Version 1.0 Surgical System On Track for

Cadaveric Testing this Spring Achieves 2023 Cash Burn Objective of

$63.4 Million 2024 Cash Burn Guidance of $50 Million Reflects Prior

Cost Reduction Initiatives

Vicarious Surgical Inc. (“Vicarious Surgical” or the “Company”)

(NYSE: RBOT, RBOT WS), a next-generation robotics technology

company seeking to improve patient outcomes as well as both the

cost and efficiency of surgical procedures, today announced

financial results for the quarter and full year ended December 31,

2023. Management will host a corresponding conference call at 4:30

p.m. ET today, March 4, 2024.

“We made meaningful progress transitioning our Beta 2 surgical

system into our highly anticipated Version 1.0 product in 2023.

Through close collaboration with our surgeon and major hospital

system partners, we refined our V1.0 system design and successfully

constructed each subsystem,” stated Adam Sachs, Co-Founder and CEO

of Vicarious Surgical. “Although market headwinds and certain

system integration hurdles drove us to prioritize capital

efficiency and extend our timeline to build completion, we ended

the year with a more resilient business structure, a defined

regulatory strategy, and just under $100 million in cash and

investments. We are well positioned to execute upon our 2024

milestones and look forward to our spring cadaveric testing, and

completing the integration of our Version 1.0 system this

fall.”

Recent Business Highlights

- Signed a fourth major U.S. hospital system agreement with

Intermountain Health, bringing the total number of Vicarious

Surgical partner hospitals to over 250.

- Successfully executed a $47 million dollar equity follow-on

offering, meaningfully extending the Company’s cash runway.

- Gained clarity on development and clinical pathway, with V1.0

integration expected in the fall of 2024.

- Appointed Randy Clark as Company President to assume

responsibility for day-to-day oversight of various core business

functions, including product development, operations, commercial

strategy, clinical, regulatory and quality affairs, and human

resources.

Fourth Quarter 2023 Financial Results

- Operating expenses were $15.5 million for the fourth quarter of

2023, compared to $20.6 million in the corresponding prior year

period, a decrease of 25%.

- R&D expenses for the fourth quarter of 2023 were $8.5

million, compared to $11.9 million in the fourth quarter of

2022.

- General and administrative expenses for the fourth quarter of

2023 were $5.9 million, compared to $6.9 million in the fourth

quarter of 2022.

- Sales and marketing expenses for the fourth quarter of 2023

were $1.2 million, compared to $1.8 million in the fourth quarter

of 2022.

- Adjusted net loss for the fourth quarter was $14.6 million,

equating to a loss of $0.07 per share, as compared to an adjusted

net loss of $19.9 million, or a loss of $0.16 per share, for the

same period of the prior year. GAAP net loss for the fourth quarter

was $13.1 million, equating to a net loss per share of $0.06, as

compared to a GAAP net loss of $11.2 million or a net loss per

share of $0.09 for the same period of the prior year.

Full Year 2023 Financial Results

- Operating expenses were $80.7 million for the full year of

2023, compared to $80.1 million in the corresponding prior year

period, an increase of 1%.

- R&D expenses for the full year of 2023 were $47.6 million,

compared to $43.9 million for the full year of 2022.

- General and administrative expenses for the full year of 2023

were $26.9 million, compared to $29.7 million for the full year of

2022.

- Sales and marketing expenses for the full year of 2023 were

$6.2 million, compared to $6.5 million for the full year of

2022.

- Adjusted net loss for the full year of 2023 was $76.3 million,

equating to a net loss of $0.52 per share, as compared to an

adjusted net loss of $78.8 million, or a net loss of $0.65 per

share, for the same period of the prior year. GAAP net loss for the

full year of 2023 was $71.1 million, equating to a net loss per

share of $0.49, as compared to a net income of $5.2 million or a

net income per share of $0.04 for the same period of the prior

year.

- The Company had $98.2 million cash and investments as of

December 31, 2023. The Company’s cash burn rate for the full year

of 2023 was $63.4 million.

Full Year 2024 Cash Burn Guidance

- Vicarious Surgical expects full year 2024 cash burn of

approximately $50 million.

Conference Call

Vicarious Surgical will host a conference call at 4:30 p.m. ET

on Monday, March 4, 2024, to discuss its fourth quarter and full

year 2023 financial results. The call may be accessed through an

operator by dialing +1 833 470 1428 for domestic callers or +1 404

975 4839 for international callers, using access code: 608739. A

live and archived webcast of the event will be available at

https://investor.vicarioussurgical.com.

About Vicarious Surgical

Founded in 2014, Vicarious Surgical is a next generation

robotics company, developing a unique disruptive technology with

the multiple goals of substantially increasing the efficiency of

surgical procedures, improving patient outcomes, and reducing

healthcare costs. The Company’s novel surgical approach uses

proprietary human-like surgical robots to virtually transport

surgeons inside the patient to perform minimally invasive surgery.

