affect payments

under the Partnership’s existing vessel charters; (2) the

Partnership’s counterparties being potentially limited by sanctions

from performing under its agreements; and (3) a general

deterioration of the Russian economy. In addition, the Partnership

may have greater difficulties raising capital in the future, which

could potentially reduce the level of future investment into its

expansion and operations. The Partnership cannot provide any

assurance that any further development in sanctions, or escalation

of the Ukraine situation more generally, will not have a

significant impact on its business, financial condition, or results

of operations.

Please see the Partnership’s filings with the

Securities and Exchange Commission for a more complete discussion

of these and other risks and uncertainties. The information set

forth herein speaks only as of the date hereof, and the Partnership

disclaims any intention or obligation to update any forward-looking

statements as a result of developments occurring after the date of

this communication.

APPENDIX A

DYNAGAS LNG PARTNERS

LPCondensed Consolidated Statements of

Income

| (In thousands of U.S. dollars

except units and per unit data) |

|

Three Months Ended March

31, |

| |

|

2024(unaudited) |

|

|

2023(unaudited) |

| REVENUES |

|

|

|

|

|

|

Voyage revenues |

$ |

38,055 |

|

|

$ |

37,263 |

|

| EXPENSES |

|

|

|

|

|

| Voyage expenses (including

related party) |

|

(857 |

) |

|

|

(714 |

) |

| Vessel operating expenses |

|

(7,700 |

) |

|

|

(7,296 |

) |

| General and administrative

expenses (including related party) |

|

(526 |

) |

|

|

(469 |

) |

| Management fees -related

party |

|

(1,641 |

) |

|

|

(1,575 |

) |

| Depreciation |

|

(7,994 |

) |

|

|

(7,865 |

) |

| Operating

income |

|

19,337 |

|

|

|

19,344 |

|

| Interest and finance costs,

net |

|

(8,655 |

) |

|

|

(9,180 |

) |

| Loss on debt

extinguishment |

|

— |

|

|

|

(154 |

) |

| Gain/ (Loss) on derivative

instruments |

|

1,260 |

|

|

|

(341 |

) |

| Other Expense |

|

(110 |

) |

|

|

— |

|

| Other, net |

|

(82 |

) |

|

|

(69 |

) |

| Net

income |

$ |

11,750 |

|

|

$ |

9,600 |

|

| Earnings per common

unit (basic and diluted) |

$ |

0.23 |

|

|

$ |

0.18 |

|

| Weighted average

number of units outstanding, basic and diluted: |

|

|

|

|

|

| Common units |

|

36,802,247 |

|

|

|

36,802,247 |

|

| |

|

|

|

|

|

|

|

DYNAGAS LNG PARTNERS LP

Consolidated Condensed Balance

Sheets(Expressed in thousands of U.S.

Dollars—except for unit data)

|

|

March 31,2024 (unaudited) |

|

December 31,2023(unaudited) |

|

ASSETS: |

|

|

|

|

|

| Cash and cash equivalents and

restricted cash (current and non-current) |

$ |

76,155 |

|

$ |

73,752 |

| Derivative financial

instrument (current and non-current) |

|

10,637 |

|

|

15,631 |

| Due from related party

(current and non-current) |

|

1,447 |

|

|

1,350 |

| Other current assets |

|

12,015 |

|

|

15,874 |

| Vessels, net |

|

789,369 |

|

|

797,363 |

| Other non-current assets |

|

5,210 |

|

|

4,943 |

| Total

assets |

$ |

894,833 |

|

$ |

908,913 |

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Total long-term debt, net of

deferred financing costs |

$ |

407,959 |

|

$ |

419,584 |

| Total other current

liabilities |

|

27,108 |

|

|

37,622 |

| Due to related party (current

and non-current) |

|

114 |

|

|

1,555 |

| Total other non-current

liabilities |

|

2,929 |

|

|

1,912 |

| Total

liabilities |

$ |

438,110 |

|

$ |

460,673 |

| |

|

|

|

|

|

| PARTNERS’

