0001878897false00018788972024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

(Exact Name of Registrant as Specified in Its Charter)

| | |

| Delaware |

| (State or Other Jurisdiction of Incorporation) |

| | | | | | | | | | | | | | |

| 001-41054 | | 87-2176850 |

| (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | |

| 4400 Biscayne Boulevard | Miami | Florida | | 33137 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(305) 579-8000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to 12(b) of the Act:

| | | | | | | | |

| Title of each class: | Trading | Name of each exchange |

| Symbol(s) | on which registered: |

| Common stock, par value $0.01 per share | DOUG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements with Certain Officers. |

Employment Agreement with James Bryant Kirkland III

On October 30, 2024, Douglas Elliman Inc. (the “Company”) entered into an employment agreement, effective as of October 7, 2024 (the “Kirkland Employment Agreement”), with James Bryant Kirkland III, which sets forth the terms and conditions of his employment as the Company’s Executive Vice President, Treasurer and Chief Financial Officer and Secretary. Mr. Kirkland had previously been serving as the Company’s Senior Vice President & Chief Financial Officer.

Pursuant to the Kirkland Employment Agreement, Mr. Kirkland’s employment has an initial term of two years, which term will automatically be extended by one year on each anniversary of the effective date (the “Renewal Date”) of the employment agreement unless either party provides prior notice within the sixty (60)-day period prior to the Renewal Date that such party does not desire to extend the term. Mr. Kirkland is entitled to an annual base salary of $621,863 and is eligible to participate in the Company’s annual incentive program with a target annual bonus opportunity of 50% of his annual base salary. Mr. Kirkland’s bonus payments are subject to compliance with performance goals determined by the Compensation and Human Capital Committee (the “Compensation Committee”) of the Board of Directors of the Company (the “Board”). Such performance goals shall be consistent with Mr. Kirkland’s positions as the Executive Vice President and Chief Financial Officer of the Company.

Subject to Mr. Kirkland’s continued employment through the grant date, Mr. Kirkland shall be entitled to participate in the long-term incentive plans of the Company. In addition, subject to the approval of the Board (or the Compensation Committee of the Board, if properly authorized), the Company will recommend to the Board to grant Mr. Kirkland an aggregate of 300,000 restricted shares (the “Restricted Stock Grant”) of the Company’s common stock, par value of $0.01 per share (the “Common Stock”). Subject to the approval of the Board (or the Compensation Committee, if properly authorized) and the terms of the applicable Restricted Stock Agreement, the Restricted Stock Grant will vest equally on each of December 15, 2024, 2025, 2026 and 2027, so long as the Executive remains employed by the Company on a full time basis. In the event that Mr. Kirkland ceases to be employed by the Company according to the terms of the Kirkland Employment Agreement, the Restricted Stock Grant shall cease vesting.

The Kirkland Employment Agreement may be terminated by the Company without Cause (as defined in the Kirkland Employment Agreement) upon providing notice (the “Termination Notice”) to Mr. Kirkland stating such intention. In the event that the Company terminates Mr. Kirkland’s employment without Cause, the Employment Period shall terminate on the date set forth in the Termination Notice (the “Termination Date”) and a severance period of six (6) months (such period, the “Severance Period”) shall commence upon the Termination Date.

Upon a termination by the Company without Cause, during the Severance Period, Mr. Kirkland shall be entitled to receive his base salary, and subject to Mr. Kirkland’s timely election of continuation coverage under the Company’s group health plan plans, and continued copayment of premiums at the same level as if Mr. Kirkland were an active employee of the Company, Mr. Kirkland and his eligible dependents shall be entitled to a taxable monthly reimbursement in an amount equal to the amount of health insurance premiums that the Company would have subsidized, if any, had Mr. Kirkland remained an active employee, for the Severance Period, provided that the Executive remains eligible for coverage through the Severance Period. Mr. Kirkland shall also be eligible to receive a prorated bonus for the year in which the termination occurred. In addition, Mr. Kirkland shall be entitled to (x) payment of any earned but unpaid amounts, including bonuses for performance periods that ended prior to the Termination Date and any unreimbursed business expenses, with such payment made in accordance with Company practices in effect on the date of his termination of employment, and (y) any other rights, benefits or entitlements in accordance with this Kirkland Employment Agreement or any applicable plan, policy, program, arrangement of, or other agreement with, the Company or any of its subsidiaries or affiliates (collectively referred to as the “Accrued Obligations”).

In the event of Mr. Kirkland’s termination due to his death or Disability (as defined in the Kirkland Employment Agreement), Mr. Kirkland or his estate, as applicable, shall be entitled to the Accrued Obligations.

In the event of the voluntary termination of employment by Mr. Kirkland, Mr. Kirkland shall only be entitled to the Accrued Obligations; provided, however, if (A) such voluntary termination occurs as a result of (referred to herein as “Good Reason”): (i) a material diminution of Mr. Kirkland’s duties and responsibilities, including, without limitation, the failure to appoint or re-appoint Mr. Kirkland as Executive Vice President, Treasurer, Secretary & Chief Financial Officer of the Company or the removal of Mr. Kirkland from any such position, (ii) a material reduction of Mr. Kirkland’s base salary or target bonus opportunity as a percentage of base salary or any other material breach of any material provision of the Kirkland Employment

Agreement by the Company, (iii) relocation of Mr. Kirkland’s office outside of a 90 mile radius from Miami, Florida, or (iv) the failure of a successor to all or substantially all of the Company’s business and/or assets to promptly assume and continue the Company’s obligations under the Kirkland Employment Agreement, whether contractually or as a matter of law, within 15 days of such transaction and (B) Mr. Kirkland gives the Company sixty (60) days’ prior notice of his intent to voluntarily terminate his employment for any (or all) of the foregoing reasons and the Company shall not have cured such breach within such 60-day period, then the Severance Period shall begin at the end of such 60-day period and Mr. Kirkland shall be entitled to the same benefits above as if Mr. Kirkland had been terminated by the Company without Cause.

