UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

|

|

| Investment Company Act file number |

|

811-22988 |

Nuveen Global High Income Fund

(Exact name of registrant as

specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive

offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker

Drive, Chicago, IL 60606

(Name

and address of agent for service)

|

|

|

| Registrant’s telephone number, including area code: |

|

(312) 917-7700 |

|

|

|

| Date of fiscal year end: |

|

December 31 |

|

|

|

| Date of reporting period: |

|

June 30, 2023 |

Form N-CSR is to

be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment

Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the

clearance requirements of 44 U.S.C. ss.3507.

| ITEM 1. |

REPORTS TO STOCKHOLDERS. |

Closed-End Funds

June 30, 2023

Nuveen Closed-End Funds

This semi-annual report

contains the Funds’ unaudited financial statements.

|

|

|

| JGH |

|

Nuveen Global High Income Fund |

| NPCT |

|

Nuveen Core Plus Impact Fund |

| JLS |

|

Nuveen Mortgage and Income Fund |

Semi-annual Report

Table of Contents

2

Chair’s Letter to Shareholders

Dear Shareholders,

The

significant measures taken by the U.S. Federal Reserve (Fed) and other global central banks since 2022 to contain inflation have begun to take effect. From March 2022 to July 2023, the Fed raised the target fed funds rate by 5.25% to a range of

5.25% to 5.50%. Even with a brief pause in June 2023, this has been one of the fastest interest rate hiking cycles in the Fed’s history. Inflation rates in the U.S. and across most of the world have fallen from their post-pandemic highs but

currently remain above the levels that central banks consider supportive of their economies’ long-term growth, particularly when looking at core inflation measures, which exclude volatile food and energy prices.

At the same time, the U.S. and other large economies have remained relatively resilient, even as financial conditions have tightened. U.S. gross domestic product

accelerated to 2.4% in the second quarter of 2023 from 2.0% in the first quarter of 2023, after growing 2.1% in 2022 overall compared to 2021. A relatively strong jobs market has helped support consumer sentiment and spending despite historically

high inflation. Markets are concerned that these conditions could keep upward pressure on prices and wages and continue to assess the impact of the collapse of three regional U.S. banks (Silicon Valley Bank, Signature Bank and First Republic Bank)

and major European bank Credit Suisse in March 2023.

Fed officials are closely monitoring inflation data and other economic measures to modify their rate setting

activity based upon these factors on a meeting-by-meeting basis, including pausing rate adjustments at the June 2023 meeting to assess the effects of monetary policy on

the economy. While uncertainty has increased given the unpredictable outcome of tighter credit conditions on the economy, the Fed remains committed to acting until it sees sustainable progress toward its inflation goals. Additionally, market

concerns surrounding the U.S. debt ceiling faded after the government agreed in June 2023 to suspend the nation’s borrowing limit until January 2025, averting a near-term default scenario. In the meantime, markets are likely to continue

reacting in the short term to news about inflation data, economic indicators and central bank policy. We encourage investors to keep a long-term perspective amid the short-term turbulence. Your financial professional can help you review how well

your portfolio is aligned with your time horizon, risk tolerance and investment goals.

On behalf of the other members of the Nuveen Fund Board, we look forward to

continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chair of the Board

August 22, 2023

3

Important Notices

Portfolio Manager Commentaries in Semi-annual Shareholder Reports

The Funds include portfolio manager commentary in their annual shareholder reports. For the Funds’ most recent annual portfolio manager discussion, please refer to

the Portfolio Managers’ Comments section of each Fund’s December 31, 2022 annual shareholder report.

For current information on your Fund’s

investment objectives, portfolio management team and average annual total returns please refer to the Fund’s website at www.nuveen.com.

For changes that

occurred to your Fund both during and subsequent to this reporting period, please refer to the Notes to Financial Statements section of this report.

For average

annual total returns as of the end of this reporting period, please refer to the Performance Overview and Holding Summaries section within this report.

Portfolio Manager Update for (JGH)

Effective March 21, 2023, John Espinosa,

Brenda Langenfeld, and Katherine Renfrew have been added as portfolio managers and Anders Persson no longer serves as a portfolio manager of the Fund. Mr. Persson continues in his role as Chief Investment Officer of Nuveen Global Fixed Income. Kevin

Lorenz and Jacob Fitzpatrick continue to serve as portfolio managers of the Fund.

4

Fund Leverage

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the common share returns of the Funds relative to their comparative benchmarks was the use of leverage through bank borrowings, Taxable

Fund Preferred Shares (TFP) for NPCT and reverse repurchase agreements for NPCT and JLS. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when

short-term rates that the Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund’s common shares will experience a greater

increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in

value. All this will make the shares’ total return performance more variable over time.

In addition, common share income in levered funds will typically

decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term interest

rates. While fund leverage expenses are higher than prior year lows, leverage nevertheless continues to provide the opportunity for incremental common share income, particularly over longer-term periods.

JGH and JLS’s use of leverage contributed to relative performance during the reporting period. In addition, the Funds’ use of leverage was accretive to common

share income. NPCT’s use of leverage detracted from relative performance during the reporting period.

JGH also continued to use interest rate swap contracts to

partially hedge its future interest cost of leverage. The interest rate swaps contributed to relative performance during the reporting period.

