+Income provides guaranteed income, moving

beyond growth potential and protection opportunities

Jackson National Life Insurance Company® (Jackson®), the main

operating subsidiary of Jackson Financial Inc.1 (NYSE: JXN), today

launched +Income, an add-on benefit available for an additional

charge, offering guaranteed2 lifetime income3 through Jackson’s

Market Link Pro® suite of registered index-linked annuities

(RILAs). +Income enables clients to create an immediate income

stream or defer withdrawals, providing the opportunity to grow

income over time.

RILAs are long-term, tax-deferred insurance contracts designed

for retirement. They are subject to investment risk, the value will

fluctuate, and loss of principal is possible. Earnings are taxable

as ordinary income when distributed. Individuals may be subject to

a 10% additional tax for withdrawals before age 59½ unless an

exception to the tax is met.

“Across the industry, RILAs are helping risk-averse consumers

unlock protection opportunities and ways to potentially grow their

assets,” said Brian Sward, Head of Product Solutions for Jackson

National Life Distributors LLC (JNLD), the marketing and

distribution business of Jackson. “With the addition of +Income,

Jackson’s RILA offerings can now provide clients with guaranteed

retirement income that can withstand unexpected market events,

together with the same benefits they’ve become accustomed to when

utilizing RILAs in their portfolio.”

Jackson’s Market Link Pro suite offers five index options that

can be used in any combination, along with the flexibility to

allocate funds through three crediting methods (not all crediting

methods and/or protection options are available with all Index

Account Option terms). Additionally, the suite can create a legacy

through its built-in death benefits4, available at no additional

charge. Enhancements to the suite were announced in June 2023,

including the addition of an exclusive crediting method

(Performance Boost), 3-year Index Account Option Terms and an

intra-term Performance Lock feature.

Jackson continues to enrich its digital capabilities through its

robust RILA Digital Ecosystem, a user-friendly, one-stop-shop for

financial professionals and clients seeking more information about

the company’s RILA offerings. The ecosystem showcases the features

of the Jackson Market Link Pro Suite, including product benefits,

marketing literature and current rates. It also provides access to

a data-driven tool that enables clients to generate customized,

hypothetical scenarios of the various RILA options. To coincide

with the launch of +Income, the tool now includes a new option to

illustrate how lifetime income can impact client portfolios.

"Jackson has a strong track record of serving as a trusted

provider of guaranteed lifetime income strategies for financial

professionals and their clients,” continued Sward. “The

introduction of +Income expands on this experience and confirms our

commitment to bringing new products, resources and tools that can

help clients meet their financial planning goals.”

Financial professionals who would like to learn more about

Jackson’s RILA products can contact the company at 1-800-711-7397,

connect with their local wholesaler or visit

www.jackson.com/RILA.

ABOUT JACKSON

Jackson® (NYSE: JXN) is committed to helping clarify the

complexity of retirement planning—for financial professionals and

their clients. Through our range of annuity products, financial

know-how, history of award-winning service* and streamlined

experiences, we strive to reduce the confusion that complicates

retirement planning. We take a balanced, long-term approach to

responsibly serving all our stakeholders, including customers,

shareholders, distribution partners, employees, regulators and

community partners. We believe by providing clarity for all today,

we can help drive better outcomes for tomorrow. For more

information, visit www.jackson.com.

*SQM (Service Quality Measurement Group) Contact Center Awards

Program for 2004 and 2006-2023, for the financial services industry

(to achieve world-class certification, 80% or more of call-center

customers surveyed must have rated their experience as very

satisfied, the highest rating possible).

Jackson® is the marketing name for Jackson Financial Inc.,

Jackson National Life Insurance Company® (Home Office: Lansing,

Michigan) and Jackson National Life Insurance Company of New York®

(Home Office: Purchase, New York).

SAFE HARBOR STATEMENT

The information in this press release contains forward-looking

statements about future events and circumstances and their effects

upon revenues, expenses and business opportunities. Generally

speaking, any statement in this release not based upon historical

fact is a forward-looking statement. Forward-looking statements can

also be identified by the use of forward-looking or conditional

words, such as “could,” “should,” “can,” “continue,” “estimate,”

“forecast,” “intend,” “look,” “may,” “will,” “expect,” “believe,”

“anticipate,” “plan,” “remain,” “confident” and “commit” or similar

expressions. In particular, statements regarding plans, strategies,

prospects, targets and expectations regarding the business and

industry are forward-looking statements. They reflect expectations,

are not guarantees of performance and speak only as of the dates

the statements are made. We caution investors that these

forward-looking statements are subject to known and unknown risks

and uncertainties that may cause actual results to differ

materially from those projected, expressed or implied. Factors that

could cause actual results to differ materially from those in the

forward-looking statements include those reflected in Part I, Item

1A. Risk Factors and Part II, Item 7. Management's Discussion and

Analysis of Financial Condition and Results of Operations in our

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 28, 2024, and elsewhere in Jackson

Financial Inc.’s filings with the U.S. Securities and Exchange

Commission. Except as required by law, Jackson Financial Inc. does

not undertake to update such forward-looking statements. You should

not rely unduly on forward-looking statements.

