false

0001592000

0001592000

2024-09-12

2024-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

September 12, 2024

ENLINK

MIDSTREAM, LLC

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36336 |

|

46-4108528 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer Identification No.) |

1722

ROUTH STREET, SUITE

1300

DALLAS,

Texas |

|

75201 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (214) 953-9500

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13(c))

SECURITIES REGISTERED PURSUANT TO SECTION 12(b)

OF THE SECURITIES EXCHANGE ACT OF 1934:

| Title of Each Class |

|

Symbol |

|

Name of Exchange on which Registered |

Common

Units Representing Limited Liability Company Interests |

|

ENLC |

|

The

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On September 12, 2024, EnLink Midstream, LLC

(“ENLC”) entered into an amendment (the “Credit Agreement Amendment”) to the Amended and Restated Credit Agreement,

dated as of June 3, 2022 (as amended, the “Credit Agreement”), among ENLC, Bank of America, N.A., as Administrative Agent,

and the lenders party thereto, to, among other things, (i) amend the definition of funded indebtedness such that up to $500.0 million

of obligations under our accounts receivable securitization facility are excluded from our leverage ratio and (ii) amend the change of

control provisions of the Credit Agreement to designate ONEOK, Inc. (“ONEOK”) and its subsidiaries as Qualifying Owners (as

defined in the Credit Agreement Amendment), such that the previously disclosed transaction (the “Acquisition”) pursuant to

which ONEOK has agreed to acquire from GIP III Stetson I, L.P. (“GIP Stetson I”) and GIP III Stetson II, L.P. (“GIP

Stetson II” and together with GIP Stetson I, collectively, the “GIP Entities”), in the aggregate, all of the equity

interests held by the GIP Entities in ENLC and EnLink Midstream Manager, LLC, the managing member of ENLC (the “Manager”)

will not constitute a change of control under the Credit Agreement.

The foregoing description of the Credit Agreement

Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Credit Agreement Amendment,

a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein

by reference.

| Item 1.02 | Termination of a Material Definitive Agreement. |

In connection with the Acquisition, on September

16, 2024, ENLC gave notice to the GIP Entities of its election to terminate the Unit Repurchase Agreement, dated as of January 16, 2024,

by and among ENLC, GIP Stetson I, and GIP Stetson II (the “Unit Repurchase Agreement”), in accordance with the terms of the

Unit Repurchase Agreement. The termination of the Unit Repurchase Agreement will be effective as of October 2, 2024, upon which date ENLC

will repurchase the applicable number of common units representing limited liability company interests in ENLC (the “Common Units”)

held by the GIP Entities, based on ENLC’s repurchases of Common Units from public unitholders effected during the third quarter

of 2024 under ENLC’s Common Unit repurchase program, in accordance with the terms of the Unit Repurchase Agreement.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information provided in Item 1.01 of this Current

Report is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENLINK MIDSTREAM, LLC |

| |

|

|

| |

By: |

EnLink Midstream Manager, LLC,

its Managing Member |

| |

|

| Date: September 16, 2024 |

By: |

/s/ Benjamin D. Lamb |

| |

|

Benjamin D. Lamb |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 10.1

Execution Version

First

Amendment to Amended and Restated Revolving Credit Agreement

This FIRST

AMENDMENT TO AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT (this “Amendment”), dated as of September 12,

2024 (the “First Amendment Effective Date”), is among ENLINK MIDSTREAM, LLC,

a Delaware limited liability company (the “Borrower”); each of the Lenders that is a signatory hereto; and BANK

OF AMERICA, N.A., as administrative agent for the Lenders (in such capacity, together with its successors in such capacity, the

“Administrative Agent”), Swing Line Lender and L/C Issuer.

Recitals

A. The

Borrower, the Administrative Agent and the Lenders are parties to that certain Amended and Restated Revolving Credit Agreement dated as

of June 3, 2022 (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”),

pursuant to which the Lenders have, subject to the terms and conditions set forth therein, made certain credit available to and on behalf

of the Borrower.

B. The

Borrower, the Administrative Agent and the requisite Lenders are parties to that certain Letter Agreement Regarding Limited Consent and

Limited Waiver with respect to Change of Control due to Acquisition of Global Infrastructure Management, LLC by BlackRock, Inc.,

dated as of May 3, 2024 (the “BlackRock Consent”), pursuant to which the requisite Lenders consented, subject

to the terms and conditions of the BlackRock Consent, to any Change of Control resulting from the acquisition by BlackRock, Inc.

of GIP.

C. The

Borrower has informed the Administrative Agent and the Lenders that ONEOK, Inc., an Oklahoma corporation, has executed a definitive

agreement with GIP to acquire GIP’s entire interest in the Borrower, consisting of approximately 43% of the Borrower’s outstanding

common units and 100% of the equity securities of EnLink Manager (the “ONEOK Transaction”), which, upon consummation,

would constitute a Change of Control.