As of June 30, 2023,

the Funds’ percentages of leverage are as shown in the accompanying table.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

JGH |

|

|

NPCT |

|

|

JLS |

|

| Effective Leverage* |

|

|

28.78 |

% |

|

|

39.38 |

% |

|

|

28.39 |

% |

| Regulatory Leverage* |

|

|

28.78 |

% |

|

|

34.00 |

% |

|

|

8.54 |

% |

| * |

Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage

effects of reverse repurchase agreements, certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of the Fund. Both

of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such

incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

5

Fund Leverage (continued)

Bank Borrowings

As noted previously, the Funds employ leverage through the use of bank borrowings. The Funds’ bank borrowing activities are as shown in the accompanying table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Subsequent to the Close of |

|

| |

|

Current Reporting Period |

|

|

|

|

|

the Reporting Period |

|

| Fund |

|

Outstanding

Balance as of

January 1, 2023 |

|

|

Draws |

|

|

Paydowns |

|

|

Outstanding

Balance as of

June 30, 2023 |

|

|

Average

Balance

Outstanding |

|

|

|

|

|

Draws |

|

|

Paydowns |

|

|

Outstanding

Balance as of

August 22, 2023 |

|

| JGH |

|

$ |

127,000,000 |

|

|

$ |

— |

|

|

$ |

(8,000,000 |

) |

|

$ |

119,000,000 |

|

|

$ |

122,845,304 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

119,000,000 |

|

| NPCT |

|

$ |

105,500,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

105,500,000 |

|

|

$ |

105,500,000 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

105,500,000 |

|

| JLS |

|

$ |

12,495,000 |

|

|

$ |

700,000 |

|

|

$ |

(3,500,000 |

) |

|

$ |

9,695,000 |

|

|

$ |

10,167,928 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

9,695,000 |

|

Refer to Notes to Financial Statements, Note 10 – Borrowing Arrangements and Reverse Repurchase Agreements for further details.

Reverse Repurchase Agreements

As noted previously, JLS and NPCT use reverse

repurchase agreements, in which the Fund sells to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date. The Funds’ transactions in reverse repurchase

agreements are as shown in the accompanying table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Subsequent to the Close of |

|

| |

|

Current Reporting Period |

|

|

|

|

|

the Reporting Period |

|

| Fund |

|

Outstanding

Balance as of

January 1, 2023 |

|

|

Sales |

|

|

Purchases |

|

|

Outstanding

Balance as of

June 30, 2023 |

|

|

Average

Balance

Outstanding |

|

|

|

|

|

Sales |

|

|

Purchases |

|

|

Outstanding

Balance as of

August 22, 2023 |

|

| NPCT |

|

$ |

45,820,000 |

|

|

$ |

91,640,000 |

|

|

$ |

(91,640,000 |

) |

|

$ |

45,820,000 |

|

|

$ |

45,820,000 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

45,820,000 |

|

| JLS |

|

$ |

32,145,000 |

|

|

$ |

62,050,000 |

|

|

$ |

(62,750,000 |

) |

|

$ |

31,445,000 |

|

|

$ |

31,839,475 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

(897,000 |

) |

|

$ |

30,548,000 |

|

Refer to Notes to Financial Statements, Note 10 – Borrowing Arrangements and Reverse Repurchase Agreements for further details.

Taxable Fund Preferred Shares

As noted previously, in addition to bank

borrowings, NPCT also issued TFP. The Fund’s transactions in TFP are as shown in the accompanying table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Subsequent to the Close of |

|

| |

|

Current Reporting Period |

|

|

|

|

|

the Reporting Period |

|

| Fund |

|

Outstanding

Balance as of

January 1, 2023 |

|

|

Issuance |

|

|

Redemptions |

|

|

Outstanding

Balance as of

June 30, 2023 |

|

|

Average

Balance

Outstanding |

|

|

|

|

|

Sales |

|

|

Purchases |

|

|

Outstanding

Balance as of

August 22, 2023 |

|

| NPCT |

|

$ |

70,000,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

70,000,000 |

|

|

$ |

70,000,000 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

70,000,000 |

|

Refer to Notes to Financial Statements, Note 6 – Fund Shares for further details on TFP.

6

Common Share Information

(Unaudited)

COMMON SHARE DISTRIBUTION INFORMATION FOR JGH AND JLS

The following

information regarding the distributions for JGH and JLS are current as of June 30, 2023, the Funds’ fiscal and tax year end, and may differ from previously issued distribution notices.

The Funds have implemented a level distribution program to provide shareholders with stable, but not guaranteed, cash flow, independent of the amount or timing of income

earned or capital gains realized by the Fund. Under this program, the Fund’s regular monthly distribution, in order to maintain its level distribution amount, may include net investment income, return of capital and potentially capital gains

for tax purposes. The practice of maintaining a stable distribution level had no material effect on each Fund’s investment strategy during the most recent fiscal period and is not expected to have such an effect in future periods, however,

distributions in excess of Fund returns will cause its NAV per share to erode. For additional information, refer to the distribution information section below and in the Notes to Financial Statements herein.

Actual amounts and sources for tax reporting purposes will be determined as of each Fund’s fiscal year-end and reported to shareholders on Form 1099-DIV. Because

distribution source estimates are updated throughout the current fiscal year based on a Fund’s performance, these estimates may differ from both the tax information reported to you in your Fund’s 1099 statement, as well as the ultimate

economic sources of distributions over the life of your investment. The figures in the table below provide an estimate of the sources of distributions and may include amounts attributed to realized gains and/or returns of capital. The Funds

attribute these estimates equally to each regular distribution throughout the year. Consequently, the estimated information shown below is for the current distribution, and also represents an updated estimate for all prior months in the fiscal year.

These estimates should not be used for tax reporting purposes. The final determination for all distributions paid in 2023 will be made in early 2024 and reported to you on Form 1099-DIV. More details about each Fund’s distributions and the

basis for these estimates are available on www.nuveen.com/en-us/closed-end-funds.

