Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 Février 2024 - 10:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File No. 001-36675

_______________________________

STELLANTIS N.V.

(Translation of Registrant’s Name Into English)

_______________________________

Taurusavenue 1

2132 LS Hoofddorp

The Netherlands

Tel. No.: +31 23 700 1511

(Address of Principal Executive Offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(7): o

The following exhibit is furnished herewith:

Exhibit 99.1 Stellantis N.V. Supplemental Information as of and for the year ended December 31, 2023

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

Date: February 22, 2024 | STELLANTIS N.V. |

| | | |

| | | |

| By: | /s/ Natalie Knight |

| | Name: Natalie Knight |

| | Title: Chief Financial Officer |

Index of Exhibits

Exhibit

Number Description of Exhibit

99.1 Stellantis N.V. Supplemental Information as of and and for the year ended December 31, 2023

Exhibit 99.1

Income Statement by activity

Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the year ended December 31, 2023 | | For the year ended December 31, 2022 |

| (€ million) | | Stellantis | | Industrial activities | | Financial services | | Stellantis | | Industrial activities | | Financial services |

Net revenues | | 189,544 | | | 188,642 | | | 1,030 | | | 179,592 | | | 179,095 | | | 647 | |

Cost of revenues | | 151,400 | | | 150,740 | | | 788 | | | 144,327 | | | 144,048 | | | 429 | |

Selling, general and other costs | | 9,541 | | | 9,237 | | | 304 | | | 8,981 | | | 8,854 | | | 127 | |

Research and development costs | | 5,619 | | | 5,619 | | | — | | | 5,200 | | | 5,200 | | | — | |

Gains/(losses) on disposal of investments | | 20 | | | 27 | | | (7) | | | 72 | | | 44 | | | 28 | |

Restructuring costs | | 1,119 | | | 1,119 | | | — | | | 1,144 | | | 1,144 | | | — | |

| Share of the profit/(loss) of equity method investees | | 491 | | | 32 | | | 459 | | | 264 | | | (265) | | | 529 | |

Operating income/(loss)(1) | | 22,376 | | | 21,986 | | | 390 | | | 20,276 | | | 19,628 | | | 648 | |

Net financial expenses/(income) | | (42) | | | (42) | | | — | | | 768 | | | 770 | | | (2) | |

Profit/(loss) before taxes | | 22,418 | | | 22,028 | | | 390 | | | 19,508 | | | 18,858 | | | 650 | |

Tax expense/(benefit) | | 3,793 | | | 3,857 | | | (64) | | | 2,729 | | | 2,699 | | | 30 | |

| Result from intersegment investments | | — | | | 454 | | | — | | | — | | | 620 | | | — | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Net profit/(loss) | | 18,625 | | | 18,625 | | | 454 | | | 16,779 | | | 16,779 | | | 620 | |

| | | | | | | | | | | | |

Adjusted operating income(1)(2) | | 24,343 | | | 23,876 | | | 467 | | | 24,017 | | | 23,263 | | | 754 | |

| | | | | | | | | | | | |

______________________________________________________________________________________________________________________________________________

Figures presented for Industrial activities and Financial services include intersegment transactions

(1) Effective from January 1, 2023, our Operating income/(loss) and Adjusted operating income includes Share of the profit/(loss) of equity method investees. The comparatives for the respective period for 2022 have been adjusted accordingly. Refer to the Stellantis N.V. Annual Report for the year ended December 31, 2023 - Non-GAAP Financial Measures

(2) The reconciliation of Net profit to Adjusted operating income for the Company is included in the Stellantis N.V. Annual Report for the year ended December 31, 2023 - Management discussion and analysis - Company results

Statement of Financial Position by activity

Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | At December 31, 2023 | | At December 31, 2022 |

| (€ million) | | Stellantis | | Industrial activities | | Financial services | | Stellantis | | Industrial activities | | Financial services |

| Assets | | | | | | | | | | | | |

| Goodwill and intangible assets with indefinite useful lives | | 30,994 | | | 30,856 | | | 138 | | | 31,738 | | | 31,611 | | | 127 | |

Other intangible assets | | 20,625 | | | 20,459 | | | 166 | | | 19,006 | | | 18,861 | | | 145 | |

Property, plant and equipment | | 37,687 | | | 35,992 | | | 1,695 | | | 36,205 | | | 36,129 | | | 76 | |

Equity method investments | | 8,070 | | | 11,252 | | | 3,419 | | | 4,834 | | | 7,244 | | | 3,182 | |

