UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities

Exchange Act of 1934

For the month of January 2024

Commission File Number

001-35754

Infosys Limited

(Exact name of Registrant as

specified in its charter)

Not Applicable.

(Translation of Registrant's name

into English)

Electronics City, Hosur Road,

Bengaluru - 560 100,

Karnataka, India. +91-80-2852-0261

(Address of principal executive

offices)

Indicate by check mark whether the registrant files or

will file annual

reports under cover Form 20-F or Form 40-F:

Form 20-F þ

Form 40-F o

Indicate by check mark if the registrant is submitting

the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting

the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): o

TABLE OF CONTENTS

DISCLOSURE OF

RESULTS OF OPERATIONS AND FINANCIAL

CONDITION

Infosys Limited (“we” or “the

Company”) hereby furnishes the United States Securities and Exchange Commission with copies of the following information concerning

our public disclosures regarding our results of operations and financial condition for the quarter ended December 31, 2023.

The following information

shall not be deemed

"filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange

Act"), or incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by

specific reference in such a filing.

On January 11, 2024, we announced

our results of operations

for the quarter ended December 31, 2023. A copy of the outcome of the board meeting is attached to this Form 6-K as

Exhibit 99.1.

We issued press releases announcing

our results under

International Financial Reporting Standards ("IFRS"), copies of which are attached to this Form 6-K as

Exhibit 99.2.

We have placed the form of release to stock exchanges

concerning our results of operations for the quarter ended December 31, 2023 under Indian Accounting Standards (Ind-AS). A copy of the

release to stock exchanges is attached to this Form 6-K as Exhibit 99.3.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Infosys Limited

|

| |

|

|

Date: January 11, 2024

|

Inderpreet Sawhney

General Counsel and Chief

Compliance Officer

|

INDEX TO

EXHIBITS

|

Exhibit No.

|

Description of Document

|

|

99.1

|

Outcome of the Board Meeting

|

|

99.2

|

IFRS USD press release

|

|

99.3

|

Form of Release to Stock Exchanges

|

Exhibit 99.1

Outcome of the Board meeting

Exhibit 99.2

IFRS USD Press Release

Resilient performance in a seasonally weak quarter; Large deal momentum continues with 71% net new deals

Infosys Topaz driving strong differentiation and market leadership in generative AI

Bengaluru, India – January 11, 2024: Infosys (NSE, BSE, NYSE: INFY), a global leader in next generation digital services and consulting, delivered $4,663 million in Q3 revenues with year-on-year and sequential decline of 1.0% in constant currency. Large deal TCV for the quarter was $3.2 billion, with 71% being net new. Operating margin for the quarter was 20.5%, a sequential decline of 70 bps. Attrition declined further to 12.9%. FY24 revenue guidance revised to 1.5%-2.0% and operating margin guidance at 20%-22%.

“Our performance in Q3 was resilient.

Large deal wins were strong at $3.2 billion, with 71% of this as net new, reflecting the relevance and strength of our portfolio of offerings

ranging from generative AI, digital and cloud to cost, efficiency and automation” said Salil Parekh, CEO and MD. “Our

clients are leveraging our Topaz generative AI capabilities and our Cobalt cloud capabilities to create long-term value for their businesses”,

he added.

Guidance

for FY24:

| · |

Revenue

growth of 1.5%-2.0% in constant currency |

| · |

Operating

margin of 20%-22% |

For quarter ended December 31, 2023

·

Revenues in CC terms declined by 1.0% YoY and QoQ

·

Reported revenues at $4,663 million, growth of 0.1% YoY

·

Operating margin at 20.5%, decline of 1.0% YoY and 0.7% QoQ

·

Basic EPS at $0.18, decline of 7.1% YoY

·

FCF at $665 million, growth of 15.5% YoY; FCF conversion at 90.6% of net profit |

For the nine months ended December 31, 2023

·

Revenues in CC terms grew by 1.8% YoY

·

Reported revenues at $13,997 million, growth of 2.5% YoY

·

Operating margin at 20.8%, decline of 0.2% YoY

·

Basic EPS at $0.53, flat YoY

·

FCF at $2,034 million, growth of 11.7% YoY; FCF conversion at 92.1% of net profit |

“Q3

performance is a demonstration of our strong execution capabilities reflected in improved operational efficiencies achieved under ‘Project

Maximus’, despite a challenging environment”, said Nilanjan Roy, Chief Financial Officer. “Cash generation remained

robust with FCF to net profit conversion for Q3 at 90.6%”, he added.