Data as of June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Current Month

Estimated Percentage of Distributions |

|

|

|

|

|

Fiscal YTD

Estimated Per Share Amounts |

|

| Fund |

|

Latest

Monthly

Per Share

Distribution |

|

|

Net

Investment

Income |

|

|

Realized

Gains |

|

|

Return of

Capital |

|

|

|

|

|

Total

Distributions |

|

|

Net

Investment

Income |

|

|

Realized

Gains |

|

|

Return of

Capital |

|

| JGH |

|

$ |

0.1035 |

|

|

|

74.15 |

% |

|

|

0.00 |

% |

|

|

25.85 |

% |

|

|

|

|

|

$ |

0.6210 |

|

|

$ |

0.4605 |

|

|

$ |

0.0000 |

|

|

$ |

0.1605 |

|

| JLS |

|

$ |

0.1230 |

|

|

|

93.37 |

% |

|

|

0.00 |

% |

|

|

6.63 |

% |

|

|

|

|

|

$ |

0.7170 |

|

|

$ |

0.6694 |

|

|

$ |

0.0000 |

|

|

$ |

0.0476 |

|

The following table provides information regarding Fund distributions and total return performance over various time periods. This

information is intended to help you better understand whether Fund returns for the specified time periods were sufficient to meet Fund distributions.

Data as of

June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Annualized |

|

|

|

|

|

Cumulative |

|

| Fund |

|

Inception

Date |

|

|

Latest

Monthly

Per Share

Distribution |

|

|

|

|

|

Current

Distribution

on NAV |

|

|

1-Year

Return on

NAV |

|

|

5-Year

Return on

NAV |

|

|

|

|

|

Fiscal YTD

Distributions

on NAV |

|

|

Fiscal

YTD Return

on NAV |

|

| JGH |

|

|

11/24/2014 |

|

|

|

$0.1035 |

|

|

|

|

|

|

|

9.78% |

|

|

|

11.24% |

|

|

|

1.42% |

|

|

|

|

|

|

|

4.89% |

|

|

|

4.21% |

|

| JLS |

|

|

11/25/2009 |

|

|

|

$0.1230 |

|

|

|

|

|

|

|

7.79% |

|

|

|

5.61% |

|

|

|

1.00% |

|

|

|

|

|

|

|

3.78% |

|

|

|

4.33% |

|

7

Common Share Information (Unaudited) (continued)

COMMON SHARE DISTRIBUTION INFORMATION FOR NPCT

NPCT makes regular cash distributions to shareholders of a stated dollar amount per share. Subject to approval and oversight by the Board of Trustees, the Fund seeks to

maintain a stable distribution level designed to deliver the long-term return potential of the Fund’s investment strategy through regular distributions (a “Managed Distribution Program”). The

practice of maintaining a stable distribution level had no material effect on the Fund’s investment strategy during the most recent fiscal period and is not expected to have such an effect in future periods, however, distributions in excess of

Fund returns will cause its NAV per share to erode. For additional information, refer to the distribution information section below and in the Notes to Financial Statements herein.

The following information regarding the Fund’s distributions is current as of June 30, 2023. This notice provides shareholders with information regarding fund

distributions, as required by current securities laws. You should not draw any conclusions about the Fund’s investment performance from the amount of the distribution or from the terms of the Fund’s Managed Distribution Policy.

The following table provides estimates of the Fund’s distribution sources, reflecting year-to-date cumulative experience through the month-end prior to the latest

distribution. The Fund attributes these estimates equally to each regular distribution throughout the year. Consequently, the estimated information as of the specified month-end shown below is for the current distribution, and also represents an

updated estimate for all prior months in the year. For the Fund, it is estimated that the Fund has distributed more than its income and net realized capital gains; therefore, a portion of the distributions may be (and is shown below as being

estimated to be) a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s

investment performance and should not be confused with “yield” or “income.”

The amounts and sources of distributions reported in this notice are

only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be

subject to changes based on tax regulations. The Fund will send a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. More details about the Fund’s distributions and the

basis for these estimates are available on www.nuveen.com/cef.

Data as of June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Fiscal YTD |

|

| |

|

|

|

|

|

|

|

Per Share Estimated Sources of Distribution |

|

|

|

|

|

Estimated Percentage of the Distribution |

|

| Fund |

|

Per Share

Distribution |

|

|

|

|

|

Net

Investment

Income |

|

|

Long-Term

Gains |

|

|

Short-Term

Gains |

|

|

Return of

Capital |

|

|

|

|

|

Net

Investment

Income |

|

|

Long-Term

Gains |

|

|

Short-Term

Gains |

|

|

Return of

Capital |

|

| NPCT (FYE 12/31) |

|

|

$0.5380 |

|

|

|

|

|

|

|

$0.1997 |

|

|

|

$0.0000 |

|

|

|

$0.0000 |

|

|

|

$0.3383 |

|

|

|

|

|

|

|

37.1% |

|

|

|

0.00% |

|

|

|

0.00% |

|

|

|

62.9% |

|

The following tables provide information regarding the Fund’s common share distributions and total return performance for the six

month ended June 30, 2023. This information is intended to help you better understand whether the Funds’ returns for the specified time period were sufficient to meet its distributions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized |

|

|

|

|

|

Cumulative |

|

| Fund |

|

Inception

Date |

|

|

Latest

Monthly

Distribution |

|

|

Fiscal YTD

Distribution |

|

|

Net Asset

Value (NAV) |

|

|

|

|

|

Since Inception

Return on

NAV |

|

|

Fiscal YTD

Distribution

Rate on NAV |

|

|

|

|

|

Fiscal YTD

Return on

NAV |

|

|

Fiscal YTD

Distribution

Rate on NAV |

|

| NPCT (FYE 12/31) |

|

|

4/27/2021 |

|

|

|

$0.0830 |

|

|

|

$0.5380 |

|

|

|

$11.85 |

|

|

|

|

|

|

|

(15.11)% |

|

|

|

9.08% |

|

|

|

|

|

|

|

0.89% |

|

|

|

4.54% |

|

8

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s

enhanced closed-end fund resource page, which is at https://www.nuveen.com/resource-center-closed-end-funds, along with other Nuveen closed-end fund product updates. To ensure timely access to the latest information, shareholders may use a subscribe

function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

COMMON SHARE REPURCHASES

The Funds’ Board of Trustees reauthorized an open-market common share repurchase program, allowing each Fund to repurchase and retire an aggregate of up to

approximately 10% of its outstanding common shares.

