Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”),

a global, leading provider of specialty industrial services

offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services, today reported its financial results for the

third quarter ended September 30, 2023.

Third Quarter 2023

Highlights1:

- Reported total revenues of

$206.7 million.

- Grew gross margin to 25.5% of

revenue or $52.8 million.

- Decreased net loss from continuing

operations to $12.1 million, a 54.4% improvement over the 2022

third quarter net loss from continuing operations of $26.6

million.

- Grew consolidated Adjusted EBITDA2

to $11.1 million (5.4% of consolidated revenue), up from

$10.6 million (4.9% of consolidated revenue) in the 2022 third

quarter.

- Reduced ongoing cash selling,

general and administrative expenses by 7.6% or $3.7 million

compared to the 2022 period.

- Repaid the Company’s remaining

$41.2 million of convertible notes with proceeds from the

previously announced June 2023 refinancing transaction.

1. Unless otherwise specified, the financial

information and discussion in this earnings release is based on the

Company’s continuing operations (IHT and MS segments as defined

below) and excludes results of its discontinued operations (Quest

Integrity).

2. See the accompanying reconciliation of

non-GAAP financial measures at the end of this press release.

“For the third quarter, we grew Adjusted EBITDA

to $11.1 million and expanded our Adjusted EBITDA margin to

5.4%, both improvements over the 2022 period,” said Keith D.

Tucker, TEAM’s Chief Executive Officer. “We achieved this

improvement despite lower revenue in our Inspection and Heat

Treating and Mechanical Services segments resulting from turnaround

activity and other project work shifting into the fourth quarter.

These margin improvements clearly demonstrate the tangible progress

made to date in our ongoing program to improve TEAM’s financial and

operational performance through targeted cost actions while

maintaining best in class safety and service quality. We are

focused on building a sustainable and profitable TEAM capable of

continuing to deliver strong operational and financial results as

we have thus far in 2023.”

“During the third quarter, we implemented

various cost reductions that we expect will result in savings of

between $11 million to $13 million per annum, with the full benefit

from those actions starting in the fourth quarter of 2023. These

expected savings are in addition to the meaningful reductions

implemented earlier in 2023, and we have identified additional

actions we believe will have a significant impact starting in the

first quarter of 2024. As we continue to optimize our cost

structure, we are also refining our commercial strategy with an eye

towards profitably growing our existing business while also

diversifying into new adjacent end markets.”

“Turning to the fourth quarter, we are initially

experiencing stronger activity levels in both segments in October

versus the prior year and remain enthusiastic about our prospects

for the full year. We are also taking steps to manage the impact to

our results of the seasonal slowdown in activity that typically

begins in mid-November and continues through January by identifying

further opportunities to improve efficiency and margins to drive

better profitability during the shoulder season,” said Tucker.

“During the last eighteen months, our focus has

been on the continued execution of various operational and

financial initiatives necessary to strengthen the balance sheet and

position TEAM for improved financial performance. To further

support those efforts, we are leveraging the skills and experience

of our Executive Chairman Michael Caliel, who will primarily focus

on the design and execution of our long-term strategic and

commercial plan to profitably grow the business. Mike’s support

will allow our leadership team to remain focused on the operational

and financial improvement initiatives we have identified, and his

expertise and close relationship with both management and the Board

will help refine our long-term strategic plans and optimize our

global portfolio of businesses to further unlock the intrinsic

value of TEAM,” concluded Tucker.

Financial Results

On November 1, 2022, the Company closed the sale

of its Quest Integrity business. Financial information, performance

metrics and discussions for comparative period 2022 are based on

the Company’s continuing operations (Inspection and Heat Treating

(“IHT”) and Mechanical Services (“MS”) segments) and exclude

results of discontinued operations (“Quest Integrity”) except where

stated otherwise.

Third quarter 2023 revenues were down

$11.6 million to $206.7 million as compared to

$218.3 million in the prior-year quarter, primarily due to

lower activity in nested and turnaround services in the IHT segment

and lower activity levels in repair and maintenance work across the

MS segment. In the third quarter of 2023, consolidated gross margin

was $52.8 million, or 25.5% of revenue, compared with $56.0

million, or 25.7%, in the same quarter a year ago. Gross margin was

positively impacted by lower indirect costs as a percent of revenue

attributable to the Company’s ongoing expense reduction program,

which partially offset the impact of lower revenue.

Selling, general and administrative expenses for

the third quarter were down $3.7 million, or 6.4% from the

third quarter of 2022 to $54.0 million, mainly due to savings

from the Company’s ongoing cost reduction efforts and lower legal

costs. Our ongoing cash selling, general and administrative

expenses, which exclude expenses not representative of the

Company’s ongoing operations as well as depreciation and

amortization and share-based compensation expense, declined by $3.7

million versus the 2022 period and $1.7 million versus the second

quarter of 2023.

Net loss from continuing operations in the third

quarter of 2023 was $12.1 million ($2.78 loss per share) compared

to a net loss from continuing operations of $26.6 million ($6.16

loss per share) in the third quarter of 2022. The Company’s

adjusted measure of net income/loss, consolidated Adjusted EBIT, a

non-GAAP financial measure, was income of $1.5 million in the third

quarter of 2023 compared to $1.0 million in the prior year’s

comparable quarter. Consolidated Adjusted EBITDA, a non-GAAP

financial measure, was $11.1 million for the third quarter of 2023

compared to $10.6 million for the prior year quarter, with the

improvement driven by the factors noted above.