The Company is led by an experienced team of technologists, medical

device professionals and physicians, and is backed by technology

luminaries including Bill Gates, Vinod Khosla’s Khosla Ventures,

Innovation Endeavors, Jerry Yang’s AME Cloud Ventures, Sun Hung Kai

& Co. Ltd and Philip Liang’s E15 VC. The Company is

headquartered in Waltham, Massachusetts. Learn more at

www.vicarioussurgical.com.

Use of Non-GAAP Financial Measures

In addition to providing financial measurements that have been

prepared in accordance with accounting principles generally

accepted in the United States of America (“U.S. GAAP”), Vicarious

Surgical provides additional financial metrics that are not

prepared in accordance with U.S. GAAP (“non-GAAP”). The non-GAAP

financial measures included in this press release are Adjusted Net

Loss and Adjusted Net Loss Per Share (“Adjusted EPS”, and together

with Adjusted Net Loss, “Non-GAAP Financial Measures”). The Company

presents Non-GAAP Financial Measures in order to assist readers of

its consolidated financial statements in understanding the core

operating results that its management uses to evaluate the business

and for financial planning purposes. Vicarious Surgical’s Non-GAAP

financial measures provide an additional tool for investors to use

in comparing its financial performance over multiple periods.

Adjusted Net Loss and Adjusted EPS are key performance measures

that Vicarious Surgical’s management uses to assess its operating

performance. These Non-GAAP Financial Measures facilitate internal

comparisons of Vicarious Surgical’s operating performance on a more

consistent basis. Vicarious Surgical uses these performance

measures for business planning purposes and forecasting. Vicarious

Surgical believes that the Non-GAAP Financial Measures enhance an

investor’s understanding of Vicarious Surgical’s financial

performance as it is useful in assessing its operating performance

from period-to-period by excluding certain items that Vicarious

Surgical believes are not representative of its core business.

The Non-GAAP Financials Measures may not be comparable to

similarly titled measures of other companies because they may not

calculate this measure in the same manner. Adjusted Net Loss and

Adjusted EPS are not prepared in accordance with U.S. GAAP and

should not be considered in isolation of, or as an alternative to,

measures prepared in accordance with U.S. GAAP. When evaluating

Vicarious Surgical’s performance, you should consider the Non-GAAP

Financial Measures alongside other financial performance measures

prepared in accordance with U.S. GAAP, including net loss.

The Non-GAAP Financial Measures do not replace the presentation

of Vicarious Surgical’s U.S. GAAP financial results and should only

be used as a supplement to, not as a substitute for, Vicarious

Surgical’s financial results presented in accordance with U.S.

GAAP. In this press release, Vicarious Surgical has provided a

reconciliation of Adjusted Net Loss to net loss, the most directly

comparable U.S. GAAP financial measure, and the calculation for

Adjusted EPS.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. The company’s

actual results may differ from its expectations, estimates, and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. All

statements other than statements of historical facts contained

herein, including without limitation the quotations of our Chief

Executive Officer regarding Vicarious Surgical’s opportunity, among

other things, are forward-looking statements that reflect the

current beliefs and expectations of management. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from those discussed in the forward-looking statements.

Most of these factors are outside Vicarious Surgical’s control and

are difficult to predict. Factors that may cause such differences

include, but are not limited to: the ability to maintain the

listing of Vicarious Surgical’s Class A common stock on the New

York Stock Exchange; the approval, commercialization and adoption

of Vicarious Surgical’s initial product candidates and the success

of its single-port surgical robot, called the Vicarious Surgical

System, and any of its future product candidates and service

offerings; changes in applicable laws or regulations; the ability

of Vicarious Surgical to raise financing in the future; the

success, cost and timing of Vicarious Surgical’s product and

service development activities; the potential attributes and

benefits of Vicarious Surgical’s product candidates and services;

Vicarious Surgical’s ability to obtain and maintain regulatory

approval for the Vicarious Surgical System, and any related

restrictions and limitations of any approved product; the size and

duration of human clinical trials for the Vicarious Surgical;

Vicarious Surgical’s ability to identify, in-license or acquire

additional technology; Vicarious Surgical’s ability to maintain its

existing license, manufacture, supply and distribution agreements;