2. Client

wins & Testimonials

| · | Infosys

entered into a collaboration with smart Europe GmbH for five years to bring sustainable electric

mobility to customers. Dirk Adelmann, Chief Executive Officer, smart Europe GmbH,

said, “We are pleased to have Infosys as our partner on this journey. Infosys’

strong leadership commitment backed by its ability to drive end-to-end application development

and maintenance with efficiency and effectiveness, will help us boost our operational performance

and user experience.” |

| · | Infosys

announced a strategic long-term collaboration with TK Elevator (TKE) to help consolidate,

harmonize, and modernize their digital landscape. Susan Poon, Global CIO at TK Elevator,

said, “Technology empowers our employees and business associates to deliver high-quality

services to customers and users across the value chain. We are delighted to significantly

expand our collaboration with Infosys, which brings end-to-end digital transformation capabilities,

helping us accelerate our business transformation and to realize our strategic vision.” |

| · | Infosys

collaborated with LKQ Europe to help integrate and standardize their disparate business processes

and systems, to enable synergies and achieve economies of scale. Varun Laroyia, Chief

Executive Officer, LKQ Europe, said, “At LKQ, we are constantly enhancing our market

leading position. This project is an extension of our original program and focused on building

a more streamlined and impactful organization. With Infosys as our strategic partner, we

are aiming to reduce complexities, increase efficiency and leverage our strengths. This will

allow us to upgrade our focus on customer-centricity, ensure best in class customer experiences

and further excel our top position.” |

| · | Infosys

and Spirit AeroSystems inaugurated their dedicated center for aerospace engineering excellence

in Richardson, Texas. The center will enable Infosys to work more closely with Spirit AeroSystems

to develop cross-functional solutions to pressing business challenges in the aircraft development

lifecycle. Dr. Sean Black, Senior Vice President, Chief Technology Officer and Chief Engineer,

Spirit AeroSystems, said, “The strategic collaboration with Infosys in Richardson,

Texas, will leverage the talent pool in the North Texas region and create a dedicated center

for aerospace engineering excellence to cover the complete aircraft development life cycle

for both new derivatives and in-service aircraft.” |

| · | Infosys

helped enhance Spotlight Retail Group’s customer growth via an omnichannel digital

fulfilment and advanced analytics platform leveraging Infosys Topaz. Tal Lall, Group General

Manager, Digital and Omnichannel, Spotlight Retail Group, said, “At Spotlight Retail

Group, we are committed to continuously optimize customer experiences as one of our key competitive

differentiators. One of the ways that we’ve done this is through greater investment

in personalization, and this is core to the digital commerce platform built with Infosys

Topaz, leveraging its advanced analytics capabilities. This platform now provides us with

deeper customer insights while supporting scalability to meet customer demands and onboarding

new brands. We are delighted to have collaborated with Infosys on this journey.” |

| · | Infosys

collaborated with Proximus to help modernize their IT stack, optimize costs and broaden their

portfolio of offerings. Antonietta Mastroianni, Chief Digital & IT Officer at Proximus,

said, “Our affiliates are an important part of Proximus’ multi-brand strategy.

They have a fantastic reputation in Belgium when it comes to quality service at great prices.

In order to continue to ensure smooth operations and an enhanced portfolio of offerings to

all our customers, it was crucial to achieve deeper integration in the Proximus IT stack.

A complex transition, involving multiple vendors, applications in an evolving landscape meant

that we needed new operating model and sourcing strategy that could anticipate and adapt

to our requirements. Infosys as a managing partner for this venture with the out-tasking

model enabled us to successfully complete the program on time and with great quality of delivery.” |

| · | Bank

of Commerce selected Infosys Finacle for its core banking transformation to help replace

their legacy platform. Michelangelo R. Aguilar, President and CEO, Bank of Commerce,

said, “We are pleased to have chosen Infosys Finacle due to its established presence

in the Philippines, robust solutions suite, and record of reliable delivery in the market.

The modernization of our core banking system is an integral part of BankCom’s digital

transformation journey as a universal bank in delivering a truly digital banking experience

to our clients. It will enable us to operate better, innovate, and keep pace with industry

best practices, regulatory requirements, and evolving expectations of the markets we serve,

notably the San Miguel Group and SMC ecosystem.” |

3. Recognitions & Awards

AI and Cloud Services

| · | Positioned as a leader in HFS Horizons: Generative Enterprise Services, 2023 |

| · | Recognized as a leader in Constellation ShortList 2023: AI-Driven Cognitive Applications |

| · | Recognized as a leader in Constellation ShortList 2023: Artificial Intelligence and Machine Learning

Best-of-Breed Platforms |

| · | Positioned as a leader in Gartner Magic Quadrant for Cloud ERP Services for Service-Centric

Enterprises |

| · | Rated as a leader in Cloud Services in Insurance PEAK Matrix® Assessment 2023 by Everest

Group |

| · | Recognized as a leader in IDC MarketScape: Worldwide Managed Public Cloud Services 2023 Vendor

Assessment |

| · | Recognized as a leader in IDC MarketScape: IDC Asia/Pacific Cloud Professional Services Vendor

Assessment |

| · | Recognized as a leader in IDC MarketScape: Asia/Pacific Microsoft Business Applications Implementation