Adjusted Net Loss, consolidated Adjusted EBIT,

and consolidated Adjusted EBITDA are non-GAAP financial measures

that exclude certain items that are not indicative of TEAM’s

ongoing operations. A reconciliation of these non-GAAP financial

measures to the most comparable GAAP financial measures is

presented at the end of this earnings release.

Segment Results

The following table illustrates the composition

of the Company’s revenue and operating income (loss) by segment for

the quarter ended September 30, 2023 and 2022 (in thousands):

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

|

|

|

|

| |

Three Months EndedSeptember

30, |

|

Better (Worse) |

| |

|

2023 |

|

|

|

2022 |

|

|

$ |

|

% |

| Revenues |

|

|

|

|

|

|

|

|

IHT |

$ |

103,857 |

|

|

$ |

110,312 |

|

|

$ |

(6,455 |

) |

|

(5.9 |

)% |

|

MS |

|

102,858 |

|

|

|

108,027 |

|

|

|

(5,169 |

) |

|

(4.8 |

)% |

| |

$ |

206,715 |

|

|

$ |

218,339 |

|

|

$ |

(11,624 |

) |

|

(5.3 |

)% |

| |

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

|

|

|

|

IHT |

$ |

6,412 |

|

|

$ |

7,390 |

|

|

$ |

(978 |

) |

|

(13.2 |

)% |

|

MS |

|

6,482 |

|

|

|

7,655 |

|

|

|

(1,173 |

) |

|

(15.3 |

)% |

|

Corporate and shared support services |

|

(14,152 |

) |

|

|

(16,774 |

) |

|

|

2,622 |

|

|

15.6 |

% |

| |

$ |

(1,258 |

) |

|

$ |

(1,729 |

) |

|

$ |

471 |

|

|

27.2 |

% |

Revenues. IHT revenues

decreased by $6.4 million or 5.9%, primarily due to lower activity

in nested and turnaround services that resulted in a $4.3 million

decrease in IHT U.S. revenue and a $2.8 million decrease in IHT

Canada revenue, partially offset by a $0.7 million increase in

revenue from other international regions. MS revenue decreased by

$5.2 million or 4.8%, driven by lower activity in repair and

maintenance work in the U.S. that resulted in a $5.6 million or

8.4% decrease in MS U.S. revenue, and a $3.3 million decrease in MS

Canada revenue due to less project work in the current period,

partially offset by a $3.7 million revenue increase in other

international regions.

Operating income (loss). IHT

operating income decreased by $1.0 million due to lower activity in

several regions, partially offset by improved direct margins

resulting from cost reductions in the U.S. and Canada. MS operating

income decreased by $1.1 million as compared to the prior year

quarter, driven by declines in our Canada operations and domestic

valve business, partially offset by savings in our overhead costs

that drove higher operating income from our U.S. and other

international operations. Corporate operating loss decreased by

$2.6 million due to lower legal costs in the current quarter

compared to the prior year quarter and lower overall costs due to

the Company’s ongoing cost reduction efforts.

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

|

|

|

|

| |

Nine Months EndedSeptember

30, |

|

Better (Worse) |

| |

|

2023 |

|

|

|

2022 |

|

|

$ |

|

% |

| Revenues |

|

|

|

|

|

|

|

|

IHT |

$ |

322,426 |

|

|

$ |

320,033 |

|

|

$ |

2,393 |

|

0.7 |

% |

|

MS |

|

326,058 |

|

|

|

308,884 |

|

|

|

17,174 |

|

5.6 |

% |

| |

$ |

648,484 |

|

|

$ |

628,917 |

|

|

$ |

19,567 |

|

3.1 |

% |

| |

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

|

|

|

IHT |

$ |

17,683 |

|

|

$ |

13,038 |

|

|

$ |

4,645 |

|

35.6 |

% |

|

MS |

|

22,395 |

|

|

|

15,152 |

|

|

|

7,243 |

|

47.8 |

% |

|

Corporate and shared support services |

|

(44,486 |

) |

|

|

(63,119 |

) |

|

|

18,633 |

|

29.5 |

% |

| |

$ |

(4,408 |

) |

|

$ |

(34,929 |

) |

|

$ |

30,521 |

|

87.4 |

% |

Revenues. IHT revenues

increased by $2.4 million or 0.7%, primarily driven by an increase

of $9.4 million in U.S. revenue due to higher callout and

turnaround activity and an increase of $3.0 million in revenue from

other international regions, partially offset by a $10.0 million

revenue decrease in Canada due to non-recurring turnaround/project

work in the 2022 period. MS revenue increased by $17.2 million or

5.6%, consisting of a $4.0 million increase in the U.S. market,

primarily attributable to higher activity in callout, hot tapping

and leak repair services, and a $13.0 million increase in other

international regions attributable to higher turnaround activity,

leak repair services and product sales.

