0000097216false00000972162023-10-272023-10-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) October 27, 2023

TEREX CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 1-10702 | 34-1531521 |

| (State or Other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | |

| 45 Glover Avenue | Norwalk | Connecticut | 06850 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (203) 222-7170

| | |

| NOT APPLICABLE |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | TEX | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

Attached as Exhibit 99.1 to this Form 8-K of Terex Corporation (“Terex”) are the prepared statements of Terex from its October 27, 2023, conference call providing certain third quarter 2023 financial results. In addition, a replay of the teleconference is available to the public at https://investors.terex.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 31, 2023

| | |

| TEREX CORPORATION |

|

By: /s/Julie Beck |

| Julie Beck |

| Senior Vice President and |

| Chief Financial Officer |

|

Third Quarter 2023 Earnings Release Conference Call

October 27, 2023

Paretosh Misra – Terex Corporation – Investor Relations

Good morning and welcome to the Terex Corporation (“Terex” or “Company”) third quarter 2023 earnings conference call. A copy of the press release and presentation slides are posted on our Investor Relations website at investors.terex.com. In addition, the replay and slide presentation will be available on our website. We are joined by John Garrison, Chairman and Chief Executive Officer, and Julie Beck, Senior Vice President and Chief Financial Officer. Their prepared remarks will be followed by question-and-answer.

Please turn to slide 2 of the presentation which reflects our safe harbor statement. Today’s conference call contains forward-looking statements, which are subject to risks that could cause actual results to be materially different from those expressed or implied. In addition, we will be discussing non-GAAP information we believe is useful in evaluating the Company’s operating performance. Reconciliations for these non-GAAP measures can be found in the conference call materials. Please turn to slide 3 and I’ll turn it over to John Garrison.

John L. Garrison, Jr. – Terex Corporation – Chairman and Chief Executive Officer

Thank you, Paretosh, and good morning. I would like to welcome everyone to our earnings call and appreciate your interest in Terex.

I would like to begin by thanking all Terex team members around the globe for their exceptional efforts in this challenging global macroeconomic environment and for their continued commitment to our Zero Harm safety culture and Terex Way Values. Safety remains the top priority of the Company, driven by think safe, work safe, home safe. I’m proud of the Terex team member’s resilience as they continue to work tirelessly to improve our performance for our customers, dealers and shareholders, while maintaining a safe working environment.

Please turn to slide 4 to review our strong third quarter financial results. This quarter the team delivered: sales of $1.3 billion, up 15% from last year; operating margins of 12.7%, an expansion of 190 basis points from the prior year; and earnings per share of $1.75, up 46% on a year-over-year basis. As a result of solid execution by our team members throughout the year and a robust backlog, we are increasing our full-year earnings outlook to approximately $7.05 per share.

Please turn to slide 5. Terex products have leading positions in diverse and attractive end markets. The global focus on sustainability is driving increasing investments in infrastructure, digitization, waste recycling, and electrification. These megatrends provide additional growth opportunities for all of our businesses. Our Materials Processing (“MP”) aggregate businesses, led by Powerscreen and Finlay, have leading positions in global mobile crushing and screening markets that will benefit from growth in the demand for construction materials. Mobile aggregate equipment has the benefits of reducing unnecessary material handling and the ability to recycle material at the point of use. MP brands including Ecotec, CBI, and Terex Washing Systems are at the forefront of developing innovative solutions to meet rising demand for recycling technologies. Our Utilities business offers a wide portfolio of products to support strengthening demand from electrification investments, and our Genie booms, scissors, verticals, and telehandlers are essential components of any infrastructure or onshoring project.

Let’s turn to slide 6. We remain encouraged by the favorable trends in our key markets, especially in North America. The United States is investing in infrastructure with the three federal stimulus programs that were passed in 2021 and 2022. These investments provide a source of resilient demand visibility over the next several years. More than 35,000 projects, representing in excess of $120 billion in funding, have been announced or awarded. United States nonresidential construction spending is up 16% year-over-year, while manufacturing spending is up 63% in the last twelve-month period, driven by multi-billion-dollar and multi-year investments related to semiconductor manufacturing, clean energy, and electric vehicle battery projects. In addition, the biggest growth areas in construction will be publicly financed or built by manufacturers who are onshoring to reduce geopolitical risk and these investments are less sensitive to interest rates. Our end market diversification is a strength and we are excited about the opportunities to grow our business.

