Smartsheet Announces Results of 2024 Special Shareholders’ Meeting

09 Décembre 2024 - 10:27PM

Business Wire

Smartsheet Shareholders Approve Acquisition by

Blackstone and Vista Equity Partners

Smartsheet (NYSE:SMAR) (“Smartsheet” or the “Company”), the AI

enhanced enterprise grade work management platform, today announced

that Smartsheet shareholders overwhelmingly approved the Merger

Proposal for the Company’s proposed acquisition by funds managed by

Blackstone and Vista Equity Partners. This approval satisfies the

shareholder vote condition for the consummation of the acquisition,

originally announced in September 2024.

In addition, shareholders also voted in favor of the executive

compensation plan related to the acquisition, further validating

their support for the Company's leadership and strategic

direction.

Smartsheet will disclose the final vote results on a Current

Report on Form 8-K to be filed with the U.S. Securities and

Exchange Commission.

Following the approval of the Merger Proposal, the acquisition

remains subject to other customary closing conditions, including

certain regulatory approvals that are proceeding in the normal

course. Assuming the satisfaction of necessary closing conditions,

the acquisition is expected to close in the fourth quarter of

Smartsheet’s fiscal year ending January 31, 2025, or shortly

thereafter.

About Smartsheet

Smartsheet is the modern enterprise work management platform

trusted by millions of people at companies across the globe,

including over 85% of the 2024 Fortune 500 companies. The category

pioneer and market leader, Smartsheet delivers powerful solutions

fueling performance and driving the next wave of innovation. Visit

www.smartsheet.com to learn more.

Forward-Looking Statements

This communication may contain forward-looking statements made

pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including, among other

things, statements regarding the ability of the parties to complete

the proposed transaction and the expected timing of completion of

the proposed transaction; the prospective performance and outlook

of Smartsheet’s business, performance and opportunities; as well as

any assumptions underlying any of the foregoing. When used in this

communication, or any other documents, words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “forecast,” “goal,” “objective,” “plan,” “project,”

“seek,” “strategy,” “target,” and similar expressions should be

considered forward-looking statements made in good faith by

Smartsheet, as applicable, and are intended to qualify for the safe

harbor from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

based on the beliefs and assumptions of management at the time that

these statements were prepared and are subject to risks,

uncertainties, and assumptions that could cause Smartsheet’s actual

results to differ materially from those expressed or implied in the

forward-looking statements. Forward-looking statements involve

known and unknown risks, uncertainties and other factors that may

cause our actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. These risks include, but are not limited to, risks and

uncertainties related to: (i) the risk that the proposed

transaction may not be completed in a timely manner or at all; (ii)

the possibility that competing offers or acquisition proposals for

Smartsheet will be made; (iii) the possibility that any of the

various conditions to the consummation of the proposed transaction

may not be satisfied or waived, including the failure to receive

any required regulatory approvals from any applicable governmental

entities; (iv) the occurrence of any event, change or other

circumstance that could give rise to the termination of the merger

agreement, including in circumstances that would require Smartsheet

to pay a termination fee or other expenses; (v) the effect of the

pendency of the proposed transaction on Smartsheet’s ability to

retain and hire key personnel, its ability to maintain

relationships with its customers, suppliers and others with whom it

does business, its business generally or its stock price; (vi)

risks related to diverting management’s attention from Smartsheet’s

ongoing business operations or the loss of one or more members of

the management team; (vii) the risk that shareholder litigation in

connection with the proposed transaction may result in significant

costs of defense, indemnification and liability; (viii)

Smartsheet’s ability to achieve future growth and sustain its

growth rate; (ix) Smartsheet’s ability to attract and retain

talent; (x) Smartsheet’s ability to attract and retain customers

(including government customers) and increase sales to its

customers; (xi) Smartsheet’s ability to develop and release new

products and services and to scale its platform; (xii) Smartsheet’s

ability to increase adoption of its platform through its

self-service model; (xiii) Smartsheet’s ability to maintain and

grow its relationships with channel and strategic partners; (xiv)

the highly competitive and rapidly evolving market in which it

participates; (xv) Smartsheet’s ability to identify targets for,

execute on, or realize the benefits of, potential acquisitions; and

(xvi) its international expansion strategies. Further information

on risks that could affect Smartsheet’s results is included in its

filings with the SEC, including its most recent Quarterly Report on

Form 10-Q and its Annual Report on Form 10-K for the fiscal year

ended January 31, 2024, and any current reports on Form 8-K that it

may file from time to time. Should any of these risks or

uncertainties materialize, actual results could differ materially

from expectations. Except as required by applicable law, Smartsheet

assumes no obligation to, and does not currently intend to, update

or supplement any such forward-looking statements to reflect actual

results, new information, future events, changes in its

expectations or other circumstances that exist after the date of

this communication.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209789684/en/

Investor Relations Contact Aaron Turner

investorrelations@smartsheet.com Media Contact FGS Global

Smartsheet@FGSGlobal.com

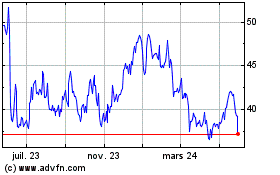

Smartsheet (NYSE:SMAR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

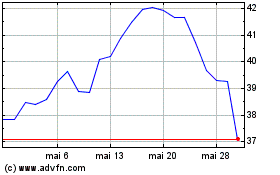

Smartsheet (NYSE:SMAR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025