Deferred tax assets | | 2,152 | | | 2,094 | | | 58 | | | 2,052 | | | 2,040 | | | 12 | |

Inventories | | 21,414 | | | 21,367 | | | 47 | | | 17,360 | | | 17,303 | | | 57 | |

| Assets sold with a buy-back commitment | | 1,328 | | | 1,328 | | | — | | | 1,594 | | | 1,594 | | | — | |

| Trade receivables | | 6,426 | | | 6,498 | | | 117 | | | 4,928 | | | 5,004 | | | 70 | |

| Tax receivables | | 919 | | | 911 | | | 165 | | | 655 | | | 650 | | | 41 | |

| Other assets and prepaid expenses | | 17,982 | | | 12,447 | | | 8,900 | | | 14,272 | | | 10,673 | | | 4,884 | |

| Financial assets | | 10,099 | | | 8,339 | | | 1,952 | | | 5,033 | | | 4,696 | | | 304 | |

| Cash and cash equivalents | | 43,669 | | | 42,419 | | | 1,250 | | | 46,433 | | | 45,335 | | | 1,098 | |

| Assets held for sale | | 763 | | | 763 | | | — | | | 2,046 | | | 2,042 | | | 1,700 | |

TOTAL ASSETS | | 202,128 | | | 194,725 | | | 17,907 | | | 186,156 | | | 183,182 | | | 11,696 | |

| Equity and Liabilities | | | | | | | | | | | | |

| Equity | | 82,120 | | | 82,120 | | | 6,601 | | | 72,382 | | | 72,382 | | | 7,222 | |

| Employee benefits liabilities | | 5,473 | | | 5,471 | | | 2 | | | 6,436 | | | 6,434 | | | 2 | |

| Provisions | | 21,468 | | | 21,365 | | | 103 | | | 19,771 | | | 19,641 | | | 135 | |

| Deferred tax liabilities | | 4,784 | | | 4,411 | | | 373 | | | 4,332 | | | 4,320 | | | 12 | |

| Debt | | 29,463 | | | 22,907 | | | 10,082 | | | 27,153 | | | 24,496 | | | 3,972 | |

| Trade payables | | 33,008 | | | 33,045 | | | 182 | | | 31,726 | | | 31,735 | | | 95 | |

| Other financial liabilities | | 39 | | | 11 | | | 28 | | | 18 | | | 18 | | | — | |

| Tax liabilities | | 1,806 | | | 1,900 | | | 63 | | | 1,568 | | | 1,546 | | | 29 | |

| Other liabilities | | 23,635 | | | 23,163 | | | 473 | | | 22,657 | | | 22,497 | | | 229 | |

| Liabilities held for sale | | 332 | | | 332 | | | — | | | 113 | | | 113 | | | — | |

TOTAL EQUITY AND LIABILITIES | | 202,128 | | | 194,725 | | | 17,907 | | | 186,156 | | | 183,182 | | | 11,696 | |

________________________________________________________________________________________________________________________________________________

Figures presented for Industrial activities and Financial services include intersegment transactions

Statement of Cash Flows by activity

Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the year ended December 31, 2023 | | For the year ended December 31, 2022 |

| (€ million) | | Stellantis | | Industrial activities | | Financial services | | Stellantis | | Industrial activities | | Financial services |

| Consolidated profit | | 18,625 | | | 18,625 | | | 454 | | | 16,779 | | | 16,779 | | | 620 | |

Adjustments for non-cash items: | | | | | | | | | | | | |

| depreciation and amortization | | 7,549 | | | 7,513 | | | 36 | | | 6,797 | | | 6,772 | | | 25 | |

| (gains)/losses on disposals | | (195) | | | (164) | | | 7 | | | (192) | | | (165) | | | (27) | |

| change in deferred taxes | | 701 | | | 372 | | | 329 | | | (711) | | | (738) | | | 27 | |

| other non-cash items | | 720 | | | 538 | | | 182 | | | 391 | | | 310 | | | 81 | |

| Change in provisions | | 2,460 | | | 2,438 | | | 22 | | | 1,906 | | | 1,870 | | | 40 | |

| Result of equity method investments net of dividends received | | (156) | | | (420) | | | (224) | | | (47) | | | (266) | | | (399) | |

| Change in carrying amount of leased vehicles | | (1,747) | | | (125) | | | (1,622) | | | (483) | | | (456) | | | (27) | |