During the current reporting period, the Funds did not repurchase any of their outstanding common shares. As of

June 30, 2023, and since the inception of the Funds’ repurchase program, each Fund have cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

JGH |

|

|

NPCT |

|

|

JLS |

|

| Common shares cumulatively repurchased and retired |

|

|

900,000 |

|

|

|

— |

|

|

|

10,814 |

|

| Common shares authorized for repurchase |

|

|

2,315,000 |

|

|

|

2,875,000 |

|

|

|

545,000 |

|

OTHER COMMON SHARE INFORMATION

As of June 30,

2023, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs and trading at an average premium/(discount) to NAV during the current reporting period, as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

JGH |

|

|

NPCT |

|

|

JLS |

|

| Common share NAV |

|

$ |

12.70 |

|

|

$ |

11.85 |

|

|

$ |

18.95 |

|

| Common share price |

|

$ |

11.17 |

|

|

$ |

9.97 |

|

|

$ |

16.12 |

|

| Premium/(Discount) to NAV |

|

|

(12.05 |

)% |

|

|

(15.86 |

)% |

|

|

(14.93 |

)% |

| Average premium/(discount) to NAV |

|

|

(11.17 |

)% |

|

|

(14.48 |

)% |

|

|

(14.57 |

)% |

9

About the Funds’ Benchmarks

| ∎ |

|

Bloomberg Global High Yield Index (USD Hedged): An index designed to measure the performance of the fixed-rate high

yield debt of companies in the U.S., developed markets and emerging markets. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees. |

| ∎ |

|

Bloomberg MSCI U.S. Green Bond Index: An index designed to measure the performance of USD-denominated, investment

grade fixed income securities issued by U.S. and non-U.S. companies to fund projects with direct environmental benefits. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

|

| ∎ |

|

Bloomberg U.S. Aggregate Bond Index: An index designed to measure the performance of the USD-denominated, fixed-rate

U.S. investment grade taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities (MBS), asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS). Index returns

assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees. |

| ∎ |

|

Bloomberg U.S. Corporate High Yield Bond Index: An index designed to measure the performance of the USD-denominated,

fixed-rate corporate high yield bond market. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees. |

| ∎ |

|

ICE BofA U.S. ABS & CMBS Index: An index that consists of a 50/50 blend of USD-denominated investment grade

fixed- and floating-rate asset backed securities (ABS) and fixed-rate commercial mortgage-backed securities (CMBS) publicly issued in the U.S. domestic market. Index returns assume reinvestment of distributions, but do not reflect any applicable

sales charges or management fees. |

| ∎ |

|

JLS Blended Benchmark (effective October 14, 2019): The ICE BofA U.S. ABS & CMBS Index consists of a 50/50 blend

of USD-denominated, investment grade fixed and floating-rate asset backed securities (ABS) and fixed-rate commercial mortgage backed securities (CMBS) publicly issued in the U.S. The Fund’s performance was measured against the Bloomberg U.S.

Aggregate Bond Index (defined herein) through October 13, 2019. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees. |

| ∎ |

|

NPCT Blended Benchmark: Consists of: 1) 60% Bloomberg MSCI U.S. Green Bond Index (defined herein), and 2) 40%

Bloomberg U.S. Corporate High Yield Bond Index (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees. |

10

|

|

|

| JGH |

|

Nuveen Global High Income Fund

Performance Overview and Holding Summaries as of June 30, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within

this section.

Average Annual Total Returns as of June 30, 2023*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cumulative |

|

|

Average Annual |

|

| |

|

6-Month |

|

|

1-Year |

|

|

5-Year |

|

|

Since

Inception |

|

| JGH at Common Share NAV |

|

|

4.21% |

|

|

|

11.24% |

|

|

|

1.42% |

|

|

|

2.84% |

|

| JGH at Common Share Price |

|

|

4.81% |

|

|

|

7.90% |

|

|

|

2.50% |

|

|

|

3.38% |

|

| Bloomberg Global High Yield Index (USD Hedged) |

|

|

4.94% |

|

|

|

10.12% |

|

|

|

2.59% |

|

|

|

3.67% |

|

| * |

For purposes of Fund performance, relative results are measured against the Bloomberg Global High Yield Index (USD

Hedged). |

Since inception returns are from 11/24/14. Performance data shown represents past performance and does not predict or guarantee future

results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses,

and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

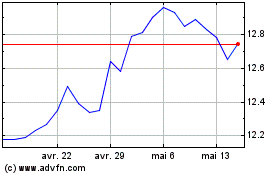

Daily Common Share NAV and Share Price

11

This data relates to the securities held in the

Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The Fund uses credit quality ratings for its portfolio securities provided by Standard & Poor’s Group, Moody’s Investors Service, Inc. and Fitch, Inc. If

all three provide a rating for a security, the middle is used; if two of the three agencies rate a security, the lower rating is used; and if only one rating agency rates a security, that rating is used. This treatment of split-rated securities may

differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated

N/R are not rated by these national rating agencies.

Fund Allocation

(% of net

assets)

|

|

|

|

|

| Corporate Bonds |

|

|

94.5% |

|

| Sovereign Debt |

|

|

14.7% |

|

| $1000 Par (or similar) Institutional Preferred |

|

|

9.9% |

|

| Variable Rate Senior Loan Interests |

|

|

9.3% |

|

| Contingent Capital Securities |

|

|

5.3% |

|

| $25 Par (or similar) Retail Preferred |

|

|

1.3% |

|

| Common Stocks |

|

|

0.2% |

|

| Asset-Backed Securities |

|

|

0.2% |

|

| Repurchase Agreements |

|

|

4.0% |

|

| Other Assets Less Liabilities, Net |

|

|

1.0% |

|

| Borrowings |

|

|

(40.4)% |

|

| Net Assets |

|

|

100% |

|

Top Five Issuers

(% of total investments)

