Cadeler A/S (OSE: CADLR) (“Cadeler”) and Eneti Inc. (NYSE: NETI)

(“Eneti”), two offshore wind turbine and foundation installation

companies, announced the extension of the expiration date for the

share exchange offer (the “Share Exchange Offer”) to acquire all of

the issued and outstanding shares of the common stock of Eneti Inc.

(NYSE: NETI) (“Eneti”) to 5:30 p.m. Eastern Time on December 14,

2023. In addition, Cadeler has determined pursuant to the terms of

the Share Exchange Offer as set forth in the Prospectus/Offer to

Exchange, dated November 7, 2023 (the “Prospectus/Offer to

Exchange”) to reduce the minimum tender condition for the Share

Exchange Offer from 85.01% to 70%.

Cadeler is offering to exchange for each

outstanding share of Eneti, par value USD 0.01 per share (the

“Eneti Common Stock”), validly tendered and not validly withdrawn

in the Share Exchange Offer, 0.85225 American Depositary Shares

(the “Cadeler ADSs”), each one (1) Cadeler ADS representing four

(4) shares of Cadeler, nominal value DKK 1 per share (the “Cadeler

Shares”) providing for the previously agreed and announced exchange

ratio of 3.409 Cadeler Shares for each share of Eneti Common Stock,

subject to payment of cash compensation in lieu of any fractional

Cadeler ADSs, without interest and subject to reduction for any

applicable withholding taxes.

The Share Exchange Offer, which was previously

scheduled to expire at 4:30 p.m. Eastern Time on December 7, 2023,

has been extended to 5:30 p.m. Eastern Time on December 14, 2023,

unless further extended or earlier terminated, in order for the

parties to satisfy the minimum tender condition. In addition,

Cadeler has determined pursuant to the terms of the Share Exchange

Offer as set forth in the Prospectus/Offer to Exchange to reduce

the minimum tender condition for the Offer from 85.01% to 70%. In

determining to reduce the Minimum Condition, Cadeler considered a

number of factors, including the strong overall level of support

for the Share Exchange Offer as reflected in the acceptances

received from Eneti stockholders.

JPMorgan Chase Bank, N.A., the exchange agent for

the Share Exchange Offer, has advised Cadeler that, as of 4:30 p.m.

Eastern Time on December 7, 2023, approximately 30,243,821 shares

of Eneti Common Stock had been validly tendered and not validly

withdrawn in the Share Exchange Offer, representing approximately

78.25% of the total number of issued and outstanding shares of

Eneti Common Stock at such date and time.

Holders that have previously tendered their shares

do not need to re-tender their shares or take any other action in

response to the extension of the Share Exchange Offer.

If you would like to tender your shares, have

questions or requests for assistance please contact D.F. King &

Co., Inc., the information agent for the Offer, at +1 (800)

967-4607 (Toll Free), +1 (212) 269-5550 (call collect) or by e-mail

at: NETI@dfking.com.

Assuming that the conditions to the Share Exchange

Offer are satisfied or waived, Cadeler expects that settlement will

be completed on or about December 19, 2023.

Indicative Timetable

The following indicative timetable is subject to

Cadeler’s right to extend, re-open, amend, limit, terminate or

withdraw the Share Exchange Offer, subject to applicable law.

Accordingly, the actual timetable may differ significantly from the

expected timetable set out below.

|

Event |

Calendar date |

| Commencement of trading of

Cadeler ADSs on the New York Stock Exchange on a “when issued”

basis |

On or about December 15,

2023 |

| Expected date for approval of

an EU/EEA Listing Prospectus for the new Cadeler Shares |

On or about December 18,

2023 |

| Expected settlement date |

On or about December 19,

2023 |

| Admission to trading of the

new Cadeler Shareson the Oslo Stock Exchange |

On or about December 20,

2023 |

| Commencement of trading of

Cadeler ADSs on the New York Stock Exchange on a regular-way

settlement basis |

On or about December 20,

2023 |

| |

|

Signing of Green Loan and Guarantee

Facilities

Also today, Cadeler announced the signing of

the previously-announced EUR 550m Senior Secured

Green Loan Facilities with a group of banks led

by DNB and supported by Rabobank, Credit

Agricole, Danske Bank, Oversea-Chinese Banking

Corporation (OCBC), Standard Chartered

Bank and SocieteGenerale. The purpose of such

facilities is to refinance existing vessels in Cadeler and Eneti

Inc. ahead of the contemplated business

combination between the two companies, to finance

crane upgrades of Cadeler’s two exiting vessels and to fund general

corporate and working capital purposes. See Cadeler’s separate

press release dated today, December 8, 2023, for additional

details.

