UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 28, 2024

| |

|

SUZANO S.A. |

| |

|

|

| |

By: |

/s/ Marcelo Feriozzi Bacci |

| |

Name: |

Marcelo Feriozzi Bacci |

| |

Title: |

Chief Financial and Investor Relations Officer |

Exhibit 99.1

Management

Report

MESSAGE

FROM MANAGEMENT

The

year 2023 was replete with milestones that lay the foundation for the future of the Company and its business. In the midst of greater

volatility in international pulp prices, which at the start of the year declined sharply at an unprecedented pace, and the strong influence

on demand caused by significant variations in inventories across paper chains in Europe and China, our management’s decisions were

taken with the aim of maximizing long-term value creation.

In

the wake of this highly volatile scenario, the evolution of fundamentals since mid-2023 sustained a series of increases in pulp prices,

resulting in the recovery of Adjusted EBITDA throughout the year. The paper and packaging business unit once again delivered solid results

in the period. As a result, consolidated Adjusted EBITDA in 2023 came to R$18.3 billion.

The

market scenario, combined with the largest investment cycle in our century-old history - R$18.6 billion in competitiveness and growth

projects in 2023 – demanded financial discipline from us in managing our balance sheet. We continued to generate cash and create

the conditions that would enable us to achieve significant advances in our strategic avenues.

One

of management’s key focus themes during the year and which represents the avenues “Be best-in class in the total pulp

cost vision” and “Maintain relevance in pulp, through good projects”, was the progress of the Cerrado Project

in Ribas do Rio Pardo (MS), which is one of the biggest private investments underway in Brazil. Having successfully executed the physical

and financial schedules, which continued as planned throughout the year and we are already planning the startup of the new mill by June

2024. Besides being the largest and most competitive pulp mill in our portfolio in the future, the project and its operations take into

account the most advanced social and environmental parameters.

We

also accelerated the expansion of our forestry base in 2023 by planting 1.3 million eucalyptus seedlings per day and seizing opportunities

for acquiring forestry assets, since we believe that eucalyptus biomass is a key component of our structural competitiveness and a future

growth optionality.

Since

we believe that the expansion of Suzano's addressable market is associated with an increase in the consumption of eucalyptus hardwood

pulp, we approved an important project to expand the production of Eucafluff, a pioneering material developed by Suzano, within the strategic

avenue “Maintain relevance in pulp, through good projects.” The new line at the Limeira Unit (SP) will have a capacity

of 340 thousand tons per year, taking our total production capacity to 440 thousand tons per year, with production scheduled to start

in 2025.

In

the strategic avenue “Advance in the links of the chain, always driven by competitive advantage,” we successfully

acquired and merged Kimberly-Clark’s tissue assets in Brazil, besides adding the Neve brand to our consumer goods portfolio. We

also announced the construction of a sanitary paper mill in Aracruz (ES), with an annual production capacity of 60,000 tons and slated

for startup in 2026.

Apart from all

these initiatives, the cash generation and strong balance sheet in 2023 enabled the company to carry out, as compensation for shareholders,

the third consecutive share buyback program at an average price of R$44.02 per share, and the decision to pay R$1.5 billion as interest

on equity, both of which once again underline the Company's commitment to capital allocation.

To guarantee our

successful future, we strongly believe in two key action fronts: capital allocation with financial discipline and preparing people to

build our future of excellence. We ended the year with an entrepreneurial spirit, improving the Company every single day to create an

even more positive social, environmental, and economic impact and to play an increasingly important role in the sector and in society.

It is this virtuous circle that has been transforming our Company over the past one hundred years (celebrated in January 2024), inspired

by our purpose of “Renewing life inspired by trees.”

The Management.

OVERVIEW

Suzano is committed

to becoming the global benchmark in developing sustainable and innovative solutions based on planted trees - the natural resource on

which our current and future business is founded on. The world's leading producer of market pulp and one of Latin America’s largest

paper producers, Suzano exports its products - essential for hygiene, education, and the well-being of society - to more than one hundred

countries. Its thirteen plants, including the joint operation Veracel, have a combined installed capacity to produce 10.9 million tons

of market pulp, 1.3 million tons of paper and 280,000 tons of consumer goods a year. In 2023, the Company announced the expected startup

of the Cerrado Project by June 2024. The new market pulp mill will have an annual production capacity of 2.55 million, of which around

0.7 million tons should be already available for sale in 2024.

At the end of 2023,

the Company had over 49,000 direct and indirect employees and has been investing for one hundred years in innovative and sustainable

solutions based on planted trees.

INNOVATION

In 2023, the Company

actively pursued its strategic avenues and the commitments to “renewing life inspired by trees”. The Sustainability, Research

and Innovation Department invested in an extensive portfolio of advanced developments to ensure the sustainability of company’s

forests and operations, as well as its business growth and transformation of business, to expand its market beyond pulp and paper, besides

consolidating its position as an innovative company committed to the SDGs.

The Clonal Development

project improved the recombination of breeding populations and the selection of new parents, resulting in the planting of 118,000 seedlings

with high potential for large-scale selection. Using the Tetrys clonal allocation system, clones were allocated for approximately 15%

of Suzano’s total planted area in 2023, corresponding to more than three hundred million trees. And through the Viveiros de Transição

project, the area for experimenting with superior genetic materials was expanded, which accelerated the recommendation of new clones

on an operational scale, with greater genetic and phytosanitary safety.