Services Vendor Assessment, 2023–2024 |

| · | Rated as a leader in NelsonHall’s Advanced Digital Workplace Services NEAT |

| · | Recognized as a leader in Public Cloud ISG Provider Lens™ report in the US, UK and

Nordics regions |

Key Digital Services

| · | Recognized as a leader in Constellation ShortList 2023: Metaverse Design and Services |

| · | Rated as a leader in Healthcare Payer Digital Services PEAK Matrix® Assessment 2023 by

Everest Group |

| · | Recognized

as a Leader in the Gartner® Magic Quadrant™ for Finance and Accounting Business Process Outsourcing 2023 |

| · | Rated as a leader in Lending IT Services PEAK Matrix® Assessment 2023 by Everest Group |

| · | Rated as a leader in Next-generation Quality Engineering (QE) Services PEAK Matrix® Assessment

2023 by Everest Group |

| · | Recognized as a leader in IDC MarketScape: Worldwide Production Management Service Providers

2023 Vendor Assessment |

| · | Recognized as a leader in IDC MarketScape: Worldwide Quality Management Service Providers

2023 Vendor Assessment |

| · | Positioned as a leader in HFS Horizons: Low-Code Services, 2023 |

| · | Recognized as a leader in IDC MarketScape: Worldwide Supply Chain All Other Ecosystems Services

2023 Vendor Assessment |

| · | Recognized as a leader in IDC MarketScape: Worldwide Software Engineering Services 2023 Vendor

Assessment |

| · | Recognized as a leader in Avasant’s Tech-enabled Sustainability Services 2023–2024

RadarView™ |

| · | Recognized as a leader in Avasant’s Intelligent IT Ops Services 2023-2024 RadarView™ |

| · | Recognized as a leader in Avasant’s Nordics Digital Services 2023-2024 RadarView™ |

Industry & Solutions

| · |

Positioned as a leader in HFS Horizons: Retail and CPG Service Providers, 2023 |

| · |

Infosys BPM won the ‘Best CSR Impact’ award, at the Corporate Social Responsibility Summit and Awards 2023 |

| · | Infosys Finacle recognized as Best SaaS Provider Europe 2023 at the Global Finance Awards |

| · | Infosys Finacle and The National Bank of Greece awarded in the category ‘Best Core Banking Implementation Europe 2023’ at the Global Finance Awards |

| · | Infosys Finacle and Union Bank of India recognized at the 2023 Banking Tech awards in the Best Embedded Finance Initiative category |

| · | Infosys Finacle and Emirates NBD awarded ‘Best Digital Transformation Implementation’ at the MEA Finance Leaders Awards 2023 |

About

Infosys

|

Infosys is a global leader in next-generation digital services and consulting. Over 300,000 of our people work to amplify human potential and create the next opportunity for people, businesses and communities. We enable clients in more than 56 countries to navigate their digital transformation. With over four decades of experience in managing the systems and workings of global enterprises, we expertly steer clients, as they navigate their digital transformation powered by the cloud. We enable them with an AI-powered core, empower the business with agile digital at scale and drive continuous improvement with always-on learning through the transfer of digital skills, expertise, and ideas from our innovation ecosystem. We are deeply committed to being a well-governed, environmentally sustainable organization where diverse talent thrives in an inclusive workplace.

Visit

www.infosys.com to

see how Infosys (NSE, BSE, NYSE: INFY) can help your enterprise navigate your next. |

|

Safe

Harbor

Certain

statements in this release concerning our future growth prospects, or our future financial or operating performance, are forward-looking

statements intended to qualify for the 'safe harbor' under the Private Securities Litigation Reform Act of 1995, which involve a number

of risks and uncertainties that could cause actual results or outcomes to differ materially from those in such forward-looking statements.

The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding the execution

of our business strategy, our ability to attract and retain personnel, our transition to hybrid work model, economic uncertainties, technological

innovations such as Generative AI, the complex and evolving regulatory landscape including immigration regulation changes, our ESG vision,

our capital allocation policy and expectations concerning our market position, future operations, margins, profitability, liquidity,

capital resources, our corporate actions including acquisitions, the actual or anticipated findings of the ongoing assessment of the

extent and nature of exfiltrated data in relation to the McCamish cybersecurity incident and customer reaction to such findings, and

the amount of any additional costs, including indemnities or damages / claims, resulting from the McCamish cybersecurity incident. Important

factors that may cause actual results or outcomes to differ from those implied by the forward-looking statements are discussed in more

detail in our US Securities and Exchange Commission filings including our Annual Report on Form 20-F for the fiscal year ended March

31, 2023. These filings are available at www.sec.gov. Infosys may, from time to time, make

additional written and oral forward-looking statements, including statements contained in the Company's filings with the Securities and

Exchange Commission and our reports to shareholders. The Company does not undertake to update any forward-looking statements that may

be made from time to time by or on behalf of the Company unless it is required by law.