Please turn to slide 7 to review our backlog. Our Q3 backlog of $3.3 billion remains significantly above historical levels and is the second highest in recent history, providing healthy momentum going into 2024. Although backlog has declined sequentially from Q2 levels, this is a function of improved manufacturing production volumes and customer deliveries. Consolidated Q3 bookings remained solid at approximately $900 million and reflects a return to more normal ordering patterns for our dealers and customers. Importantly, we are seeing minimal customer and dealer pushouts and cancelations. The higher interest rates, inflation and geopolitical uncertainties have had an impact on Europe, and we are seeing softening in that market, but it is important to emphasize demand in North America is very strong. For more than two years, our backlog levels have increased as we have been constrained in our production ability due to supply chain challenges. As we and the industry improve deliveries and lead times, our backlog will eventually return to normalized levels, which is a good thing for our customers. In addition, elevated customer fleet ages and low dealer inventory levels continue to provide encouraging signs for the demand environment. In our Genie business, the industry replacement cycle and significant global investments in infrastructure, onshoring and electrification creates a clear opportunity for future growth. In our MP segment, in addition to these favorable trends, dealer inventory levels remain low in several businesses. Overall, our customer feedback, bookings, significant backlog and leading indicators give us confidence going into 2024.

Please turn to slide 8. The global demand for waste recycling solutions is increasing, driven by evolving regulations and consumer preferences. The MP segment is well-positioned to capitalize on these opportunities. Our EvoQuip brand recently added a shredder capable of handling multiple applications, including construction and demolition waste. Our Ecotec Metal Separator can efficiently extract valuable metals from a variety of waste sources. And our CBI business continues to find new market applications for our

equipment, such as the recycling of windmill blades. This eliminates the need for landfill disposal when blades are decommissioned and replaced. I am confident the MP business will continue to provide innovative solutions to support the increasing demand for recycling technologies.

Please turn to slide 9. Our sustainability practices deliver stakeholder value. During each quarterly investor call, we feature one of the pillars of our Environmental, Social and Governance (“ESG”) strategy. This quarter we are highlighting environmental stewardship. Our 2023 sustainability report published earlier this week highlights products and solutions that enable our customers to operate in sustainable ways. Approximately 70% of our MP and Genie products are now offered with electric or hybrid options, while 10 of our sites are operating using 100% renewable energy. We reached our 2024 greenhouse gas target two years early and reduced our emissions intensity by 15% from our 2019 levels. We are proud of our team members’ accomplishments in helping build a more sustainable economy.

Turning to slide 10 for an update on our strategic operational priorities. We continue to make great progress on our Execute, Innovate and Grow strategic initiatives. Our operations teams executed well during the third quarter, maintaining their focus on improving deliveries for our customers and continuing with cost reduction and productivity improvement initiatives. On a year-to-date basis our sales are up 23% and operating margins are up 400 basis points, demonstrating the strength of our operating model and the improvements we have made over the last several years. Supply chain performance has improved throughout the year, but we continue to experience disruptions in the system. In the third quarter, our Monterrey, Mexico team members were focused on increasing production, startup of our inhouse paint systems and process improvements. I want to congratulate our Genie Monterrey team members for earning the prestigious LEED Gold certification, demonstrating our commitment to sustainable practices in design, construction and operations. Our investments in new product and technologies will enable us to take advantage of the sustainability trends such as recycling, electrification, and decarbonization. We remain confident in our ability to execute on our strategy to deliver long-term shareholder value. And with that, let me turn it over to Julie.