D. The

Borrower has requested that the Lenders consent to any Change of Control resulting from the ONEOK Transaction, whether such transaction

occurs before or after the transaction contemplated by the BlackRock Consent, which BlackRock Consent remains in full force and effect

in accordance with its terms regardless of whether the ONEOK Transaction closes.

E. The

parties hereto desire to enter into this Amendment to amend the Credit Agreement as set forth herein, effective as of the First Amendment

Effective Date.

NOW, THEREFORE, in consideration

of the premises and the mutual covenants herein contained, for good and valuable consideration, the receipt and sufficiency of which are

hereby acknowledged, the parties hereto agree as follows:

Section 1. Defined

Terms. Each capitalized term which is defined in the Credit Agreement, but which is not defined in this Amendment, shall have the

meaning ascribed such term in the Credit Agreement, as amended hereby. Unless otherwise indicated, all section references in this Amendment

refer to the Credit Agreement.

Section 2. Amendments.

In reliance on the representations, warranties, covenants and agreements contained in this Amendment, and subject to the satisfaction

of the conditions precedent set forth in Section 3 hereof, the Credit Agreement shall be amended effective as of the First

Amendment Effective Date, in the manner provided in this Section 2.

2.1 New

Defined Terms. Section 1.01 of the Credit Agreement is hereby amended by adding the following new defined terms in appropriate

alphabetical order to read in full as follows:

“First

Amendment” means that certain First Amendment to Amended and Restated Revolving Credit Agreement dated as of the First Amendment

Effective Date, among the Borrower, the Administrative Agent and the Lenders party thereto.

“First

Amendment Effective Date” means September 12, 2024.

2.2 Amended

Defined Terms. The definitions of “Consolidated Funded Indebtedness”, “Loan Documents”, “Permitted Receivables

Financing” and “Qualifying Owners” contained in Section 1.01 of the Credit Agreement are hereby amended and restated

in their respective entireties to read in full as follows:

“Consolidated

Funded Indebtedness” means, as of any date of determination, for the Borrower and its Subsidiaries on a consolidated basis,

the sum of (a) the outstanding principal amount of all obligations, whether current or long-term, for borrowed money (including outstanding

Loans) and all obligations evidenced by bonds, debentures, notes, loan agreements or other similar instruments, (b) all purchase

money Indebtedness, (c) all matured obligations then owed by the Borrower or any Subsidiary under or with respect to letters of credit

(including standby and commercial), bankers' acceptances, bank guaranties, surety bonds and similar instruments (i.e., excluding

letters of credit, bankers' acceptances, bank guaranties, surety bonds and similar instruments that have not been drawn upon), (d) all

obligations in respect of the deferred purchase price of property or services (other than trade accounts payable in the ordinary course

of business), (e) Attributable Indebtedness in respect of Capital Leases and Synthetic Lease Obligations, (f) all Indebtedness

of the Borrower or any Subsidiary of the type referred to in clause (h) of the definition of “Indebtedness” in this Agreement,

(g) without duplication, all Guarantees with respect to outstanding Indebtedness of the types specified in clauses (a) through

(f) above of Persons other than the Borrower or any Subsidiary, and (h) all Indebtedness of the types referred to in clauses (a) through

(g) above of any partnership or joint venture (other than a joint venture that is itself a corporation or limited liability company)

in which the Borrower or a Subsidiary is a general partner or joint venturer, unless such Indebtedness is expressly made non-recourse

to the Borrower or such Subsidiary; provided that, notwithstanding the foregoing, principal or similar amounts outstanding under

any Permitted Receivables Financing (whether or not on the balance sheet of the Borrower or any of its Subsidiaries) shall be excluded

from Consolidated Funded Indebtedness.

“Loan Documents”

means this Agreement, the First Amendment, each Revolving Note, each Issuer Document, any agreement creating or perfecting rights in Cash

Collateral pursuant to the provisions of Section 2.16 of this Agreement, each Guaranty Agreement, and each Fee Letter.

“Permitted

Receivables Financing” means a receivables securitization facility or program of the Borrower or any Subsidiary, the obligations

under which are non-recourse (except for representations, warranties, covenants, repurchase obligations and indemnities, in each case,

that are reasonably customary for a seller or servicer of assets transferred in connection with such a facility or program) to the Borrower

and the Subsidiaries, providing for the sale, transfer, conveyance or contribution to capital of, or the granting of a Lien on, Receivables

Facility Assets to a Person that is not the Borrower or a Subsidiary.

