(All amounts in US$ unless

otherwise indicated)

Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“Lithium Americas” or the “Company”) announced the

Company and General Motors Holdings LLC (“GM”) have entered

into a new investment agreement (“Investment Agreement”) to

establish a joint venture (“JV”) for the purpose of funding,

developing, constructing and operating (the “JV

Transaction”) Thacker Pass in Humboldt County, Nevada

(“Thacker Pass” or the “Project”). The JV Transaction

will deliver $625 million of cash and letters of credit from GM to

Thacker Pass alongside the conditional commitment for a $2.3

billion U.S. Department of Energy (“DOE”) loan announced

earlier this year.

Under the terms of the Investment Agreement, GM will acquire a

38% asset-level ownership stake in Thacker Pass for $625 million in

total cash and letters of credit (“GM’s JV Investment”),

including $430 million of direct cash funding to the JV to support

the construction of Phase 11 and a $195 million letter of credit

facility (“LC Facility”) that can be used as collateral to

support reserve account requirements2 under the DOE Loan (as

defined below). The JV Transaction replaces the $330 million

Tranche 2 common equity investment commitment from GM under its

original investment agreement with the Company (“Tranche 2”)

announced in January 2023.

TRANSACTION HIGHLIGHTS

- Largest ever publicly announced investment by a U.S. OEM in a

lithium carbonate project highlights the strategic importance of

Thacker Pass in creating a domestic supply chain for critical

minerals.

- Allows Lithium Americas to secure $625 million in cash and

letters of credit, while avoiding common equity dilution associated

with Tranche 2.

- Builds upon an already strong relationship with GM as strategic

investor and extends Phase 1 offtake to 20 years.

The JV Transaction is incremental to GM’s February 2023 Tranche

1 investment of $320 million, which resulted in GM acquiring

approximately 15 million common shares of Lithium Americas3. In

addition to the JV Transaction, GM has agreed to extend its

existing offtake agreement for up to 100% of production volumes

from Phase 1 of Thacker Pass to 20 years to support the expected

maturity of the DOE Loan. Upon closing of the JV, GM will also

enter into an additional 20-year offtake agreement for up to 38% of

Phase 24 production volumes and will retain its existing right of

first offer on the remaining Phase 2 production volumes.

“Our relationship with GM has been significantly strengthened

with this joint venture as we continue to pursue a mutual goal to

develop a robust domestic lithium supply chain by advancing the

development of Thacker Pass,” said Jonathan Evans, President and

CEO of Lithium Americas. “Today’s joint venture announcement is a

win-win for GM and Lithium Americas. GM’s JV Investment

demonstrates their continued support and helps us to unlock the

previously announced $2.3 billion DOE Loan. We will be working

closely with GM to advance towards the final investment decision,

which we are targeting by the end of the year.”

“We’re pleased with the significant progress Lithium Americas is

making to help GM achieve our goal to develop a resilient EV

material supply chain,” said Jeff Morrison, SVP, Global Purchasing

and Supply Chain. “Sourcing critical EV raw materials, like

lithium, from suppliers in the U.S., is expected to help us manage

battery cell costs, deliver value to our customers and investors,

and create jobs.”

JV TRANSACTION DETAILS

The key terms of the JV Transaction are summarized below:

- Lithium Americas will have a 62% interest in Thacker Pass and

will manage the Project (the “Manager”) on behalf of Lithium

Americas and GM (together the “JV Partners”).

- GM will have a 38% interest in Thacker Pass and commit $625

million in cash and letters of credit to the JV:

- $330 million cash to be contributed on the date of the JV

closing;

- $100 million cash to be contributed at Final Investment

Decision (“FID”) for Phase 1; and

- $195 million LC Facility prior to first draw on the $2.3

billion DOE Loan.

- Lithium Americas will contribute $387 million of funding to the

JV for its 62% ownership in the Project:

- $211 million (with expenditures on capex after August 2024

being credited against and reducing this amount, along with other

adjustments) to be contributed on the date of the JV closing;

and

- The remainder to be contributed upon FID for Phase 1.

- As of June 30, 2024, Lithium Americas had approximately $376

million in cash and cash equivalents.

- LC Facility provided by GM to the JV as part of its

consideration for its equity interest will have no interest and a

maturity consistent with DOE Loan requirement that will be

withdrawn once replaced with cash that is generated by Thacker

Pass.

- Board of Directors to be established at the JV level to oversee

the JV and approve the Project’s budgets and business plans, and

implement policies to align with GM’s vendor requirements,

including GM’s Human Rights Policy.

- Upon closing of the JV Transaction, GM will also enter into an

additional 20-year offtake agreement for up to 38% of production

volumes from Phase 2 of Thacker Pass and will retain its right of

first offer on the remaining balance of Phase 2 volumes.

GM’s JV Investment is subject to certain conditions precedent,

including those related to the loan agreement for the DOE Loan.