Operating income (loss). IHT

operating income increased by $4.6 million or 35.6%, driven by

higher activity in the U.S. and reductions in indirect and SG&A

costs in the US and Canada. MS operating income increased by $7.2

million as compared to the prior year period. Operating income from

the U.S., other international and Canada regions increased by $3.7

million, $2.3 million, and $1.2 million, respectively, driven by

higher activity and improved margins. Corporate operating loss

decreased by $18.6 million due to lower professional fees, lower

legal and severance cost in the current year period as compared to

the prior year period and lower overall costs due to the Company’s

ongoing cost reduction efforts.

Balance Sheet and Liquidity

On September 30, 2023, the Company had

$36.4 million of total liquidity, consisting of consolidated

cash and cash equivalents of $16.5 million (excluding

$5.0 million of restricted cash) and $19.9 million of

undrawn availability under its various credit facilities.

The Company’s total debt as of September 30,

2023 was $301.1 million as compared to $285.9 million as

of fiscal year end 2022. The Company’s net debt (total debt less

cash and cash equivalents), a non-GAAP financial measure, was

$279.6 million at September 30, 2023.

On November 7, 2023, the Company had

$39.5 million of total liquidity, consisting of consolidated

cash and cash equivalents of $25.5 million (excluding

$5.0 million of restricted cash) and approximately

$14.0 million of undrawn availability under its various credit

facilities.

Non-GAAP Financial Measures

The non-GAAP financial measures in this earnings

release are provided to enable investors, analysts and management

to evaluate TEAM’s performance excluding the effects of certain

items that management believes impact the comparability of

operating results between reporting periods. These measures should

be used in addition to, and not in lieu of, results prepared in

conformity with generally accepted accounting principles (“GAAP”).

A reconciliation of each of the non-GAAP financial measures to the

most directly comparable historical GAAP financial measure is

contained in the accompanying schedules for each of the fiscal

periods indicated.

About Team, Inc.

Headquartered in Sugar Land, Texas, Team, Inc.

(NYSE: TISI) is a global, leading provider of specialty industrial

services offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services. We deploy conventional to highly specialized

inspection, condition assessment, maintenance, and repair services

that result in greater safety, reliability, and operational

efficiency for our client’s most critical assets. Through locations

in more than 20 countries, we unite the delivery of technological

innovation with over a century of progressive, yet proven integrity

and reliability management expertise to fuel a better tomorrow. For

more information, please visit www.teaminc.com.

Certain forward-looking information contained

herein is being provided in accordance with the provisions of the

Private Securities Litigation Reform Act of 1995. We have made

reasonable efforts to ensure that the information, assumptions, and

beliefs upon which this forward-looking information is based are

current, reasonable, and complete. However, such forward-looking

statements involve estimates, assumptions, judgments, and

uncertainties. They include but are not limited to statements

regarding the Company’s financial prospects and the implementation

of cost saving measures. There are known and unknown factors that

could cause actual results or outcomes to differ materially from

those addressed in the forward-looking information. Although it is

not possible to identify all of these factors, they include, among

others, the Company’s ability to continue as a going concern; the

Company’s ability to execute on its cost management actions; the

Company’s ability to generate sufficient cash from operations,

access its credit facility, or maintain its compliance with

covenants under its credit facility and debt agreement; the

Company’s ability to manage inflationary pressures on its operating

costs; the Company’s ability to successfully divest assets on terms

that are favorable to the Company; the Company’s ability to repay,

refinance or restructure its debt and the debt of certain of its

subsidiaries; anticipated or expected purchases or sales of assets;

negative market conditions, including from the lingering impact of

widespread public health crises, epidemics and pandemics, threats

of domestic and global economic recession and future economic

uncertainties, particularly in industries in which we are heavily

dependent; seasonal and other variation, such as severe weather

conditions (including conditions influenced by climate change) and

the nature of the Company’s clients’ industry; the Company’s

ability to expand into new markets (including low carbon energy

transition) and attract clients in new industries may be limited

due to its competition’s breadth of service offerings and

intellectual property; the Company’s significant debt and high

leverage which could have a negative impact on its financing

options, liquidity position and ability to manage increases in

interest rates; the Company’s ability to access capital and

liquidity provided by the financial and capital markets; the timing

of new client contracts and termination of existing contracts may

result in unpredictable fluctuations in the Company’s cash flows

and financial results; the risk of non-payment and/or delays in

payment of receivables from the Company’s clients; the Company may

not be able to continue to meet the New York Stock Exchange’s

(“NYSE”) continued listing requirements and rules, and the NYSE may

delist the Company’s common stock, which could negatively affect

the Company, the price of the Company’s common stock and its

shareholders’ ability to sell the Company’s common stock; the

Company’s financial forecasts being based upon estimates and

assumptions that may materially differ from actual results; the

Company’s incurrence of liabilities and suffering of negative

financial or reputational impacts relating to occupational health

and safety matters; changes in laws or regulations in the local

jurisdictions that the Company conducts its business; the outcome

of tax examinations; changes in tax laws, and other tax matters;

foreign currency exchange rate and interest rate fluctuations; the

inherently uncertain outcome of current and future litigation;

failure to maintain effective internal controls and the resulting

inability to report its financial results accurately or timely or

prevent or detect fraud; acts of terrorism, war or political or

civil unrest in the U.S. or elsewhere, changes in laws and

regulations, or the imposition of economic or trade sanctions

affecting international commercial transactions and such known

factors as are detailed in the Company’s Annual Report on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K, each as filed with the Securities and Exchange Commission, and

in other reports filed by the Company with the Securities and

Exchange Commission from time to time. Accordingly, there can be no

assurance that the forward-looking information contained herein,

including statement regarding the Company’s financial prospects and

the implementation of cost saving measures, will occur or that

objectives will be achieved. We assume no obligation to publicly

update or revise any forward-looking statements made today or any

other forward-looking statements made by the Company, whether as a

result of new information, future events or otherwise, except as

may be required by law.