This material is authorized for use only when preceded or

accompanied by the current contract prospectus. Before investing,

investors should carefully consider the investment objectives and

risks of the registered index-linked annuity. This and other

important information is contained in the current contract

prospectus at Jackson.com/ProspectusJMLP2 for Jackson

Market Link Pro II or Jackson.com/ProspectusJMLPA2

for Jackson Market Link Pro Advisory II. Please read the

prospectus carefully before investing or sending money.

Jackson, its distributors, and their respective

representatives do not provide tax, accounting, or legal advice.

Any tax statements contained herein were not intended or written to

be used and cannot be used for the purpose of avoiding U.S.

federal, state, or local tax penalties. Tax laws are complicated

and subject to change. Tax results may depend on each taxpayer’s

individual set of facts and circumstances. You should rely on your

own independent advisors as to any tax, accounting, or legal

statements made herein.

Impact of withdrawals: Withdrawals before the end of a

term are subject to an interim value adjustment. The interim value

adjustment may have a positive or negative impact on the contract

value at the end of the term which may be significant.

For Jackson Market Link Pro II, withdrawal charges will apply to

withdrawals during the first six years of the contract which will

result in a reduced contract value. The withdrawal charge schedule

is 8%, 8%, 7%, 6%, 5%, 4%, 0%.

For Jackson Market Link Pro Advisory II, a market value

adjustment (MVA) will be applied to certain amounts withdrawn or

annuitized during the first six contract years. The MVA may result

in an increase or decrease to amounts removed from the

contract.

An add-on benefit that provides income for the length of the

designated life and/or covered lives may be available for an

additional charge. The amount of income that this benefit may

provide can vary depending on age, when income is taken, and how

many lives are covered when the benefit is elected. Certain state

variations may also apply. The cost of this benefit may negatively

impact the contract’s cash value.

Owners could see a substantial loss during an index period if

the index declines more than the level of downside protection. If

an owner does see a substantial loss during an index period, the

owner may not be able to participate fully in a subsequent market

recovery due to the capped upside potential in subsequent index

periods.

Not all crediting methods and/or protection options are

available with all Index Account Option terms.

Guarantees are backed by the claims-paying ability of Jackson

National Life Insurance Company. They are not backed by the

broker/dealer from which this annuity contract is purchased, by the

insurance agency from which this annuity contract is purchased or

any affiliates of those entities, and none makes any

representations or guarantees regarding the claims-paying ability

of Jackson National Life Insurance Company.

Registered index-linked annuities (contract form numbers

RILA290, RILA290-CB1, RILA292, RILA292-CB1, RILA295, RILA295-FB1,

RILA297, RILA297-FB1) are issued by Jackson National Life Insurance

Company (Home Office: Lansing, Michigan) and distributed by Jackson

National Life Distributors LLC, member FINRA. These products have

limitations and restrictions, including withdrawal charges, a

market value adjustment, and an interim value adjustment. Jackson

issues other annuities with similar features, benefits,

limitations, and charges. Discuss them with your financial

professional or contact Jackson for more information.

Firm and state variations may apply. Additionally, product

may not be available in all states.

1Jackson Financial Inc. is a U.S. holding company and the direct

parent of Jackson Holdings LLC (JHLLC). The wholly-owned direct and

indirect subsidiaries of JHLLC include Jackson National Life

Insurance Company, Brooke Life Insurance Company, PPM America, Inc.

and Jackson National Asset Management, LLC. 2 Guarantees are backed

by the claims-paying ability of Jackson National Life Insurance

Company. 3 On the contract anniversary on or immediately following

the designated life’s attained age 59½, the for-life guarantee

becomes effective provided: 1) the contract value is greater than

zero and 2) the contract has not been annuitized. If the designated

life is age 59½ on the effective date of the endorsement, then the

for-life guarantee becomes effective on that date. 4 If the oldest

owner’s age when the contract is issued is between 0 and 80, the

death benefit is equal to the greater of the current contract value

or premiums paid into the contract adjusted for any withdrawals

incurred since the issuance of the contract. If the oldest owner’s

age is between 81 and 85 when the contract is issued, the death

benefit is equal to the current contract value.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429835969/en/

Courtney Roberts courtney.roberts@jackson.com

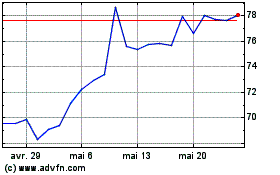

Jackson Financial (NYSE:JXN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Jackson Financial (NYSE:JXN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025