In 2023, FuturaGene

received commercial approval from the National Biosafety Technical Commission (CTNBio) for four new genetically modified (GM) eucalyptus

trees. The approvals include two new herbicide-tolerant GM eucalyptus trees, the first insect-resistant GM eucalyptus and the first GM

eucalyptus variety that combines two characteristics: higher yield and herbicide tolerance. Currently, FuturaGene has eight approvals

for GM eucalyptus. After approval, GM eucalyptus trees are incorporated into Suzano's genetic enhancement programs for expanded tests

in different environmental conditions and following the highest safety and ethical guidelines, as established in Suzano's Genetically

Modified Tree Policy, and the company's forestry management practices. This year, the focus was on increasing field trials with GM eucalyptus,

whose characteristics include higher productivity and herbicide tolerance.

The FenomicS project

continued to bring resilience to the forests of the future, with its mission to characterize safely on a large-scale, genotypes for sensitivity

to pesticides, resistance to diseases and pests, and tolerance to abiotic stresses, accelerating the breeding program and minimizing

losses by quickly identifying clones that should not proceed to the subsequent phases. Last year, climate predictability and erosion

risk algorithms, as well as soil and plant sensors, were provided to the operation. As a result, operations can now plan better by monitoring

operational scenarios before they turn unpredictable, being able to selected and prioritized areas for planting and reduced the time

and cost of soil and plant analysis, besides eliminating the generation of waste from this activity.

To address the

Company's challenges and ambitions, in 2023, the innovation in pulp portfolio included projects focused on processes, as well as the

development and consolidation of new products and services. To advance further on its “Fiber to Fiber” strategy, the Company

expanded its portfolio by developing new eucalyptus pulp products with different characteristics and physical properties, which will

enable the Company to deliver high-performance and competitive products that replace other competing fibers, as well as enter new markets,

such as specialties and packaging. The conversion of these products into paper and packaging has shown diverse benefits across the value

chain, such as the replacement of competing fibers, which are becoming scarce and have inferior sustainability aspects, reduction of

the density of papers produced, which increases productivity and reduces specific energy consumption in the paper production process,

thus contributing to greater energy efficiency and bringing sustainability to end consumers.

For better management

and control of specific wood consumption at Suzano's mills, diagnostics were run, new measurement methodologies were implemented, in-depth

identification was made of the main factors that influence this indicator and specialists from our mills were engaged to build knowledge

and generate value this, which is the main component of the company's pulp production cash cost. These actions led to the integration

of people and strategic technologies in wood quality management and brought important results for the company during the year.

Notable among the

projects rolled out by the consumer goods business unit in 2023 are the launch of Mimmo and Max double-ply toilet paper in 40m rolls.

These products represent a significant gain in sustainability since they generate 24% less plastic packaging waste and 50 % less internal

tube residue from the rolls, when compared to similar products in the market. In the development of Fluff pulp in 2023, most of the resources

were used to sustain the expansion project, while also monitoring, together with the corporate engineering team, the tests, and adjustments

for the production of Eucafluff® at the Limeira Unit, which is slated for startup in 2025.

In the paper and

packaging business unit, the Flexibles line was developed, obtaining approval for the paper wrapper for the cut size Report 500 sheets,

replacing the plastic wrapper, in line with Suzano's commitment to replacing products from fossil sources.

Finally, it is

worth highlighting that the 2023 Valor Inovação Brasil Awards, one of the leading innovation rankings in Brazil, compiled

by the Valor Econômico newspaper in partnership with Strategy&, the consulting arm of PwC, nominated Suzano for the third consecutive

year as the most innovative company in the pulp and paper sector and, for the first time, as the most innovative company in Brazil. Apart

from this important honor, Suzano was also recognized as the most innovative company by the CNI National Innovation Awards, in the large

companies – Process Innovation category, and won the ABTCP Sector Leaders Award, in the Market Pulp Manufacturer, Innovation (R&D

and Technology), Sustainability and Social Responsibility categories.

PULP

BUSINESS UNIT

The hardwood pulp

market witnessed different scenarios in each quarter of 2023. Continuing the trend in 2022, the first quarter witnessed high prices,

though at the end of the period, pulp prices dropped and remained low throughout the second quarter. However, at the end of the first

half of the year, prices rose gradually until they reached more stable levels in the fourth quarter. Several factors impacted the decline,

including the normalization of the logistics scenario, the destocking of finished goods across Europe, and the startup of new market

hardwood pulp mills. The price of pulp also went below the marginal cash cost of producers, which contributed to several unscheduled

downtimes.

Regarding the demand

for pulp in China, it is worth mentioning relevant factors that marked the year 2023: (i) the decline in pulp prices below the marginal

cost of integrated producers during the initial months of the year, which encouraged the trend of acquiring market pulp; (ii) increase

in paper exports; and (iii) economic reopening after the pandemic, resulting in high production levels of sanitary paper, paperboard

and printing and writing paper since the second quarter, and in the process of restocking, especially of sanitary paper, throughout the

value chain.

