Pembina Pipeline Corporation Announces Pembina Gas Infrastructure’s Acquisition of Working Interests From Whitecap Resources and New Long-term Agreements

02 Juillet 2024 - 1:00PM

Business Wire

All financial figures are approximate and in Canadian dollars

unless otherwise noted

Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX:

PPL; NYSE: PBA) is pleased to announce that Pembina Gas

Infrastructure Inc. (“PGI”), a premier gas processing entity in

Western Canada jointly owned by Pembina and KKR, has entered into a

purchase and sale agreement with Whitecap Resources Inc.

("Whitecap") to acquire a 50 percent working interest in Whitecap’s

15-07 Kaybob Complex (the “Kaybob Complex”) as well as executed an

agreement to support the future infrastructure development for

Whitecap’s Lator growth area (the “Transaction”). Gross proceeds

related to the Transaction are $420 million ($252 million, net to

Pembina).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240702672014/en/

“Our ability to provide unique and value-added solutions to

support Whitecap's development in both the Montney and Duvernay

demonstrates our leading advantage and is why our customers choose

us. These plays have significant growth potential, and we are proud

to be Whitecap’s infrastructure partner,” said Chris Rousch, PGI’s

President & Chief Executive Officer. “The Transaction further

demonstrates the ability for Pembina’s integrated value chain to

meet the growth demands of our customers.”

Transaction Details

- PGI will acquire a 50 percent working interest in the Kaybob

Complex, which includes natural gas processing capacity of 165

million cubic feet per day and condensate stabilization capacity of

15,000 barrels per day; Whitecap will retain operatorship of the

assets. In turn, Whitecap will enter into a long-term take-or-pay

agreement for PGI’s capacity in the Kaybob Complex and will commit

to an area of dedication to PGI for all volumes Whitecap produces

out of the area.

- PGI has agreed to fund Whitecap’s Lator area development,

including a new battery and gathering lateral (the “Lator

Infrastructure”), which PGI will own. In exchange, Whitecap has

entered into long-term take-or-pay agreements with PGI for priority

access to the Lator Infrastructure. In addition, the Lator area

development includes an area of dedication to PGI for all volumes

Whitecap produces out of the area.

- Whitecap has entered into additional long-term take-or-pay

contracts with PGI at the Musreau gas plant within the Cutbank

Complex (“Musreau”) and the K3 gas plant.

- In addition to PGI’s transaction, Pembina has signed a

combination of new and extended long-term integrated

transportation, fractionation, and marketing services agreements

with Whitecap, including a dedication of future growth volumes from

Whitecap's Kaybob and Lator developments.

Strategic Benefits

- Further Aligns PGI and Pembina with a Strong Growth

Company: Whitecap is a Western Canadian Montney and Duvernay

producer with an exceptional track record of growth.

- Enhanced Asset Utilization: The Transaction will

increase volumes at PGI’s Musreau and K3 facilities, utilizing

existing white space.

- Increased Volume Capture: The Lator Lateral will connect

PGI’s Musreau facility into the Lator area, enhancing PGI’s

potential to capture further volumes.

- Strong Contractual Protections: The existing assets and

further infrastructure development will be underpinned by an

area-of-dedication and long-term take-or-pay agreements.

- Benefits Full Pembina Value Chain: In addition to the

acquired infrastructure and future development within PGI, there

are added benefits across Pembina’s integrated value chain. A

combination of new and extended long-term transportation,

fractionation, and marketing services agreements, and dedication of

future growth, will support higher utilization on Pembina’s Peace

Pipeline and at the Redwater Complex, including RFS IV, which is

currently being constructed. Further, the arrangement for

Whitecap's Lator development includes deep cut processing and

ethane-plus NGL transportation and fractionation, which supports

Pembina's ethane supply commitments.

Transaction Funding

The Transaction will initially be funded using PGI’s existing

credit facility.

Closing

Closing is expected to occur in the third quarter of 2024 and is

subject to the satisfaction or waiver of customary closing

conditions, including all required regulatory approvals.

