Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

21 Décembre 2023 - 10:49PM

Edgar (US Regulatory)

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON DECEMBER 21, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

ISSUER TENDER OFFER STATEMENT

UNDER SECTION 13(e)(1) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. 1)

TEMPLETON DRAGON FUND, INC.

(Name of Subject Company)

TEMPLETON DRAGON FUND, INC.

(Name of Filing Person (Issuer))

COMMON SHARES, $0.01 PAR VALUE PER SHARE

(Title of Class of Securities)

88018T101

(CUSIP Number of Class of Securities)

Alison E. Baur

One Franklin Parkway

San Mateo, CA 94403-1906

(954) 527-7500

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of Filing Person)

CALCULATION OF FILING FEE

|

TRANSACTION VALUATION $83,580,743.57 (a)

|

AMOUNT OF FILING FEE: $12,366.52 (b)

|

|

(a)

|

Pursuant to Rule 0‑11(b)(1) under the Securities Exchange Act of 1934, as amended, the transaction value was calculated by multiplying 8,451,035 Common

Shares of Templeton Dragon Fund, Inc. by $9.89, 98% of the Net Asset Value per share of $10.09 as of the close of ordinary trading on the New York Stock Exchange on November 6, 2023.

|

| |

|

|

(b)

|

Calculated as $147.96 per $1,000,000 of the Transaction Valuation.

|

/ / Check box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

Amount Previously Paid:

Form or Registration No.:

Filing Party:

Date Filed:

/ / Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

/ / third-party tender offer subject to Rule 14d-1.

|

|

|

|

|

|

/X/ issuer tender offer subject to Rule 13e-4.

|

|

|

|

|

|

/ / going-private transaction subject to Rule 13e-3.

|

|

|

|

|

|

/ / amendment to Schedule 13D under Rule 13d-2.

|

|

|

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: / /

This Amendment No. 1 to the Issuer

Tender Offer Statement on Schedule TO filed with the U.S. Securities and Exchange Commission on November 21, 2023, by Templeton Dragon Fund, Inc., a Maryland corporation (the “Fund”), relating to an offer to purchase for cash up to 8,451,035 shares of its issued and outstanding common shares, $0.01 par value per share, amends such Issuer Tender Offer Statement on Schedule TO to add

an additional exhibit in accordance with Rule 13e-4(c)(1) promulgated under the Securities Exchange Act of 1934, as amended.

| |

(a)(5)(iii)

|

Press Release dated December 21, 2023

|

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is

true, complete and correct.

| |

TEMPLETON DRAGON FUND, INC.

|

| |

|

| |

/s/ Alison E. Baur

Alison E. Baur

Vice President and Assistant Secretary

|

December 21, 2023

Exhibit

(a)(5)(iii)

|

|

TEMPLETON DRAGON FUND, INC.

300 S.E. 2nd Street

Fort Lauderdale, FL 33301

|

For more information, please contact Franklin Templeton at 1-800-342-5236.

TEMPLETON DRAGON FUND, INC. (“TDF”) ANNOUNCES

EXPIRATION OF SELF-TENDER OFFER

Fort Lauderdale, Florida, December 21, 2023—Templeton Dragon Fund [NYSE: TDF] (the “Fund”), today announced the preliminary results of its issuer tender offer to purchase for cash up to 8,451,035 of its common shares, representing 25% of its issued and

outstanding common shares.

The tender offer expired at 5:00 p.m. New York City time, on Wednesday, December 20, 2023. Based on current

information, approximately 23,989,011 common shares, or approximately 70.96% of the Fund’s common shares outstanding, were tendered through the expiration date. This total includes shares tendered pursuant to notices of guaranteed delivery.

Accordingly, on a pro rata basis, approximately 35.22% of Shares for each stockholder who properly tendered Shares have been accepted for payment. The final number of shares validly tendered and accepted pursuant to the tender offer will be

announced at a later date.

The Fund expects to make cash payments for tendered and accepted shares at a price equal to 98% of the Fund’s net asset

value (“NAV”) per share as of the close of trading on December 20, 2023. Payment for shares tendered and accepted is expected to be sent to tendering shareholders within approximately 5 business days after the expiration date.

The offer to purchase and other documents filed by the Fund with the U.S.

Securities and Exchange Commission (the “SEC”), including the Fund's annual report for the fiscal year ended December 31, 2022, are or will be available without cost at the SEC’s website (sec.gov) or by calling the Fund’s Information Agent at (866)

828-6931.

Other information

You may request a copy of the Fund’s current Annual and Semi-Annual Reports to Shareholders by contacting Franklin Templeton’s Fund Information Department at

1-800/DIAL BEN® (1-800-342-5236) or by visiting franklintempleton.com. All investments involve risks, including possible loss of principal. International investments are subject to special risks, including currency fluctuations and social,

economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. There are special risks associated with investments in China, Hong Kong and Taiwan, including less liquidity, expropriation,

confiscatory taxation, international trade tensions, nationalization, and exchange control regulations and rapid inflation, all of which can negatively impact the Fund. Investments in Taiwan could be adversely affected by its political and economic

relationship with China. The Fund is actively managed, but there is no guarantee that the manager's investment decisions will produce the desired results. For portfolio management discussions, including information regarding the Fund’s investment

strategies, please view the most recent Annual or Semi-Annual Report to Shareholders which can be found at franklintempleton.com or sec.gov.

Unlike open-end funds (mutual funds), closed-end funds are not continuously offered. Closed-end funds trade on the secondary market through a national stock

exchange at a price which may be above (a premium), but is

often below (a discount to) the net asset value (NAV) of the fund's portfolio. Unlike a mutual fund, the market price for a closed-end fund is based on

supply and demand, not the fund's NAV.

Franklin Resources, Inc. is a global investment management organization with subsidiaries operating as Franklin Templeton and serving clients in over 150

countries. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the company offers specialization on a

global scale, bringing extensive capabilities in fixed income, equity, alternatives and multi-asset solutions. With more than 1,300 investment professionals, and offices in major financial markets around the world, the California-based company has

over 75 years of investment experience and over $1.4 trillion in assets under management as of November 30, 2023. For more information, please visit franklintempleton.com.

# # #

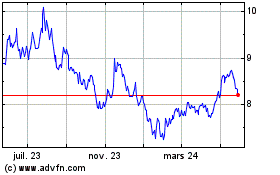

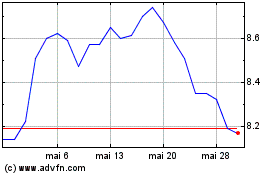

Templeton Dragon (NYSE:TDF)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Templeton Dragon (NYSE:TDF)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024