Form SC 13G/A - Statement of Beneficial Ownership by Certain Investors: [Amend]

14 Novembre 2024 - 4:41PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 13G/A

Under the Securities Exchange Act of

1934*

(Amendment No. 2)

INTERCONTINENTAL HOTELS GROUP PLC

Common Stock

| (Title of Class of Securities) |

September 30, 2024

| (Date of Event Which Requires Filing of this Statement) |

Check the appropriate box to designate the rule pursuant to

which this Schedule is filed:

x Rule 13d-1(b)

¨ Rule 13d-1(c)

¨ Rule 13d-1(d)

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

| 1. |

|

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Royal Bank of Canada |

| 2. |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ¨

(b) ¨ |

| 3. |

|

SEC Use Only

|

| 4. |

|

Citizenship or Place of Organization

Canada |

|

Number of

Shares

Beneficially

Owned by Each

Reporting

Person With: |

|

5. |

|

Sole Voting Power

0 |

| |

6. |

|

Shared Voting Power

6,280,935 |

| |

7. |

|

Sole Dispositive Power

0 |

| |

8. |

|

Shared Dispositive Power

6,280,935 |

| 9. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

6,280,935 |

| 10. |

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares

(See Instructions)

☐ |

| 11. |

|

Percent of Class Represented by Amount in Row (9)

3.94% |

| 12. |

|

Type of Reporting Person (See Instructions)

HC |

|

|

|

|

|

|

|

Item 1.

| (a) | Name of Issuer:

INTERCONTINENTAL HOTELS GROUP PLC |

| (b) | Address of Issuer’s Principal Executive Offices:

Broadwater Park

Denham, Buckinghamshire UB9 5HJ

United Kingdom |

Item 2.

| |

(a) |

Name of Person Filing:

Royal Bank of Canada

|

| |

(b) |

Address of Principal Business Office or, if none, Residence:

200 Bay Street

Toronto, Ontario M5J 2J5

Canada

|

| |

(c) |

Citizenship:

Canada

|

| |

(d) |

Title of Class of Securities:

Common Stock |

| |

(e) |

CUSIP Number:

G4804L163 |

| Item 3. | If this statement is filed pursuant to §§240.13d-1(b) or 240.13d-2(b) or (c), check

whether the person filing is a: |

| |

(a) |

o |

Broker or dealer registered under section 15 of the Act (15 U.S.C. 78o). |

| |

(b) |

o |

Bank as defined in section 3(a)(6) of the Act (15 U.S.C. 78c). |

| |

(c) |

o |

Insurance company as defined in section 3(a)(19) of the Act (15 U.S.C. 78c). |

| |

(d) |

o |

Investment company registered under section 8 of the Investment Company Act of 1940 (15 U.S.C 80a-8). |

| |

(e) |

o |

An investment adviser in accordance with §240.13d-1(b)(1)(ii)(E); |

| |

(f) |

o |

An employee benefit plan or endowment fund in accordance with §240.13d-1(b)(1)(ii)(F); |

| |

(g) |

x |

A parent holding company or control person in accordance with § 240.13d-1(b)(1)(ii)(G); |

| |

(h) |

o |

A savings associations as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813); |

| |

(i) |

o |

A church plan that is excluded from the definition of an investment company under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C. 80a-3); |

| |

(j) |

o |

A non-U.S. institution in accordance with Rule 240.13d-1(b)(1)(ii)(J); |

| |

(k) |

o |

Group, in accordance with §240.13d-1(b)(1)(ii)(K). |

Provide the following

information regarding the aggregate number and percentage of the class of securities of the issuer identified in Item 1.

| |

(a) |

Amount beneficially

owned: 6,280,935 |

| |

|

|

| |

(b) |

Percent of class: 3.94% |

| |

|

|

| |

(c) |

Number of shares as to which the person has: |

| |

|

|

|

| |

|

(i) |

Sole power to vote or to direct the vote

0 |

| |

|

(ii) |

Shared power to vote or to direct the vote

6,280,935 |

| |

|

(iii) |

Sole power to dispose or to direct the disposition of

0 |

| |

|

(iv) |

Shared power to dispose or

to direct the disposition of

6,280,935 |

| |

|

|

|

|

Instruction: For computations

regarding securities which represent a right to acquire an underlying security see §240.13d-3(d)(1).

| Item 5. | Ownership of Five Percent or Less of a Class |

If this statement is being filed to

report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the

class of securities, check the following: x .

| Item 6. | Ownership of More than Five Percent on Behalf of Another Person |

Not applicable.

| Item 7. | Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on by the Parent Holding

Company |

RBC Capital Markets, LLC: A broker-dealer

registered under section 15 of the Act (15 U.S.C. 78o)

RBC Global Asset Management Inc.: An

investment adviser in accordance with §240.13d-1(b)(1)(ii)(E)

RBC Phillips Hager & North Investment

Counsel Inc.: A non-U.S. institution in accordance with Rule 240.13d-1(b)(1)(ii)(J)

RBC Private Counsel (USA) Inc.: An investment

adviser in accordance with §240.13d-1(b)(1)(ii)(E)

Royal Trust Corporation of Canada, GFC

Partnership and RT Partnership are entities that beneficially own in aggregate less than one percent of the reported securities

| Item 8. | Identification and Classification of Members of the Group |

Not applicable.

| Item 9. | Notice of Dissolution of Group |

Not applicable.