If within twelve (12) months of a Change of Control (as defined in the Kirkland Employment Agreement), the Company terminates Mr. Kirkland without Cause (as defined in the Kirkland Employment Agreement), other than for reason of death or Disability (as defined in the Kirkland Employment Agreement), or Mr. Kirkland voluntarily terminates his employment for Good Reason, Mr. Kirkland shall be entitled to: (i) a lump sum payment of 2.0 times the of Mr. Kirkland’s annual base salary, (ii) a prorated bonus for the year in which the termination occurs, (iii), subject to Mr. Kirkland’s timely election of continuation coverage under the Company’s group health plan, and continued copayment of premiums at the same level as if Mr. Kirkland were an active employee of the Company, Mr. Kirkland and his eligible dependents shall be entitled to a taxable monthly reimbursement in an amount equal to the amount of health insurance premiums that the Company would have subsidized, if any, had Mr. Kirkland remained an active employee, for six (6) months, provided that the Mr. Kirkland remains eligible for coverage during such period and (iv) the Accrued Obligations.

Any payments or severance payable to Mr. Kirkland pursuant to the Kirkland Employment Agreement shall be conditioned upon Mr. Kirkland’s execution of a general release of claims and covenant not to sue provided by the Company at the time of termination.

The Kirkland Employment Agreement contains a non-disclosure, non-competition, customer non-solicitation, and employee non-solicitation covenants.

The foregoing description of the Kirkland Employment Agreement is qualified in its entirety by reference to the full text of the Kirkland Employment Agreement, a copy of which is filed as exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| |

| |

| | Employment Agreement, dated October 30, 2024, between Douglas Elliman Inc, and James B. Kirkland III. |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | DOUGLAS ELLIMAN INC. |

| | |

| By: | /s/ J. Bryant Kirkland III |

| | | J. Bryant Kirkland III |

| | | Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

Date: November 1, 2024

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT dated as of October 30, 2024, by and between Douglas Elliman Inc., a Delaware corporation (together with its successors and assigns, the “Company”), and James B. Kirkland III (the “Executive”).

WITNESSETH

WHEREAS, the Executive has been serving as the Company’s Chief Financial Officer since December 30, 2021 without a formal employment agreement;

WHEREAS, on October 10, 2024, the Board of Directors of the Company (the “Board”) resolved to confirm the Executive’s continuation as Executive Vice President, Treasurer & Chief Financial Officer and appointed the Executive also as secretary of the Company, in each case, on a full-time basis and effective as of October 7, 2024 (the “Effective Date”); and

WHEREAS the Company and the Executive desire to enter into this Employment Agreement (the “Agreement”), to provide for the employment of the Executive by the Company for the period and upon the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and conditions contained herein, the Company and the Executive hereby agree as follows:

1. Employment and Term.

(a) Effective as of the Effective Date, the Company agrees to employ the Executive, and the Executive accepts employment by the Company, as its Executive Vice President, Treasurer, Secretary & Chief Financial Officer upon the terms and conditions set forth herein.

(b) Subject to Sections 1(c) and (d) and the provisions for termination hereinafter provided in Section 6, the term of the Executive’s employment hereunder shall be from the Effective Date through and including the day immediately preceding the second anniversary of the Effective Date (the “Initial Period”).

(c) On the first anniversary of the Effective Date and on each subsequent anniversary of such date (each a “Renewal Date”), the term of this Agreement shall automatically be extended by one additional calendar year (the “Extension Period”) unless either party shall have provided notice to the other within the sixty (60)-day period prior to a Renewal Date that such party does not desire to extend the term of this Agreement, in which case no further extension of the term of this Agreement shall occur pursuant hereto but all previous extensions of the term shall continue to be given full force and effect.

(d) For purposes of this Agreement, subject to the provisions for termination hereinafter provided in Section 6, the term “Employment Period” means the Initial Period, if the term of this Agreement has not been extended pursuant to Section 1(c); otherwise, the period beginning on the Effective Date and ending with the last day of the most recently arising Extension Period. Notwithstanding the foregoing, the Employment Period shall terminate on the applicable date set forth in Section 6 and shall not include any Severance Period (as hereinafter defined).

(e) Notwithstanding anything herein to the contrary, to the extent the Executive’s employment as Executive Vice President, Treasurer, Secretary & Chief Financial Officer of the Company is terminated, except in a case of termination for Cause (as defined herein), Executive shall be entitled to remain as a real estate agent of the Company.

2. Duties.

(a) Throughout the Employment Period, the Executive shall be the Executive Vice President, Treasurer, Secretary & Chief Financial Officer and Secretary of the Company, reporting directly to the Board and the Chief Executive Officer of the Company, and shall have all duties and authorities as customarily exercised by an individual serving in such positions in a company the nature and size of the Company. The Executive shall at all times comply with all written Company policies applicable to him.

(b) Throughout the Employment Period, the Executive shall devote his business time and attention to performing his services to the Company hereunder and shall use his reasonable best efforts to perform his duties under this Agreement fully, diligently and faithfully, and shall use his reasonable best efforts to promote the interests of the Company and its subsidiaries and affiliates.

(c) Except as expressly set forth herein (including Section 5(c) below), nothing shall preclude the Executive from (i) serving on the boards of directors of a reasonable number of other business entities (other than public companies), trade associations and/or charitable organizations, (ii) engaging in charitable activities and community affairs, (iii) managing his personal and/or family investments and affairs, and (iv) engaging in any other activities (including serving on the boards of directors of public companies) approved by the Board (or a committee thereof) or the Chief Executive Officer; provided, however, that such activities do not materially interfere with the proper performance of his duties and responsibilities specified in Section 2(b).

3. Compensation.

As compensation for his services to be performed hereunder and for his acceptance of the responsibilities described herein, the Company agrees to pay the Executive, and the Executive agrees to accept, the following compensation and other benefits:

(a)Base Salary. During the Employment Period, the Company shall pay the Executive a salary (the “Base Salary”) at the rate of $621,863.00 per annum, payable in equal installments at such payment intervals as are the usual custom of the Company, but not less often than monthly. In addition to the foregoing, the Board shall periodically review such Base Salary and may increase (but not decrease) it from time to time, in its sole discretion. After any increase, “Base Salary” as used in this Agreement shall mean the increased amount.