|

|

|

|

|

| Tenet Healthcare Corp |

|

|

1.3% |

|

| EQM Midstream Partners LP |

|

|

1.3% |

|

| Albion Financing 2SARL |

|

|

1.2% |

|

| Presidio Holdings Inc |

|

|

1.2% |

|

| Colombia Government International Bond |

|

|

1.1% |

|

Portfolio Composition1

(% of total investments)

|

|

|

|

|

| Oil, Gas & Consumable Fuels |

|

|

12.5% |

|

| Sovereign Debt |

|

|

10.5% |

|

| Banks |

|

|

5.4% |

|

| Media |

|

|

4.8% |

|

| Metals & Mining |

|

|

3.6% |

|

| Insurance |

|

|

3.6% |

|

| Specialty Retail |

|

|

3.3% |

|

| Electric Utilities |

|

|

3.1% |

|

| IT Services |

|

|

3.1% |

|

| Chemicals |

|

|

2.8% |

|

| Hotels, Restaurants & Leisure |

|

|

2.8% |

|

| Diversified Telecommunication Services |

|

|

2.7% |

|

| Trading Companies & Distributors |

|

|

2.7% |

|

| Health Care Providers & Services |

|

|

2.6% |

|

| Wireless Telecommunication Services |

|

|

2.4% |

|

| Capital Markets |

|

|

2.2% |

|

| Automobile Components |

|

|

2.2% |

|

| Beverages |

|

|

2.1% |

|

| Gas Utilities |

|

|

1.9% |

|

| Passenger Airlines |

|

|

1.8% |

|

| Pharmaceuticals |

|

|

1.8% |

|

| Asset-Backed Securities |

|

|

0.2% |

|

| Other |

|

|

19.1% |

|

| Repurchase Agreements |

|

|

2.8% |

|

| Total |

|

|

100% |

|

Portfolio Credit Quality

(%

of total long-term investments)

|

|

|

|

|

| BBB |

|

|

11.0% |

|

| BB or Lower |

|

|

88.0% |

|

| N/R (not rated) |

|

|

0.8% |

|

| N/A (not applicable) |

|

|

0.2% |

|

| Total |

|

|

100% |

|

Country Allocation2

(% of total investments)

|

|

|

|

|

| United States |

|

|

56.3% |

|

| Canada |

|

|

5.7% |

|

| Mexico |

|

|

3.3% |

|

| Colombia |

|

|

2.6% |

|

| Australia |

|

|

2.4% |

|

| United Kingdom |

|

|

2.0% |

|

| Luxembourg |

|

|

2.0% |

|

| Netherlands |

|

|

1.9% |

|

| Israel |

|

|

1.8% |

|

| France |

|

|

1.6% |

|

| South Africa |

|

|

1.4% |

|

| Other3 |

|

|

19.0% |

|

| Total |

|

|

100% |

|

| 1 |

See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the

table above. |

| 2 |

Includes 25.0% (as a percentage of total investments) in emerging market countries. |

| 3 |

“Other” countries include thirty-nine countries that individually constitute less than 1.3% as a percentage of

total investments. |

12

|

|

|

| NPCT |

|

Nuveen Core Plus Impact Fund

Performance Overview and Holding Summaries as of June 30, 2023 |

Refer to Glossary of Terms Used in this Report for further definition of terms used in this

section.

Cumulative Total Returns as of June 30, 2023*

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cumulative |

|

|

Average Annual |

|

| |

|

6-Month |

|

|

1-Year |

|

|

Since

Inception |

|

| NPCT at Common Share NAV |

|

|

0.89% |

|

|

|

(3.97)% |

|

|

|

(15.11)% |

|

| NPCT at Common Share Price |

|

|

1.27% |

|

|

|

(5.36)% |

|

|

|

(20.81)% |

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

2.09% |

|

|

|

(0.94)% |

|

|

|

(11.13)% |

|

| NPCT Blended Benchmark |

|

|

3.56% |

|

|

|

3.87% |

|

|

|

(3.23)% |

|

| * |

For purposes of Fund performance, relative results are measured against the NPCT Blended Benchmark. The Fund’s

Blended Benchmark consists of: 1) 60% of Bloomberg MSCI U.S. Green Bond Index and 2) 40% Bloomberg U.S. Corporate High Yield Bond Index. |

Since

inception returns are from 4/27/21. Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes

that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares

at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

13

This data relates to the securities held in the

Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The Fund uses credit quality ratings for its portfolio securities provided by Standard & Poor’s Group, Moody’s Investors Service, Inc. and Fitch, Inc. If

all three provide a rating for a security, the middle is used; if two of the three agencies rate a security, the lower rating is used; and if only one rating agency rates a security, that rating is used. This treatment of split-rated securities may

differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated

N/R are not rated by these national rating agencies.

Fund Allocation

(% of net

assets)

|

|

|

|

|

| Corporate Bonds |

|

|

95.5% |

|

| $1000 Par (or similar) Institutional Preferred |

|

|

22.5% |

|

| Asset-Backed Securities |

|

|

13.5% |

|

| Mortgage-Backed Securities |

|

|

10.2% |

|

| Sovereign Debt |

|

|

6.7% |

|

| $25 Par (or similar) Retail Preferred |

|

|

6.1% |

|

| Municipal Bonds |

|

|

3.4% |

|

| Variable Rate Senior Loan Interests |

|

|

3.0% |

|

| Repurchase Agreements |

|

|

1.8% |

|

| Other Assets Less Liabilities, Net |

|

|

2.3% |

|

| Borrowings |

|

|

(31.0)% |

|

| Reverse Repurchase Agreements, including accrued interest |

|

|

(13.5)% |

|

| TFP Shares, Net |

|

|

(20.5)% |

|

| Net Assets |

|

|

100% |

|

Portfolio Composition1

(% of total investments)

