Teva Acquisition of Allergan Generics Unit Delayed--Update

15 Mars 2016 - 5:10PM

Dow Jones News

By Anne Steele

Teva Pharmaceutical Industries Ltd. said its acquisition of

Allergan PLC's generics unit will close later than expected, as it

works to obtain approval from federal regulators.

Analysts said the delay may indicate tougher-than-expected

negotiations with regulators, possibly leading to the need for more

divestitures. In addition, analysts said, the new target date means

Teva will likely miss the initial launch on May 2 of generic

Crestor, the cholesterol medication, shifting 11 cents in per-share

earnings to Allergan.

Shares of Teva, which have fallen about 13% over the past three

months, slid 3.8% on Tuesday morning to $220.50.

The company in July agreed to buy Actavis Generics for $40.5

billion in a cash-and-stock deal that will vault the Israeli

company into the top ranks of global drugmakers.

On Tuesday, Teva said significant progress has been made toward

completing the acquisition, but it now anticipates it could take

until as long as June to wrap up the deal based upon its current

estimate of the timing to obtain clearance from the U.S. Federal

Trade Commission. Teva previously had expected to close the

transaction as early as the end of the first quarter.

The company already has regulatory approval from the European

Commission.

Sanford C. Bernstein analysts said the FTC is the bottleneck,

and the two sides are discussing divestitures, notably on pipeline

products. The FTC is waiting for input from the U.S. Food and Drug

Administration, and "this process is taking some time." Bernstein

said the FDA is likely asking Teva for fairly extensive

divestitures, and Teva decided to negotiate those further, which

could take three to five weeks.

"The impact of the divestitures will likely be more material

than previously believed," the research firm said.

Bernstein also noted that Allergan's much larger tie-up with

Pfizer Inc. could be delayed as a result. The companies in November

agreed on a historic merger deal worth more than $150 billion that

would create the world's biggest drugmaker and move one of the top

names in corporate America to a foreign country.

Teva's acquisition of Allergan's generics unit--the latest in a

wave of consolidation in the drug industry--combines Teva, the

world's largest generic-drug company by sales, with the

third-largest.

It will give Teva increased scale in the competitive

generic-drug market and an opportunity to pursue further cost

reductions that could help it cope with the end of a wave of big

patent expirations.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

March 15, 2016 11:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

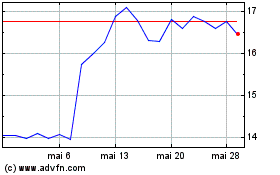

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024