Contact:Nelson M. HaightExecutive Vice

President, Chief Financial Officer(281) 388-5521

|

TEAM, INC. AND SUBSIDIARIES |

|

SUMMARY OF CONSOLIDATED OPERATING RESULTS |

|

(unaudited, in thousands, except per share

data) |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Revenues |

$ |

206,715 |

|

|

$ |

218,339 |

|

|

$ |

648,484 |

|

|

$ |

628,917 |

|

| Operating

expenses |

|

153,928 |

|

|

|

162,322 |

|

|

|

487,779 |

|

|

|

479,656 |

|

|

Gross margin |

|

52,787 |

|

|

|

56,017 |

|

|

|

160,705 |

|

|

|

149,261 |

|

| Selling, general, and

administrative expenses |

|

54,045 |

|

|

|

57,746 |

|

|

|

165,113 |

|

|

|

184,174 |

|

| Restructuring and

other related charges, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

Operating loss |

|

(1,258 |

) |

|

|

(1,729 |

) |

|

|

(4,408 |

) |

|

|

(34,929 |

) |

| Interest expense,

net |

|

(10,067 |

) |

|

|

(26,653 |

) |

|

|

(43,499 |

) |

|

|

(63,708 |

) |

| Loss on debt

extinguishment |

|

(3 |

) |

|

|

— |

|

|

|

(1,585 |

) |

|

|

— |

|

| Other income,

net |

|

266 |

|

|

|

3,227 |

|

|

|

914 |

|

|

|

9,664 |

|

| Loss before income

taxes |

|

(11,062 |

) |

|

|

(25,155 |

) |

|

|

(48,578 |

) |

|

|

(88,973 |

) |

| Less: Provision for

income taxes |

|

(1,072 |

) |

|

|

(1,465 |

) |

|

|

(4,020 |

) |

|

|

(4,182 |

) |

| Net loss from

continuing operations |

|

(12,134 |

) |

|

|

(26,620 |

) |

|

|

(52,598 |

) |

|

|

(93,155 |

) |

| Net income from

discontinued operations |

|

— |

|

|

|

3,747 |

|

|

|

— |

|

|

|

16,268 |

|

| Net loss |

$ |

(12,134 |

) |

|

$ |

(22,873 |

) |

|

$ |

(52,598 |

) |

|

$ |

(76,887 |

) |

| Basic net loss per

common share: |

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

(2.78 |

) |

|

|

(6.16 |

) |

|

|

(12.07 |

) |

|

|

(22.51 |

) |

|

Income from discontinued operations |

|

— |

|

|

|

0.87 |

|

|

|

— |

|

|

|

3.93 |

|

|

Total |

$ |

(2.78 |

) |

|

$ |

(5.29 |

) |

|

$ |

(12.07 |

) |

|

$ |

(18.58 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average

number of shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

4,368 |

|

|

|

4,322 |

|

|

|

4,358 |

|

|

|

4,139 |

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SUMMARY CONSOLIDATED BALANCE SHEET

INFORMATION |

|

(in thousands) |

| |

|

|

|

| |

September 30, |

|

December 31, |

|

|

|

2023 |

|

|

2022 |

| |

(unaudited) |

|

|

| |

|

|

|

| Cash and cash

equivalents |

$ |

21,483 |

|

$ |

58,075 |

| |

|

|

|

| Other current

assets |

|

291,353 |

|

|

289,478 |

| |

|

|

|

| Property, plant, and

equipment, net |

|

127,714 |

|

|

138,099 |

| |

|

|

|

| Other non-current

assets |

|

120,904 |

|

|

130,993 |

| |

|

|

|

|

Total assets |

$ |

561,454 |

|

$ |

616,645 |

| |

|

|

|

| Current portion of

long-term debt and finance lease obligations |

$ |

5,302 |

|

$ |

280,993 |

| |

|

|

|

| Other current

liabilities |

|

153,770 |

|

|

167,871 |

| |

|

|

|

| Long-term debt and

finance lease obligations, net of current maturities |

|

295,778 |

|

|

4,942 |

| |

|

|

|

| Other non-current

liabilities |

|

41,989 |

|

|

45,079 |

| |

|

|

|

| Stockholders’