Vicarious Surgical’s ability to compete with other companies

currently marketing or engaged in the development of products and

services that Vicarious Surgical is currently marketing or

developing; the size and growth potential of the markets for

Vicarious Surgical’s product candidates and services, and its

ability to serve those markets, either alone or in partnership with

others; the pricing of Vicarious Surgical’s product candidates and

services and reimbursement for medical procedures conducted using

its product candidates and services; the company’s estimates

regarding expenses, revenue, capital requirements and needs for

additional financing; Vicarious Surgical’s financial performance;

economic downturns, political and market conditions and their

potential to adversely affect Vicarious Surgical’s business,

financial condition and results of operations; Vicarious Surgical’s

intellectual property rights and its ability to protect or enforce

those rights, and the impact on its business, results and financial

condition if it is unsuccessful in doing so; and other risks and

uncertainties indicated from time to time in Vicarious Surgical’s

filings with the SEC. Vicarious Surgical cautions that the

foregoing list of factors is not exclusive. The company cautions

readers not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. Vicarious

Surgical does not undertake or accept any obligation or undertaking

to release publicly any updates or revisions to any forward-looking

statements to reflect any change in its expectations or any change

in events, conditions or circumstances on which any such statement

is based.

VICARIOUS SURGICAL

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per

share data)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Operating expenses:

Research and development

$

8,468

$

11,877

$

47,578

$

43,900

Sales and marketing

1,203

1,838

6,230

6,463

General and administrative

5,870

6,895

26,858

29,715

Total operating expenses

15,541

20,610

80,666

80,078

Loss from operations

(15,541

)

(20,610

)

(80,666

)

(80,078

)

Other income (expense):

Change in fair value of warrant

liabilities

1,486

8,709

5,191

84,000

Interest and other income

966

832

4,429

1,435

Interest expense

(22

)

(111

)

(25

)

(200

)

Income/(loss) before income taxes

(13,111

)

(11,180

)

(71,071

)

5,157

Provision for income taxes

—

—

—

—

Net income/(loss)

$

(13,111

)

$

(11,180

)

$

(71,071

)

$

5,157

Net income/(loss) per share of Class A and

Class B common stock, basic and diluted

$

(0.06

)

$

(0.09

)

$

(0.49

)

$

0.04

Weighted average shares, basic

175,123,050

123,515,191

146,006,388

121,791,878

Weighted average shares, diluted

175,123,050

123,515,191

146,006,388

127,528,509

Other comprehensive income:

Net unrealized income on investments

99

—

10

—

Other comprehensive income

99

—

10

—

Comprehensive net income/(loss)

$

(13,012

)

$

(11,180

)

$

(71,061

)

$

5,157

VICARIOUS SURGICAL

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands, except share

and per share data)

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

52,822

$

116,208

Short-term investments

45,355

—

Prepaid expenses and other current

assets

2,776

4,196

Total current assets

100,953

120,404

Restricted cash

936

936

Property and equipment, net

6,402

6,586

Right-of-use assets

11,459

12,273

Other long-term assets

114

92

Total assets

$

119,864

$

140,291

Liabilities, Convertible Preferred Stock

and Stockholders’ Equity

Current liabilities:

Accounts payable

$

1,258

$

1,731

Accrued expenses

4,975

5,808

Lease liabilities, current portion

1,047

838

Current portion of equipment loans

—

16

Total current liabilities

7,280

8,393

Lease liabilities, net of current

portion

13,785

14,832

Warrant liabilities

830

6,021

Total liabilities

21,895

29,246

Stockholders’ equity:

Class A Common Stock

15

11

Class B Common Stock

2

2

Additional paid-in capital

230,654

172,673

Accumulated other comprehensive income

10

—

Accumulated deficit

(132,712

)

(61,641

)

Total stockholders’ equity

97,969

111,045

Total liabilities and stockholders’

equity

$

119,864

$

140,291

VICARIOUS SURGICAL

INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except share

and per share data)

Adjusted net loss and Adjusted

EPS

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Net income/(loss)

$

(13,111

)

$

(11,180

)

$

(71,071

)

$

5,157

Change in fair value of warrant

liabilities

1,486

8,709

5,191

84,000

Adjusted net loss

(14,597

)

(19,889

)

(76,262

)

(78,843

)

Adjusted EPS, basic and diluted

$

(0.07

)

$

(0.16

)

$

(0.52

)

$

(0.65

)

Weighted average shares, basic and

diluted

175,123,050

123,515,191

146,006,388

121,791,878

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240304077017/en/

Investor Contact Kaitlyn Brosco Vicarious Surgical

Kbrosco@vicarioussurgical.com

Marissa Bych Gilmartin Group Marissa@gilmartinir.com

Media Inquiries media@vicarioussurgical.com

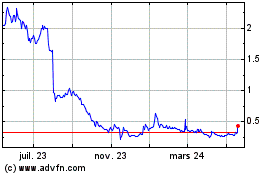

Vicarious Surgical (NYSE:RBOT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

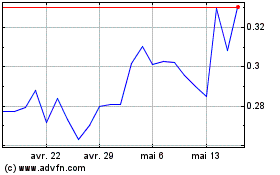

Vicarious Surgical (NYSE:RBOT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025