(b)Annual Incentive Compensation. During the Employment Period, the Executive shall be entitled to participate in the Company’s Annual Bonus Plan, including any successor thereto, commencing with the calendar year ending December 31, 2024, and be eligible to receive an annual bonus (“Bonus Amount”) based on a target bonus opportunity of 50% of Base Salary. Bonus payments shall be subject to compliance with performance goals determined by the Compensation and Human Capital Committee of the Board in accordance with the Annual Bonus Plan, which performance goals shall be consistent with the Executive’s positions as the Executive Vice President and Chief Financial Officer of the Company. Any Bonus Amount earned for a calendar year shall be paid to the Executive in the immediately following calendar year, as soon as practicable after the audited financial statements for the Company for the year for which the Bonus Amount is earned have been released but in no event later than thirty (30) days after such release. Except as otherwise provided herein, in order to be eligible to receive a Bonus Amount for a calendar year, the Executive must remain employed with the Company through the date of payment of such Bonus Amount.

(c)Long-Term Incentive Plans. During the Employment Period, the Executive shall be entitled to participate in the long-term incentive plans of the Company, including, but not limited to, the Company’s 2021 Management Incentive Plan (the “2021 Plan”) or any successor thereto, on a basis consistent with the Executive’s positions with the Company. Subject to the approval of the Board (or the Compensation and Human Capital Committee of the Board, if properly authorized), at its sole discretion, the Company will recommend to the Board to grant you an aggregate of 300,000 restricted shares (the “Restricted Stock Grant”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”), according to the 2021 Plan (or any successor plan then in effect), subject to the requirements of the relevant securities, tax and other applicable laws and regulations. Subject to the approval of the Board (or the Compensation and Human Capital Committee of the Board, if properly authorized) and the terms of the applicable Restricted Stock Agreement, the Restricted Stock Grant will vest equally on each of December 15, 2024, 2025, 2026 and 2027, so long as the Executive remains employed by the Company on a full time basis, according to the terms of this Employment Agreement on each applicable vesting date (for the avoidance of doubt, and notwithstanding anything to the contrary in the 2021 Plan and applicable Restricted Stock Agreement, the Restricted Stock Grant shall cease vesting if Executive ceases to be employed by the Company according to the terms of this Employment Agreement, as may be amended from time to time). Executive shall be responsible for any and all tax consequences in connection with the Restricted Stock Grant and/or the sale of the underlying shares of Common Stock once vested, and the Company shall be entitled to withhold taxes according to the requirements under applicable laws, rules, and regulations.

(d)Benefit Plans. During the Employment Period and as otherwise provided herein in Section 6, the Executive shall be entitled to participate in the employee welfare and health benefit plans (including, but not limited to, life insurance, health and medical, dental and disability plans) and other employee benefit plans, including but not limited to qualified pension plans established by the Company from time to time for the general and overall benefit of the senior executives of the Company; provided that nothing herein contained shall be construed as requiring the Company to establish or continue any particular benefit plan in discharge of its obligations hereunder.

4. Vacation and Other Benefits.

During the Employment Period, the Executive shall be entitled to five (5) weeks of paid vacation each year of his employment hereunder, as well as to payment or reimbursement of all reasonable expenses incurred by the Executive in the performance of his responsibilities and the promotion of the Company’s businesses. In all events, during the Employment Period, the Executive shall be entitled to reasonable and documented air travel and lodging, cellular phone charges and reimbursement for reasonable automobile expenses in connection with approved business travel on an after-tax basis. The Executive shall submit to the Company periodic statements of all expenses so incurred. Subject to such audits as the Company may deem necessary, the Company shall reimburse the Executive the full amount of any such expenses incurred by him promptly in the ordinary course.

5. Executive Covenants.

Provided that the Company is not in material default to the Executive on any of its obligations under this Agreement, the Executive agrees as follows:

(a)Except with the consent of or as directed by the Board or otherwise in the ordinary course of the business of the Company or any subsidiary, affiliate or investee in which the Company holds, directly or indirectly, more than a 20% equity interest (a “Significant Investee”), the Executive shall keep confidential and not divulge to any other person, during the Employment Period or thereafter, any business secrets and other confidential information regarding the Company, its subsidiaries, its affiliates and/or its Significant Investees, except for information which is or becomes publicly available or known within the relevant trade or industry other than as a result of disclosure by the Executive in violation of this Section 5(a). Anything herein to the contrary notwithstanding, the provisions of this Section 5(a) shall not apply (i) when disclosure is required by law or by any court, arbitrator, mediator or administrative or legislative body (including any committee thereof) with apparent jurisdiction to order the Executive to disclose or make accessible any information, (ii) when disclosure is necessary to resolve an issue raised in good faith in any litigation, arbitration or mediation involving this Agreement or any other agreement between the Executive and the Company or any of its subsidiaries, affiliates or Significant Investees, including, but not limited to, the enforcement of such agreements or (iii) when disclosure is required in connection with the Executive’s cooperation pursuant to Section 5(f). Notwithstanding anything to the contrary in this Agreement or otherwise, nothing shall limit the Executive’s rights under applicable law to provide truthful information to any governmental entity or to file a charge with or participate in an investigation conducted by any governmental entity. If Executive files a lawsuit for retaliation by the Company for reporting a suspected violation of law, Executive may disclose the Company’s trade secrets to Executive’s attorney and use the trade secret information in the court proceeding if the Executive files any document containing the trade secret under seal and does not disclose the trade secret, except pursuant to court order. Notwithstanding the foregoing, the Executive agrees to waive the Executive’s right to recover monetary damages in connection with any charge, complaint or lawsuit filed by the Executive or anyone else on the Executive’s behalf (whether involving a governmental entity or not); provided that the Executive is not agreeing to waive, and this Agreement shall not be read as requiring the Executive to waive, any right the Executive may have to receive an award for information provided to any governmental entity. The Executive is hereby notified that the immunity provisions in Section 1833 of title 18 of the United States Code provide that an individual cannot be held criminally or civilly liable under any federal or state trade secret law for any disclosure of a trade secret that is made (1) in confidence to federal, state or local government officials, either directly or indirectly, or to an attorney, and is solely for the purpose of reporting or investigating a suspected violation of the law, (2) under seal in a complaint or other document filed in a lawsuit or other proceeding, or (3) to the Executive’s attorney in connection with a lawsuit for retaliation for reporting a suspected violation of law (and the trade secret may be used in the court proceedings for such lawsuit) as long as any document containing the trade secret is filed under seal and the trade secret is not disclosed except pursuant to court order.

