UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-40685

METALS ACQUISITION LIMITED

(Translation of registrant’s name into

English)

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

On November 14, 2023, Metals Acquisition Limited

issued a press release announcing an operational update on the CSA Copper Mine.

The information in this Form

6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act.

The press release is

furnished as Exhibit 99.1 to this Report on Form 6-K.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| METALS ACQUISITION LIMITED |

|

| |

|

|

| By: |

/s/ Michael James McMullen |

|

| |

Name: |

Michael James McMullen |

|

| |

Title: |

Chief Executive Officer |

|

Date: November 14, 2023

Exhibit 99.1

November 14, 2023

Metals Acquisition Limited Provides Operational Update

ST. HELIER, Jersey--(BUSINESS WIRE)--Metals Acquisition Limited (NYSE:

MTAL):

Metals Acquisition Limited (“MAC”

or the “Company”) today provides a market update on the following aspects of the CSA Copper Mine for the September quarter:

| · | Total Reportable Injury Frequency Rate (“TRIFR”)

reduced slightly to 9.5 per million hours and zero Lost Time Injuries (“LTI”) |

| · | September quarter production of 9,845 tonnes

of copper and 115,000 ounces of silver |

| · | September quarter C11 costs

of US$1.86/lb down from US$3.02/lb and US$2.90/lb in the immediate two quarters prior to MAC ownership, as post acquisition offtake terms

and cost reductions were implemented. Site general administration (“G+A”) costs are inclusive of US$1.5 million of exploration

costs equivalent to US$0.07/lb |

| · | Approval of the new Rehabilitation Cost Estimate

(“RCE”) by the NSW Resource Regulator at A$44 million and approval of the Stage 10 lift of the Tailings Storage Facility (“TSF”) |

| · | Cash on hand as of the date of this release of

US$48 million |

Mick McMullen CEO, commented “Since acquiring

the CSA Copper Mine just five months ago, the results demonstrate that our team has continued to identify opportunities to unlock value,

while not compromising safety. We have accomplished a lot in a short period and the work being done now will yield strong returns in 2024

and beyond. I am particularly excited about the positive trends in safety, production and cost reduction that our team have been able

to implement in such a short period.

1 MAC’s results are reported under International Financial

Reporting Standards (IFRS). This release may also include certain non-IFRS measures including C1 costs. These C1 cost measures are used

internally by management to assess the performance of our business, make decisions on the allocation of our resources and assess operational

management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication of or alternative

to an IFRS measure of financial performance. Historical C1 costs for the CSA Copper Mine prior to the acquisition by MAC include the costs

of the previous offtake agreement that was terminated on closing of the acquisition by MAC in June 2023.

1

The rapid advances made on the various permitting

initiatives further cement our view that CSA is a Tier 1 asset in a mining friendly jurisdiction. We will continue to work relentlessly

to unlock additional value at CSA and any future assets that fit within our strategy.”

Unless stated otherwise all references to dollar

or $ are in US$.

ESG

Safety

The TRIFR for the CSA Copper Mine has reduced

slightly from 10.2 to 9.5 for the quarter (refer Figure 1). This is below the NSW underground metalliferous TRIFR for 2022 of 11.97. The

LTI rate of zero compares favourably with the NSW underground metalliferous LTI of 2.6 for 2022.

Whilst MAC believes that safety can continue to

be improved in the future, MAC also believes that remaining at this relatively low level is a great result coming immediately after a

change of ownership and all the operational changes being made at the mine.

Figure 1 - CSA Copper Mine Recordable Injuries

Trailing 12 months

ESG management at the CSA Copper Mine site has

performed above expectations throughout this quarter for the newly acquired asset with various approvals received in short order and a

strong environmental performance.

Regulatory

Key regulatory activities that occurred throughout

the quarter include:

| · | The CSA Copper Mine’s rehabilitation objectives

(“ROBJ’s”) were reviewed to align with the NSW Resource Regulators requirements and submitted on 27th September 2023. |

| · | MAC received the acceptance from the NSW Resource

Regulator for the updated Rehabilitation Cost Estimate (“RCE”) for CML5 (being the CSA Copper Mine’s key tenure). This

RCE is a bond/guarantee which needs to be provided to the NSW government to provide security for the rehabilitation and closure requirements

on the site and is a total of A$44m. |

Approvals

Approvals at the CSA Copper Mine are predominately

through the local Cobar Shire Council as the approving authority, as an integrated development. The following development applications

were approved during the September Quarter.

| · | Stage 9 STSF buttress approved |

| · | Stage 10 Lift and Stage 10 Buttress approved |

| · | Railway dam Borrow Pit approved |

MAC has been actioning significant changes at

the CSA Copper Mine and working closely with local stakeholders during this period of change. The community and approval authorities have

been supportive during this period and MAC continues to believe that Cobar in western NSW is a Tier 1 mining jurisdiction which is becoming

increasingly important in this period of global instability.