Contact

| Investor

Relations |

Sandeep

Mahindroo

+91

80 3980 1018

Sandeep_Mahindroo@infosys.com |

|

| Media

Relations |

Rishi

Basu

+91

80 4156 3998

Rajarshi.Basu@infosys.com |

Harini

Babu

+1

469 996 3516

Harini_Babu@infosys.com |

Infosys

Limited and subsidiaries

Extracted

from the Condensed Consolidated Balance Sheet under IFRS as at:

(Dollars

in millions)

| |

December 31, 2023 |

March 31, 2023 |

| ASSETS |

|

|

| Current assets |

|

|

| Cash and cash equivalents |

1,640 |

1,481 |

| Current investments |

958 |

841 |

| Trade receivables |

3,680 |

3,094 |

| Unbilled revenue |

1,589 |

1,861 |

| Other Current assets |

1,425 |

1,349 |

| Total current assets |

9,292 |

8,626 |

| Non-current assets |

|

|

| Property, plant and equipment and Right-of-use assets |

2,375 |

2,516 |

| Goodwill and other Intangible assets |

1,075 |

1,095 |

| Non-current investments |

1,354 |

1,530 |

| Unbilled revenue |

202 |

176 |

| Other non-current assets |

1,308 |

1,369 |

| Total non-current assets |

6,314 |

6,686 |

| Total assets |

15,606 |

15,312 |

| LIABILITIES AND EQUITY |

|

|

| Current liabilities |

|

|

| Trade payables |

460 |

470 |

| Unearned revenue |

922 |

872 |

| Employee benefit obligations |

326 |

292 |

| Other current liabilities and provisions |

2,970 |

3,135 |

| Total current liabilities |

4,678 |

4,769 |

| Non-current liabilities |

|

|

| Lease liabilities |

802 |

859 |

| Other non-current liabilities |

458 |

460 |

| Total non-current liabilities |

1,260 |

1,319 |

| Total liabilities |

5,938 |

6,088 |

| Total equity attributable to equity holders of the company |

9,617 |

9,172 |

| Non-controlling interests |

51 |

52 |

| Total equity |

9,668 |

9,224 |

| Total liabilities and equity |

15,606 |

15,312 |

Extracted

from the Condensed Consolidated statement of Comprehensive Income under IFRS for:

(Dollars

in millions except per equity share data)

| |

3 months ended December 31, 2023 |

3 months ended December 31, 2022 |

9 months ended December 31, 2023 |

9 months ended December 31, 2022 |

| Revenues |

4,663 |

4,659 |

13,997 |

13,657 |

| Cost of sales |

3,274 |

3,230 |

9,755 |

9,544 |

| Gross profit |

1,389 |

1,429 |

4,242 |

4,113 |

| Operating expenses: |

|

|

|

|

| Selling and marketing expenses |

204 |

196 |

633 |

574 |

| Administrative expenses |

229 |

232 |

692 |

671 |

| Total operating expenses |

433 |

428 |

1,325 |

1,245 |

| Operating profit |

956 |

1,001 |

2,917 |

2,868 |

| Other

income, net (3) |

79 |

84 |

196 |

229 |

| Profit before income taxes |

1,035 |

1,085 |

3,113 |

3,097 |

| Income tax expense |

301 |

285 |

904 |

859 |

| Net profit (before minority interest) |

734 |

800 |

2,209 |

2,238 |

| Net profit (after minority interest) |

733 |

800 |

2,208 |

2,237 |

| Basic EPS ($) |

0.18 |

0.19 |

0.53 |

0.53 |

| Diluted EPS ($) |

0.18 |

0.19 |

0.53 |

0.53 |

NOTES:

| 1. | |

The above information is extracted from the audited condensed consolidated Balance sheet and Statement of Comprehensive Income for the quarter and nine months ended December 31, 2023, which have been taken on record at the Board meeting held on January 11, 2024. |

| 2. | | A

Fact Sheet providing the operating metrics of the Company can be downloaded from www.infosys.com. |

| 3. | | Other

income is net of Finance Cost |

| 4. | | As the quarter and nine months ended figures are taken from the source and rounded to the nearest digits, the quarter figures in this statement added up to the figures reported for the previous quarters might not always add up to the nine months ended figures reported in this statement. |

Exhibit 99.3

Form of Release to Stock Exchanges

|

Infosys Limited

Regd. office: Electronics City, Hosur Road,

Bengaluru 560 100, India |

CIN : L85110KA1981PLC013115

Website: www.infosys.com

email: investors@infosys.com

T: 91 80 2852 0261, F: 91 80 2852 0362 |

Statement of Consolidated Audited Results of Infosys Limited and its subsidiaries for the quarter and nine months ended December 31, 2023

prepared in compliance with the Indian Accounting Standards (Ind-AS)