Julie Beck – Terex Corporation – Senior Vice President and Chief Financial Officer

Thanks, John, and good morning, everyone. Let’s take a look at our third quarter financial performance found on slide 11. Sales of $1.3 billion were up 15% year-over-year, on higher volume and improved price realization necessary to mitigate rising costs. Sales in constant currency were up 13%, as foreign currency translation positively impacted sales by $25 million, or approximately 2%. Gross margins increased by 150 basis points in the quarter, as volume, pricing, improved manufacturing efficiencies, cost out initiatives and strict expense discipline helped to offset cost inflation. Selling, general, and administrative expenses (“SG&A”) increased over the prior year due to inflation, incremental spend on new acquisitions and increased marketing, engineering and technology expenses. SG&A was 10% of sales, a decrease of 40 basis points from the prior year, with business investment offset by continued strict expense management throughout the Company. Compared to last year, income from operations of $163 million increased 35%, operating margin of 12.7% was up 190 basis points and our incremental margin was 25%. Interest and other expense of $14 million increased $1 million from the prior year, as higher interest rates were partially offset by favorable mark-to-market adjustments. The third quarter global effective tax rate was 20%. Third quarter earnings per share of $1.75 increased 46%, representing a $0.55 improvement over last year. This strong performance was driven by increased volume, disciplined pricing and continued cost management. Free cash flow for the quarter was $106 million, representing a $53 million improvement over the prior year, primarily driven by increased operating profit. Hospital inventory at the end of third quarter was $20 million, a decrease of $3 million from the second quarter and a 68% improvement from the prior year. Free cash flow conversion was 89% in the quarter. On a year-to-date basis, our sales are up 23% over the prior year, operating margins have expanded 400 basis points at an incremental margin of 30%, earnings per share are up 90% and free cash flow has increased by over $200 million.

Let’s take a look at our segment results starting with our MP segment found on slide 12. MP had another excellent quarter with consistently strong operational execution. Sales of $541 million increased 18% compared to the third quarter of 2022, driven by strong demand for our aggregates, environmental and concrete products. On a foreign exchange neutral basis, sales were up 16%. MP operating profit increased 37% over the prior year, driven by higher sales volumes, favorable product and geographic mix, improved manufacturing efficiencies and disciplined cost management, with strong operating margins of 16.9%, up 230 basis points. MP’s incremental margin was 29%. MP ended the quarter with backlog of approximately $900 million. The backlog remains robust and is approximately two times historical norms. Bookings were slightly higher than historical averages for the third quarter.

On slide 13, see our Aerial Work Platforms (“AWP”) segment financial results. AWP had a solid quarter with sales of $751 million, up 13% compared to the prior year, on higher demand, improved supply chain and disciplined pricing actions to offset cost pressures. On a foreign exchange neutral basis, sales were up 11%. AWP operating profit increased 47% over the prior year and the team delivered operating margins of 12.5% in the quarter, up 290 basis points from last year, with an incremental margin of 34%. The improvement was the result of higher sales volumes, favorable geographic mix and cost reduction initiatives offsetting increasing costs and Monterrey start-up inefficiencies. Genie had a strong quarter, but our Utilities business was negatively impacted by manufacturing inefficiencies due to supply chain issues and related unfavorable product mix. Bookings of $536 million were up 4% sequentially and at levels typical of historical Q3 bookings, with a solid backlog of $2.5 billion, which is three times the historical norm. Negotiations with the national accounts continue and we expect to return to seasonally higher bookings in Q4.

Please see slide 14 for an overview of our disciplined capital allocation strategy. Our strong balance sheet provides us with financial flexibility to invest in our future growth. Year to date free cash flow has increased $205 million over the prior year. We continue to invest in our business with Q3 capital expenditures of $34 million primarily related to our Monterrey facility. We increased our dividend 31% since the beginning of the year, which reflects our continued confidence in the Company’s strong financial position and future prospects. Year to date, we have returned $66 million to our shareholders and are currently purchasing shares as we believe our shares are an attractive investment. We have no debt maturities until 2026 and 85% of our debt is at a fixed rate of 5% until the end of the decade. In addition, we have paid down $118 million of debt over the last twelve months. Our net leverage remains low at 0.5

times, which is well below our 2.5 times target through the cycle. We have ample liquidity of $846 million, and we reported a return on invested capital over 29%, well above our cost of capital. The Company is in an excellent position to execute our plan and grow the business.