(b) All papers, books and records of every kind and description relating to the business and affairs of the Company, its subsidiaries, affiliates or Significant Investees, whether or not prepared by the Executive are the exclusive property of the Company, and the Executive shall surrender them to the Company, at any time upon request by the General Counsel or Chief Executive Officer of the Company, during or after the Employment Period. Anything to the contrary notwithstanding, the Executive shall be entitled to retain (i) papers and other materials of a personal nature, including, but not limited to, photographs, correspondence, personal diaries, calendars and Rolodexes, personal files and phone books, (ii) information showing his compensation or relating to reimbursement of expenses, (iii) information that he reasonably believes may be needed for tax purposes and (iv) copies of plans, programs and agreements relating to his employment, or, if applicable, his termination of employment, with the Company or any of its subsidiaries or affiliates.

(c) During the Employment Period and for a period of six (6) months following the end of the Employment Period, the Executive shall not, without the prior written consent of the Board, participate as a director, officer, employee, agent, representative, stockholder, or partner, or have any direct or indirect financial interest as a creditor, in any business which directly or indirectly competes with a business in which the Company, a subsidiary, affiliate or Significant Investee (collectively, the “Restricted Group”) is engaged both for some period during the Employment Period and on the day the Executive’s employment is terminated hereunder (“Competitive Business”); provided, however, that this Section 5(c) shall not restrict the Executive from holding up to 5% of the publicly traded securities of any entity which so competes with the Company. Anything to the contrary notwithstanding, this Section 5(c) shall not prohibit the Executive from (i) serving on the board of directors of any entity on which he was serving prior to his termination date and (ii) providing services to a subsidiary, division or affiliate of a Competitive Business if such subsidiary, division or affiliate is not itself engaged in a Competitive Business and the Executive does not provide services to or with respect to the Competitive Business.

(d) During the Employment Period and for a period of six (6) months following the end of the Employment Period, the Executive shall not, without the prior written consent of the Board, either for his own account or for any person, firm or company (i) solicit any customer of the Company, its subsidiaries or affiliates (other than with respect to products and services not provided by any member of the Restricted Group on the date the Executive’s employment is terminated), or (ii) solicit or endeavor to cause any employee of any member of the Restricted Group to leave such employment or induce or attempt to induce any such employee to breach any written employment agreement with the Company, its subsidiaries or affiliates, provided the Executive knows (or reasonably should have known) about the provisions of such agreement.

(e) Without limiting any other provision of this Agreement, the Executive hereby agrees to act in a manner consistent with, and to use his reasonable best efforts to cause the Company, its subsidiaries and its affiliates, as appropriate, to comply with, any obligations known to the Executive and imposed on the Company, its subsidiaries or affiliates, by law, rule, regulation, ordinance, order, decree, instrument, agreement, understanding or other restriction of any kind.

(f) The Executive hereby agrees to provide reasonable cooperation to the Company, its subsidiaries and affiliates during the Employment Period and, subject to his other personal and business commitments, any Severance Period in any litigation between the Company, its subsidiaries or affiliates, and third parties.

(g) The parties agree that the Company shall, in addition to other remedies provided by law, have the right and remedy to have the provisions of this Section 5 specifically enforced by any court having equity jurisdiction, it being acknowledged and agreed that any breach or threatened breach by the Executive of the provisions of this Section 5 will cause irreparable injury to the Company and that money damages will not provide an adequate remedy to the Company. Nothing contained herein shall be construed as prohibiting the Company from pursuing any other remedies available to it for such breach or threatened breach, including the recovery of damages from the Executive.

6. Termination of Employment Period and Severance.

(a) Termination by the Company Without Cause. Except as provided in Section 6(d), if for any reason the Company wishes to terminate the Employment Period and the Executive’s employment hereunder (including by not extending the term of this Agreement pursuant to Section 1(c)), (i) the Company shall give notice (the “Termination Notice”) to the Executive stating such intention, (ii) the Employment Period shall terminate on the

date set forth in the Termination Notice (the “Termination Date”), and (iii) a severance period shall commence upon such Termination Date for a period of six (6) months (such period, the “Severance Period”). During the Severance Period, the Executive shall continue to receive the Base Salary under Section 3(a), and subject to Executive’s timely election of continuation coverage under the Company’s group health plan pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), and continued copayment of premiums at the same level as if Executive were an active employee of the Company, the Executive and his eligible dependents shall be entitled to a taxable monthly reimbursement in an amount equal to the amount of health insurance premiums that the Company would have subsidized, if any, had Executive remained an active employee, for the Severance Period, provided that the Executive remains eligible for COBRA coverage during such period. The Executive shall also be eligible to receive a prorated Bonus Amount for the year in which the termination occurred. Such prorated Bonus Amount shall be paid in accordance with Section 3(b) and shall be subject to the performance requirements being achieved for that year. In addition, the Executive shall be entitled to (x) payment of any earned but unpaid amounts, including bonuses for performance periods that ended prior to the Termination Date and any unreimbursed business expenses, with such payment made in accordance with Company practices in effect on the date of his termination of employment, and (y) any other rights, benefits or entitlements in accordance with this Agreement or any applicable plan, policy, program, arrangement of, or other agreement with, the Company or any of its subsidiaries or affiliates. Any amounts or benefits provided under this Section 6(a) (other than pursuant to Section 6(a)(x) and (y), such amounts the “Accrued Obligations”) shall be shall be conditioned upon the Executive’s execution of a general release of claims and covenant not to sue provided by the Company at the time of termination (the “Release”), and the Release becoming effective within fifty-two (52) days after the Termination Date (or such earlier date as may be required by the Company). Payment of any amounts under this Section 6(a) (other than the Accrued Obligations) shall commence on the first payroll date after the Release becomes irrevocable or, if earlier, the sixtieth (60th) day following the Termination Date, provided, that if the sixty (60)-day period following the Termination Date crosses calendar years, if necessary to comply with Section 409A of Code payment shall not commence until the second calendar year (the commencement date, “Payment Commencement Date”). Any payments that are so delayed shall be paid on the Payment Commencement Date.

