false00018003470001800347us-gaap:CommonClassAMember2024-03-072024-03-0700018003472024-03-072024-03-070001800347us-gaap:WarrantMember2024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 7, 2024

E2open Parent Holdings, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

Delaware |

|

001-39272 |

|

86-1874570 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

9600 Great Hills Trail, Suite 300E |

Austin, TX |

(address of principal executive offices) |

78759 |

(zip code) |

866-432-6736 |

(Registrant’s telephone number, including area code) |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A Common Stock, par value $0.0001 per share |

|

ETWO |

|

New York Stock Exchange |

Warrants to purchase one share of Class A Common Stock at an exercise price of $11.50 |

|

ETWO-WT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2024, E2open Parent Holdings, Inc. (the Company) issued a press release reaffirming its fiscal year 2024 financial guidance. A copy of the Company's press release for the same periods is furnished as Exhibit 99.1 to this Current Report on Form 8-K. In accordance with the General Instruction B.2 of Form 8-K, the information set forth in this Item 2.02 and in the attached exhibit is deemed to be furnished and shall not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Item 7.01 Regulation FD Disclosure

On March 7, 2024, the Company issued a press release announcing that its Board of Directors is evaluating potential strategic alternatives to enhance value for stockholders. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information discussed under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

Exhibits.

* Furnished herewith

SIGNATURE

Pursuant to the Requirements of the Securities Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

E2open Parent Holdings, Inc. |

|

|

|

Date: March 7, 2024 |

By: |

/s/ Jennifer S. Grafton |

|

|

Jennifer S. Grafton |

|

|

Executive Vice President and General Counsel |

Exhibit 99.1

www.e2open.com

Press Release

E2open Announces Initiation of Strategic Review

AUSTIN – March 7, 2024 – E2open Parent Holdings, Inc. (NYSE: ETWO) (“e2open” or “the Company”), the connected supply chain SaaS platform with the largest multi-enterprise network, today announced initiation of a strategic review for the Company. The review will evaluate options to enhance shareholder value and further strengthen e2open’s leading position in the growing supply chain management software market.

“E2open’s board of directors and management team are committed to acting in the best interests of the Company and its many customers, employees, and shareholders,” said Chinh E. Chu, chairman of the Company’s board of directors. “E2open enjoys a unique market position based on its industry-leading software platform and proven ability to drive unmatched impact for customers. We have recently brought new senior leadership into the Company who have already made progress executing a comprehensive and customer-centric plan to drive growth and innovation.”

“We remain highly confident in our ability to execute this growth plan and in e2open’s potential as a stand-alone company,” said Andrew Appel, e2open’s chief executive officer. “As responsible stewards for our stakeholders, we are undertaking this strategic review to explore a full range of options to further accelerate growth and value creation.”

E2open has not set a deadline or definitive timetable for the completion of the strategic review process, and there can be no assurance that this process will result in any particular outcome. The Company does not intend to comment further regarding the strategic review until it has been completed or the Company determines that additional disclosure is appropriate or required by law.

In conjunction with this announcement, e2open reaffirms the Company’s most recent FY2024 financial guidance. The Company continues to expect subscription revenue in the range of $533 million to $536 million, total revenue in the range of $628 million to $633 million, non-GAAP gross profit margin in the range of 68% to 70%, and adjusted EBITDA in the range of $215 million to $220 million for the full year ended February 29, 2024. The Company’s actual FY24 financial results are pending completion of the Company’s year-end financial reporting processes, reviews, audit, and potential adjustments that may result.

Rothschild & Co is acting as lead financial advisor to e2open. Citi is acting as financial advisor to e2open. Kirkland & Ellis is serving as legal counsel to e2open.

About e2open

E2open is the connected supply chain software platform that enables the world’s largest companies to transform the way they make, move, and sell goods and services. With the broadest cloud-native global platform purpose-built for modern supply chains, e2open connects more than 480,000 manufacturing, logistics, channel, and distribution partners as one multi-enterprise network tracking over 15 billion transactions annually. Our SaaS platform anticipates disruptions and opportunities to help companies improve efficiency, reduce waste, and operate sustainably. Moving as one.™ Learn More: www.e2open.com.

E2open and “Moving as one.” are the registered trademarks of E2open, LLC. All other trademarks, registered trademarks and service marks are the property of their respective owners.

Non-GAAP Financial Measures

E2open is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures for non-GAAP gross profit margin or adjusted EBITDA without unreasonable effort, and therefore no reconciliation of certain forward-looking non-GAAP financial measures for non-GAAP gross profit margin or adjusted EBITDA is included.

9600 Great Hills Trail, Suite 300E, Austin, TX 78759 | Tel. 1.512.425.3500 | e2open.com

Copyright E2open, LLC. All rights reserved. CONFIDENTIAL

Safe Harbor Statement

Certain statements in this press release are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or the Company’s future financial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or its industry to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about the Company’s expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this press release are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “outlook,” “guidance” or the negative of those terms or other comparable terminology. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking.

Please see the Company’s documents filed or to be filed with the Securities and Exchange Commission, including the annual report filed on Form 10-K, and any amendments thereto for a discussion of certain important risk factors that relate to forward-looking statements contained in this press release. The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Company’s control. These and other important factors may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Any forward-looking statements are made only as of the date hereof, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company's historical experience and its present expectations, assumptions, estimates or projections. These risks and uncertainties include, but are not limited to, whether the objectives of the strategic alternative review process will be achieved; the terms, structure, benefits and costs of any strategic transaction; the timing of any transaction and whether any transaction will be consummated at all; the risk that the strategic alternatives review and its announcement could have an adverse effect on the ability of the Company to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, shareholders and other business relationships and on its operating results and business generally; the risk the strategic alternatives review could divert the attention and time of the Company’s management, the risk of any unexpected costs or expenses resulting from the review; and the risk of any litigation relating to the review.

###

Contacts

Media Contact:

5W PR for e2open

e2open@5wpr.com

718.757.6144

Investor Relations Contact:

Dusty Buell

dusty.buell@e2open.com

investor.relations@e2open.com

Corporate Contact:

Kristin Seigworth

VP Communications, e2open

kristin.seigworth@e2open.com

pr@e2open.com

1

9600 Great Hills Trail, Suite 300E, Austin, TX 78759 | Tel. 1.512.425.3500 | e2open.com

Copyright 2022 E2open, LLC. All rights reserved. CONFIDENTIAL

v3.24.0.1

Cover

|

Mar. 07, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity File Number |

001-39272

|

| Entity Registrant Name |

E2open Parent Holdings, Inc.

|

| Entity Central Index Key |

0001800347

|

| Entity Tax Identification Number |

86-1874570

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

9600 Great Hills Trail

|

| Entity Address, Address Line Two |

Suite 300E

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78759

|

| City Area Code |

866

|

| Local Phone Number |

432-6736

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ETWO

|

| Security Exchange Name |

NYSE

|

| Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of Class A Common Stock at an exercise price of $11.50

|

| Trading Symbol |

ETWO-WT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

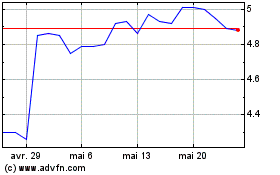

E2open Parent (NYSE:ETWO)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

E2open Parent (NYSE:ETWO)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024