|

|

|

|

|

| Electric Utilities |

|

|

13.7% |

|

| Banks |

|

|

12.8% |

|

| Asset-Backed Securities |

|

|

8.3% |

|

| Mortgage-Backed Securities |

|

|

6.3% |

|

| Independent Power and Renewable Electricity Producers |

|

|

6.2% |

|

| Multi-Utilities |

|

|

4.3% |

|

| Sovereign Debt |

|

|

4.1% |

|

| Trading Companies & Distributors |

|

|

3.4% |

|

| Chemicals |

|

|

2.8% |

|

| Automobiles |

|

|

2.6% |

|

| Insurance |

|

|

2.6% |

|

| Gas Utilities |

|

|

2.6% |

|

| Capital Markets |

|

|

2.4% |

|

| Oil, Gas & Consumable Fuels |

|

|

2.2% |

|

| Municipal Bonds |

|

|

2.1% |

|

| Commercial Services & Supplies |

|

|

2.0% |

|

| Diversified REITs |

|

|

1.9% |

|

| Other |

|

|

18.6% |

|

| Repurchase Agreements |

|

|

1.1% |

|

| Total |

|

|

100% |

|

Portfolio Credit Quality

(%

of total long-term investments)

|

|

|

|

|

| AAA |

|

|

0.6% |

|

| AA |

|

|

3.2% |

|

| A |

|

|

10.2% |

|

| BBB |

|

|

40.6% |

|

| BB or Lower |

|

|

35.4% |

|

| N/R (not rated) |

|

|

10.0% |

|

| Total |

|

|

100% |

|

Country Allocation2

(% of total investments)

|

|

|

|

|

| United States |

|

|

59.9% |

|

| Italy |

|

|

4.3% |

|

| Chile |

|

|

4.0% |

|

| United Kingdom |

|

|

3.7% |

|

| Mexico |

|

|

3.1% |

|

| Australia |

|

|

2.7% |

|

| Canada |

|

|

2.6% |

|

| Switzerland |

|

|

2.6% |

|

| Indonesia |

|

|

2.3% |

|

| India |

|

|

2.2% |

|

| South Korea |

|

|

1.5% |

|

| Other3 |

|

|

11.1% |

|

| Total |

|

|

100% |

|

| 1 |

See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the

table above. |

| 2 |

Includes 21.0% (as a percentage of total investments) in emerging market countries. |

| 3 |

“Other” countries include twelve countries that individually constitute less than 1.5% as a percentage of total

investments. |

14

|

|

|

| JLS |

|

Nuveen Mortgage and Income Fund

Performance Overview and Holding Summaries as of June 30, 2023 |

Refer to Glossary of Terms Used in this Report for further definition of terms used in this

section.

Average Annual Total Returns as of June 30, 2023*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cumulative |

|

|

Average Annual |

|

| |

|

6-Month |

|

|

1-Year |

|

|

5-Year |

|

|

10-Year |

|

| JLS at Common Share NAV |

|

|

4.33% |

|

|

|

5.61% |

|

|

|

1.00% |

|

|

|

3.89% |

|

| JLS at Common Share Price |

|

|

4.11% |

|

|

|

5.57% |

|

|

|

(1.11)% |

|

|

|

3.09% |

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

2.09% |

|

|

|

(0.94)% |

|

|

|

0.77% |

|

|

|

1.52% |

|

| JLS Blended Benchmark |

|

|

1.68% |

|

|

|

0.16% |

|

|

|

1.82% |

|

|

|

2.04% |

|

| * |

For purposes of Fund performance, relative results are measured against the JLS Blended Benchmark. The Fund’s Blended

Benchmark, the ICE BofA U.S. ABS & CMBS Index, consists of a 50/50 blend of USD-denominated, investment grade fixed- and floating-rate asset-backed securities (ABS) and fixed-rate commercial mortgage-backed securities (CMBS) publicly issued in

the U.S. The Fund’s performance was measured against the Bloomberg U.S. Aggregate Bond Index through October 13, 2019. |

Performance prior to

October 14, 2019, reflects the Fund’s performance under the management of a sub-adviser using investment strategies that differed from those currently in place. Performance data shown represents past

performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of

Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

15

This data relates to the securities held in the

Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors

Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B,

CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net

assets)

|

|

|

|

|

| Mortgage-Backed Securities |

|

|

98.5% |

|

| Asset-Backed Securities |

|

|

39.7% |

|

| U.S. Government and Agency Obligations |

|

|

3.0% |

|

| Other Assets Less Liabilities, Net |

|

|

(1.2)% |

|

| Borrowings |

|

|

(9.3)% |

|

| Reverse Repurchase Agreements, including accrued interest |

|

|

(30.7)% |

|

| Net Assets |

|

|

100% |

|

Portfolio Credit Quality

(%

of total investments)

|

|

|

|

|

| U.S. Treasury/Agency |

|

|

2.2% |

|

| AAA |

|

|

0.1% |

|

| AA |

|

|

2.1% |

|

| A |

|

|

11.0% |

|

| BBB |

|

|

19.8% |

|

| BB or Lower |

|

|

36.7% |

|

| N/R (not rated) |

|

|

28.1% |

|

| Total |

|

|

100% |

|

16

Shareholder Meeting Report

The annual meeting of shareholders was held on May 8, 2023 for JGH, JLS and NPCT; at this meeting

the shareholders were asked to elect Board members.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