Forward-Looking Information and Statements

This news release contains certain forward-looking statements

and forward-looking information (collectively, "forward-looking

statements"), including forward-looking statements within the

meaning of the "safe harbor" provisions of applicable securities

legislation, that are based on Pembina’s, current expectations,

estimates, projections, and assumptions in light of its experience

and its perception of historical trends. In some cases,

forward-looking statements can be identified by terminology such as

"continue", "anticipate", "will", "expects", "estimate",

"potential", "planned", "future", "outlook", "strategy", "protect",

"plan", "commit", "maintain", "focus", "ongoing", "believe" and

similar expressions suggesting future events or future

performance.

In particular, this news release contains forward-looking

pertaining to, without limitation, the following: (i) the terms and

conditions of the Transaction, including with respect to PGI’s

acquisition of working interests in certain assets, entering into

new agreements with Whitecap including related to areas of

dedication, transportation, fractionation, and marketing services,

and the funding of Lator Infrastructure; (ii) the strategic

benefits of the Transaction; (iii) the funding of the Transaction;

and (iv) the anticipated timing of closing of the Transaction.

The forward-looking statements are based on certain assumptions

that Pembina have made in respect thereof as at the date of this

news release regarding, among other things: prevailing commodity

prices, margins and exchange rates; that Pembina’s financial

results will be consistent with management expectations; the

availability and sources of capital; estimated operating and

development costs; utilization rates and future demand for

services; the ability to reach required commercial agreements; and

the ability to obtain required regulatory approvals and to comply

with the conditions thereof.

Although Pembina believes the expectations and material factors

and assumptions reflected in these forward-looking statements are

reasonable as of the date hereof, there can be no assurance that

these expectations, factors and assumptions will prove to be

correct. These forward-looking statements are not guarantees of

future performance and are subject to a number of known and unknown

risks and uncertainties that could cause actual events or results

to differ materially, including, but not limited to: the regulatory

environment and decisions and Indigenous and landowner consultation

requirements; the impact of competitive entities and pricing;

reliance on key relationships, joint venture partners and

agreements; labour and material shortages; the strength and

operations of the oil and natural gas production industry and

related commodity prices; non-performance or default by contract

counterparties; actions by governmental or regulatory authorities,

including changes in tax laws and treatment, changes in royalty

rates, changes in regulatory processes or increased environmental

regulation; the ability of Pembina or PGI to acquire or develop the

necessary infrastructure in respect of the Transaction;

fluctuations in operating results; adverse general economic and

market conditions, including potential recessions in Canada, North

America and worldwide resulting in changes, or prolonged

weaknesses, as applicable, in interest rates, foreign currency

exchange rates, inflation rates, commodity prices, supply/demand

trends and overall industry activity levels; constraints on, or the

unavailability of, adequate supplies, infrastructure or labour; the

political environment in North America and elsewhere, and public

opinion; the ability to access various sources of debt and equity

capital; adverse changes in credit ratings; counterparty credit

risk; technology and cyber security risks; natural catastrophes;

and certain other risks detailed in Pembina's Annual Information

Form and Management's Discussion and Analysis, each dated February

22, 2024 for the year ended December 31, 2023, and from time to

time in Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com.

This list of risk factors should not be construed as exhaustive.

Readers are cautioned that events or circumstances could cause

results to differ materially from those predicted, forecasted or

projected by forward-looking statements contained herein. The

forward-looking statements contained in this news release speak

only as of the date of this news release. Neither the Haisla Nation

nor Pembina undertakes any obligation to publicly update or revise

any forward-looking statements or information contained herein,

except as required by applicable laws. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240702672014/en/

Pembina Investor Relations (403) 231-3156 1-855-880-7404

investor-relations@pembina.com www.pembina.com

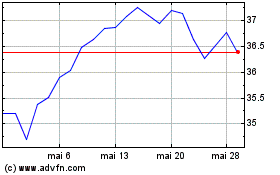

Pembina Pipeline (NYSE:PBA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Pembina Pipeline (NYSE:PBA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025