(in  crore, except per equity share data)

crore, except per equity share data)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months

ended

December 31, |

Year ended

March 31, |

| |

2023 |

2023 |

2022 |

2023 |

2022 |

2023 |

| |

Audited |

Audited |

Audited |

Audited |

Audited |

Audited |

| Revenue from operations |

38,821 |

38,994 |

38,318 |

115,748 |

109,326 |

146,767 |

| Other income, net |

789 |

632 |

769 |

1,982 |

2,030 |

2,701 |

| Total Income |

39,610 |

39,626 |

39,087 |

117,730 |

111,356 |

149,468 |

| Expenses |

|

|

|

|

|

|

| Employee benefit expenses |

20,651 |

20,796 |

20,272 |

62,228 |

58,048 |

78,359 |

| Cost of technical sub-contractors |

3,066 |

3,074 |

3,343 |

9,264 |

10,946 |

14,062 |

| Travel expenses |

387 |

439 |

360 |

1,288 |

1,099 |

1,525 |

| Cost of software packages and others |

3,722 |

3,387 |

3,085 |

9,828 |

8,017 |

10,902 |

| Communication expenses |

169 |

179 |

183 |

531 |

542 |

713 |

| Consultancy and professional charges |

504 |

387 |

401 |

1,237 |

1,296 |

1,684 |

| Depreciation and amortisation expenses |

1,176 |

1,166 |

1,125 |

3,515 |

3,104 |

4,225 |

| Finance cost |

131 |

138 |

80 |

360 |

202 |

284 |

| Other expenses |

1,185 |

1,292 |

1,307 |

3,731 |

3,246 |

4,392 |

| Total expenses |

30,991 |

30,858 |

30,156 |

91,982 |

86,500 |

116,146 |

| Profit before tax |

8,619 |

8,768 |

8,931 |

25,748 |

24,856 |

33,322 |

| Tax expense: |

|

|

|

|

|

|

| Current tax |

2,419 |

2,491 |

2,195 |

7,216 |

7,027 |

9,287 |

| Deferred tax |

87 |

62 |

150 |

258 |

(145) |

(73) |

| Profit for the period |

6,113 |

6,215 |

6,586 |

18,274 |

17,974 |

24,108 |

| |

|

|

|

|

|

|

| Other comprehensive income |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Items that will not be reclassified subsequently to profit or loss |

|

|

|

|

|

|

| Remeasurement of the net defined benefit liability/asset, net |

71 |

(64) |

29 |

94 |

(17) |

8 |

| Equity instruments through other comprehensive income, net |

(9) |

40 |

1 |

31 |

8 |

(7) |

| |

|

|

|

|

|

|

| Items that will be reclassified subsequently to profit or loss |

|

|

|

|

|

|

| Fair value changes on derivatives designated as cash flow hedges, net |

(46) |

23 |

(57) |

(17) |

(43) |

(7) |

| Exchange differences on translation of foreign operations |

436 |

5 |

676 |

457 |

715 |

776 |

| Fair value changes on investments, net |

52 |

(20) |

48 |

107 |

(298) |

(256) |

| Total other comprehensive income/(loss), net of tax |

504 |

(16) |

697 |

672 |

365 |

514 |

| |

|

|

|

|

|

|

| Total comprehensive income for the period |

6,617 |

6,199 |

7,283 |

18,946 |

18,339 |

24,622 |

| |

|

|

|

|

|

|

| Profit attributable to: |

|

|

|

|

|

|

| Owners of the company |

6,106 |

6,212 |

6,586 |

18,264 |

17,967 |

24,095 |

| Non-controlling interest |

7 |

3 |

– |

10 |

7 |

13 |

| |

6,113 |

6,215 |

6,586 |

18,274 |

17,974 |

24,108 |

| |

|

|

|

|

|

|

| Total comprehensive income attributable to: |

|

|

|

|

|

|

| Owners of the company |

6,605 |

6,196 |

7,268 |

18,934 |

18,322 |

24,598 |

| Non-controlling interest |

12 |

3 |

15 |

12 |

17 |

24 |

| |

6,617 |

6,199 |

7,283 |

18,946 |

18,339 |

24,622 |

| |

|

|

|

|

|

|

Paid up share capital (par value  5/- each, fully paid) 5/- each, fully paid) |

2,070 |

2,070 |

2,086 |

2,070 |

2,086 |

2,069 |

| Other equity *# |

73,338 |

73,338 |

73,252 |

73,338 |

73,252 |

73,338 |

| |

|

|

|

|

|

|

| Earnings per equity share (par value `5/- each)** |

|

|

|

|

|

|

Basic (in  per share) per share) |

14.76 |

15.01 |

15.72 |

44.13 |

42.85 |

57.63 |

Diluted (in  per share) per share) |

14.74 |

14.99 |

15.70 |

44.08 |

42.79 |

57.54 |

| * | | Balances for the quarter and nine months ended December 31, 2023 and quarter ended September

30, 2023 represent balances as per the audited Balance Sheet as at March 31, 2023 and balances for the quarter and nine months ended

December 31, 2022 represent balances as per the audited Balance Sheet as at March 31, 2022 as required by SEBI (Listing and Other Disclosure

Requirements) Regulations, 2015 |

| ** | | EPS is not annualized for the quarter and nine months ended December 31, 2023, quarter

ended September 30, 2023 and quarter and nine months ended December 31, 2022. |

| # | | Excludes non-controlling interest |

1. Notes pertaining to the current quarter

a) The audited interim condensed consolidated

financial statements for the quarter and nine months ended December 31, 2023 have been taken on record by the Board of Directors at its

meeting held on January 11, 2024. The statutory auditors, Deloitte Haskins & Sells LLP have expressed an unmodified audit opinion.