equity |

|

64,615 |

|

|

117,760 |

| |

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

561,454 |

|

$ |

616,645 |

|

TEAM INC. AND SUBSIDIARIES |

|

SUMMARY CONSOLIDATED CASH FLOW

INFORMATION1 |

|

(unaudited, in thousands) |

| |

|

| |

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

20221 |

|

| |

|

|

|

| |

|

|

|

| Net loss |

$ |

(52,598 |

) |

|

$ |

(76,887 |

) |

| |

|

|

|

| Depreciation and

amortization expense |

|

28,481 |

|

|

|

28,591 |

|

| |

|

|

|

| Loss on debt

extinguishment |

|

1,585 |

|

|

|

— |

|

| |

|

|

|

| Amortization of debt

issuance costs, debt discounts and deferred financing

costs |

|

16,926 |

|

|

|

25,666 |

|

| |

|

|

|

| Deferred income

taxes |

|

986 |

|

|

|

382 |

|

| |

|

|

|

| Non-cash compensation

cost |

|

859 |

|

|

|

571 |

|

| |

|

|

|

| Write-off of deferred

loan costs |

|

— |

|

|

|

2,748 |

|

| |

|

|

|

| Write-off of software

cost |

|

629 |

|

|

|

— |

|

| |

|

|

|

| Working Capital and

Other |

|

(18,937 |

) |

|

|

(27,436 |

) |

| |

|

|

|

|

Net cash used in operating activities |

|

(22,069 |

) |

|

|

(46,365 |

) |

| |

|

|

|

| Capital

expenditures |

|

(7,433 |

) |

|

|

(21,002 |

) |

| |

|

|

|

| Proceeds from disposal

of assets |

|

414 |

|

|

|

7,165 |

|

| |

|

|

|

|

Net cash used in investing activities |

|

(7,019 |

) |

|

|

(13,837 |

) |

| |

|

|

|

| Borrowings under ABL

Facilities, net |

|

10,999 |

|

|

|

67,816 |

|

| |

|

|

|

| Borrowings under ME/RE

Loans, net |

|

26,551 |

|

|

|

— |

|

| |

|

|

|

| Payment under APSC

Term Loan |

|

(37,092 |

) |

|

|

— |

|

| |

|

|

|

| Payments under

Convertible Debt |

|

(41,161 |

) |

|

|

— |

|

| |

|

|

|

| Borrowings under Corre

Incremental Term Loans |

|

42,500 |

|

|

|

— |

|

| |

|

|

|

| Payments for debt

issuance costs |

|

(8,446 |

) |

|

|

(13,609 |

) |

| |

|

|

|

| Issuance of common

stock, net of issuance costs |

|

— |

|

|

|

9,696 |

|

| |

|

|

|

| Other |

|

(746 |

) |

|

|

(615 |

) |

| |

|

|

|

|

Net cash provided by (used in) financing

activities |

|

(7,395 |

) |

|

|

63,288 |

|

| |

|

|

|

| Effect of exchange

rate changes |

|

(109 |

) |

|

|

(1,373 |

) |

| |

|

|

|

| Net change in cash and

cash equivalents |

$ |

(36,592 |

) |

|

$ |

1,713 |

|

| |

|

|

|

1 Consolidated statement of cash flow for 2022

includes cash flows from discontinued operations.

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenues |

|

|

|

|

|

|

|

|

IHT |

$ |

103,857 |

|

|

$ |

110,312 |

|

|

$ |

322,426 |

|

|

$ |

320,033 |

|

|

MS |

|

102,858 |

|

|

|

108,027 |

|

|

|

326,058 |

|

|

|

308,884 |

|

| |

$ |

206,715 |

|

|

$ |

218,339 |

|

|

$ |

648,484 |

|

|

$ |

628,917 |

|

| |

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

|

|

|

IHT |

$ |

6,412 |

|

|

$ |

7,390 |

|

|

$ |

17,683 |

|

|

$ |

13,038 |

|

|

MS |

|

6,482 |

|

|

|

7,655 |

|

|

|

22,395 |

|

|

|

15,152 |

|

|

Corporate and shared support services |

|

(14,152 |

) |

|

|

(16,774 |

) |

|

|

(44,486 |

) |

|

|

(63,119 |

) |

| |

$ |

(1,258 |

) |

|

$ |

(1,729 |

) |

|

$ |

(4,408 |

) |

|

$ |

(34,929 |

) |

| |

|

|

|

|

|

|

|

| Segment Adjusted

EBIT1 |

|

|

|

|

|

|

|

|

IHT |

$ |

6,607 |

|

|

$ |

7,540 |

|

|

$ |

18,911 |

|

|

$ |

13,230 |

|

|

MS |

|

6,769 |

|

|

|

7,690 |

|

|

|

23,057 |

|

|

|

15,241 |

|

|

Corporate and shared support services |

|

(11,877 |

) |

|

|

(14,208 |

) |

|

|

(38,529 |

) |

|

|

(46,528 |

) |

| |

$ |

1,499 |

|

|

$ |

1,022 |

|

|

$ |

3,439 |

|

|

$ |

(18,057 |

) |

| |

|

|

|

|

|

|

|

| Segment Adjusted

EBITDA1 |

|

|

|

|

|

|

|

|

IHT |

$ |

9,755 |

|

|

$ |

10,562 |

|

|

$ |

28,301 |

|

|

$ |

22,602 |

|

|

MS |

|

11,425 |

|

|

|

12,394 |

|

|

|

37,170 |

|

|

|

29,463 |

|

|

Corporate and shared support services |

|

(10,053 |

) |

|

|

(12,318 |

) |

|

|

(32,692 |

) |

|

|

(42,102 |

) |

| |

$ |

11,127 |

|

|

$ |

10,638 |

|

|

$ |

32,779 |

|

|

$ |

9,963 |

|

| |

|

|

|

|

|

|

|

___________________

1 See the accompanying reconciliation of

non-GAAP financial measures at the end of this earnings

release.