EQUITY |

|

|

|

|

|

| General partner (35,526 units

issued and outstanding as at March 31, 2024 and December 31,

2023) |

|

110 |

|

|

102 |

| Common unitholders (36,802,247

units issued and outstanding as at March 31, 2024 and December 31,

2023) |

|

329,899 |

|

|

321,424 |

| Series A Preferred

unitholders: (3,000,000 units issued and outstanding as at March

31, 2024 and December 31, 2023) |

|

73,216 |

|

|

73,216 |

| Series B Preferred

unitholders: (2,200,000 units issued and outstanding as at March

31, 2024 and December 31, 2023) |

|

53,498 |

|

|

53,498 |

| Total partners’

equity |

$ |

456,723 |

|

$ |

448,240 |

| |

|

|

|

|

|

| Total liabilities and

partners’ equity |

$ |

894,833 |

|

$ |

908,913 |

| |

|

|

|

|

|

DYNAGAS LNG PARTNERS LP

Consolidated Condensed Statements of Cash Flows

(Expressed in thousands of U.S. Dollars)

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024(unaudited) |

|

|

2023(unaudited) |

| Cash flows from

Operating Activities: |

|

|

|

|

|

|

Net income: |

$ |

11,750 |

|

|

$ |

9,600 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

| Depreciation |

|

7,994 |

|

|

|

7,865 |

|

| Amortization and write-off of

deferred financing fees |

|

375 |

|

|

|

447 |

|

| Deferred revenue

amortization |

|

1,700 |

|

|

|

(3,629 |

) |

| Amortization and write off of

deferred charges |

|

54 |

|

|

|

53 |

|

| Loss on debt

extinguishment |

|

— |

|

|

|

154 |

|

| (Gain)/ Loss on derivative

financial instrument |

|

(1,260 |

) |

|

|

341 |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

|

| Trade accounts receivable |

|

344 |

|

|

|

(379 |

) |

| Prepayments and other

assets |

|

2,731 |

|

|

|

(45 |

) |

| Inventories |

|

(11 |

) |

|

|

23 |

|

| Due from/ to related

parties |

|

(1,538 |

) |

|

|

1,204 |

|

| Trade accounts payable |

|

(1,493 |

) |

|

|

(821 |

) |

| Accrued liabilities |

|

(678 |

) |

|

|

(726 |

) |

| Unearned revenue |

|

(8,399 |

) |

|

|

(431 |

) |

| Net cash from

Operating Activities |

$ |

11,569 |

|

|

$ |

13,656 |

|

| |

|

|

|

|

|

| Cash flows from

Investing Activities |

|

|

|

|

|

| Ballast water treatment system

installation |

|

(27 |

) |

|

|

(86 |

) |

| Net cash used in

Investing Activities |

$ |

(27 |

) |

|

$ |

(86 |

) |

| |

|

|

|

|

|

| Cash flows from

Financing Activities: |

|

|

|

|

|

| Distributions declared and

paid |

|

(3,267 |

) |

|

|

(2,891 |

) |

| Repayment of long-term

debt |

|

(12,000 |

) |

|

|

(43,270 |

) |

| Payment of derivative

instruments |

|

6,128 |

|

|

|

5,601 |

|

| Net cash used in

Financing Activities |

$ |

(9,139 |

) |

|

|

(40,560 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Net increase/

(decrease) in cash and cash equivalents and restricted

cash |

|

2,403 |

|

|

|

(26,990 |

) |

| Cash and cash equivalents and

restricted cash at beginning of the year |

|

73,752 |

|

|

|

79,868 |

|

| Cash and cash

equivalents and restricted cash at end of the period |

$ |

76,155 |

|

|

$ |

52,878 |

|

| |

|

|

|

|

|

|

|

APPENDIX B

Fleet Statistics and Reconciliation of U.S. GAAP

Financial Information to Non-GAAP Financial

Information

| |

Three Months Ended March 31, |

|

(expressed in United states dollars except for operational data and

Time Charter Equivalent rate) |

|

2024 |

|

|

|

2023 |

|

| Number of vessels at the end

of period |

|

6 |

|

|

|

6 |

|

| Average number of vessels in

