Metals Acquisition Limited (NYSE: MTAL):

As previously announced, Metals Acquisition Limited (NYSE:MTAL)

(“MAC” or the “Company”) has been progressing a

secondary listing on the Australian Securities Exchange

(“ASX”) and is pleased to provide an update in relation to

its proposed ASX listing.

MAC has lodged a prospectus with the Australian Securities and

Investments Commission today (26 January 2024)

(“Prospectus”) to undertake an initial public offering

(“IPO”) in Australia of CHESS depository interests

(“CDIs”) and to seek a dual listing on the ASX

(“Listing”).

In connection with the Listing, the Company is seeking to raise

A$300 million1 (US$197 million) (before costs) through the issue of

between 17,647,059 - 18,750,000 CDIs (equivalent to between

17,647,059 - 18,750,000 ordinary shares in the capital of the

Company (“Shares”), representing a ratio of one CDI for one

Share). The Shares underlying the CDIs will rank equally with the

Shares currently on issue in the Company.

The offer (which will not extend to the Company’s United States

shareholders or US Persons within the meaning under Rule 902(k)

under Regulation S and will be conducted solely outside the United

States (other than to eligible US fund managers acting for the

benefit or account of persons that are not US Persons))

comprises:

- the Institutional Offer – which consists of an offer to

certain institutional investors in Australia, New Zealand and

certain other non-US jurisdictions around the world;

- the Broker Firm Offer – which is open to Australian

resident retail clients of participating brokers, who have a

registered address in Australia and who receive an invitation from

a broker to acquire CDIs under the Prospectus; and

- the Priority Offer – which is open to select investors

nominated by the Company in eligible jurisdictions, who receive a

Priority Offer invitation,

(together, the “Offer”).

The final price for the issue CDIs under the Offer will be

determined through a bookbuild process, with the indicative price

range of the Offer having been set at A$16.00 to A$17.00 ((US$10.52

to US$11.18) per CDI.

The Broker Firm and Priority Offers are currently scheduled to

formally open on 5 February 2024 and are expected to close on 9

February 2024.

The proceeds of the Offer will (among other things) be used

to:

- provide funds to repay Glencore’s deferred consideration

facility in connection with the Company’s acquisition of the

Cornish, Scottish and Australian underground copper mine near

Cobar, New South Wales, Australia (“CSA Copper Mine”);

- increase working capital to facilitate operational flexibility

and potential production growth;

- provide additional funding for exploration programs and mine

development at the CSA Copper Mine; and

- fund the costs of the Offer and other administrative costs

expected to be incurred by the Company.

Barrenjoey Markets Pty Limited and Canaccord Genuity (Australia)

Limited are acting as joint lead managers to the IPO (“Joint

Lead Managers”). Gilbert + Tobin, Skadden, Arps, Slate, Meagher

& Flom and Ogier are acting as Australian, US and Jersey legal

advisors to the Company in relation to the IPO.

Timetable*

An indicative timetable in relation to the Offer and Listing is

set out below.

Important dates

Lodgement of Prospectus with ASIC

26 January 2024

Broker Firm Offer and Priority Offer

opens

5 February 2024

Broker Firm Offer and Priority Offer

closes

9 February 2024

Settlement of the Offer

14 February 2024

Issue of CDIs (Completion)

15 February 2024

Expected dispatch of holding

statements

16 February 2024

Expected commencement of trading of CDIs

on ASX on a normal settlement basis

20 February 2024

*The above dates are to Australian Eastern Daylight Savings

Times and are indicative only and may change without notice. The

Company, in consultation with the Joint Lead Managers, reserves the

right to vary the times and dates of the Offer including to close

the Offer early, extend the Offer or to accept late applications or

bids, either generally or in particular cases, or to cancel or

withdraw the Offer before Settlement of the Offer, in each case

without notification to any recipient of this Prospectus or any

applicants.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy securities in any jurisdiction, and

shall not constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that jurisdiction.

Not an offer in the United States

This announcement does not constitute an offer to sell, or a

solicitation of an offer to buy, securities in the United States or

any other jurisdiction. Any securities described in this

announcement have not been, and will not be, registered under the

US Securities Act of 1933 and may not be offered or sold in the

United States except in transactions exempt from, or not subject

to, the registration requirements under the US Securities Act and

applicable US state securities laws.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL) is a company focused on

operating and acquiring metals and mining businesses in high

quality, stable jurisdictions that are critical in the

electrification and decarbonization of the global economy.

Forward Looking Statements

This press release includes “forward-looking statements.” MAC’s

actual results may differ from expectations, estimates, and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions)

are intended to identify such forward-looking statements. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult

to predict. Factors that may cause such differences include, but

are not limited to: the ability to recognize the anticipated

benefits of the business combination, which may be affected by,

among other things; the supply and demand for copper; the future

price of copper; the timing and amount of estimated future

production, costs of production, capital expenditures and

requirements for additional capital; cash flow provided by

operating activities; unanticipated reclamation expenses; claims

and limitations on insurance coverage; the uncertainty in mineral

resource estimates; the uncertainty in geological, metallurgical

and geotechnical studies and opinions; infrastructure risks; and

dependence on key management personnel and executive officers; and

other risks and uncertainties. MAC cautions that the foregoing list

of factors is not exclusive. MAC cautions readers not to place

undue reliance upon any forward-looking statements, which speak

only as of the date made. MAC does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions, or

circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or

CSA Mine’s financial results is included from time to time in MAC’s

public reports filed with the SEC. If any of these risks

materialize or MAC’s assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. There may be additional risks that MAC

does not presently know, or that MAC currently believes are

immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or

forecasts of future events and views as of the date of this

communication. MAC anticipates that subsequent events and

developments will cause its assessments to change. However, while

MAC may elect to update these forward-looking statements at some

point in the future, MAC specifically disclaims any obligation to

do so, except as required by law. These forward- looking statements

should not be relied upon as representing MAC’s assessment as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

____________________________ 1 An exchange rate of A$1 =

US$0.6575$, which represents the exchange rate reported by the

Reserve Bank of Australia on 24 January 2024, has been applied

throughout this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240126036925/en/

Mick McMullen Chief Executive Officer Metals Acquisition

Limited. mick.mcmullen@metalsacqcorp.com

Dan Vujcic Chief Development Officer and Interim Chief Financial

Officer Metals Acquisition Limited. +61 461 304 393

dan.vujcic@metalsacqcorp.com

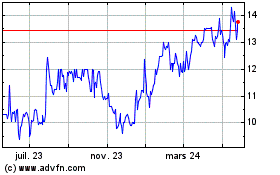

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

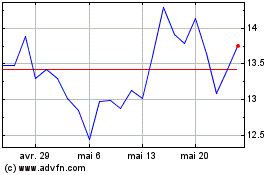

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025