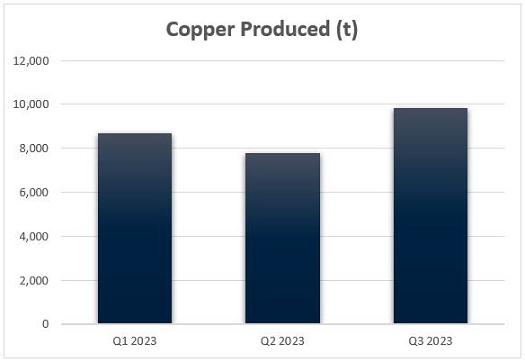

Production

The September quarter is the first full quarter

of CSA’s ownership under MAC and was a period of significant change in the organisation. Table 1 contains a summary by quarter for

the year to date.

Table 1 - Quarterly Operational Performance

of the CSA Copper Mine

| | |

Q1 2023 | | |

Q2 2023 | | |

Q3 2023 | |

| Ore Tonnes Milled | |

| 240,698 | | |

| 254,380 | | |

| 300,328 | |

| Grade Milled | |

| 3.7 | % | |

| 3.1 | % | |

| 3.4 | % |

| Copper Produced (t) | |

| 8,691 | | |

| 7,779 | | |

| 9,845 | |

| Silver Produced (oz) | |

| 100,092 | | |

| 84,517 | | |

| 115,081 | |

| | |

| | | |

| | | |

| | |

| Mining Cost/t Ore Mined (US$) | |

$ | 97.5 | | |

$ | 88.8 | | |

$ | 79.1 | |

| Processing Cost/t Milled (US$) | |

$ | 26.4 | | |

$ | 28.0 | | |

$ | 19.8 | |

| G+A Cost/t Milled (US$) | |

$ | 28.9 | | |

$ | 33.0 | | |

$ | 29.3 | |

| C11 (US$/lb) | |

$ | 2.90 | | |

$ | 3.02 | | |

$ | 1.86 | |

| Average Cu Price Received (US$/lb) | |

$ | 4.12 | | |

$ | 3.80 | | |

$ | 3.81 | |

| Development Cost/metre (US$) | |

$ | 18,677 | | |

$ | 11,773 | | |

$ | 10,225 | |

| Total Capital Cost (US$ million) | |

$ | 12.66 | | |

$ | 13.15 | | |

$ | 10.62 | |

The September quarter was the highest quarterly

copper and silver production (Fig 2) for 2023. Whilst this was a good result from the operations team, the production in the month of

September was below plan as a result of a 4 week delay in accessing a high grade stope due to a regulator imposed prohibition notice

relating to ventilation requirements, with actions being taken to reduce the risk of such prohibitions occurring in the future.

On an annual basis the mine turns over approximately

70 stopes, the top 5 or 6 of which account for up to 1/3 of the contained metal mined. Therefore, any delays accessing these high-grade

stopes can negatively impact production in the short term. Access to this stoping area has subsequently been restored and the high grade

(+4% copper) material is now being mined.

Site G+A costs are inclusive of exploration costs

that total US$1.5 million in the September quarter, equivalent to US$0.07/lb of the C1 cash cost.

The average received copper

price was flat quarter on quarter and declined slightly from the first quarter in line with market prices.

Figure 2 - CSA Copper Mine Quarterly Copper

Production

A large number of staffing changes were carried

out during the quarter.

Specific changes include:

| · | Rob Walker commenced as the new General Manager

on 31 July 2023 |

| · | MAC corporate environmental manager appointed

and commenced |

| · | Underground manager appointed and commenced |

| · | MAC corporate contracts manager appointed and

commenced |

| · | HR Manager appointed and commenced |

Total headcount of employees and contractors has

been significantly reduced during the September quarter and now sits at just over 500 people on an FTE basis.