“Qualifying

Owners” means (a) GIP and its Subsidiaries and (b) ONEOK, Inc., an Oklahoma corporation, and its Subsidiaries.

2.3 Amendment

to Definition of “Change of Control”. Clause (d) of the definition of “Change of Control” contained in

Section 1.01 of the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

(d) EnLink

Manager ceases to be a Subsidiary of a Qualifying Owner; or

2.4 Amendment

to Section 7.01. Section 7.01(q) is hereby amended and restated in its entirety to read in full as follows:

(q) Liens

on Receivables Facility Assets or accounts into which solely collections or proceeds of Receivables Facility Assets are deposited, in

each case arising in connection with a Permitted Receivables Financing permitted under Section 7.02(e);

2.5 Amendment

to Section 7.02. Section 7.02(e) is hereby amended and restated in its entirety to read in full as follows:

(e) Indebtedness

under a Permitted Receivables Financing; provided that the aggregate principal or similar amount outstanding at any time under

all Permitted Receivables Financings in the aggregate without duplication shall not exceed $500,000,000;

Section 3. Conditions

Precedent. The effectiveness of this Amendment is subject to the following:

3.1 Counterparts.

The Administrative Agent shall have received counterparts of this Amendment from the Loan Parties and the Required Lenders.

3.2 Other

Documents. The Administrative Agent shall have received such other documents as the Administrative Agent or counsel to the Administrative

Agent may reasonably request.

The Administrative Agent is

hereby authorized and directed to declare this Amendment to be effective (and the First Amendment Effective Date shall occur) when it

has received documents confirming or certifying, to the satisfaction of the Administrative Agent, compliance with the conditions set forth

in this Section 3 or the waiver of such conditions as permitted in Section 10.01 of the Credit Agreement. Such declaration

shall be final, conclusive and binding upon all parties to the Credit Agreement for all purposes.

Section 4. Representations

and Warranties; Ratifications and Affirmations.

4.1 The

Borrower hereby affirms: (i) that as of the date hereof, all of the representations and warranties contained in each Loan Document

to which each Loan Party is a party are true and correct in all material respects as though made on and as of the date hereof except (A) to

the extent any such representation and warranty is expressly made as of a specific earlier date, in which case, such representation and

warranty was true and correct in all material respects as of such date and (B) to the extent that any such representation and warranty

is expressly qualified by materiality or by reference to Material Adverse Effect, such representation and warranty (as so qualified) is

true and correct in all respects and (ii) no Default or Event of Default exists under the Loan Documents or will, after giving effect

to this Amendment, exist under the Loan Documents.

4.2 The

Borrower hereby expressly (i) acknowledges the terms of this Amendment, (ii) ratifies and affirms its obligations under the

Credit Agreement and the other Loan Documents to which it is a party, (iii) acknowledges, renews and extends its continued liability

under the other Loan Documents to which it is a party, and (iv) represents and warrants that (A) the execution, delivery and

performance of this Amendment has been duly authorized by all necessary corporate or similar action of the Borrower, (B) this Amendment

constitutes a valid and binding agreement of the Borrower, and (C) this Amendment is enforceable against the Borrower in accordance

with its terms except as (1) the enforceability thereof may be limited by bankruptcy, insolvency or similar Laws affecting creditors’

rights generally, and (2) the availability of equitable remedies may be limited by equitable principles of general applicability.

Section 5. Miscellaneous.

5.1 ENTIRE

AGREEMENT. THIS AMENDMENT REPRESENTS THE FINAL AGREEMENT AMONG THE PARTIES REGARDING THE MATTERS SET FORTH HEREIN AND MAY NOT

BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS

AMONG THE PARTIES.

5.2 Confirmation

and Effect. Except as expressly set forth in this Amendment, this Amendment shall not by implication or otherwise limit, impair, constitute

a waiver of, or otherwise affect the rights and remedies of the Administrative Agent or the Lenders under the Credit Agreement or any

other Loan Document, and shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements

contained in the Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall continue

in full force and effect. Except as expressly set forth in this Amendment, nothing herein shall be deemed to entitle any Loan Party to

a consent to, or a waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements

contained in the Credit Agreement or any other Loan Document in similar or different circumstances. This Amendment shall not modify, replace

or constitute a novation of the BlackRock Consent, which is hereby ratified by the parties hereto.

5.3 Counterparts.

This Amendment may be executed by one or more of the parties hereto in any number of separate counterparts, and all of such counterparts

taken together shall be deemed to constitute one and the same instrument. Delivery of this Amendment by facsimile or electronic (e.g.,

..pdf) transmission shall be effective as delivery of a manually executed original counterpart hereof. This Amendment may be in the form

of an Electronic Record and may be executed using Electronic Signatures, as contemplated by Section 10.17 of the Credit Agreement.

