false

--12-31

0001562528

0001562528

2024-01-08

2024-01-08

0001562528

us-gaap:CommonStockMember

2024-01-08

2024-01-08

0001562528

us-gaap:SeriesEPreferredStockMember

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 8, 2024

Franklin

BSP Realty Trust, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland |

001-40923 |

46-1406086 |

| (State or other jurisdiction |

(Commission File Number) |

(I.R.S. Employer |

| of incorporation) |

|

Identification No.) |

1345

Avenue of the Americas, Suite

32A

New York, New York 10105

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (212) 588-6770

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Common

Stock, par value $0.01 per share |

FBRT |

New York Stock Exchange |

| 7.50%

Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share |

FBRT PRE |

New York Stock Exchange |

Indicated by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.03. |

Material Modification to Rights of Security Holders. |

The information set forth below under Item 5.03

is hereby incorporated by reference into this Item 3.03.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Amendment No. 2 to Articles Supplementary

for Series H Convertible Preferred Stock

On January 10, 2024, Franklin

BSP Realty Trust, Inc. (the “Company”) filed Amendment No. 2 (the “Amendment”) to the Articles Supplementary

(the “Series H Articles Supplementary”) relating to the Company’s Series H Convertible Preferred Stock, $0.01

par value per share (the “Series H Preferred Stock”) with the Maryland State Department of Assessments and Taxation,

which Amendment became effective upon filing.

The Company’s Board

of Directors (the “Board”) and the sole holder of the Series H Preferred Stock approved the Amendment, which was requested

by the holder of the Series H Preferred Stock, to extend the mandatory conversion date for the Series

H Preferred Stock, which was set to occur on January 19, 2024, to January 21, 2025. In addition, under the Amendment, the holder of the

Series H Preferred Stock has the right to convert up to 4,487 shares of Series H Preferred Stock one time in each calendar month through

December 2024, upon 10 business days’ advance notice to the Company. No other terms in the Series H Articles Supplementary were

amended.

The foregoing description

of the Amendment is a summary and is qualified in its entirety by the terms of the Amendment, which is attached hereto as Exhibit 3.1

and is incorporated herein by reference.

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

On January 8, 2024, the sole

stockholder of the Series H Preferred Stock executed and delivered to the Company a written consent approving the Amendment.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Franklin BSP Realty Trust, Inc. |

| |

|

| |

By: |

/s/ Jerome S. Baglien |

| |

Name: |

Jerome S. Baglien |

| |

Title: |

Chief Financial Officer, Chief Operating Officer and Treasurer |

January 12, 2024

Exhibit 3.1

FRANKLIN BSP REALTY TRUST, INC.

AMENDMENT NO. 2 TO ARTICLES SUPPLEMENTARY

SERIES H CONVERTIBLE PREFERRED STOCK

FRANKLIN BSP REALTY TRUST,

INC., a Maryland corporation (the “Company”), hereby certifies to the State Department of Assessments and Taxation

of Maryland (the “SDAT”) that:

FIRST: The Articles of Amendment

and Restatement (the “Charter”) of the Company is hereby amended by deleting the existing first sentence of Section

7(a) of the Articles Supplementary, filed with, and accepted for record by, the SDAT on June 21, 2022, and as amended by Amendment No.

1 to Articles Supplementary filed with, and accepted for record by, the SDAT on January 19, 2023 (as amended, the “Series H Articles

Supplementary”) in its entirety and inserting in lieu thereof a new sentence to read as follows:

Subject to the provisions of Section

7(c) below, on January 21, 2025 (the “Mandatory Conversion Date”), all of the outstanding Series H Preferred Shares

(including, except as otherwise provided herein, Series H Preferred Shares for which a redemption notice has been submitted pursuant to

Section 6 above if such Series H Preferred Shares remain outstanding as of the Mandatory Conversion Date) shall convert into Common Shares

(the “Mandatory Conversion”).

SECOND: the Charter is hereby

amended by deleting the existing Section 7(c) of the Series H Articles Supplementary in its entirety and inserting in lieu thereof the

following:

(c) Optional Conversion. During

each calendar month from the date hereof through and including December, 2024, the holder of the Series H Preferred Shares shall have

the right (“Optional Conversion Right”) to convert up to 4,487 Series H Preferred Shares into a number of Common Shares

per Series H Preferred Share equal to the Conversion Rate, following the delivery of written notice of such election (“Conversion

Notice”) to the Company. The holder may not exercise the Optional Conversion Right more than one time per each calendar month.

The Conversion Notice shall specify the amount of Series H Preferred Shares to be converted and the requested Business Day for conversion,

which shall not be less than 10 business days after the date the Company has received the Conversion Notice.

THIRD: The amendments to the

Series H Articles Supplementary as set forth above have been duly advised by the Board of Directors and approved by the unanimous written

consent of the stockholders of the Company entitled to vote thereon as required by law.

FOURTH: The undersigned Chief

Financial Officer, Chief Operating Officer and Treasurer of the Company acknowledges this Amendment No. 2 to Articles Supplementary to

be the act of the Company and, as to all matters or facts required to be verified under oath, the undersigned Chief Financial Officer,

Chief Operating Officer and Treasurer of the Company acknowledges that to the best of his knowledge, information and belief, these matters

and facts are true in all material respects and that this statement is made under the penalties for perjury.

[Signature Page Follows]

IN WITNESS WHEREOF, the Company

has caused this Amendment No. 2 to Series H Articles Supplementary to be signed in its name and on its behalf by its Chief Financial Officer

and attested by its Secretary on this 10th day of January, 2024.

| |

FRANKLIN BSP REALTY TRUST, INC. |

| |

|

| |

|

| |

By: |

/s/

Jerome S. Baglien |

| |

Name: Jerome S. Baglien |

| |

Title:

Chief Financial Officer, Chief Operating Officer and Treasurer |

| ATTEST: |

|

| |

|

| By:

|

/s/

Micah Goodman |

|

| Name:

Micah Goodman |

|

| Title:General

Counsel and Secretary |

|

v3.23.4

Cover

|

Jan. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-40923

|

| Entity Registrant Name |

Franklin

BSP Realty Trust, Inc.

|

| Entity Central Index Key |

0001562528

|

| Entity Tax Identification Number |

46-1406086

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1345

Avenue of the Americas

|

| Entity Address, Address Line Two |

Suite

32A

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10105

|

| City Area Code |

212

|

| Local Phone Number |

588-6770

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

FBRT

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.50%

Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

FBRT PRE

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

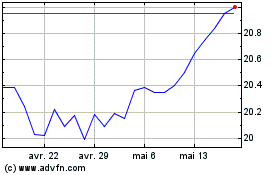

Franklin BSP Realty (NYSE:FBRT-E)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Franklin BSP Realty (NYSE:FBRT-E)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024