JGH |

|

|

JLS |

|

|

NPCT |

|

| |

|

Common

Shares |

|

|

Common

Shares |

|

|

Common and

Preferred

shares voting

together

as a class |

|

|

Preferred

Shares |

|

| Approval of the Board Members was reached as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amy B.R. Lancellotta |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

|

17,889,948 |

|

|

|

3,281,093 |

|

|

|

17,751,797 |

|

|

|

— |

|

| Withhold |

|

|

581,641 |

|

|

|

86,903 |

|

|

|

5,683,686 |

|

|

|

— |

|

| Total |

|

|

18,471,589 |

|

|

|

3,367,996 |

|

|

|

23,435,483 |

|

|

|

— |

|

| John K. Nelson |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

|

17,033,002 |

|

|

|

3,276,021 |

|

|

|

17,583,558 |

|

|

|

— |

|

| Withhold |

|

|

1,438,587 |

|

|

|

91,975 |

|

|

|

5,851,925 |

|

|

|

— |

|

| Total |

|

|

18,471,589 |

|

|

|

3,367,996 |

|

|

|

23,435,483 |

|

|

|

— |

|

| Terence J. Toth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

|

17,880,243 |

|

|

|

3,277,031 |

|

|

|

17,764,869 |

|

|

|

— |

|

| Withhold |

|

|

591,346 |

|

|

|

90,965 |

|

|

|

5,670,614 |

|

|

|

— |

|

| Total |

|

|

18,471,589 |

|

|

|

3,367,996 |

|

|

|

23,435,483 |

|

|

|

— |

|

| Robert L. Young |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

|

17,050,862 |

|

|

|

3,279,392 |

|

|

|

17,609,112 |

|

|

|

— |

|

| Withhold |

|

|

1,420,727 |

|

|

|

88,604 |

|

|

|

5,826,371 |

|

|

|

— |

|

| Total |

|

|

18,471,589 |

|

|

|

3,367,996 |

|

|

|

23,435,483 |

|

|

|

— |

|

| William C. Hunter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

70,000 |

|

| Withhold |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

70,000 |

|

| Albin F. Moschner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

70,000 |

|

| Withhold |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

70,000 |

|

17

|

|

|

| JGH |

|

Nuveen Global High Income Fund

Portfolio of Investments June 30, 2023 |

| |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount (000) |

|

|

Description (1) |

|

Coupon |

|

|

Maturity |

|

|

Ratings (2) |

|

|

Value |

|

|

|

|

|

|

|

|

|

|

LONG-TERM INVESTMENTS – 135.4% (97.2% of Total Investments) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATE BONDS – 94.5% (67.8% of Total Investments) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Air Freight & Logistics – 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

500 |

|

|

Cargo Aircraft Management Inc, 144A |

|

|

4.750% |

|

|

|

2/01/28 |

|

|

|

BB |

|

|

$ |

438,035 |

|

|

|

|

|

Total Air Freight & Logistics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

438,035 |

|

|

|

|

|

|

|

| |

|

|

Automobile Components – 2.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

3,000 |

|

|

Dana Inc |

|

|

4.250% |

|

|

|

9/01/30 |

|

|

|

BB+ |

|

|

|

2,497,603 |

|

| |

3,000 |

|

|

Goodyear Tire & Rubber Co/The |

|

|

5.250% |

|

|

|

4/30/31 |

|

|

|

BB- |

|

|

|

2,635,010 |

|

| |

3,000 |

|

|

IHO Verwaltungs GmbH, 144A , (cash 6.375%, PIK 7.125%) |

|

|

6.375% |

|

|

|

5/15/29 |

|

|

|

Ba2 |

|

|

|

2,780,320 |

|

|

|

|

|

Total Automobile Components |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,912,933 |

|

|

|

|

|

|

|

| |

|

|

Automobiles – 1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,200 |

|

|

Ford Motor Credit Co LLC |

|

|

7.350% |

|

|

|

11/04/27 |

|

|

|

BB+ |

|

|

|

1,225,344 |

|

| |

1,810 |

|

|

Ford Motor Credit Co LLC |

|

|

7.350% |

|

|

|

3/06/30 |

|

|

|

BB+ |

|

|

|

1,848,448 |

|

|

|

|

|

Total Automobiles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,073,792 |

|

|

|

|

|

|

|

| |

|

|

Banks – 1.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

875 |

|

|

Access Bank PLC, 144A |

|

|

6.125% |

|

|

|

9/21/26 |

|

|

|

B- |

|

|

|

734,213 |

|

| |

1,000 |

|

|

Akbank TAS, 144A |

|

|

6.800% |

|

|

|

2/06/26 |

|

|

|

B3 |

|

|

|

952,800 |

|

| |

1,250 |

|

|

Grupo Aval Ltd, 144A |

|

|

4.375% |

|

|

|

2/04/30 |

|

|

|

BB+ |

|

|

|

980,669 |

|

| |

1,525 |

|

|

Turkiye Vakiflar Bankasi TAO, 144A |

|

|

5.500% |

|

|

|

10/01/26 |

|

|

|

B- |

|

|

|

1,342,396 |

|

|

|

|

|

Total Banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,010,078 |

|

|

|

|

|

|

|

| |

|

|

Beverages – 2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

3,500 |

|

|

Primo Water Holdings Inc, 144A |

|

|

4.375% |

|

|

|

4/30/29 |

|

|

|

B1 |

|

|

|

2,998,975 |

|

| |

3,425 |

|

|

Triton Water Holdings Inc, 144A |

|

|

6.250% |

|

|

|

4/01/29 |

|

|

|

CCC+ |

|

|

|

2,939,404 |

|

|

|

|

|

Total Beverages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,938,379 |

|

|

|

|

|

|

|

| |

|

|

Biotechnology – 0.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,500 |

|

|

Emergent BioSolutions Inc, 144A |

|

|

3.875% |

|

|

|

8/15/28 |

|

|

|

B |

|

|

|

872,407 |

|

|

|

|

|

Total Biotechnology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

872,407 |

|

|

|

|

|

|

|

| |

|

|

Broadline Retail – 0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

650 |

|

|

B2W Digital Lux Sarl, 144A (3) |

|

|

4.375% |

|

|

|

12/20/30 |

|

|

|

C |

|

|

|

111,475 |

|

| |

2,000 |

|

|

Kohl’s Corp |

|

|

4.625% |

|

|

|

5/01/31 |

|

|

|

BBB- |

|

|

|

1,391,560 |

|

|

|

|

|

Total Broadline Retail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,503,035 |