In Europe, the

destocking process across the paper chain lasted longer than initially expected, until the start of the second half of the year, naturally

impacting pulp demand during the period. Despite low demand and the challenging macroeconomic scenario, the European market witnessed

a recovery in utilization rates across the paper industry and in demand for pulp in the final two quarters of the year. The difference

between the prices of softwood and hardwood pulp widened, softwood pulp capacities were closed in the region and inventories at ports

were reduced, especially in the second half of the year, all of which increased the demand for hardwood pulp. Sanitary papers remained

resilient and stable in both the European and North American markets during the period.

On the supply side,

the year 2023 was marked by the entry of major projects. However, unplanned downtimes, mostly due to the market conditions, and the announcement

of definitive closures of less competitive mills helped soften the effect of these new capacities on the market.

For 2024, the Company

continue to prioritize the level of service to our customers around the globe, and to support the “fiber to fiber” replacement

movement, by supporting the commercial strategy for the entry of new volumes from Cerrado, which have been planned to hit the markets

by the end of the year.

PAPER

AND PACKAGING BUSINESS UNIT

According to Brazil's

Forestry Industry Association (IBÁ), demand for Printing & Writing paper in Brazil, considering imports, declined 11% in 2023

compared to 2022. Suzano’s paper sales, including the consumer goods unit, totaled 1,291 million tons, down 1% from 2022. Sales

of printing and writing paper declined sharply on account of lower demand caused mainly by the adjustment of stock levels across the

chain and by digitalization, especially in the coated paper line. Moreover, the volume of paperboard was also impacted by stock adjustments

across the chain. The sanitary papers segment continued to perform solidly since the acquisition of Kimberly Clark's tissue business

in Brazil in 2Q23.

In 2023, net revenue

from paper sales was R$9,078 million, up 7% from the previous year. Net revenue from the domestic market increased 15% year-on-year,

while revenue from exports decreased 9%. Of the total net revenue, 74% came from exports and 26% from domestic sales. In 2023, revenue

from paper sales mainly came from Brazil and Latin America (90%), followed by North America (5%), while other regions accounted for 5%.

Average net paper price in 2023 was R$7,030/ton, 9% higher than in 2022.

For 2024, the Company

plans to deliver solid operational performance in the paper and consumer goods lines, with the normalization of inventory levels in the

global chain, besides streamlining actions aimed at our portfolio of innovative products with the focus on sustainability, as well as

other initiatives, linked to the expansion of the Suzano go-to-market model, e-commerce and the strategy of attracting new customers,

thus ensuring business sustainability.

FINANCIAL

PERFORMANCE

Results

The consolidated

financial statements were prepared in accordance with the standards of the Securities and Exchange Commission of Brazil (CVM) and the

pronouncements issued by the Accounting Pronouncements Committee (CPC) and comply with the International Financial Reporting Standards

(IFRS) issued by the International Accounting Standards Board (IASB). The operational and financial information of Suzano S.A. is presented

on a consolidated basis and in Brazilian real (R$).

Net revenue

Suzano’s

net revenue in 2023 was R$39,756 million, a decrease of 20% from R$49,831 million in 2022, mainly due to the lower net price of pulp

during the year.

Cost of Goods Sold (COGS)

In 2023, cost of

goods sold totaled R$25,077 million, 1% higher than R$24,821 million in 2022, mainly due to higher cash cost of pulp production (+28%)

and higher Brent price, which affected logistics costs. COGS was positively affected by lower sales volume and by lower costs of commodities

(such as Brent and soda), but was offset by fixed costs, in addition to higher expenses with scheduled shutdowns (more shutdowns and

higher inflation in the period) and higher depreciation, amortization and depletion costs.

Gross profit

Gross profit decreased

from R$25,010 million in 2022 to R$14,679 million in 2023, mainly driven by lower price of pulp, as mentioned above.

Selling and administrative

expenses

Selling expenses

totaled R$2,596 million in 2023, up 5% from R$ 2,483 million in 2022, mainly driven by personnel and service expenses due to the merger

of Kimberly Clark’s tissue business in Brazil and other less relevant items.

Administrative

expenses came to R$1,923 million in 2023, an increase of 12% from R$1,710 million in 2022, chiefly due to the increase in personnel expenses.

Adjusted

EBITDA

Adjusted EBITDA

in 2023 totaled R$18,273 million, 35% lower than R$28,195 million in 2022, chiefly due to the lower average net price of pulp in USD

(-21%).

Net financial result

Net financial result

was an income of R$5,781 million in 2023, down 10% from an income of R$6,433 million in 2022. The performance in 2023 reflects the appreciation

of the Brazilian real against the U.S. dollar, as well as the positive results from derivatives.

Inflation adjustment

and exchange rate variation generated a positive impact of R$3,088 million in 2023, maintaining the positive impact of R$3,295 in 2022.

The result of operations with derivatives (debt and cash flow hedges) was an income of R$5,527 million in 2023 compared to an income

of R$6,762 million in 2022, mainly due to the appreciation of the Brazilian real against the U.S. dollar and the healthy adjustment of

the portfolio’s strike levels.

Net income (loss)

With the drop in

pulp prices, the Company registered net income of R$14,106 million in 2023, compared to R$23,395 million in 2022.