About Cadeler A/SCadeler A/S is a

key supplier within the offshore wind industry for installation

services and marine and engineering operations with a strong focus

on safety and the environment. Cadeler’s experience as provider of

high-quality offshore wind support services, combined with

innovative vessel designs, positions the company to deliver premium

services to the industry. Cadeler facilitates the global energy

transition towards a future built on renewable energy. Cadeler is

listed on the Oslo Stock Exchange (OSE: CADLR).

About Eneti Inc. Eneti Inc. is a

leading provider of installation and maintenance vessels to the

offshore wind sector and has invested in the next generation of

wind turbine installation vessels. Eneti Inc. is listed on the New

York Stock Exchange (NYSE: NETI).

For further information, please

contact:

Point of contact for investors:

Mikkel Gleerup, CEO+45 3246

3102mikkel.gleerup@cadeler.com

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The Company desires to take

advantage of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The

words “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“plan,” “targets,” “projects,” “likely,” “would,” “could” and

similar expressions or phrases may identify forward-looking

statements.

The forward-looking statements in this press

release are not guarantees of future performance, conditions or

results, and involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of

which are outside our management’s control, that could cause actual

results or outcomes to differ materially from those discussed in

the forward-looking statements. These forward-looking statements

are based on information available as of the date hereof, and

current expectations, forecasts and assumptions, and involve a

number of judgments, risks and uncertainties. Although we believe

that these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, we cannot assure you that we will achieve or

accomplish these expectations, beliefs or projections and we do not

undertake any obligation to update forward-looking statements to

reflect events or circumstances after the date they were made,

whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

In addition to these important factors, other

important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include: our future operating or financial results;

changes in demand for Wind Turbine Installation Vessel (“WTIV”)

capacity; the strength of world economies and currencies; the

length and severity of the recent novel coronavirus (COVID-19)

outbreak, including its effects on demand for WTIVs and the

installation of offshore wind turbines; our ability to successfully

employ our existing and newbuilding WTIVs and the availability and

suitability of our vessels for customer projects; our ability to

compete successfully for future chartering and newbuilding

opportunities; our continued ability to employ our vessels;

fluctuations in interest rates and foreign exchange rates; early

termination of customer contracts, our failure to win new contracts

for our vessels or the failure of counterparties to fully perform

their contracts with us; our ability to successfully identify,

consummate, integrate and realize the expected benefits from

acquisitions and changes to our business strategy; our ability to

successfully operate in new markets; changes in our operating

expenses, including bunker prices, drydocking and insurance costs;

compliance with, and our liabilities under, governmental, tax,

environmental and safety laws and regulations; changes in

governmental rules and regulations or actions taken by regulatory

authorities; potential liability from pending or future litigation;

general domestic and international political conditions; potential

disruption of shipping routes due to accidents or political events;

our ability to procure or have access to financing, our liquidity

and the adequacy of cash flows for our operations; our continued

borrowing availability under our debt agreements and compliance

with the covenants contained therein; fluctuations in the value of

our vessels and investments; our ability to fund future capital

expenditures and investments in the construction, acquisition and

refurbishment of our vessels (including the amount and nature

thereof and the timing of completion thereof, the timely delivery

to us and commencement of operations dates, expected downtime and

lost revenue); potential exposure or loss from investment in

derivative instruments or other equity investments in which we

invest; potential conflicts of interest involving members of our

Board and senior management and our significant shareholders; and

our expectations regarding the availability of vessel acquisitions

and our ability to complete acquisition transactions planned and

other factors.

Contact Information

Eneti Inc.James Doyle – Head of Corporate

Development & Investor RelationsTel: +1 646-432-1678Email:

Investor.Relations@Eneti-inc.comhttps://www.eneti-inc.com

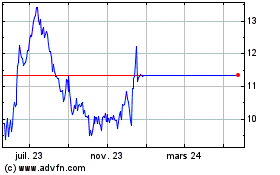

Eneti (NYSE:NETI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Eneti (NYSE:NETI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024