The information presented above is extracted from the audited interim condensed consolidated financial statements. These interim condensed

consolidated financial statements are prepared in accordance with the Indian Accounting Standards (Ind-AS) as prescribed under Section

133 of the Companies Act, 2013 read with Rule 3 of the Companies (Indian Accounting Standards) Rules, 2015 and relevant amendment rules

thereafter.

b) Board and Management changes

i) The Board, based on the recommendation of the Nomination

and Remuneration Committee, considered and approved the re-appointment of Chitra Nayak (DIN - 09101763), as an Independent Director for

the second term of three years from March 25, 2024 to March 24, 2027, subject to shareholders’ approval.

ii) The Board appointed Jayesh Sanghrajka as the Chief

Financial Officer of the Company with effect from April 1, 2024.

iii) Nilanjan Roy resigned as the Chief Financial Officer

of the Company. He will continue to be with Infosys till March 31, 2024 as the Chief Financial Officer. The Board placed on record its

appreciation for the services rendered by him and for his contributions to the Company.

c) Update on McCamish Cybersecurity incident

In November 2023, Infosys McCamish Systems LLC (McCamish)

a step down subsidiary of Infosys Limited, experienced a cybersecurity incident resulting in the non-availability of certain applications

and systems. McCamish initiated its incident response and engaged cybersecurity and other specialists to assist in its investigation of

and response to the incident and remediation and restoration of impacted applications and systems. By December 31, 2023, McCamish, with

external specialists’ assistance, substantially remediated and restored the affected applications and systems.

Loss of contracted revenues and costs incurred with

respect to remediations, restoration, communication efforts and others amounted to approximately  250 crore ($30 million).

250 crore ($30 million).

Actions taken by McCamish included investigative analysis

conducted by a third-party cybersecurity firm to determine, among other things, whether and the extent to which company or customer data

was subject to unauthorized access or exfiltration. On the basis of analysis conducted by the cybersecurity firm, McCamish believes that

certain data was exfiltrated by unauthorized third parties during the incident and this exfiltrated data included certain customer data.

McCamish has engaged a third-party e- discovery vendor in assessing the extent and nature of such data. This review process is ongoing.

McCamish may incur additional costs including indemnities or damages/claims, which are indeterminable at this time.

Infosys had previously communicated the occurence of

this cybersecurity incident to BSE Limited, National Stock Exchange of India Limited, New York Stock Exchange and to United States Securities

and Exchange Commission on November 3, 2023.

d) Proposed acquisition

On January 11, 2024, Infosys Limited entered into a

definitive agreement to acquire 100% of the equity share capital in InSemi Technology Services Private Limited, a semiconductor design

services company headquartered in India, for a consideration including earn-outs, and management incentives and retention bonuses totalling

up to  280 crore (approximately $34 million) , subject to customary closing adjustments.

280 crore (approximately $34 million) , subject to customary closing adjustments.

e) Update on stock grants

The Board, on January 11, 2024, based on the recommendations

of the Nomination and Remuneration Committee, approved the annual time-based stock incentives in the form of Restricted Stock Units (RSUs)

to Salil Parekh, CEO & MD having a market value of  3 crore as on the date of grant under the 2015 Stock Incentive Compensation

Plan (2015 Plan) in accordance with the terms of his employment agreement. The RSUs will vest in line with the employment agreement. The

RSUs will be granted w.e.f February 1, 2024 and the number of RSUs will be calculated based on the market price at the close of trading

on February 1, 2024. The exercise price of RSUs will be equal to the par value of the share.

3 crore as on the date of grant under the 2015 Stock Incentive Compensation

Plan (2015 Plan) in accordance with the terms of his employment agreement. The RSUs will vest in line with the employment agreement. The

RSUs will be granted w.e.f February 1, 2024 and the number of RSUs will be calculated based on the market price at the close of trading

on February 1, 2024. The exercise price of RSUs will be equal to the par value of the share.

2. Information on dividends for the quarter and

nine months ended December 31, 2023

The Board of Directors (in the meeting held on October

12, 2023) declared an interim dividend of  18/- per equity share. The record date for the payment was October 25, 2023 and the same

was paid on November 6, 2023. The interim dividend declared in the previous year was

18/- per equity share. The record date for the payment was October 25, 2023 and the same

was paid on November 6, 2023. The interim dividend declared in the previous year was  16.50/- per equity share.