Debt

On December 31,

2023, gross debt stood at R$77,173 million and was composed of 94% long-term maturities and 6% short-term maturities. Foreign currency

debt corresponded to 79% of the Company's total debt at the end of the year. The percentage of gross debt in foreign currency, considering

the effect of debt hedge, was 87%.

Suzano contracts

debt in foreign currency as a natural hedge, since net operating cash generation is mostly denominated in foreign currency (USD) due

to its predominant status as an exporter. This structural exposure allows the Company to match loans and financing payments in USD with

receivable flows from sales.

On December 31,

2023, the average cost of debt in USD was 5.0% p.a. (considering debt in BRL adjusted by the market swap curve), marginally higher than

the average cost in USD of 4.7% registered on December 31, 2022. The average term of consolidated debt at the end of 2023 was 75 months,

as against 80 months at the end of 2022.

Cash, cash equivalents

and financial investments on December 31, 2023, amounted to R$21,613 million, 65% of which were invested in foreign currency fixed-income

and short-term investments. The remaining 35% was invested in local currency, in government and fixed-income bonds, remunerated at a

percentage of the DI rate.

On December 31,

2023, the Company also had a revolver credit facility of US$1.275 million (R$6.173 million), available through February 2027. As such,

the cash and equivalents of R$21,613 million plus the revolving credit facility amounted to a readily available cash position of R$27,786

million at the end of 2023. Also, the Company has a financing agreement with Finnvera (US$800 million) related to the Cerrado Project,

which has not yet been withdrawn, further strengthening its liquidity position.

On December 31,

2023, net debt stood at R$55,560 million (US$11,476 million), compared to R$57.103 million (US$10.944 million) on December 31, 2022.

The reduction in net debt is mainly due to the appreciation of the Brazilian real against the U.S. dollar.

Financial leverage,

measured as the ratio of net debt to Adjusted EBITDA in BRL, was 3.0 times on December 31, 2023 (2.0 times in 2022). The same ratio in

USD, a measure established in Suzano’s financial policy, was 3.1 times on December 31, 2023 (2.0 times in 2022).

OPERATING CASH

GENERATION

Operating cash

generation (adjusted EBITDA less sustaining capex) amounted to R$11,567 million in 2023, down 49% from 2022, due to lower Adjusted EBITDA

and higher sustaining capex.

| (R$ million) | |

2023 | | |

2022 | |

| Adjusted EBITDA¹ | |

| 18,273 | | |

| 28,195 | |

| Maintenance CAPEX² | |

| (6,706 | ) | |

| (5,632 | ) |

| Operating Cash Flow | |

| 11,567 | | |

| 22,563 | |

¹

Excludes non-recurring items and PPA effects.

²

Cash basis.

DIVIDENDS

The Bylaws of Suzano

establish a minimum mandatory dividend equivalent to the lowest amount between 25% of net income after constituting the legal reserves

for the fiscal year or 10% of Operating Cash Generation from the respective fiscal year. Operating Cash Generation is obtained by deducting

sustaining capex from Adjusted EBITDA.

As per the Notice

to Shareholders on December 1, 2023, the Company approved the distribution of interest on equity in the total gross amount of one billion,

five hundred million reais (R$1,500,000,000.00) at the rate of R$ 1.163375077 per share of Company, considering the number of shares

“ex-treasury” on the current date, as remuneration based on net income shown in the Company's quarterly balance sheet dated

September 30, 2023.

The Interest on

Equity mentioned above was calculated towards the full minimum mandatory dividends, as established in article 27 of the Bylaws of the

Company (10% of Operating Cash Generation), and the residual amount to additional dividends + 3% of Operating Cash Generation) related

to fiscal year ending December 31, 2023. Interest on equity was paid on January 10, 2024, to shareholders of record at the end of trading

on B3 S.A. – Brasil, Bolsa, Balcão (“B3”) on December 7, 2023 (baseline date in Brazil).

SHARE

BUYBACK PROGRAM

In 2023, the Company

continued its third consecutive share buyback program (“October/2022 Program”) to maximize value creation for its shareholders,

enabling the Company to efficiently allocate capital considering on the potential profitability of its shares, in order to generate higher

returns for its shareholders. In addition, the stock buyback signals to the market the management’s confidence in the Company’s

performance. The company acquired twenty million (20,000,000) shares during regular trading sessions on the stock exchange at an average

price of R$44.02/share, totaling R$880 million during the program, which was concluded on July 7, 2023.

In 2023, the Board

of Directors of the Company also resolved to cancel 37,145,969 common shares held in treasury, which had been acquired under the Company’s

share buyback programs approved at the Board of Directors meetings held on May 4, 2022 and July 27, 2022, and fully implemented between

May and September that year.

Based on shareholders

of record on December 31, 2023, the Company had: (a) 621,938,492 outstanding shares, as per the definition in article 67 of CVM Resolution

80/22; and (b) 34,765,600 treasury shares, corresponding to 5.2% of its total outstanding shares.

CAPITAL

EXPENDITURE

Capex totaled R$18,577

million in 2023, of which R$6,707 million went to forestry and industrial maintenance. Investments in Land and Forests totaled R$2,610

million and primarily went to projects aimed at increasing structural forest competitiveness. Investments in Expansion and Modernization

totaled R$694 million, mainly going to projects aimed at increasing the competitiveness of our industrial units, besides R$55million

to terminal ports and others. Investments in the Cerrado Project totaled R$8,511 million.