(b) Death. If the Executive dies during the Employment Period, the Employment Period shall automatically terminate. The Executive’s designated beneficiary(ies) (or his estate in the absence of any surviving designated beneficiary) shall be entitled to the Accrued Obligations. If the Executive dies during any Severance Period during which he is entitled to benefits pursuant to Section 6, his designated beneficiary(ies) (or his estate in the absence of any surviving designated beneficiary) shall continue to receive the compensation that the Executive would have otherwise received during the remainder of the Severance Period and his designated beneficiary(ies) shall be entitled to continue to participate in the Company’s medical plans during the remainder of the Severance Period.

(c) Disability. If the Executive is deemed to have a Disability (as hereinafter defined) during the Employment Period, the Company shall be entitled to terminate the Executive’s employment upon thirty (30) days’ notice to the Executive. In the event of such termination, the Executive shall be released from his duties under Section 2, and the Employment Period shall end and the Executive shall be entitled to the Accrued Obligations. For purposes of this Employment Agreement, “Disability” shall mean mental or physical impairment or incapacity rendering the Executive substantially unable to perform his duties under this Agreement for more than 180 days out of any 360-day period during the Employment Period. A determination of Disability shall be made by the Board in its reasonable discretion after obtaining the advice of a medical doctor mutually selected by the Company and the Executive. If the parties cannot agree upon a medical doctor, each party shall select a medical doctor and the two doctors shall select a third who shall be the approved medical doctor for this purpose.

(d) Termination by the Company for Cause. The Company, by notice to the Executive, shall have the right to terminate the Employment Period and the Executive’s employment hereunder in the event of any of the following (any of which shall constitute “Cause” for purposes of this Agreement):

(i) the Executive having been convicted of or entered a plea of nolo contendere with respect to a criminal offense constituting a felony;

(ii) the Executive having committed in the performance of his duties under this Agreement one or more acts or omissions constituting fraud, dishonesty or willful injury to the Company which results in a material adverse effect on the business, financial condition or results of operations of the Company;

(iii) the Executive having committed one or more acts constituting gross neglect or willful misconduct;

(iv) the Executive having exposed the Company to criminal liability substantially and knowingly caused by the Executive; or

(v) the Executive having failed, after written warning from the Board specifying in reasonable detail the breach(es) complained of, to substantially perform his duties under this Agreement (excluding, however, any failure to meet any performance targets or to raise capital or any failure as a result of an approved absence or any mental or physical impairment that could reasonably be expected to result in a Disability).

For purposes of the foregoing, no act or failure to act on the part of the Executive shall be considered “willful” or “knowingly” unless it is done, or omitted to be done, by the Executive without reasonable belief that the Executive’s action or omission was in the best interests of the Company. Any act or failure to act that is expressly authorized by the Board pursuant to a resolution duly adopted by the Board, or pursuant to the written advice of counsel for the Company, shall be conclusively presumed to be done, or omitted to be done, by the Executive in the best interests of the Company.

Any termination of employment under this Section 6(d) shall not be followed by a Severance Period and shall be without damages or liability to the Company for compensation and other benefits other than Accrued Obligations.

(e) Voluntary Termination by the Executive. In the event of the voluntary termination of employment by the Executive, the terms of the last paragraph of Section 6(d) shall apply; provided, however, if (A) such voluntary termination occurs as a result of: (i) a material diminution of the Executive’s duties and responsibilities provided in Section 2, including, without limitation, the failure to appoint or re-appoint the Executive as Executive Vice President, Treasurer, Secretary & Chief Financial Officer of the Company or the removal of the Executive from any such position, (ii) a material reduction of the Executive’s Base Salary or target bonus opportunity as a percentage of Base Salary or any other material breach of any material provision of this Agreement by the Company, (iii) relocation of the Executive’s office outside of a 90 mile radius from Miami, Florida, or (iv) the failure of a successor to all or substantially all of the Company’s business and/or assets to promptly assume and continue the Company’s obligations under this Agreement, whether contractually or as a matter of law, within 15 days of such transaction and (B) the Executive gives the Company sixty (60) days’ prior notice of his intent to voluntarily terminate his employment for any (or all) of the reasons set forth in Section 6(e)(A)(i), (ii), (iii) or (iv) and the Company shall not have cured such breach within such 60-day period, then the Severance Period shall begin at the end of such 60-day period and the provisions of Section 6(a) shall apply.

(f) Termination Following a Change in Control.

For purposes of this Agreement, a “Change in Control” shall occur if or upon the occurrence of:

(i) Any “Person” (as the term person is used for purposes of Section 13(d) or 14(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) acquires “Beneficial Ownership” (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of any securities of the Company which generally entitles the holder thereof to vote for the election of directors of the Company (the “Voting Securities”), which, when added to the Voting Securities then “Beneficially Owned” by such person, would result in such Person “Beneficially Owning” more than fifty percent (50%) of the combined voting power of the Company’s then outstanding Voting Securities; provided, however, that for purposes of this paragraph (i), a Person shall not be deemed to have made an acquisition of Voting Securities if such Person: (a) acquires Voting Securities as a result of a stock split, stock dividend or other corporate restructuring in which all stockholders of the class of such Voting Securities are treated on a pro rata basis; (b) acquires the Voting Securities directly from the Company; (c) becomes the Beneficial Owner of more than the permitted percentage of Voting Securities solely as a result of the acquisition of Voting Securities by the Company, which, by reducing the number of Voting Securities outstanding, increases the proportional number of shares Beneficially Owned by such Person; (d) is the Company or any corporation or other Person of which a majority of its voting power or its equity securities or equity interest is owned directly or

indirectly by the Company (a “Controlled Entity”); or (e) acquires Voting Securities in connection with a “Non-Control Transaction” (as defined in paragraph (iii) below); or