16.50/- per equity share.

(in  )

)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months

Ended

December 31, |

Year ended

March 31, |

| |

2023 |

2023 |

2022 |

2023 |

2022 |

2023 |

Dividend per share (par value  5/- each) 5/- each) |

|

|

|

|

|

|

| Interim dividend |

– |

18.00 |

– |

18.00 |

16.50 |

16.50 |

| Final dividend |

– |

– |

– |

– |

– |

17.50 |

3. Segment reporting (Consolidated - Audited)

(in  crore)

crore)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months

Ended

December 31, |

Year ended

March 31, |

| |

2023 |

2023 |

2022 |

2023 |

2022 |

2023 |

| Revenue by business segment |

|

|

|

|

|

|

| Financial Services (1)# |

10,783 |

10,705 |

11,235 |

32,149 |

32,945 |

43,763 |

| Retail (2) |

5,649 |

5,913 |

5,480 |

17,075 |

15,667 |

21,204 |

| Communication (3) |

4,421 |

4,463 |

4,710 |

13,325 |

13,675 |

18,086 |

| Energy, Utilities, Resources and Services |

5,121 |

4,957 |

4,957 |

14,966 |

13,714 |

18,539 |

| Manufacturing |

5,786 |

5,574 |

5,099 |

16,710 |

13,957 |

19,035 |

| Hi-Tech |

2,985 |

3,053 |

3,095 |

9,095 |

8,878 |

11,867 |

| Life Sciences (4) |

2,954 |

3,050 |

2,695 |

8,753 |

7,404 |

10,085 |

| All other segments (5) |

1,122 |

1,279 |

1,047 |

3,675 |

3,086 |

4,188 |

| Total |

38,821 |

38,994 |

38,318 |

115,748 |

109,326 |

146,767 |

| Less: Inter-segment revenue |

– |

– |

– |

– |

– |

– |

| Net revenue from operations |

38,821 |

38,994 |

38,318 |

115,748 |

109,326 |

146,767 |

| Segment profit before tax, depreciation and non-controlling interests: |

|

|

|

|

|

|

| Financial Services (1)# |

2,260 |

2,579 |

2,678 |

7,384 |

8,243 |

10,843 |

| Retail (2) |

1,715 |

1,674 |

1,646 |

5,018 |

4,761 |

6,396 |

| Communication (3) |

860 |

1,035 |

1,042 |

2,879 |

2,801 |

3,759 |

| Energy, Utilities , Resources and Services |

1,450 |

1,352 |

1,457 |

4,091 |

3,853 |

5,155 |

| Manufacturing |

1,110 |

1,033 |

1,035 |

3,116 |

2,212 |

3,113 |

| Hi-Tech |

758 |

788 |

813 |

2,349 |

2,209 |

2,959 |

| Life Sciences (4) |

766 |

799 |

684 |

2,266 |

1,861 |

2,566 |

| All other segments (5) |

218 |

180 |

12 |

538 |

192 |

339 |

| Total |

9,137 |

9,440 |

9,367 |

27,641 |

26,132 |

35,130 |

| Less: Other Unallocable expenditure |

1,176 |

1,166 |

1,125 |

3,515 |

3,104 |

4,225 |

| Add: Unallocable other income |

789 |

632 |

769 |

1,982 |

2,030 |

2,701 |

| Less: Finance cost |

131 |

138 |

80 |

360 |

202 |

284 |

| Profit before tax and non-controlling interests |

8,619 |

8,768 |

8,931 |

25,748 |

24,856 |

33,322 |

| (1) | | Financial Services include enterprises in Financial Services and Insurance |

| (2) | | Retail includes enterprises in Retail, Consumer Packaged Goods and Logistics |

| (3) | | Communication includes enterprises in Communication, Telecom OEM and Media |

| (4) | | Life Sciences includes enterprises in Life sciences and Health care |

| (5) | | All other segments include operating segments of businesses in India, Japan, China, Infosys

Public Services & other enterprises in Public Services |

| # | | Includes impact on account of McCamish cybersecurity incident. Refer note 1.c) above. |

Notes on segment information

Business segments

Based on the "management approach" as defined

in Ind-AS 108 - Operating Segments, the Chief Operating Decision Maker evaluates the Group's performance and allocates resources based

on an analysis of various performance indicators by business segments. Accordingly, information has been presented along these business

segments. The accounting principles used in the preparation of the financial statements are consistently applied to record revenue and

expenditure in individual segments.

Segmental capital employed

Assets and liabilities used in the Group's business

are not identified to any of the reportable segments, as these are used interchangeably between segments. The Management believes that

it is not practicable to provide segment disclosures relating to total assets and liabilities since a meaningful segregation of the available

data is onerous.