For 2024, Management

has approved a capital budget of R$16.5 billion, of which R$7.7 billion will be allocated to industrial and forestry maintenance and

R$4.6 billion to the Cerrado Project, among others.

CAPITAL

MARKETS

Suzano’s

stock is listed on the Novo Mercado, the trading segment of the São Paulo stock exchange (B3 – Brasil, Bolsa e Balcão)

with the highest corporate governance standards, and on the New York Stock Exchange (NYSE) – ADR Level II under the ticker symbols

SUZB3 and SUZ, respectively.

On December 31,

2023, the capital stock of the Company was represented by 1,324,117,615 common shares (SUZB3 and SUZ), of which 34,765,600 common shares

were held in the treasury. SUZB3 stock ended the year quoted at R$55.63/share, while SUZ stock was quoted at US$11.36/share.

RATING

In 2023, Fitch,

Moody's and S&P confirmed (in March, May and July, respectively), Suzano’s BBB-/Baa3 rating with a stable outlook. The agencies

highlighted the Company's leadership in the pulp, printing and writing paper, and cardboard sectors, as well as its growing share in

the tissue segment. They also mentioned Suzano's low-cost business model, as well as its solid financial management and liquidity position

during the investment period related to the Cerrado Project.

SUSTAINABILITY

Climate change

At the industrial

Units, the Company has reduced emissions by implementing modernization projects and by increasing the efficiency of furnaces, boilers

and turbogenerators gradually in order to reduce and replace high-emission fuels (such as fuel oil and natural gas) with low-emission

fuels (such as biomass and black liquor), and by deploying new technologies such as biomass gasification (Syngas), as will occur in the

future Unit at Ribas do Rio Pardo (MS), currently under construction and slated for startup in 2024.

After joining the

Science Based Targets Initiative (SBTi) in 2021, Suzano submitted its greenhouse gas (GHG) emissions ambition for assessment by the initiative

in 2023. This commitment to science-based guidelines reflects the company’s efforts to align its sustainability targets with internationally

recognized standards.

In 2024, the focus

will be on deeply understanding the decarbonization levers identified and seeking technical details to develop effective alternatives.

The process of setting targets based on the SBTi will be continued, while the decarbonization roadmap will be refined, especially after

the targets are approved by the initiative.

Carbon credits

The Company has

certification for ongoing carbon credit projects aimed at restoring degraded areas by reforesting them with native trees and eucalyptus.

In March 2023, the Company obtained approval for 1.7 million tons of carbon credits from Verra, a certification agency, in a potential

pipeline of over 30 million tons of carbon credits of forest origin - ARR (Afforestation, Reforestation and Revegetation).

Biodiversity

On the biodiversity

front, Suzano has been honoring its commitment to connect 500,000 hectares of forest fragments in the three biomes in which it operates.

In 2023, were planted and connected fragments of native vegetation through ecological corridors by implementing biodiverse models and

ecological restoration actions in the three corridors: the Atlantic Forest, Cerrado and the Amazon. The 2023 results of this commitment

will be disclosed in the 2023 Sustainability Report.

Suzano is one of

the 40 members of the working group of the Task Force on Nature-Related Financial Disclosures (TNFD), whose mission is to create a risk

management and disclosure instrument for organizations to report and act on threats related to nature. As part of the initiative's multidisciplinary

forum, the Company participated directly in preparing and constructing the guidelines and indicators. With the TNFD recommendations formally

announced in September 2023, the Company announced its commitment to adopt the financial disclosure standard from the year 2025, underscoring

its commitment to the protection of biodiversity forests.

In 2023, the Company

joined the International Sustainable Forestry Coalition (ISFC), launched by a group of leading sustainable forestry companies from around

the world, which will seek to work collectively in addressing the global environmental challenges.

New business

In May 2023, Suzano

and Spinnova inaugurated in Finland, Woodspin, the first mill to produce the Spinnova® Fiber from micro fibrillated cellulose. It

is a pre-commercial plant with production capacity of up to 1,000 tons of sustainable, recyclable and fully biodegradable textile yarn.

The new mill will expand testing to mature the technology and increase its scalability.

In Brazil, Suzano

started operations at the MFC mill in Limeira, whose capacity is 20kt/year. Micro fibrillated cellulose, besides being used in the production

of textile fiber, is also being studied for use in papers, personal hygiene and construction.

Suzano Ventures,

the corporate venture capital arm of Suzano, made its first two investments: The first, of up to US$6.7 million, in the British startup

Allotrope Energy, whose technology focuses on the development of a carbon technology based on biomaterials for use in lithium-carbon

batteries; and the second, of up to US$1.0 million, in Marvin Blue, an Israeli agroforestry company that uses cutting-edge technology

to analyze land use, measure carbon sequestration and the use of water resources, bringing greater transparency and reliability to these

operations.

Also, two BioSolutions

Startup Acceleration Programs were launched to identify and foster businesses based on planted forests: One is a global edition in collaboration

with Cycle Momentum of Canada, and the other in Brazil, in partnership with Emerge. In all, the initiatives have supported twelve deep

tech start-ups, providing access to technical resources, mentoring and connections with partners across the innovation ecosystem, four

of which were selected for investment.