TEAM, INC. AND

SUBSIDIARIESNon-GAAP Financial

Measures(Unaudited)

The Company uses supplemental non-GAAP financial

measures which are derived from the consolidated financial

information, including adjusted net income (loss); adjusted net

income (loss) per share; earnings before interest and taxes

(“EBIT”); Adjusted EBIT; adjusted earnings before interest, taxes,

depreciation, and amortization (“Adjusted EBITDA”) and free cash

flow to supplement financial information presented on a GAAP

basis.

The Company defines adjusted net income (loss)

and adjusted net income (loss) per share to exclude the following

items: non-routine legal costs and settlements, non-routine

professional fees, restructuring charges, loss on debt

extinguishment, certain severance charges, and certain other items

that we believe are not indicative of core operating activities.

Consolidated Adjusted EBIT, as defined by us, excludes the costs

excluded from adjusted net income (loss) as well as income tax

expense (benefit), interest charges, foreign currency (gain) loss,

and items of other (income) expense. Consolidated Adjusted EBITDA

further excludes from consolidated Adjusted EBIT depreciation,

amortization and non-cash share-based compensation costs. Adjusted

EBITDA margin is calculated as Adjusted EBITDA divided by total

revenue. Segment Adjusted EBIT is equal to segment operating income

(loss) excluding costs associated with non-routine legal costs and

settlements, non-routine professional fees, loss on debt

extinguishment, certain severance charges, and certain other items

as determined by management. Segment Adjusted EBITDA further

excludes from segment Adjusted EBIT depreciation, amortization, and

non-cash share-based compensation costs. Free cash flow is defined

as net cash provided by (used in) operating activities minus

capital expenditures. Net debt is defined as the sum of the current

and long-term portions of debt, including finance lease

obligations, less cash and cash equivalents.

Management believes these non-GAAP financial

measures are useful to both management and investors in their

analysis of our financial position and results of operations. In

particular, adjusted net income (loss), adjusted net income (loss)

per share, consolidated Adjusted EBIT, and consolidated Adjusted

EBITDA are meaningful measures of performance that are commonly

used by industry analysts, investors, lenders, and rating agencies

to analyze operating performance in our industry, perform

analytical comparisons, benchmark performance between periods, and

measure our performance against externally communicated targets.

Our segment Adjusted EBIT and segment Adjusted EBITDA are also used

as a basis for the chief operating decision maker to evaluate the

performance of our reportable segments. Free cash flow is used by

our management and investors to analyze our ability to service and

repay debt and return value directly to stakeholders.

Non-GAAP financial measures have important

limitations as analytical tools, because they exclude some, but not

all, items that affect net earnings and operating income. These

measures should not be considered substitutes for their most

directly comparable U.S. GAAP financial measures and should be read

only in conjunction with financial information presented on a GAAP

basis. Further, our non-GAAP financial measures may not be

comparable to similarly titled measures of other companies who may

calculate non-GAAP financial measures differently, limiting the

usefulness of those measures for comparative purposes. The

liquidity measure of free cash flow does not represent a precise

calculation of residual cash flow available for discretionary

expenditures. Reconciliations of each non-GAAP financial measure to

its most directly comparable GAAP financial measure are presented

below.

|

TEAM, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

(unaudited, in thousands except per share

data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Adjusted Net

Loss: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(12,134 |

) |

|

$ |

(26,620 |

) |

|

$ |

(52,598 |

) |

|

$ |

(93,155 |

) |

|

Professional fees and other1 |

|

1,452 |

|

|

|

539 |

|

|

|

5,820 |

|

|

|

10,576 |

|

|

Write-off of software cost |

|

629 |

|

|

|

— |

|

|

|

629 |

|

|

|

— |

|

|

Legal costs2 |

|

650 |

|

|

|

1,543 |

|

|

|

850 |

|

|

|

3,271 |

|

|

Severance charges, net3 |

|

655 |

|

|

|

670 |

|

|

|

1,177 |

|

|

|

3,028 |

|

|

Natural disaster insurance recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(872 |

) |

|

Loss on debt extinguishment |

|

3 |

|

|

|

— |

|

|

|

1,585 |

|

|

|

— |

|

|

Tax impact of adjustments and other net tax items4 |

|

(37 |

) |

|

|

(24 |

) |

|

|

(122 |

) |

|

|

(31 |

) |

| Adjusted Net

Loss |

$ |

(8,782 |

) |

|

$ |

(23,892 |

) |

|

$ |

(42,659 |

) |

|

$ |

(77,183 |

) |

| |

|

|

|

|

|

|

|

| Adjusted Net Loss per

common share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(2.01 |

) |

|

$ |

(5.53 |

) |

|

$ |

(9.79 |

) |

|

$ |

(18.65 |

) |

| |

|

|

|

|

|

|

|

| Consolidated Adjusted

EBIT and Adjusted EBITDA: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(12,134 |