4. Audited financial results of Infosys Limited

(Standalone Information)

(in  crore)

crore)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months

Ended

December 31, |

Year ended

March 31, |

| |

2023 |

2023 |

2022 |

2023 |

2022 |

2023 |

| Revenue from operations |

32,491 |

32,629 |

32,389 |

96,932 |

93,483 |

124,014 |

| Profit before tax |

8,876 |

8,517 |

8,295 |

25,539 |

23,686 |

31,643 |

| Profit for the period |

6,552 |

6,245 |

6,210 |

18,754 |

17,364 |

23,268 |

The audited results of Infosys Limited for the above mentioned

periods are available on our website, www.infosys.com and on the Stock Exchange website www.nseindia.com and www.bseindia.com. The information

above has been extracted from the audited interim standalone condensed financial statements as stated.

| |

By order of the Board for Infosys Limited |

| Bengaluru, India |

Salil Parekh

Chief Executive Officer and Managing Director |

| January 11, 2024 |

|

The Board has also taken on record the condensed

consolidated results of Infosys Limited and its subsidiaries for the quarter and nine months ended December 31, 2023, prepared as per

International Financial Reporting Standards (IFRS) and reported in US dollars. A summary of the financial statements is as follows:

(in US$ million, except per equity share data)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months ended December 31, |

Year ended

March 31, |

| |

2023 |

2023 |

2022 |

2023 |

2022 |

2023 |

| |

Audited |

Audited |

Audited |

Audited |

Audited |

Audited |

| Revenues |

4,663 |

4,718 |

4,659 |

13,997 |

13,657 |

18,212 |

| Cost of sales |

3,274 |

3,271 |

3,230 |

9,755 |

9,544 |

12,709 |

| Gross profit |

1,389 |

1,447 |

1,429 |

4,242 |

4,113 |

5,503 |

| Operating expenses |

433 |

447 |

428 |

1,325 |

1,245 |

1,678 |

| Operating profit |

956 |

1,000 |

1,001 |

2,917 |

2,868 |

3,825 |

| Other income, net |

95 |

77 |

94 |

239 |

254 |

335 |

| Finance cost |

16 |

17 |

10 |

43 |

25 |

35 |

| Profit before income taxes |

1,035 |

1,060 |

1,085 |

3,113 |

3,097 |

4,125 |

| Income tax expense |

301 |

309 |

285 |

904 |

859 |

1,142 |

| Net profit |

734 |

751 |

800 |

2,209 |

2,238 |

2,983 |

| Earnings per equity share * |

|

|

|

|

|

|

| Basic |

0.18 |

0.18 |

0.19 |

0.53 |

0.53 |

0.71 |

| Diluted |

0.18 |

0.18 |

0.19 |

0.53 |

0.53 |

0.71 |

| Total assets |

15,606 |

15,689 |

15,226 |

15,606 |

15,226 |

15,312 |

| Cash and cash equivalents and current investments |

2,598 |

2,805 |

2,456 |

2,598 |

2,456 |

2,322 |

| * | | EPS is not annualized for the quarter and nine months ended December 31, 2023, quarter

ended September 30, 2023 and quarter and nine months ended December 31, 2022. |

Certain statements in this release concerning our future

growth prospects, our future financial or operating performance, and the McCamish cybersecurity incident are forward-looking statements

intended to qualify for the 'safe harbor' under the Private Securities Litigation Reform Act of 1995, which involve a number of risks

and uncertainties that could cause actual results or outcomes to differ materially from those in such forward-looking statements. The

risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding the execution

of our business strategy, our ability to attract and retain personnel, our transition to hybrid work model, economic uncertainties, technological

innovations such as Generative AI, the complex and evolving regulatory landscape including immigration regulation changes, our ESG vision,

our capital allocation policy and expectations concerning our market position, future operations, margins, profitability, liquidity, capital

resources, our corporate actions including acquisitions, the actual or anticipated findings of the ongoing assessment of the extent and

nature of exfiltrated data in relation to the McCamish cybersecurity incident and customer reaction to such findings, and the amount of

any additional costs, including indemnities or damages / claims, resulting from the McCamish cybersecurity incident. Important factors

that may cause actual results or outcomes to differ from those implied by the forward-looking statements are discussed in more detail

in our US Securities and Exchange Commission filings including our Annual Report on Form 20-F for the fiscal year ended March 31, 2023.

These filings are available at www.sec.gov. Infosys may, from time to time, make additional written and oral forward-looking statements,

including statements contained in the Company's filings with the Securities and Exchange Commission and our reports to shareholders. The

Company does not undertake to update any forward-looking statements that may be made from time to time by or on behalf of the Company

unless it is required by law.

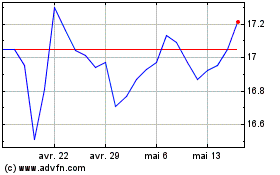

Infosys (NYSE:INFY)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Infosys (NYSE:INFY)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024