the period (1) |

|

6 |

|

|

|

6 |

|

| Calendar Days (2) |

|

546.0 |

|

|

|

540.0 |

|

| Available Days (3) |

|

546.0 |

|

|

|

540.0 |

|

| Revenue earning days (4) |

|

546.0 |

|

|

|

539.9 |

|

| Time Charter Equivalent rate

(5) |

$ |

68,128 |

|

|

$ |

67,683 |

|

| Fleet Utilization (4) |

|

100.0 |

% |

|

|

100.0 |

% |

| Vessel daily operating

expenses (6) |

$ |

14,103 |

|

|

$ |

13,511 |

|

| |

|

|

|

|

|

|

|

|

(1) |

Represents the number of vessels that constituted the Partnership’s

fleet for the relevant period, as measured by the sum of the number

of days that each vessel was a part of the Partnership’s fleet

during the period divided by the number of Calendar Days (defined

below) in the period. |

| |

|

| (2) |

“Calendar Days” are the total

days that the Partnership possessed the vessels in its fleet for

the relevant period. |

| |

|

| (3) |

“Available Days” are the total

number of Calendar Days that the Partnership’s vessels were in its

possession during a period, less the total number of scheduled

off-hire days during the period associated with major repairs, or

dry-dockings. |

| |

|

| (4) |

The Partnership calculates fleet

utilization by dividing the number of its Revenue earning days,

which are the total number of Available Days of the Partnership’s

vessels net of unscheduled off-hire days (which do not include

positioning/ repositioning days for which compensation has been

received) during a period by the number of Available Days. The

shipping industry uses fleet utilization to measure a company’s

efficiency in finding employment for its vessels and minimizing the

amount of days that its vessels are off-hire for reasons such as

unscheduled repairs but excluding scheduled off-hires for vessel

upgrades, dry-dockings or special or intermediate surveys. |

| |

|

| (5) |

Time Charter Equivalent rate

(“TCE rate”), is a measure of the average daily revenue performance

of a vessel. For time charters, we calculate TCE rate by dividing

total voyage revenues, less any voyage expenses, by the number of

Available Days during the relevant time period. Under a time

charter, the charterer pays substantially all vessel voyage related

expenses. However, the Partnership may incur voyage related

expenses when positioning or repositioning vessels before or after

the period of a time charter, during periods of commercial waiting

time or while off-hire during dry-docking or due to other

unforeseen circumstances. The TCE rate is not a measure of

financial performance under U.S. GAAP (non-GAAP measure), and

should not be considered as an alternative to voyage revenues, the

most directly comparable GAAP measure, or any other measure of

financial performance presented in accordance with U.S. GAAP.

However, the TCE rate is a standard shipping industry performance

measure used primarily to compare period-to-period changes in a

company’s performance despite changes in the mix of charter types

(such as time charters, voyage charters) under which the vessels

may be employed between the periods and to assist the Partnership’s

management in making decisions regarding the deployment and use of

the Partnership’s vessels and in evaluating their financial

performance. The Partnership’s calculation of TCE rates may not be

comparable to that reported by other companies due to differences

in methods of calculation. The following table reflects the

calculation of the Partnership’s TCE rates for the three months

ended March 31, 2024 and 2023 (amounts in thousands of U.S.