A total of US$1.1 million in restructuring costs

were incurring during the September quarter associated with headcount reductions and have been excluded from the C1 costs as non-recurring.

As seen in Figure 3, C1 cash costs have shown

a rapid decline under MAC’s ownership. As discussed below, MAC is refining the split between mining operating and mining capital

costs in the current quarter.

Figure 3 - CSA Copper Mine C1 Cash Costs

MAC management believes that there are additional

opportunities at the CSA Copper Mine to reduce costs with increased focus on productivity improvements and will continue to implement

additional productivity measures to further reduce C1 costs. Figure 4 provides an illustration of the improvements in productivity that

has already been demonstrated at the mine.

Figure 4 - CSA Copper Mine Tonnes Milled per

Employee

Productivity will have an inverse relationship

to C1 as seen in Figures 3 and 4.

Apart from copper production, the largest driver

of C1 costs is the mining unit rate as mining accounts for approximately 60% of total site operating costs. Figure 5 illustrates the improvement

in the mining unit rate since MAC took ownership of the mine which directional improvement, however these unit rates are still high in

the Australian context and many of the changes made in late September will only make an impact in the fourth quarter. The mine has

a high fixed cost base and the contractor and headcount reductions are targeted at reducing those fixed costs but ultimately material unit

rate reductions will need to also see volume increases.

Work is underway to achieve a higher degree of

granularity on the mining costs and to more accurately determine the split between operating and capital mining costs.

Figure 5 - CSA Copper Mine Mining Unit Rate

The other significant component of the mining

capital costs are development costs, which have been very high at CSA historically. Figure 6 demonstrates the improvements that have been

achieved in the cost per metre of development over the course of the year, and under new management. It should be noted that these are

still high unit rates as compared to Australian peers and MAC believes that further opportunities for reductions exists.

Figure 6 - CSA Copper Mine Mining Development

Costs

Figures 7 and 8 shows the unit rates for processing

and site G+A, with the former improving strongly and the latter slightly improving quarter on quarter. Both are heavily dependent on milled

ore volumes due to their high fixed cost nature.

Figure 7 - CSA Copper Mine Processing Unit Rate

Figure 8 - CSA Copper Mine Site G+A Unit Rate

Capital spend (including capitalized development)

has trended down over the year as seen in Figure 9. This reflects both the completion of the mill replacement works in the second quarter

and the reduction in mine development unit rates into the third quarter.

During the month of September 19 of the 21

major projects team were demobilised from site (all contractors) with the cost reduction benefit from this to be seen from October onwards.

Figure 9 - CSA Copper Mine Site Capital Expenditure

Preliminary construction works on the next lift

for TSF commenced in September which will slightly increase capital spend in the fourth quarter relative to the third quarter. Overall

capital spend for the year is likely to be lower than the US$58 million that MAC had previously estimated and will likely be closer to

US$50 million with a H2 run rate of US$44 - $46 million.

Overall, considering the significant changes at

the mine, the production and cost performance trends are pleasing and provide a strong platform to build on for the December quarter

and into 2024.

Mine Plan, Resource and Reserve

Since taking ownership the MAC team has been actively

looking for ways to improve on the previous mine plan. Figure 10 illustrates the known mineralisation in the immediate mine environment.

The bulk of the current mining is in QTSN (circa

75% of production) and QTSC with additional minor production from the East and West deposits (not shown due to angle of section). The

mine commenced production as a lead-zinc-silver mine near surface from the Upper Level Zone A mineralisation and then progressed into

the current copper deposit from the Upper Level Zone B approximately 400m below surface. There is significant remnant mineralisation in

both the Upper Zone A and Zone B areas and none of this is in the current mineral resource estimate as all the data is in hard copy. Work

is underway to digitize this material to bring it into the mineral resource estimate in the future.

The Upper Level Zone C is the top of the current

mineral resource and contains significant mineralisation that is not in the current mine plan. Work is under way to bring that material

into the mine plan and a significant number of stopes have been designed and physical inspections completed. This material is typically

in the circa 3% Cu diluted grade range however it is very close vertically to the crusher dump pocket and would have lower unit rate costs

than the ore from the bottom of QTSN.

Drilling of the QTS S Upper A mineralisation was

completed over the last 3 months with a view to bringing that into the mineral resource estimate. This is a relatively narrow but very

high-grade zone and during October the Company completed a mine design and is out to tender on the mining works associated with the

development of this. During the December quarter a decision will be made on the optimal development plan and whether to carry out

the works as an owner mining or contractor operation.