BACKGROUND

U.S. DOE Loan

In March 2024, the Company received a conditional commitment for

a $2.3 billion loan from the U.S. DOE under the Advanced Technology

Vehicles Manufacturing (“ATVM”) Loan Program (the “DOE

Loan”). Prior to making the first draw on the DOE Loan,

expected sometime in the middle of 2025, the Company is required to

fund approximately $195 million (funded by either cash or letters

of credit) for reserve accounts associated with the DOE Loan (for

construction contingency, ramp-up and sustaining capital). The GM

LC Facility will be used to fund the DOE’s reserve accounts.

2023 GM Investment

On January 30, 2023, Old LAC5 entered into a purchase agreement

with GM, pursuant to which GM agreed to make a $650 million equity

investment (the “2023 Transaction”), the proceeds of

which are to be used for the construction and development of

Thacker Pass. The 2023 Transaction was comprised of two tranches, a

first tranche investment of $320 million (“Tranche 1”) and

Tranche 2. Tranche 1 closed and the Phase 1 offtake agreement was

executed on February 16, 2023. On October 3, 2023, pursuant to the

Separation, the full amount of the remaining unspent proceeds of

Tranche 1 were included in the net assets distributed by Old LAC to

the Company.

As the Separation was completed before the closing of Tranche 2,

on October 3, 2023, the agreement for Tranche 2 in Old LAC was

terminated and replaced by a corresponding subscription agreement

between GM and the Company whereby the proceeds of Tranche 2 would

be received by the Company.

On August 30, 2024, the Company and GM agreed to extend the

outside date for the Tranche 2 subscription agreement until the end

of the year to provide time for the parties to explore alternative

structures for GM’s additional investment in a mutually beneficial

manner. The Company and GM have terminated the Tranche 2

subscription agreement concurrent with the execution of the JV

Investment Agreement.

THACKER PASS PROJECT UPDATE

The Company continues to focus on de-risking project execution

by advancing detailed engineering, project planning and procurement

packages.

- Detailed engineering continues to progress in advance of

issuing full notice to proceed, currently at approximately 40%

design complete.

- Site preparation for major earthworks has been completed and

the process plant area is currently being excavated (approximately

50% complete) to prepare for concrete placement, forecasted to

begin by mid-2025.

- Procurement packages for the top seven pieces of long-lead

equipment have been awarded. Contracts for key construction

materials have been awarded and field purchases of goods and

services have commenced.

- Major earth works for the all-inclusive housing facility for

construction workers (the Workforce Hub) are completed. The current

focus is on finalizing engineering and permitting for utilities and

preparing to award contracts for the detailed earthworks,

foundation installation and erection of the housing units.

To date, the Company has achieved over one million work hours

without a lost time injury.

NEXT STEPS

The Company continues to work closely with the DOE and expects

to close the DOE Loan in the coming weeks. The Company and GM are

targeting making the FID and issuing full notice to proceed for

Thacker Pass by the end of the year, following closing of the DOE

Loan and the JV Transaction.

ADVISORS

Goldman Sachs & Co. LLC and Evercore Group L.L.C. are acting

as financial advisors to Lithium Americas and Vinson & Elkins

and Cassels Brock & Blackwell are acting as legal counsel to

Lithium Americas in connection with the JV Transaction. BMO Capital

Markets acted as financial advisor to Lithium Americas in

connection with GM’s original Tranche 2 investment announced in

January 2023.

Morgan Stanley & Co. LLC is acting as GM’s financial advisor

and Mayer Brown and Osler, Hoskin & Harcourt are acting as

legal counsel to GM in connection with the JV Transaction.

TECHNICAL INFORMATION

The scientific and technical information in this news release

has been reviewed and approved by Rene LeBlanc, PhD, SME, Vice

President, Growth and Product Strategy of the Company, and a

“qualified person” as defined under National Instrument 43-101 and

Subpart 1300 of Regulation S-K under the United States Securities

Act of 1933.

ABOUT LITHIUM AMERICAS

Lithium Americas is committed to responsibly developing the

Thacker Pass project located in Humboldt County in northern Nevada,

which hosts the largest known Measured and Indicated lithium

resource in North America. The Company is focused on advancing

Thacker Pass Phase 1 toward production, targeting nameplate

capacity of 40,000 tpa of battery-quality lithium carbonate. The

Company and its engineering, procurement and construction

management contractor, Bechtel, entered into a National

Construction Agreement (Project Labor Agreement) with North

America’s Building Trades Unions for construction of Thacker Pass.