Social development

Suzano is present

in more than 200 Brazilian municipalities, where 3.3 million people live in poverty. In this context, its social strategy plays a key

role by pursuing different approaches to local development, which are designed to combat poverty, promote quality education and maintain

healthy relations and permanent dialogue with neighboring communities.

In 2023, investments

in social projects were the highest ever allocated to priority social agendas, relationships, education and poverty reduction in Brazil.

The year was also

marked by diverse partnerships aimed at leveraging social development actions. In the Amazon region, in 2023 were formalized the investment

of R$ 1.6 million, together with the Partners for the Amazon Platform (PPA) and with the support of the United States Agency for International

Development (USAID), in the Sustainable Territorial Development project in Southeast Pará. The goal is to help strengthen family

farming and sustainable extractivism in the Legal Amazon region, benefiting 420 families.

China

In March 2023,

were inaugurated the Innovation Hub in Shanghai, China, reinforcing the long-term strategic efforts to create an open and transformative

innovation platform. The initiative aims to address growing customer demand for materials and applications developed from eucalyptus

pulp and new biomaterials, and act as a platform for collaboration among various industry players and other stakeholders in China and

abroad to stimulate sustainable development through innovability.

With the hub, Suzano

plans to contribute to China's carbon neutral agenda, which has transitioned rapidly from high-speed growth to high-quality growth, and

this was only possible due to the wealth of expertise in R&D and innovation obtained in recent decades.

Value chain

Suzano constantly

monitors the Supplier Performance Index (IDF), which evaluates critical suppliers on social, environmental and safety requirements, with

an average approval rate of 96%. For those who fall below the desired score, action plans are defined to recover the score.

Also carry out

social and environmental analysis in the contracting phase, as well as economic, financial, and technical assessments. In 2023, during

the third cycle of the program, 200 suppliers (twice the number invited in 2022) were invited, with opportunities related to GHG emissions

to participate in the Climate Change in the Value Chain program. Thus, seek to improve the management of this topic and encourage the

reduction of GHG emissions across our supply chain every year, in line with our commitment to becoming even more climate positive. To

develop the program, Suzano have partnered with CDP, an independent global organization.

Of the 200 suppliers

invited, 152 representatives from categories considered critical in terms of greenhouse gas emissions participated, an engagement higher

than the average of 61% registered by other companies that also use the CDP Supply Chain platform.

Sustainable finance

Currently, 39%

of Suzano’s total debt is linked to ESG debt instruments, including sustainability-linked bonds and sustainability-linked loans.

The company reports annually the progress of the Commitments to Renewing Life in its sustainability report and also in the Sustainability

Center, to ensure transparency of its indicators.

Retrofitting capex

Adjustments were

made to capital allocation definitions for retrofitting projects and currently, the financial parameters have a weight of 75% while the

impacts on the Commitments to Renewing Life (which represent Suzano's long-term sustainability goals) represent 25%. Expansion investments

also include an analysis of the impact on these commitments.

Carbon pricing

The cost of carbon

emissions started to be included in the financial analysis of projects in order to assess the risks of future public policies that could

increase the Company’s costs, such as carbon taxes or limits on emissions.

The Internal Carbon

Price, which quantifies a project's potential to reduce greenhouse gas emissions and monetizes this benefit, started to be considered

while taking business and investment decisions. In practice, the Internal Carbon Price is now included in the Net Present Value (VLP)

of projects, thus helping to make investments in decarbonization feasible. Besides incorporating the feasibility assessment, to determine

in which carbon market scenario the project being analyzed becomes promising.

ESG Indexes and Ratings

In January 2023,

Suzano’s MSCI rating was upgraded from “B” to “BB”, consolidating the trend of improvement in recent years,

and reinforced by the score’s increase from 4.3 to 4.5 in 2023. Suzano understands that its current MSCI score does not adequately

reflect its sustainability practices and performance which, in its assessment, is among the most advanced in the global pulp and paper

industry.

The Company also

received the Platinum seal in the EcoVadis Sustainability Rating 2023, which measures the quality of the corporate social responsibility

management process among companies around the world. With a score of 78 points – nine higher than in 2022 – the company was

classified among the 1% of the top-rated companies from among the 100,000 companies in more than 175 countries that participated in the

process.

Also, the annual

review by Sustainalytics maintained Suzano in the “Low Risk” category.

Finally, the Company

was once again selected to the Corporate Sustainability Index (ISE) for the 2024 cycle. It was also ranked second in the sector worldwide

in the Dow Jones Sustainability Index (DJSI), once again underlining the quality of its management of sustainability issues.

GOVERNANCE

Since 2017, the

Company has been listed on the Novo Mercado special listing segment of B3 S.A. – Brasil, Bolsa, Balcão, and since 2018,

its shares have been listed on Level II American Depositary Receipts (ADRs) on the New York Stock Exchange (NYSE). Considering this broad

regulatory environment in which the Company operates, Suzano is committed to corporate governance best practices, such as those issued

by the Brazilian Institute of Corporate Governance (IBGC), the Securities and Exchange Commission of Brazil (CVM), B3 and NYSE.

Suzano has a consistent

and effective governance structure, which functions in a clear, transparent and well-grounded manner to aid in the decision-making process

and in the equitable treatment and protection of the interests of shareholders, the Company and the market. The highlight of Suzano’s

corporate governance was its new board of directors for the period 2022-2024, with over 30% gender diversity and the majority being independent

members.