dollars, except for TCE rates, which are expressed in U.S. dollars,

and Available Days): |

| |

|

| |

Three Months Ended

March

31, |

|

|

|

2024 |

|

|

|

2023 |

|

| (In thousands of U.S. dollars,

except for Available Days and TCE rate) |

|

|

|

|

|

| Voyage revenues |

$ |

38,055 |

|

|

$ |

37,263 |

|

| Voyage Expenses * |

|

(857 |

) |

|

|

(714 |

) |

| Time Charter

equivalent revenues |

$ |

37,198 |

|

|

$ |

36,549 |

|

| Available Days |

|

546 |

|

|

|

540 |

|

| Time charter

equivalent (TCE) rate |

$ |

68,128 |

|

|

$ |

67,683 |

|

*Voyage expenses include commissions of 1.25%

paid to Dynagas Ltd., the Partnership’s Manager, and third-party

ship brokers, when defined in the charter parties, bunkers, port

expenses and other minor voyage expenses.

|

(6) |

Daily vessel operating expenses, which include crew costs,

provisions, deck and engine stores, lubricating oil, insurance,

spares and repairs and flag taxes, are calculated by dividing

vessel operating expenses by fleet Calendar Days for the relevant

time period. |

| |

|

Reconciliation of Net Income to Adjusted

EBITDA

| |

|

Three Months Ended March 31, |

|

(In thousands of U.S. dollars) |

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

11,750 |

|

|

$ |

9,600 |

|

| Net interest and finance costs

(1) |

|

8,655 |

|

|

|

9,180 |

|

| Depreciation |

|

7,994 |

|

|

|

7,865 |

|

| Loss on Debt

extinguishment |

|

— |

|

|

|

154 |

|

| (Gain)/ Loss on

derivativefinancial instrument |

|

(1,260 |

) |

|

|

341 |

|

| Amortization of deferred

revenue |

|

1,700 |

|

|

|

(3,629 |

) |

| Amortization and write- off of

deferred charges |

|

54 |

|

|

|

53 |

|

| Other Expense(2) |

|

110 |

|

|

|

— |

|

| Adjusted

EBITDA |

$ |

29,003 |

|

|

$ |

23,564 |

|

| |

|

|

|

|

|

|

|

(1) Includes interest and finance costs and interest income, if

any.

(2) Includes other expense from provisions for

insurance claims for damages incurred prior years

The Partnership defines Adjusted EBITDA as

earnings before interest and finance costs, net of interest income

(if any), gains/losses on derivative financial instruments, taxes

(when incurred), depreciation and amortization (when incurred),

dry-docking and special survey costs and significant non-recurring

items (if any). Adjusted EBITDA is used as a supplemental financial

measure by management and external users of financial statements,

such as investors, to assess the Partnership’s operating

performance.

The Partnership believes that Adjusted EBITDA

assists its management and investors by providing useful

information that increases the ability to compare the Partnership’s

operating performance from period to period and against that of

other companies in its industry that provide Adjusted EBITDA

information. This increased comparability is achieved by excluding

the potentially disparate effects between periods or against

companies of interest, other financial items, depreciation and

amortization and taxes, which items are affected by various and

possible changes in financing methods, capital structure and

historical cost basis and which items may significantly affect net

income between periods. The Partnership believes that including

Adjusted EBITDA as a measure of operating performance benefits

investors in (a) selecting between investing in the Partnership and

other investment alternatives and (b) monitoring the Partnership’s

ongoing financial and operational strength.

Adjusted EBITDA is not intended to and does not

purport to represent cash flows for the period, nor is it presented

as an alternative to operating income. Further, Adjusted EBITDA is

not a measure of financial performance under U.S. GAAP and does not

represent and should not be considered as an alternative to net

income, operating income, cash flow from operating activities or

any other measure of financial performance presented in accordance

with U.S. GAAP. Adjusted EBITDA excludes some, but not all, items

that affect net income and these measures may vary among other

companies. Therefore, Adjusted EBITDA, as presented above, may not

be comparable to similarly titled measures of other businesses

because they may be defined or calculated differently by those

other businesses. It should not be considered in isolation or as a

substitute for a measure of performance prepared in accordance with

GAAP. Any Non-GAAP measures should be viewed as supplemental to,

and should not be considered as alternatives to, GAAP measures

including, but not limited to net earnings (loss), operating profit

(loss), cash flow from operating, investing and financing

activities, or any other measure of financial performance or

liquidity presented in accordance with GAAP.