Now turning to slide 15 and our updated full-year outlook. It is important to realize we are operating in a challenging macro environment with many variables and geopolitical uncertainties, so results could change negatively or positively. With that said, this updated outlook represents our best estimate as of today. Thanks to the strong performance of our team members and robust backlog, we are raising our 2023 outlook to approximately $7.05 per share, an over 60% improvement from 2022. Our increased sales outlook of approximately $5.15 billion represents a 17% increase from the prior year and incorporates the latest dialogue with our customers and our suppliers. Our sales in the fourth quarter of the year are expected to be sequentially lower due to normal production seasonality and supply chain challenges, but consistent with prior year. We are maintaining our operating margin outlook of approximately 13%, a 350 basis point improvement from last year. We reaffirm our free cash flow outlook of $375 million for the full-year, approximately $225 million higher than the prior year.

Let’s take a look at our updated segment outlook. Based upon MP’s continued strong execution, we are increasing our sales outlook to over $2.2 billion at an operating margin of approximately 16.1%. We expect MP’s fourth quarter sales to be up slightly to Q3 and margins to be sequentially lower due to a less favorable geographic and product mix. This outlook represents a 15% increase in sales and an 80 basis point improvement in operating margin from the prior year. The Genie team has executed well and as a result we are increasing our AWP sales outlook to over $2.9 billion. We expect a sequential decline in AWP’s fourth quarter sales due to fewer production days. We are updating our full-year operating margin outlook to approximately 13.3% due to material supply chain issues impacting our Utilities business. AWP’s outlook reflects a 540 basis point improvement from the prior year and an incremental margin over 40%.

On behalf of my fellow Terex team members, I want to thank John for his significant contributions, leadership and dedicated years of service to Terex, and wish he and his family a happy retirement. John has been instrumental in transforming our Company into the Terex of today, which comprises a very strong portfolio of market-leading businesses worldwide. Under his leadership, Terex has experienced remarkable success and remains well positioned for continued growth. And with that said, I will turn it back to you, John.

John L. Garrison, Jr. – Terex Corporation – Chairman and Chief Executive Officer

Thanks, Julie. Turning to slide 16 to conclude my prepared remarks. Terex is well positioned for growth to deliver long term value for our stakeholders because: we have a strong portfolio of diverse, market-leading businesses that operate in attractive growth markets and are well-positioned for long-term profitable growth; this growth is going to be bolstered by attractive global megatrends; we deployed our operating system across our businesses, improving our execution, allowing us to generate consistent profitability and superior return on our invested capital; we have a strong balance sheet and cash flow to support our growth plan; and we have a global, experienced and resilient leadership team that has clearly demonstrated the ability to create value.

Thanks, Julie. Turning to slide 16 to conclude my prepared remarks. Terex is well positioned for growth to deliver long term value for our stakeholders because: we have a strong portfolio of diverse, market-leading businesses that operate in attractive growth markets and are well-positioned for long-term profitable growth; this growth is going to be bolstered by attractive global megatrends; we deployed our operating system across our businesses, improving our execution, allowing us to generate consistent profitability and superior return on our invested capital; we have a strong balance sheet and cash flow to support our growth plan; and we have a global, experienced and resilient leadership team that has clearly demonstrated the ability to create value.

It has been an honor to help the Company position for sustainable, profitable growth, and to make progress toward becoming a workplace where all team members feel included with a voice in the enterprise. Leading Terex has been the highlight of my career. Without a doubt, our success and achievements have been driven by our dedicated, engaged team members who live our Terex Way Values and Zero Harm safety culture each and every day. Terex is in a strong position and now is the right time to begin the transition to the next leader. I have had the privilege of working closely with Simon for a number of years and he has proven to be a global strategic thinker with a natural ability to lead teams and drive results. I have great confidence that he is the right leader for Terex as the Company focuses on delivering long-term value for our stakeholders. And with that, let me turn it back to Paretosh.

Paretosh Misra – Terex Corporation – Investor Relations

Thanks, John. As a reminder, during the question-and-answer session, we ask you to limit your questions to one and a follow-up to ensure we answer as many questions as possible this morning. With that, I would like to open it up for questions. Operator.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

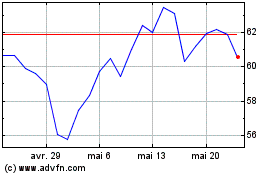

Terex (NYSE:TEX)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Terex (NYSE:TEX)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024