By signing below we certify that,

to the best of our knowledge and belief, the securities referred to above were acquired and are held in the ordinary course

of business and were not acquired and are not held for the purpose of or with the effect of changing or influencing the control

of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction

having that purpose or effect.

By signing below, I also certify that,

to the best of my knowledge and belief, the foreign regulatory scheme applicable to the investment adviser is substantially comparable

to the regulatory scheme applicable to the functionally equivalent U.S. institution. I also undertake to furnish to the Commission

staff, upon request, information that would be disclosed in a Schedule 13D.

* In accordance with the SEC Rel. No. 34-39538

(January 12, 1998) (the “1998 Release”), this filing reflects the securities beneficially owned by certain operating units

engaged in the global asset management business (collectively, the “RBC Global Asset Management Reporting Units”) of Royal

Bank of Canada and its subsidiaries and affiliates (collectively, "RBC"). This filing does not reflect securities, if any,

beneficially owned by any operating units of RBC whose ownership of securities is disaggregated from that of the RBC Global Asset Management

Reporting Units in accordance with the 1998 Release.

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 13, 2024

| |

ROYAL

BANK OF CANADA

|

| |

|

| |

/s/ Terry Fallon

|

| |

|

| |

Signature |

| |

|

| |

Terry Fallon/ MD, Head of Regulatory Services

|

| |

|

| |

Name/Title |

5

Exhibit 99.1

POWER OF ATTORNEY

KNOW ALL PERSONS that Royal Bank of Canada

(“RBC”), a Canadian chartered bank under and governed by the provisions of the Bank Act, being S.C. 1991, c.46, as amended,

by these presents makes, constitutes and appoints each of Sherry Coulter, Terry Fallon, Lori Messer and Thomas Murphy, acting individually,

its true and lawful attorney-in-fact, for and on RBC’s behalf and in its name, place and stead to do all or any of the acts and

deeds necessary to be done and to execute, without the corporate seal of RBC being required, whether RBC is acting for itself or on behalf

of its affiliates, any and all filings required to be made by RBC pursuant to Regulation 13D-G under the Securities Exchange Act of 1934,

(as amended, the “Act”), with respect to securities which may be deemed to be beneficially owned by RBC or its affiliates

under the ACT, giving and granting unto each said attorney-in-fact full power and authority to do and perform every act necessary, requisite

or proper to be done as RBC itself could do and hereby ratifies and confirms each and every act that said attorney-in-fact shall lawfully

does or causes to be done by virtue hereof.

This Power of Attorney will not expire but

is subject to revocation at any time by written notice (which may include but is not limited to e-mail communication) given to any attorney-in-fact

and shall otherwise terminate immediately upon such attorney-in-fact ceasing to be employed by RBC or one of its affiliates.

IN WITNESS WHEREOF these presents subscribed

by Howard M. Sacarob, Vice-President of RBC, and John Thurlow, Officer of RBC, this 17th day of September, 2024.

| |

ROYAL BANK OF CANADA |

| |

|

| |

By: /s/ Howard M. Sacarob |

| |

|

| |

Name: Howard M. Sacarob |

| |

Title: Vice-President |

| |

|

| |

|

| |

By: /s/ John Thurlow |

| |

|

| |

Name: John Thurlow |

| |

Title: Officer |

Before me, a Notary Public in and for said State, on this 17th

day of September, 2024 personally appeared Howard M. Sacarob and John Thurlow, to me known to be the identical persons who executed

the foregoing instrument on behalf of Royal Bank of Canada as its Vice-President and Officer, respectively, and acknowledged to me that

they executed the same as their free and voluntary act and deed and as the free and voluntary act and deed of such body corporate for

the uses and purposes therein set forth.

| |

By: /s/ Jazmin Campos |

| |

|

| |

Name: Jazmin Campos |

| |

Title: Notary Public |

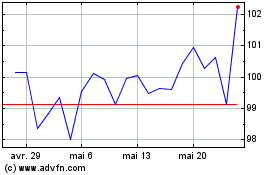

InterContinental Hotels (NYSE:IHG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

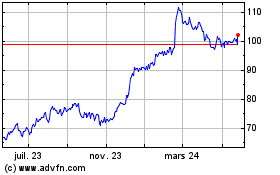

InterContinental Hotels (NYSE:IHG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024