(ii) The individuals who, as of the Effective Date are members of the Board (the “Incumbent Board”), cease for any reason to constitute at least two-thirds of the Incumbent Board, provided, however, that if either the election of any new director or the nomination for election of any new director was approved by a vote of at least a majority of the Incumbent Board, such new director shall be considered as a member of the Incumbent Board; provided further, however, that no individual shall be considered a member of the Incumbent Board if such individual initially assumed office as a result of either an actual or threatened “Election Contest” (as described in Rule 14a-11 promulgated under the Exchange Act) or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board (a “Proxy Contest”), including by reason of any agreement intended to avoid or settle any Election Contest or Proxy Contest; or

(iii) The consummation of a merger, share exchange, consolidation or reorganization involving the Company (a “Business Combination”), unless:

A. the stockholders of the Company immediately before the Business Combination, own, directly or indirectly immediately following the Business Combination, at least fifty-one percent (51%) of the combined voting power of the outstanding Voting Securities of the corporation resulting from the Business Combination (the “Surviving Corporation”), and

B. the individuals who were members of the Incumbent Board immediately prior to the execution of the agreement providing for the Business Combination constitute at least a majority of the members of the Board of Directors of the relevant Surviving Corporation, and

C. no Person (other than the Company, or any Controlled Entity, a trustee or other fiduciary holding securities under one or more employee benefit plans or arrangements (or any trust forming a part thereof) maintained by the Company, the Surviving Corporation or any Controlled Entity, or any Person who, immediately prior to the Business Combination, had Beneficial Ownership of forty percent (40%) or more of the then outstanding Voting Securities) has Beneficial Ownership of forty percent (40%) or more of the combined voting power of the Surviving Corporation’s then outstanding voting securities (a transaction described in this subparagraph (iii) shall be referred to as a “Non-Control Transaction”);

(iv) Stockholder approval of complete liquidation or dissolution of the Company; or

(v) The consummation of a sale or other disposition of all or substantially all of the assets of the Company to any Person (other than a transfer to a Controlled Entity).

Notwithstanding the foregoing, (x) a Change in Control shall not be deemed to occur solely because more than fifty percent (50%) of the then outstanding Voting Securities is Beneficially Owned by (A) a trustee or other fiduciary holding securities under one or more employee benefit plans or arrangements (or any trust forming a part thereof) maintained by the Company or any Controlled Entity or (B) any corporation which, immediately prior to its acquisition of such interest, is owned directly or indirectly by the stockholders of the Company in the same proportion as their ownership of stock in the Company, immediately prior to such acquisition; and (y) if the Executive ceases to be an employee of the Company and the Executive reasonably demonstrates that such termination (A) was at the request of a third party who has indicated an intention or taken steps reasonably calculated to effect a Change in Control and who effectuates a Change in Control or (B) otherwise occurred in connection with, or in anticipation of, a Change in Control which actually occurs, then for all purposes hereof, the date of a Change in Control with respect to the Executive shall mean the date immediately prior to the date of such termination of employment (and the Executive shall be entitled to the payments, benefits and entitlements provided under Section 6(g) determined as of his termination but reduced and offset as appropriate to reflect the value of the payments, benefits and entitlements received by the Executive and his beneficiaries pursuant to Section 6(a) prior to the date it is determined that Section 6(g) applies.

(g) If within twelve (12) months of a Change in Control, the Executive’s employment is terminated by the Company without Cause (other than for reason of death or Disability) or by the Executive for any (or all) of the reasons set forth in Sections 6(e)(A)(i), (ii), (iii), (iv) or (v), the Company shall pay the Executive in cash in a lump sum to be paid as soon as practicable following termination (but in no event later than 30 days following such

termination), an amount equal to 2.0 times the sum of the annual Base Salary of the Executive. The Executive shall also be eligible to receive a prorated Bonus Amount for the year in which the termination occurred. Such prorated Bonus Amount shall be paid in accordance with Section 3(b) and shall be subject to the performance requirements being achieved for that year. In addition, subject to Executive’s timely election of continuation coverage under the Company’s group health plan pursuant to COBRA, and continued copayment of premiums at the same level as if Executive were an active employee of the Company, the Executive and his eligible dependents shall be entitled to a taxable monthly reimbursement in an amount equal to the amount of health insurance premiums that the Company would have subsidized, if any, had Executive remained an active employee, for six (6) months, provided that the Executive remains eligible for COBRA coverage during such period. In addition, the Executive shall be entitled to the Accrued Obligations. There shall be no Severance Period following a termination under this Section 6(g) or any termination pursuant to clause (z) of Section 6(f), and upon such a termination, the Executive shall no longer be bound by the provisions of Section 5 of this Agreement.