5.4 Governing

Law. This Amendment shall be governed by and construed in accordance with the laws of the State of New York.

5.5 Loan

Document. This Amendment shall constitute a “Loan Document” for all purposes under the other Loan Documents

5.6 Payment

of Expenses. The Borrower agrees to pay or reimburse the Administrative Agent for all of its reasonable out-of-pocket costs and expenses

incurred in connection with this Amendment, any other documents prepared in connection herewith and the transactions contemplated hereby,

including, without limitation, the reasonable out-of-pocket fees and disbursements of counsel to the Administrative Agent.

[Signature Pages Follow.]

The parties hereto have caused

this Amendment to be duly executed as of the day and year first above written.

| BORROWER: |

ENLINK MIDSTREAM, LLC |

| |

|

| |

By: EnLink Midstream Manager, LLC, as its managing member |

| |

|

| |

By: |

/s/ Benjamin D. Lamb |

| |

Name: |

Benjamin D. Lamb |

| |

Title: |

Executive Vice President and Chief Financial Officer |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

BANK OF AMERICA, N.A., as Administrative Agent and a Lender |

| |

|

| |

By: |

/s/ Kimberly Miller |

| |

Name: |

Kimberly Miller |

| |

Title: |

Director |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

ROYAL BANK OF CANADA, as a Lender |

| |

|

| |

By: |

/s/ Cameron Johnson |

| |

Name: |

Cameron Johnson |

| |

Title: |

Authorized Signatory |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

CITIBANK, N.A., as a Lender |

| |

|

| |

By: |

/s/ Todd Mogil |

| |

Name: |

Todd Mogil |

| |

Title: |

Vice President |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

WELLS FARGO BANK, NATIONAL ASSOCIATION, as a Lender |

| |

|

| |

By: |

/s/ Brandon Kast |

| |

Name: |

Brandon Kast |

| |

Title: |

Executive Director |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

MUFG BANK, LTD., as a Lender |

| |

|

| |

By: |

/s/ Stephen W. Warfel |

| |

Name: |

Stephen W. Warfel |

| |

Title: |

Authorized Signatory |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

MIZUHO BANK, LTD., as a Lender |

| |

|

| |

By: |

/s/ Edward Sacks |

| |

Name: |

Edward Sacks |

| |

Title: |

Managing Director |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

PNC BANK, NATIONAL ASSOCIATION, as a Lender |

| |

|

| |

By: |

/s/ Jessica Molinar |

| |

Name: |

Jessica Molinar |

| |

Title: |

Assistant Vice President |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

REGIONS BANK, as a Lender |

| |

|

| |

By: |

/s/ Michael Kolosowsky |

| |

Name: |

Michael Kolosowsky |

| |

Title: |

Managing Director |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

TRUIST BANK, as a Lender |

| |

|

| |

By: |

/s/ Lincoln LaCour |

| |

Name: |

Lincoln LaCour |

| |

Title: |

Director |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

THE TORONTO-DOMINION BANK, NEW YORK BRANCH, as a Lender |

| |

|

| |

By: |

/s/ Evans Swann |

| |

Name: |

Evans Swann |

| |

Title: |

Authorized Signatory |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

THE BANK OF NOVA SCOTIA, HOUSTON BRANCH, as a Lender |

| |

|

| |

By: |

/s/ Joe Lattanzi |

| |

Name: |

Joe Lattanzi |

| |

Title: |

Managing Director |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

U.S. BANK NATIONAL ASSOCIATION, as a Lender |

| |

|

| |

By: |

/s/ Beth Johnson |

| |

Name: |

Beth Johnson |

| |

Title: |

Senior Vice President |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

COMERICA BANK, as a Lender |

| |

|

| |

By: |

/s/ Cassandra Lucas |

| |

Name: |

Cassandra Lucas |

| |

Title: |

Vice President |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

ZIONS BANCORPORATION, N.A. DBA AMEGY BANK, as a Lender |

| |

|

| |

By: |

/s/ Jill McSorley |

| |

Name: |

Jill McSorley |

| |

Title: |

Senior Vice President – Amegy Bank Division |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

|

COBANK, ACB, as a Lender |

| |

|

| |

By: |

/s/ Connor Schrotel |

| |

Name: |

Connor Schrotel |

| |

Title: |

Executive Director |

[Signature

Page to First Amendment to Credit Agreement – EnLink Midstream, LLC]

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

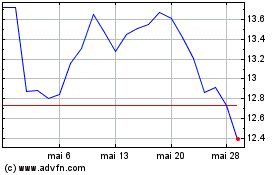

EnLink Midstream (NYSE:ENLC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

EnLink Midstream (NYSE:ENLC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024