|

|

|

|

|

|

|

| |

|

|

Capital Markets – 2.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

135 |

|

|

AG TTMT Escrow Issuer LLC, 144A |

|

|

8.625% |

|

|

|

9/30/27 |

|

|

|

B1 |

|

|

|

138,370 |

|

| |

2,000 |

|

|

Compass Group Diversified Holdings LLC, 144A |

|

|

5.000% |

|

|

|

1/15/32 |

|

|

|

B+ |

|

|

|

1,614,285 |

|

| |

600 |

|

|

Compass Group Diversified Holdings LLC, 144A |

|

|

5.250% |

|

|

|

4/15/29 |

|

|

|

B+ |

|

|

|

525,911 |

|

| |

2,000 |

|

|

Hunt Cos Inc, 144A |

|

|

5.250% |

|

|

|

4/15/29 |

|

|

|

BB- |

|

|

|

1,588,062 |

|

| |

1,550 |

|

|

Icahn Enterprises LP / Icahn Enterprises Finance Corp |

|

|

4.375% |

|

|

|

2/01/29 |

|

|

|

BB |

|

|

|

1,217,835 |

|

| |

1,275 |

|

|

Icahn Enterprises LP / Icahn Enterprises Finance Corp |

|

|

5.250% |

|

|

|

5/15/27 |

|

|

|

BB |

|

|

|

1,099,560 |

|

| |

1,250 |

|

|

NFP Corp, 144A |

|

|

6.875% |

|

|

|

8/15/28 |

|

|

|

CCC+ |

|

|

|

1,085,025 |

|

| |

1,000 |

|

|

NFP Corp, 144A |

|

|

7.500% |

|

|

|

10/01/30 |

|

|

|

B1 |

|

|

|

968,205 |

|

|

|

|

|

Total Capital Markets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,237,253 |

|

|

|

|

|

|

|

| |

|

|

Chemicals – 3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

905 |

|

|

ASP Unifrax Holdings Inc, 144A |

|

|

5.250% |

|

|

|

9/30/28 |

|

|

|

BB |

|

|

|

653,347 |

|

| |

495 |

|

|

Avient Corp, 144A |

|

|

7.125% |

|

|

|

8/01/30 |

|

|

|

BB- |

|

|

|

500,655 |

|

| |

1,905 |

|

|

EverArc Escrow Sarl, 144A |

|

|

5.000% |

|

|

|

10/30/29 |

|

|

|

B+ |

|

|

|

1,513,770 |

|

| |

600 |

|

|

OCP SA, 144A |

|

|

5.125% |

|

|

|

6/23/51 |

|

|

|

BB+ |

|

|

|

435,312 |

|

| |

1,160 |

|

|

Olympus Water US Holding Corp, 144A |

|

|

6.250% |

|

|

|

10/01/29 |

|

|

|

CCC+ |

|

|

|

839,029 |

|

18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount (000) |

|

|

Description (1) |

|

Coupon |

|

|

Maturity |

|

|

Ratings (2) |

|

|

Value |

|

|

|

|

|

|

|

| |

|

|

Chemicals (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

960 |

|

|

Olympus Water US Holding Corp, 144A |

|

|

4.250% |

|

|

|

10/01/28 |

|

|

|

B- |

|

|

$

|

758,925 |

|

| |

1,500 |

|

|

Sasol Financing USA LLC |

|

|

5.500% |

|

|

|

3/18/31 |

|

|

|

BB+ |

|

|

|

1,179,640 |

|

| |

500 |

|

|

Sasol Financing USA LLC, 144A |

|

|

8.750% |

|

|

|

5/03/29 |

|

|

|

BB+ |

|

|

|

487,071 |

|

| |

2,000 |

|

|

Trinseo Materials Operating SCA / Trinseo Materials Finance Inc, 144A |

|

|

5.125% |

|

|

|

4/01/29 |

|

|

|

B3 |

|

|

|

925,000 |

|

| |

1,600 |

|

|

Tronox Inc, 144A |

|

|

4.625% |

|

|

|

3/15/29 |

|

|

|

BB- |

|

|

|

1,329,653 |

|

| |

380 |

|

|

WR Grace Holdings LLC, 144A |

|

|

4.875% |

|

|

|

6/15/27 |

|

|

|

BB+ |

|

|

|

352,424 |

|

|

|

|

|

Total Chemicals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,974,826 |

|

|

|

|

|

|

|

| |

|

|

Commercial Services & Supplies – 2.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,275 |

|

|

ADT Security Corp/The, 144A |

|

|

4.875% |

|

|

|

7/15/32 |

|

|

|

BB |

|

|

|

1,090,125 |

|

| |

1,750 |

|

|

ADT Security Corp/The, 144A |

|

|

4.125% |

|

|

|

8/01/29 |

|

|

|

BB |

|

|

|

1,511,562 |

|

| |

2,000 |

|

|

Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl, 144A |

|

|

4.625% |

|

|

|

6/01/28 |

|

|

|

B |

|

|

|

1,692,940 |

|

| |

1,500 |

|

|

Garda World Security Corp, 144A |

|

|

4.625% |

|

|

|

2/15/27 |

|

|

|

BB |

|

|

|

1,372,502 |

|

| |

1,100 |

|

|

Prime Security Services Borrower LLC / Prime Finance Inc,

144A |

|

|

6.250% |

|

|

|

1/15/28 |

|

|

|

B |

|

|

|

1,030,482 |

|

|

|

|

|

Total Commercial Services & Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,697,611 |

|

|

|

|

|

|

|

| |

|

|

Communications Equipment – 0.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2,000 |

|

|

Viasat Inc, 144A |

|

|

5.625% |

|

|

|

9/15/25 |

|

|

|

BB- |

|

|

|

1,937,980 |

|

|

|

|

|

Total Communications Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,937,980 |

|

|

|

|

|

|

|

| |

|

|

Construction Materials – 0.9% |

|

|

|