(h) Section 409A; Timing of Payments. This Agreement is intended to comply with the requirements of Section 409A of the Code (together with the applicable regulations thereunder, “Section 409A”). To the extent that any provision in this Agreement is ambiguous as to its compliance with Section 409A, such provision will be read in such a manner so that all payments due under this Agreement will comply with Section 409A. Notwithstanding the other provisions of this Agreement, any payment or other benefit required to be made to or provided to or with respect to the Executive under this Agreement upon his termination of employment shall be made or provided promptly after the six month anniversary of the Executive’s date of termination of employment to the extent necessary to avoid imposition upon the Executive of any additional tax imposed under Section 409A. All payments due and owing for the six-month period shall be paid on the first day following the six-month anniversary of the Executive’s date of termination, with interest at the prime lending rate as published in The Wall Street Journal and in effect as of the date the payment or benefit should otherwise have been provided. In addition, if any payment or benefit permitted or required under this Agreement or otherwise is reasonably determined by either party to be subject for any reason to a material risk of additional tax pursuant to Section 409A, then the parties shall promptly negotiate in good faith appropriate provisions to avoid such risk without increasing the cost of this Agreement to the Company or, to the extent practicable, materially changing the economic value of this Agreement to the Executive. For purposes of Section 409A, each payment made under this Agreement will be treated as a separate payment. In addition, to the extent permissible under Section 409A, any series of installment payments under this Agreement shall be treated as a right to a series of separate payments. In no event may the Executive, directly or indirectly, designate the calendar year of payment. All reimbursements provided under this Agreement will be made or provided in accordance with the requirements of Section 409A, including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during the Executive’s lifetime (or during a shorter period of time specified in this Agreement), (ii) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year, (iii) the reimbursement of an eligible expense will be made on or before the last day of the calendar year following the year in which the expense is incurred, and (iv) the right to reimbursement is not subject to liquidation or exchange for another benefit. Notwithstanding anything to the contrary, the Company does not make any representation to the Executive that the payments or benefits provided under this Agreement are exempt from, or satisfy, the requirements of Section 409A, and neither the Company nor any of its subsidiaries or affiliates shall have any liability or other obligation to indemnify or hold harmless the Executive or any beneficiary of the Executive for any tax, additional tax, interest or penalties that the Executive or any beneficiary of the Executive may incur in the event that any provision of this Agreement or any other action taken with respect thereto is deemed to violate any of the requirements of Section 409A.

7. No Mitigation of Damages; No Offset.

In the event the employment of the Executive under this Agreement is terminated for any reason, the Executive shall not be required to seek other employment so as to minimize any obligation of the Company to compensate him for any damages he may suffer by reason of such termination. In addition, the Company or any of its subsidiaries or affiliates shall not have a right of offset against any payments, benefits or entitlements due to the Executive under this Agreement or otherwise on account of any remuneration the Executive receives from subsequent employment or on account of any claims the Company or any of its subsidiaries or affiliates may have against the Executive (except to the extent expressly set forth in Section 6(g) hereof).

8. Indemnification.

(a) The Company agrees that if the Executive is made a party to, is threatened to be made a party to, receives any legal process in, or receives any discovery request or request for information in connection with, any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”), by reason of the fact that he is or was a director, officer, employee, consultant or agent of the Company or was serving at the request of, or on behalf of, the Company as a director, officer, member, employee, consultant or agent of another corporation, limited liability corporation, partnership, joint venture, trust or other entity, including service with respect to employee benefit plans, whether or not the basis of such Proceeding is the Executive’s alleged action in an official capacity while serving as a director, officer, member, employee, consultant or agent of the Company or other entity, the Executive shall be indemnified and held harmless by the Company to the fullest extent permitted or authorized by the Company’s certificate of incorporation and/or bylaws, or, if greater, by applicable law, against any and all costs, expenses, liabilities and losses (including, without limitation, attorneys’ fees reasonably incurred, judgments, fines, ERISA excise taxes or penalties and amounts paid or to be paid in settlement and any reasonable costs and fees incurred in enforcing his rights to indemnification or contribution) incurred or suffered by the Executive in connection therewith, and such indemnification shall continue as to the Executive even though he has ceased to be a director, officer, member, employee, consultant or agent of the Company or other entity; provided that a Proceeding shall not include any (i) action, suit or proceeding related to the trading of Company-issued securities by the Executive (including actions, suits or proceedings related to insider trading allegations or related to Section 16 of the Securities Exchange Act of 1934, as amended), (ii) any claim, demand or charge based upon acts or omissions of Executive, where the Executive (X) acted in bad faith or in a manner reasonably believed to not be in the best interests of the Company, (y) acted in an unlawful manner or (z) has been finally adjudged by a court to be liable to the Company, (iii) any claim for injury or death to any person or for damage to or destruction of property resulting from any act or omission of Executive arising under or relating to this Agreement; and (iv) any misappropriation, misuse or theft of confidential information, unfair competition, or breach of contract (including breach of this Agreement). The Company shall advance to the Executive his legal fees and other expenses to be paid by him in connection with a Proceeding within 20 business days after receipt by the Company of a written request for such reimbursement and appropriate documentation associated with such expenses. Such request shall include an undertaking by the Executive to repay such amounts if, and to the extent, required to do so by applicable law if it shall ultimately be determined by a final court adjudication from which there is no right of appeal that the Executive is not entitled to be indemnified against such costs and expenses; provided that, to the extent permitted by law, the amount of such obligation to repay shall be limited to the after-tax amount of any such advance except to the extent the Executive is able to offset such taxes incurred on the advance by the tax benefit, if any, attributable to a deduction for repayment.

(b) The Company agrees to maintain for the Executive a directors’ and officers’ liability insurance policy not less favorable than any policy that the Company or any subsidiary or affiliate thereof maintains for its directors and executive officers in general for a period of at least six (6) years following the termination of the Executive’s employment.

(c) This Section 8 establishes contract rights which shall be binding upon, and shall inure to the benefit of the heirs, executors, personal and legal representatives, successors and assigns of the Executive. The obligations set forth in this Section 8 shall survive any termination of this Agreement (whether such termination is by the Company, the Executive, upon the expiration of this Agreement, or otherwise). Nothing in this Section 8 shall be construed as reducing or waiving any right to indemnification, advancement of expenses or coverage under directors’ and officers’ liability insurance policies the Executive has or would otherwise have under the Company’s certificate of incorporation, by laws, other agreement or under applicable law.

9. No Conflicting Agreements.

As of the date of this Agreement, the Executive hereby represents and warrants to the Company that his entering into this Agreement, and the obligations and duties undertaken by him hereunder, will not conflict with, constitute a breach of, or otherwise violate the terms of any other employment or other written agreement to which he is a party. The Company represents and warrants that it is a corporation duly organized and existing under the laws of the State of Delaware and that execution and delivery of this Agreement has been duly authorized by all necessary corporate action, including approval by the Company’s Compensation Committee.