It is also worth

highlighting the formalization and approval in 2023 of the Specific Clawback Policy related to the Company's management in compliance

with a recent requirement of the New York Stock Exchange (NYSE). The Company has already voluntarily adopted said mechanism through the

Malus and Clawback clauses, which thus represents an evolution of governance this year with regard to executive compensation.

In its mission,

the Board of Directors maintains a broad vision of the Company, relying on the valuable participation and support from other bodies in

the Suzano’s governance structure: the Shareholders Meeting, Executive Board, Statutory Audit Committee, Audit Board, Internal

and External Audit and other non-statutory advisory committees to the Board of Directors, namely the Sustainability, Management and Finance,

Strategy and Innovation, People, Appointment and Compensation Committees. The Board of Directors also has several tools to assist in

its governance activities, notably the Code of Conduct, which was revised and approved by the Board of Directors in 2023, and the policies

adopted by the Company, all in alignment with its Bylaws, which synthesize the corporate governance principles while also disseminating

these principles and practices across diverse governance fronts. These policies include the Corporate Governance Policy, the Related

Party Policy, the Integrated Risk Management Policy, the Anticorruption Policy, the Material Fact or Fact Disclosure Policy, the Trading Policy for Securities Issued by Suzano S.A.,

the Debt Policy and the Derivatives Management Policy.

Through this management

and control model, which relies on the engagement of all bodies and the use of the above-mentioned mechanisms and tools, as well as the

disclosure and the guarantee of information transparency through the Reference Form, the 20-F Form, the Governance Statement and diverse

documents disclosed on the Investor Relations Website, the Company ensures compliance with the fundamental principles of transparency,

equity, accountability and corporate responsibility in its relations with stakeholders while constantly improving its corporate governance.

In 2023, the Company's

journey of continuous evolution included the revision of the following policies: (i) Risk Management Policy; (ii) Securities Trading

Policy; (iii) Material Information Disclosure Policy to adapt the references to changes in applicable laws, while the following were

also revised and updated: (i) the Financial Debt Policy,; (ii) the Derivative Management Policy; (iii) the Related Party Policy; (iv)

the Anticorruption Policy; and (v) the Charter of the Board of Directors.

The Anticorruption Policy was notably

amended to reflect the global applicability guidelines and to simplify the concepts by translating them into a more succinct and objective

form. It now includes: (a) guideline on political contributions in line with good market practices; (b) redefinition of the guidelines

involving hiring and monitoring third parties, considering that the scope of the background check (BKG) process was streamlined and expanded

to all third parties; (c) express definition of private corruption and inclusion of the necessary precautions in relations with private

entities; (d) inclusion of the definition and necessary precautions in transactions involving Politically Exposed Persons (PEP); and

(e) express definition and guidelines on Money Laundering.

In 2023, the Company's

privacy and personal data protection (P&PD) governance program worked to increase its level of maturity regarding legal requirements

and NIST Privacy criteria through the following measures: (i) disclosure and execution of the Policy on Management of Risks in R&PD;

(ii) assessment of Risks in Processes involving the processing of personal data, with the preparation of the Data Protection Impact Report

(RIPD) when applicable; (iii) evaluation of strategic projects involving personal data – Privacy by Design; (iv) assessment of

supplier maturity regarding P&PD and information security requirements; (v) Privacy Center on the company website; (vi) In-person

training at industrial areas; Mandatory training on the subject of P&PD; (vii) annual assessment of the Company's maturity in R&PD

by an independent consulting firm.

Note that all the

long-term goals set by the Company (called Commitments to Renewing Life) remained an integral part of the individual variable compensation

of at least one executive officer, while the Diversity and Inclusion targets also remained a collective target for the entire leadership.

AUDIT

AND INTERNAL CONTROLS

The management

of Internal Controls at Suzano is structured to include the Management, as well as the Committees and Commissions advising the Board

of Directors and the Executive Board, the Managers and all employees of the Company. The purpose is to enable safer, more adequate and

efficient business conduct in line with established regulations.

Based on annual

or ad hoc reviews, the process flows are continuously validated, and compliance tests are conducted regularly to verify the effectiveness

of the existing key internal controls against the risks to which Suzano is exposed. The Company systematically applies the Control Self-Assessment

(CSA) methodology, an integrated solution that periodically documents the performance of controls related to financial statements and

management, with the focus on key business obligations. It also helps in permanently monitoring the strict compliance with laws, rules

and regulations, policies and procedures, and in rolling out contingency plans, all this to ensure the proper segregation of functions

and avoid any conflict of interests.

The Company reviews

its processes and controls annually, updating 100% of the matrix of risks and controls associated with the exposure of potential flaws

in obtaining SOx recertification, as well as in key management and compliance processes. Onsite training and e-learning programs are

held regularly and revised whenever necessary, reinforcing the behavior expected in light of the Culture of Internal Controls, with the

focus on Sarbanes-Oxley (SOx), laws governing corporations in Brazil and specific rules for FPIs on anti-corruption and on prevention

of losses and frauds.