Reconciliation of Net Income to Adjusted Net Income

available to common unitholders and Adjusted Earnings per common

unit

| |

Three Months Ended March 31, |

|

(In thousands of U.S. dollars except for units and per unit

data) |

|

2024 |

|

|

|

2023 |

|

| Net Income |

$ |

11,750 |

|

|

$ |

9,600 |

|

| Amortization of deferred

revenue |

|

1,700 |

|

|

|

(3,629 |

) |

| Amortization and write-off of

deferred charges |

|

54 |

|

|

|

53 |

|

| Loss on debt

extinguishment |

|

— |

|

|

|

154 |

|

| (Gain)/ Loss on derivative

financial instrument |

|

(1,260 |

) |

|

|

341 |

|

| Other Expense |

|

110 |

|

|

|

— |

|

| Adjusted Net

Income |

$ |

12,354 |

|

|

$ |

6,519 |

|

| Less: Adjusted Net Income

attributable to preferred unitholders and general partner |

|

(3,275 |

) |

|

|

(2,894 |

) |

| Net Income available

to common unitholders |

$ |

9,079 |

|

|

$ |

3,625 |

|

| Weighted average number of

common units outstanding, basic and diluted: |

|

36,802,247 |

|

|

|

36,802,247 |

|

| Adjusted Earnings per

common unit, basic and diluted |

$ |

0.25 |

|

|

$ |

0.10 |

|

| |

|

|

|

|

|

|

|

Adjusted Net Income represents net income before

non-recurring expenses (if any), charter hire amortization related

to time charters with escalating time charter rates and changes in

the fair value of derivative financial instruments. Net Income

available to common unitholders represents the common unitholders

interest in Adjusted Net Income for each period presented. Adjusted

Earnings per common unit represents Net Income available to common

unitholders divided by the weighted average common units

outstanding during each period presented.

Adjusted Net Income, Net Income available to

common unitholders and Adjusted Earnings per common unit, basic and

diluted, are not recognized measures under U.S. GAAP and should not

be regarded as substitutes for net income and earnings per unit,

basic and diluted. The Partnership’s definitions of Adjusted Net

Income, Net Income available to common unitholders and Adjusted

Earnings per common unit, basic and diluted, may not be the same at

those reported by other companies in the shipping industry or other

industries. The Partnership believes that the presentation of

Adjusted Net Income and Net income available to common unitholders

are useful to investors because these measures facilitate the

comparability and the evaluation of companies in the Partnership’s

industry. In addition, the Partnership believes that Adjusted Net

Income is useful in evaluating its operating performance compared

to that of other companies in the Partnership’s industry because

the calculation of Adjusted Net Income generally eliminates the

accounting effects of items which may vary for different companies

for reasons unrelated to overall operating performance. The

Partnership’s presentation of Adjusted Net Income, Net Income

available to common unitholders and Adjusted Earnings per common

unit does not imply, and should not be construed as an inference,

that its future results will be unaffected by unusual or

non-recurring items and should not be considered in isolation or as

a substitute for a measure of performance prepared in accordance

with GAAP.

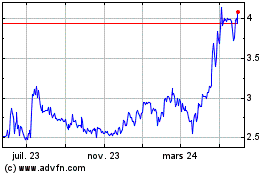

Dynagas LNG Partners (NYSE:DLNG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

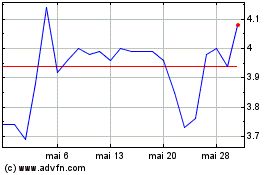

Dynagas LNG Partners (NYSE:DLNG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024