) |

|

$ |

(26,620 |

) |

|

$ |

(52,598 |

) |

|

$ |

(93,155 |

) |

|

Provision for income taxes |

|

1,072 |

|

|

|

1,465 |

|

|

|

4,020 |

|

|

|

4,182 |

|

|

Loss (gain) on equipment sale |

|

10 |

|

|

|

(786 |

) |

|

|

(286 |

) |

|

|

(4,269 |

) |

|

Interest expense, net |

|

10,067 |

|

|

|

26,653 |

|

|

|

43,499 |

|

|

|

63,708 |

|

|

Professional fees and other1 |

|

1,452 |

|

|

|

539 |

|

|

|

5,820 |

|

|

|

10,576 |

|

|

Write-off of software cost |

|

629 |

|

|

|

— |

|

|

|

629 |

|

|

|

— |

|

|

Legal costs2 |

|

650 |

|

|

|

1,543 |

|

|

|

850 |

|

|

|

3,271 |

|

|

Severance charges, net3 |

|

655 |

|

|

|

670 |

|

|

|

1,177 |

|

|

|

3,028 |

|

|

Foreign currency gain |

|

(742 |

) |

|

|

(2,264 |

) |

|

|

(776 |

) |

|

|

(3,955 |

) |

|

Pension credit5 |

|

(163 |

) |

|

|

(178 |

) |

|

|

(481 |

) |

|

|

(571 |

) |

|

Natural disaster insurance recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(872 |

) |

|

Loss on debt extinguishment |

|

3 |

|

|

|

— |

|

|

|

1,585 |

|

|

|

— |

|

| Consolidated Adjusted

EBIT |

|

1,499 |

|

|

|

1,022 |

|

|

|

3,439 |

|

|

|

(18,057 |

) |

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

Amount included in operating expenses |

|

3,613 |

|

|

|

3,771 |

|

|

|

11,026 |

|

|

|

11,843 |

|

|

Amount included in SG&A expenses |

|

5,783 |

|

|

|

5,216 |

|

|

|

17,455 |

|

|

|

15,607 |

|

|

Total depreciation and amortization |

|

9,396 |

|

|

|

8,987 |

|

|

|

28,481 |

|

|

|

27,450 |

|

|

Non-cash share-based compensation costs |

|

232 |

|

|

|

629 |

|

|

|

859 |

|

|

|

570 |

|

| Consolidated Adjusted

EBITDA |

$ |

11,127 |

|

|

$ |

10,638 |

|

|

$ |

32,779 |

|

|

$ |

9,963 |

|

| |

|

|

|

|

|

|

|

| Free Cash

Flow: |

|

|

|

|

|

|

|

|

Cash provided by (used in) operating activities |

$ |

1,548 |

|

|

$ |

5,913 |

|

|

$ |

(22,069 |

) |

|

$ |

(50,573 |

) |

|

Capital expenditures |

|

(2,360 |

) |

|

|

(5,883 |

) |

|

|

(7,433 |

) |

|

|

(17,299 |

) |

| Free Cash

Flow |

$ |

(812 |

) |

|

$ |

30 |

|

|

$ |

(29,502 |

) |

|

$ |

(67,872 |

) |

| ____________________________________ |

|

1 |

For the three and nine months ended September 30, 2023, includes

$1.5 million and $4.7 million, respectively related to debt

financing, and $0 and $1.1 million, respectively, related to lease

extinguishment charges and other project costs. For the three and

nine months ended September 30, 2022, includes $0.5 million and

$10.5 million, respectively, related to costs associated with the

debt financing and corporate support costs. |

| 2 |

Primarily relates to accrued legal matters and legal fees. |

| 3 |

For the three and nine months ended September 30, 2023, primarily

related to customary severance costs associated with staff

reductions across multiple departments. For the three months ended

September 30, 2022, primarily related to customary severance costs

associated with staff reductions across multiple corporate

departments. For the nine months ended September 30, 2022 includes

$1.3 million related to customary severance costs associated with

executive departures and $1.7 million associated with severance

across multiple corporate departments. |

| 4 |

Represents the tax effect of the adjustments. |

| 5 |

Represents pension credits for the U.K. pension plan based on the

difference between the expected return on plan assets and the cost

of the discounted pension liability. The pension plan was frozen in

1994 and no new participants have been added since that date.