Changes in working capital | | (5,472) | | | (5,539) | | | 67 | | | (4,481) | | | (4,358) | | | (128) | |

| | | | | | | | | | | | |

| Net cash from/(used in) operating activities | | 22,485 | | | 23,238 | | | (749) | | | 19,959 | | | 19,748 | | | 212 | |

Proceeds from disposal of shares in consolidated companies and of investments in non-consolidated companies(1) | | 1,457 | | | 1,756 | | | 259 | | | 235 | | | 177 | | | 58 | |

Acquisitions of consolidated subsidiaries and equity method and other investments(2) | | (3,885) | | | (4,186) | | | (821) | | | (666) | | | (769) | | | 3 | |

| | | | | | | | | | | | |

| Proceeds from disposals of property, plant and equipment and intangible assets | | 533 | | | 516 | | | 17 | | | 545 | | | 542 | | | 3 | |

| Investments in property, plant and equipment and intangible assets | | (10,193) | | | (10,099) | | | (94) | | | (8,615) | | | (8,539) | | | (76) | |

| Change in amounts payable on property, plant and equipment and intangible assets | | 1,068 | | | 1,068 | | | — | | | (399) | | | (399) | | | — | |

| Net change in receivables from financing activities | | (3,834) | | | (248) | | | (3,586) | | | (1,413) | | | (61) | | | (1,349) | |

| Other changes | | (193) | | | (120) | | | (73) | | | (218) | | | (219) | | | 1 | |

| | | | | | | | | | | | |

| Net cash from/(used in) investing activities | | (15,047) | | | (11,313) | | | (4,298) | | | (10,531) | | | (9,268) | | | (1,360) | |

| Distributions paid | | (4,208) | | | (4,208) | | | (4) | | | (3,354) | | | (3,358) | | | 2 | |

| Proceeds from issuance of shares | | 92 | | | 92 | | | 564 | | | 40 | | | 42 | | | 97 | |

| (Purchases)/sales of treasury shares | | (2,434) | | | (2,434) | | | — | | | (923) | | | (923) | | | — | |

| Changes in debt and other financial assets and liabilities | | 114 | | | (4,545) | | | 4,659 | | | (6,880) | | | (8,057) | | | 1,177 | |

| Change in securities | | (2,754) | | | (2,747) | | | (7) | | | (2,069) | | | (2,003) | | | (66) | |

| Other changes | | (10) | | | (10) | | | — | | | 19 | | | 8 | | | 10 | |

| | | | | | | | | | | | |

| Net cash from/(used in) financing activities | | (9,200) | | | (13,852) | | | 5,212 | | | (13,167) | | | (14,291) | | | 1,220 | |

| Effect of changes in exchange rates | | (836) | | | (823) | | | (13) | | | 608 | | | 595 | | | 13 | |

| (Increase)/decrease in cash and cash equivalents included in asset held for sale | | (166) | | | (166) | | | — | | | (65) | | | (65) | | | — | |

| Increase/(decrease) in cash and cash equivalents | | (2,764) | | | (2,916) | | | 152 | | | (3,196) | | | (3,281) | | | 85 | |

| Net cash and cash equivalents at beginning of period | | 46,433 | | | 45,335 | | | 1,098 | | | 49,629 | | | 48,616 | | | 1,013 | |

| NET CASH AND CASH EQUIVALENTS AT END OF PERIOD | | 43,669 | | | 42,419 | | | 1,250 | | | 46,433 | | | 45,335 | | | 1,098 | |

________________________________________________________________________________________________________________________________________________

Figures presented for Industrial activities and Financial services include intersegment transactions

(1) In April 2023, Stellantis completed the sale of the 50 percent interest held in FCA Bank to CACF for net consideration of €1,581 million of which €1,566 million related to industrial activities and €15 million related to financial services. An additional consideration of €68 million was subsequently received as earn-out. The total net consideration is comprised of €1,090 million cash and a credit linked note issued by FCA Bank with fair value at inception of €906 million and a residual amount of €559 million at December 31, 2023 after partial repayment, reported for Financial services within “Acquisitions of consolidated subsidiaries and equity method and other investments”

(2)The amount in Financial services for the year ended December 31, 2023 include the residual amount of €559 million of the credit linked note mentioned above

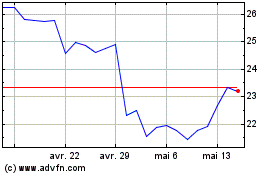

Stellantis NV (NYSE:STLA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Stellantis NV (NYSE:STLA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024