In addition to

the CSA flow, Suzano has a prior checking routine by the Internal Control Management team, which corroborates the quality assurance done

by the Controls Environment, which is always updated and reflects the reality of the Company’s process in terms of Internal Control

Evaluation (ICE). In addition, the Internal Audit area independently assesses the effectiveness of controls, reinforcing the maturity

and consistent execution of controls and the mitigation of any associated risks.

To ensure quick

and successful implementation of actions related to the control environment, the status of key issues that could affect the Company's

SOx recertification process is promptly reported to Senior Management using a tool developed internally that offers a consolidated vision,

enabling the management of timeframes and prioritization of relevant actions with those responsible in the business areas so that risks

are mitigated on time in the right manner.

As such, and in

line with environmental compliance, internal controls are reviewed and assessed by the Internal Controls Management area and evaluated

independently by both Suzano’s Internal Audit and independent external audit. The findings are periodically reported to the Executive

Board, Board of Directors, Statutory Audit Committee and Audit Board through a minimum annual agenda agreed upon with them.

In case of violation

of internal rules and external requirements, disciplinary guidelines and/or corrective measures are taken according to the specific policy

and by each area independently. If necessary, these violations are submitted to the Conduct Management Committee, an advisory body to

the Board of Directors. In compliance with Section 404 of the Sarbanes-Oxley Act, the effectiveness of internal controls related to financial

information is based on criteria established in the Internal Control - Integrated Framework defined by the Committee of Sponsoring Organizations

of the Treadway Commission (COSO). The appraisals are carried out internally by the Company and assisted by an independent auditor (PwC

PricewaterhouseCoopers), which evaluated the key controls and found them adequate, with no significant and/or material deficiencies or

observations that compromise the Company's certification. These findings are submitted systematically to the Company’s governance

bodies.

PEOPLE

Organizational

culture and people strategy

Suzano strives

not only to promote an increasingly diverse, inclusive, respectful and plural environment, but also to map a cultural journey that values

all these aspects, in accordance with law, collective bargaining agreements and its Code of Conduct.

In 2023, the Cultural

Journey initiative, which is a circular movement that permeates leadership and operations in a collaborative manner, was rolled out.

Aligned with the driver “People who inspire and transform”, the Cultural Journey emphasized throughout the year, the leader

who inspires and trains people, one who does not complicate what is simple and who strives to develop the team. A fundamental component

of the initiative was the listening process at international units and offices, which served as a source of learning for opportunities

for improvement in relation to all employees. Through focus groups, approximately 1,500 employees, representing all areas of the business,

were heard. With a governance framework in place, the initiative supports leaders in reducing bureaucracy in processes, monitoring the

progress of actions and projects, and in defining new initiatives.

Leadership,

development and training

In 2023, the performance evaluation

of employees went through a process change, increasing the weight given to behavioral elements of performance alongside technical aspects.

The goal is to look at the presence of culture drivers among teams instead of making an evaluation purely on technical results obtained

during the year. To support performance analysis, Sommos platform was used, and includes 360-degree evaluations not only of leadership,

but also of colleagues, partners and team members, and is applied to consultant positions and above. The initiative is the main milestone

in the journey of cultural evolution, as it simplifies and expands learning opportunities. In 2023, the system evaluated 6,854 people.

Another important

achievement in 2023 was the engagement survey conducted at the end of the 2023 cycle, using the Korn Ferry methodology, in which 85%

of the company participated. The overall result was favorable for Suzano, that is, people's positive perception in relation to the questions

was 84%, which is the same percentage as in the last survey conducted in 2021. This result places Suzano among the best performers in

the market.

Diversity,

Equity and Inclusion

For Suzano, promoting

diversity, equity and inclusion is both a responsibility and a business strategy. In a plural working environment, people are more engaged,

creative, and collaborative, which increases talent attraction and retention.

The Commitments

to Renewing Life include targets for 2025: having 30% of women and black people in leadership positions, having a 100% inclusive environment

for LGBTQIAPN+ people and people with disabilities, besides guaranteeing 100% accessibility. The 2023 results related to these commitments

will be disclosed in the Sustainability Report.

The Company has made progress each year

but is aware of the challenges. Regarding the target of women in manager positions and above, the percentage increased from 19.2% in

2020 to 24.9% in 2023. Black people in these positions increased from 18.3% in 2020 to 20.4% in 2023.

To promote the

career development of diversity groups (women, black people and PwDs), the D+ Program was launched, based on sponsorship and exposure

to internal opportunities, with the guarantee of building a development plan. In 2023, more than three hundred people were mapped for

participation in the program, which is based on assessments, mentoring sessions and a development trail.

In 2023, Suzano

won the 30% Club Brazil Award, which recognizes Brazilian listed companies that contribute to the growth of gender parity on their Boards.

To ensure an inclusive

work environment, the Company works in synergy with Plural affinity groups - a program designed to offer spaces for reflection and acceptance,

as well as to raise awareness and engagement across Suzano.

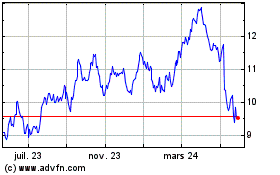

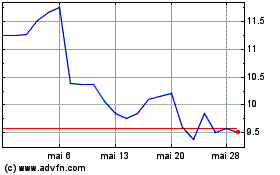

Suzano (NYSE:SUZ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Suzano (NYSE:SUZ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024