Finally, the Company has been remodelling the

resource at a lower cut-off grade based on the new cost structure post-closing. This work is well underway and will be fed into the mine

planning for the 2023 resource and reserve update.

Figure 10 - CSA Copper Mine Long Section Showing

Deposits

Finance and Corporate

The Company continues to progress work and consideration

of undertaking an additional listing on the Australian Securities Exchange (ASX). The Company is well progressed with this work

stream and, subject to board approval and various factors out of the Company’s control (including market conditions), anticipates

proceeding with the ASX listing in calendar Q1 2024. The timing and quantum of any associated equity raise would be market dependent and

the Company cannot provide any certainty as to when or if an ASX listing or associated equity raise would occur.

Subsequent to the end of the quarter, on 13 October 2023,

the Company completed a Private Placement (PIPE) with new and existing investors for gross proceeds of US$20,098,056 at a price of US$11/share

for a total of 1,827,096 new shares issued. At the time of this report the Company’s share capital is as shown below in Table 2.

Table 2

| Pro Forma Ownership | |

M Shares | | |

M Securities | | |

% of Capital

Structure | |

| Shares on Issue/Oct PIPE | |

| 50.13 | | |

| 50.13 | | |

| 72.5 | % |

Founder / Sponsor Warrants

(6,535,304 at $11.50/sh strike) | |

| - | | |

| 6.54 | | |

| 9.5 | % |

Investor Warrants

(8,838,260 at $11.50/sh strike) | |

| - | | |

| 8.84 | | |

| 13 | % |

Subordinated Debt Warrants

(3,187,500 at $12.50/sh strike) | |

| - | | |

| 3.18 | | |

| 5 | % |

| Total | |

| 50.13 | | |

| 68.80 | | |

| 100 | % |

During the quarter, the Company delivered 3,375

tonnes of copper into the hedge book at an average price of US$3.72/lb.

At the end of September, the remaining copper

hedge book consisted of the following:

| Year | |

Tonnes | | |

Price US$/lb | |

| 2023 | |

| 3,375 | | |

$ | 3.72 | |

| 2024 | |

| 12,420 | | |

$ | 3.72 | |

| 2025 | |

| 12,420 | | |

$ | 3.72 | |

As of the date of this report the Company had

US$48 million of cash on hand.

Contacts

|

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited.

+1 (817) 698-9901

mick.mcmullen@metalsacqcorp.com |

Dan Vujcic

Chief Development Officer and Interim Chief Financial

Officer

Metals Acquisition Limited.

+61 451 634 120

dan.vujcic@metalsacqcorp.com |

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL) is a company

focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification

and decarbonization of the global economy.

Forward Looking Statements

This press release includes “forward-looking

statements.” MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not

rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such

forward- looking statements. These forward-looking statements include, without limitation, MAC’s expectations with respect to future

performance of the CSA Mine . These forward-looking statements involve significant risks and uncertainties that could cause the actual

results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control

and are difficult to predict. Factors that may cause such differences include, but are not limited to: the ability to recognize the anticipated

benefits of the business combination, which may be affected by, among other things; the supply and demand for copper; the future price

of copper; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional

capital; cash flow provided by operating activities; unanticipated reclamation expenses; claims and limitations on insurance coverage;

the uncertainty in mineral resource estimates; the uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure

risks; and dependence on key management personnel and executive officers; and other risks and uncertainties indicated from time to time

in the definitive proxy statement/prospectus relating to the business combination that MAC filed with the SEC relating to its acquisition

of the CSA Copper Mine, including those under “Risk Factors” therein, and in MAC’s other filings with the SEC. MAC cautions

readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not undertake

or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any

change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could

affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with

the SEC. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the

results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently

believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication.

MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these

forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law.

These forward- looking statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date

of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-IFRS financial information

MAC’s results are reported under International

Financial Reporting Standards (IFRS). This release may also include certain non-IFRS measures including C1 costs. These C1 cost measures

are used internally by management to assess the performance of our business, make decisions on the allocation of our resources and assess

operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication of or

alternative to an IFRS measure of financial performance.

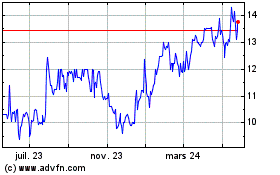

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025