Accruals for future benefits ceased in connection with a plan

curtailment in 2013. |

|

TEAM, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Continued) |

|

(unaudited, in thousands) |

| |

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Segment Adjusted EBIT

and Adjusted EBITDA: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| IHT |

|

|

|

|

|

|

|

|

Operating income |

$ |

6,412 |

|

|

$ |

7,390 |

|

|

$ |

17,683 |

|

|

$ |

13,038 |

|

|

Severance charges, net1 |

|

195 |

|

|

|

150 |

|

|

|

400 |

|

|

|

192 |

|

|

Professional fees and other |

|

— |

|

|

|

— |

|

|

|

828 |

|

|

|

— |

|

|

Adjusted EBIT |

|

6,607 |

|

|

|

7,540 |

|

|

|

18,911 |

|

|

|

13,230 |

|

|

Depreciation and amortization |

|

3,148 |

|

|

|

3,022 |

|

|

|

9,390 |

|

|

|

9,372 |

|

|

Adjusted EBITDA |

$ |

9,755 |

|

|

$ |

10,562 |

|

|

$ |

28,301 |

|

|

$ |

22,602 |

|

| |

|

|

|

|

|

|

|

| MS |

|

|

|

|

|

|

|

|

Operating income |

$ |

6,482 |

|

|

$ |

7,655 |

|

|

$ |

22,395 |

|

|

$ |

15,152 |

|

|

Severance charges, net1 |

|

287 |

|

|

|

35 |

|

|

|

595 |

|

|

|

89 |

|

|

Professional fees and other |

|

— |

|

|

|

— |

|

|

|

67 |

|

|

|

— |

|

|

Adjusted EBIT |

|

6,769 |

|

|

|

7,690 |

|

|

|

23,057 |

|

|

|

15,241 |

|

|

Depreciation and amortization |

|

4,656 |

|

|

|

4,704 |

|

|

|

14,113 |

|

|

|

14,222 |

|

|

Adjusted EBITDA |

$ |

11,425 |

|

|

$ |

12,394 |

|

|

$ |

37,170 |

|

|

$ |

29,463 |

|

| |

|

|

|

|

|

|

|

| Corporate and shared

support services |

|

|

|

|

|

|

|

|

Net loss |

$ |

(25,028 |

) |

|

$ |

(41,665 |

) |

|

$ |

(92,676 |

) |

|

$ |

(121,345 |

) |

|

Provision for income taxes |

|

1,072 |

|

|

|

1,465 |

|

|

|

4,020 |

|

|

|

4,182 |

|

|

Loss (gain) on equipment sale |

|

10 |

|

|

|

(786 |

) |

|

|

(286 |

) |

|

|

(4,269 |

) |

|

Interest expense, net |

|

10,067 |

|

|

|

26,653 |

|

|

|

43,499 |

|

|

|

63,708 |

|

|

Foreign currency gain |

|

(742 |

) |

|

|

(2,264 |

) |

|

|

(776 |

) |

|

|

(3,955 |

) |

|

Pension credit2 |

|

(163 |

) |

|

|

(178 |

) |

|

|

(481 |

) |

|

|

(571 |

) |

|

Professional fees and other3 |

|

1,452 |

|

|

|

539 |

|

|

|

4,925 |

|

|

|

10,576 |

|

|

Write-off of software cost |

|

629 |

|

|

|

— |

|

|

|

629 |

|

|

|

— |

|

|

Legal costs4 |

|

650 |

|

|

|

1,543 |

|

|

|

850 |

|

|

|

3,271 |

|

|

Severance charges, net1 |

|

173 |

|

|

|

485 |

|

|

|

182 |

|

|

|

2,747 |

|

|

Loss on debt extinguishment |

|

3 |

|

|

|

— |

|

|

|

1,585 |

|

|

|

— |

|

|

Natural disaster insurance recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(872 |

) |

|

Adjusted EBIT |

|

(11,877 |

) |

|

|

(14,208 |

) |

|

|

(38,529 |

) |

|

|

(46,528 |

) |

|

Depreciation and amortization |

|

1,592 |

|

|

|

1,261 |

|

|

|

4,978 |

|

|

|

3,856 |

|

|

Non-cash share-based compensation costs |

|

232 |

|

|

|

629 |

|

|

|

859 |

|

|

|

570 |

|

|

Adjusted EBITDA |

$ |

(10,053 |

) |

|

$ |

(12,318 |

) |

|

$ |

(32,692 |

) |

|

$ |

(42,102 |

) |

|

___________________ |

|

1 |

For the three and nine months ended September 30, 2023, primarily

related to customary severance costs associated with staff

reductions across multiple departments. For the three months ended

September 30, 2022, primarily related to customary severance costs

associated with staff reductions across multiple corporate

departments. For the nine months ended September 30, 2022 includes

$1.3 million related to customary severance costs associated with

executive departures and $1.7 million associated with severance

across multiple corporate departments. |

| 2 |

Represents pension credits for the U.K. pension plan based on the

difference between the expected return on plan assets and the cost

of the discounted pension liability. The pension plan was frozen in

1994 and no new participants have been added since that date.

Accruals for future benefits ceased in connection with a plan

curtailment in 2013. |

| 3 |

For the three and nine months ended September 30, 2023, includes

$1.5 million and $4.7 million, respectively related to debt

financing, and $0 and $1.1 million, respectively, related to lease

extinguishment charges and other project costs. For the three and

nine months ended September 30, 2022, includes $0.5 million and

$10.5 million, respectively, related to costs associated with the

debt financing and corporate support costs. |

| 4 |

Primarily relates to accrued legal matters and legal fees. |

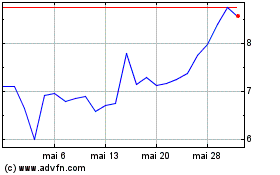

Team (NYSE:TISI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Team (NYSE:TISI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025