The three-year construction build is expected to create

approximately 1,800 direct jobs. Lithium Americas’ shares are

listed on the Toronto Stock Exchange and New York Stock Exchange

under the symbol LAC. To learn more, visit www.lithiumamericas.com

or follow @LithiumAmericas on social media.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation, and

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995

(collectively referred to as “forward-looking information”

(“FLI”)). All statements, other than statements of

historical fact, are FLI and can be identified by the use of

statements that include, but are not limited to, words, such as

“anticipate,” “plan,” “continues,” “estimate,” “expect,” “may,”

“will,” “projects,” “predict,” “proposes,” “potential,” “target,”

“implement,” “scheduled,” “forecast,” “intend,” “would,” “could,”

“might,” “should,” “believe” and similar terminology, or statements

that certain actions, events or results “may,” “could,” “would,”

“might” or “will” be taken, occur or be achieved. FLI in this news

release includes, but is not limited to, expectations regarding

completion of the JV Transaction and the DOE Loan; the expected

timetable for completing JV Transaction and the DOE Loan;

anticipated timing for FID; expectation about the extent that the

JV Transaction, DOE Loan, and cash on hand would fund the

development and construction of Thacker Pass; expectations and

timing on the commencement of major construction and first

production; project de-risking initiatives; expectations related to

the construction build, job creation and nameplate capacity as well

as other statements with respect to the Company’s future objectives

and strategies to achieve these objectives, and management’s

beliefs, plans, estimates and intentions, and similar statements

concerning anticipated future events, results, circumstances,

performance or expectations that are not historical facts.

FLI involves known and unknown risks, assumptions and other

factors that may cause actual results or performance to differ

materially. FLI reflects the Company’s current views about future

events, and while considered reasonable by the Company as of the

date of this news release, are inherently subject to significant

uncertainties and contingencies. Accordingly, there can be no

certainty that they will accurately reflect actual results.

Assumptions upon which such FLI is based include, without

limitation, the completion of the JV Transaction and DOE Loan prior

to the end of 2024, or at all, and the absence of material adverse

events affecting the Company during this time; the ability of the

Company to satisfy all closing conditions for the JV Transaction

and the DOE Loan in a timely manner; expectations regarding the

Company's financial resources and future prospects; the ability to

meet future objectives and priorities; a cordial business

relationship between the Company and third party strategic and

contractual partners; general business and economic uncertainties

and adverse market conditions; the availability of equipment and

facilities necessary to complete development and construction at

the Project; unforeseen technological and engineering problems;

political factors, including the impact of the 2024 U.S.

presidential election on, among other things, the extractive

resource industry, the green energy transition and the electric

vehicle market; uncertainties inherent to feasibility studies and

mineral resource and mineral reserve estimates; uncertainties

relating to receiving and maintaining mining, exploration,

environmental and other permits or approvals in Nevada; demand for

lithium, including that such demand is supported by growth in the

electric vehicle market; current technological trends; the impact

of increasing competition in the lithium business, and the

Company’s competitive position in the industry; compliance by joint

venture partners with terms of agreements; the regulation of the

mining industry by various governmental agencies; as well as

assumptions concerning general economic and industry growth rates,

commodity prices, resource estimates, currency exchange and

interest rates and competitive conditions. Although the Company

believes that the assumptions and expectations reflected in such

FLI are reasonable, the Company can give no assurance that these

assumptions and expectations will prove to be correct.

Readers are cautioned that the foregoing lists of factors are

not exhaustive. There can be no assurance that FLI will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. As such,

readers are cautioned not to place undue reliance on this

information, and that this information may not be appropriate for

any other purpose, including investment purposes. The Company’s

actual results could differ materially from those anticipated in

any FLI as a result of the risk factors set out herein and in the

Company’s filings with securities regulators.

The FLI contained in this news release is expressly qualified by

these cautionary statements. All FLI in this news release speaks as

of the date of this news release. The Company does not undertake

any obligation to update or revise any FLI, whether as a result of

new information, future events or otherwise, except as required by

law. Additional information about these assumptions and risks and

uncertainties is contained in the Company’s filings with securities

regulators, including the Company’s most recent Annual Report on

Form 20-F and most recent management’s discussion and analysis for

our most recently completed financial year and, if applicable,

interim financial period, which are available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov. All FLI contained in

this news release is expressly qualified by the risk factors set

out in the aforementioned documents.

___________________________________________________ 1 Phase 1 is

the initial phase of production at Thacker Pass, targeting 40,000

tonnes per annum (“tpa”) of battery-grade lithium carbonate.

2 See the section titled Background – U.S. DOE Loan for more

details. 3 See the section titled Background – 2023 GM Investment

for more details. 4 Phase 2 is the second phase of production at

Thacker Pass, targeting an additional 40,000 tpa, for total

production capacity of 80,000 tpa. 5 Old LAC is now named Lithium

Americas (Argentina) Corp., pursuant to a separation transaction

that was undertaken on October 3, 2023 (the “Separation”),

when the Company acquired ownership of Old LAC’s North American

business assets and investments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016466651/en/

INVESTOR CONTACT Virginia Morgan, VP, IR and ESG

+1-778-726-4070 ir@lithiumamericas.com

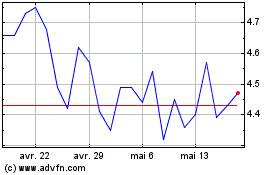

Lithium Americas (NYSE:LAC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Lithium Americas (NYSE:LAC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024