10. Assignment.

(a) By the Executive. This Agreement and any obligations hereunder shall not be assigned, pledged, alienated, sold, attached, encumbered or transferred in any way by the Executive and any attempt to do so shall be void. Notwithstanding the foregoing, the Executive may transfer his rights and entitlements to compensation and benefits under this Agreement or otherwise pursuant to will, operation of law or in accordance with any applicable plan, policy, program, arrangement of, or other agreement with, the Company or any of its subsidiaries or affiliates.

(b) By the Company. Provided that the substance of the Executive’s duties set forth in Section 2 shall not change, and provided that the Executive’s compensation as set forth in Section 3 shall not be adversely affected, the Company may assign or transfer its rights and obligations under this Agreement, provided that the assignee or transferee is the successor to all or substantially all of the assets of the Company and such assignee or transferee assumes the liabilities, obligations and duties of the Company, as contained in this Agreement, either contractually or as a matter of law.

(c) This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors, heirs (in the case of the Executive) and assigns.

11. Arbitration.

At the election of the Executive or the Company, any controversy or claim arising out of or relating to this Agreement, or the breach thereof, shall be settled by arbitration in Miami, Florida before a panel of three arbitrators in accordance with the Commercial Arbitration Rules of the American Arbitration Association then pertaining to Miami, Florida. In any such arbitration, one arbitrator shall be selected by each of the parties, and the third arbitrator shall be selected by the first two arbitrators. The arbitration award shall be final and binding upon the parties and judgment thereon may be entered in any court having jurisdiction thereof. The arbitrators shall be deemed to possess the powers to issue mandatory orders and restraining orders in connection with such arbitration; provided, however, that nothing in this Section 11 shall be construed so as to deny the Company the right and power to seek and obtain injunctive relief in a court of equity for any breach or threatened breach of the Executive of any of his covenants contained in Section 5 hereof.

12. Notices.

All notices, requests, demands and other communications hereunder must be in writing and shall be deemed to have been duly given if delivered by hand, electronic mail, or overnight delivery service or mailed within the continental United States by first-class, certified mail, return receipt requested, to the applicable party and addressed as follows:

Douglas Elliman Inc.

4400 Biscayne Boulevard

Miami, Florida 33137

Attn: General Counsel

Email: generalcounsel@dougcorp.com

Most recent home address and email address as indicated in the Company’s records.

Addresses may be changed by notice in writing signed by the addressee in accordance with this Section 12.

13. Miscellaneous.

(a) If any provision of this Agreement shall, for any reason, be adjudicated by any court of competent jurisdiction to be invalid or unenforceable, such judgment shall not affect, impair or invalidate the remainder of this Agreement but shall be confined in its operation to the jurisdiction in which made and to the provisions of this Agreement directly involved in the controversy in which such judgment shall have been rendered.

(b) No course of dealing and no delay on the part of any party hereto in exercising any right, power or remedy under or relating to this Agreement shall operate as a waiver thereof or otherwise prejudice such party’s rights, power and remedies. No single or partial exercise of any rights, powers or remedies under or relating to this Agreement shall preclude any other or further exercise thereof or the exercise of any other right, power or remedy.

(c) This Agreement may be executed by the parties hereto in counterparts, each of which shall be deemed to be an original, but all such counterparts shall together constitute the same instrument, and all signatures need not appear on any one counterpart.

(d) All payments required to be made to the Executive by the Company hereunder shall be subject to any applicable withholding under any applicable federal, state, or local tax laws. Any such withholding shall be based upon the most recent form W-4 filed by the Executive with the Company, and the Executive may from time to time revise such filing.

(e) This Agreement embodies the entire understanding and supersedes all other oral or written agreements or understandings, between the parties regarding the subject matter hereof. No change, alteration or modification hereof may be made except in writing signed by both parties hereto. Any waiver to be effective must be in writing, specifically referencing the provision of this Agreement being waived and signed by the party against whom enforcement is being sought. Except as otherwise expressly provided herein, there are no other restrictions or limitations on the Executive’s activities following termination of employment. In the event of any inconsistency between this Agreement and any plan, policy, program or arrangement of, or any other agreement with, the Company or any of its subsidiaries or affiliates, the provision most favorable to the Executive shall govern. The headings in this Agreement are for convenience of reference only and shall not be considered part of this Agreement or limit or otherwise affect the meaning hereof. This Agreement and the rights and obligations of the parties hereunder shall be construed in accordance with and governed by the laws of the state of Florida (disregarding any choice-of-law rules which might look to the laws of any other jurisdiction).

(f) Except as otherwise expressly set forth in this Agreement, upon the termination or expiration of the Employment Period, the respective rights and obligations of the parties shall survive such termination or expiration to the extent necessary to carry out the intentions of the parties as embodied under this Agreement. This Agreement shall continue in effect until there are no further rights or obligations of the parties outstanding hereunder and shall not be terminated by either party without the express prior written consent of both parties.

(g) Nothing in this Agreement shall prevent or limit the Executive’s continuing or future participation in, or entitlements under, any benefit, bonus, incentive or other plan or program of the Company or any of its subsidiaries or affiliates and for which the Executive may qualify, nor shall anything herein limit or reduce such rights as the Executive may have under any other agreement with the Company or its subsidiaries or affiliates, provided that in no event shall the Executive be entitled to duplication of benefits or payments on a benefit-by-benefit or payment-by-payment basis.

IN WITNESS WHEREOF, the parties hereto have executed and delivered this Agreement as of the day and year first written above.

| | | | | | | | |

| | |

EXECUTIVE

/s/ James B. Kirkland JAMES B. KIRKLAND III | | DOUGLAS ELLIMAN INC.

By: /s/ Michael S. Liebowitz Name: Michael S. Liebowitz Title: Chairman, President and Chief Executive Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

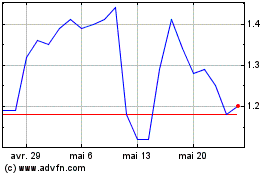

Douglas Elliman (NYSE:DOUG)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Douglas Elliman (NYSE:DOUG)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025