FALSE000009713400000971342024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported) | August 8, 2024 |

| | |

| TENNANT COMPANY |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Minnesota | 1-16191 | 41-0572550 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

10400 Clean Street Eden Prairie, Minnesota | 55344 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| Registrant’s telephone number, including area code | 763 540-1200 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.375 per share | | TNC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, the company issued the news release attached hereto as Exhibit 99 and incorporated herein by reference.

The information in this Item 2.02 and Exhibit 99 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference into any filings under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Tennant Company |

| | |

| Date: August 8, 2024 | By: | /s/ Fay West |

| | Fay West

Senior Vice President and Chief Financial Officer |

Exhibit 99

Exhibit 99

Tennant Company Reports Second Quarter 2024 Results

Delivers Net Sales and Adjusted EBITDA Growth

Increases Full-Year 2024 Guidance

MINNEAPOLIS, MN (Aug 8, 2024)—Tennant Company ("Tennant" or the "Company") (NYSE: TNC) today reported its financial results for the quarter ended June 30, 2024.

| | | | | | | | | | | | | | | | | |

| (In millions, except per share data) | Three Months Ended June 30, |

| 2024 | | 2023 | | Increase / (Decrease) |

| Net sales | $ | 331.0 | | | $ | 321.7 | | | 2.9 | % |

| Net income | $ | 27.9 | | | $ | 31.3 | | | (10.9) | % |

| Diluted EPS | $ | 1.45 | | | $ | 1.68 | | | (13.7) | % |

| | | | | |

| Adjusted diluted EPS | $ | 1.83 | | | $ | 1.86 | | | (1.6) | % |

| Adjusted EBITDA | $ | 58.6 | | | $ | 57.6 | | | 1.7 | % |

| Adjusted EBITDA margin % | 17.7 | % | | 17.9 | % | | (20 bps) |

Highlights

•Delivered net sales of $331.0 million for the second quarter of 2024, an increase of 2.9% from the second quarter of 2023, or 2.7% on an organic basis, driven primarily by strong pricing realization.

•Achieved Adjusted EBITDA of $58.6 million, an increase of $1.0 million, primarily due to strong sales growth.

•Generated operating cash flow of $18.6 million and returned $13.3 million to Tennant shareholders through dividends and share repurchases.

•The Company increased its full-year 2024 guidance and now expects net sales to be between $1,280 million and $1,305 million and Adjusted EBITDA to be between $205 million and $215 million.

•Published the 2024 (FY23) Sustainability Report highlighting the Company's commitment to leading the industry in sustainability.

•The Company refinanced its existing debt agreement, increasing its revolving credit facility limit to $650 million providing more flexibility and capability to drive expansion.

“We are pleased to report a record second quarter performance, underpinned by strong order rates and continued progress toward normalized backlog levels. As our investments in our enterprise growth strategy continue to yield positive results, we are confident the second half of the year will see strong performance supported by increased order rates,” said Dave Huml, Tennant President and Chief Executive Officer. "Looking ahead, our strong performance in the first half of the year gives us confidence in raising our guidance for 2024."

Page 2 – Tennant Company Reports Second Quarter 2024 Results

Net Sales

Consolidated net sales for the second quarter of 2024 totaled $331.0 million, a 2.9% increase compared to consolidated net sales of $321.7 million in the second quarter of 2023. The components of the consolidated net sales change were as follows:

| | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 vs. 2023 |

| Price | | 2.7% | | 3.6% |

| Volume | | —% | | (1.8)% |

| Organic growth | | 2.7% | | 1.8% |

| Acquisitions | | 0.8% | | 0.6% |

| Foreign currency | | (0.6)% | | (0.1)% |

| Total growth | | 2.9% | | 2.3% |

Organic Sales

Organic sales, which exclude the effects of foreign currency and acquisitions, increased 2.7% compared to the prior year, led by strong equipment sales, particularly in the Americas region, partially offset by lower sales in the EMEA and APAC regions. Additionally, there was a shift in product mix in each of our geographies from smaller, commercial-application equipment to larger, industrial-application equipment. Backlog shipped in the quarter was largely concentrated in our large industrial-application equipment, which generally has a higher average selling price per unit.

Volumes in the current period were negatively impacted by slow economic growth in EMEA and difficult business conditions in APAC, particularly in China, where government authorities are intensifying efforts to bolster manufacturing against weaker demand, creating market oversupply and pricing pressure in the region.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 | | Six Months Ended June 30, 2024 |

| Americas | | EMEA | | APAC | | Total | | Americas | | EMEA | | APAC | | Total |

| Organic net sales growth | 5.5% | | (0.3)% | | (11.9)% | | 2.7% | | 5.3% | | (4.8)% | | (7.1)% | | 1.8% |

Americas: The 5.5% increase in the Americas, which includes all of North America and Latin America, was driven primarily by price realization and net volume increases from product and channel mix. This was partially offset by unit volume decreases in North America, specifically in our commercial-application machines, which had a higher backlog benefit in the prior-year period.

EMEA: The 0.3% decrease in EMEA, which includes Europe, the Middle East and Africa, was due to volume declines in both equipment and parts and consumables partly offset by price realization in all product categories. Equipment volumes were impacted by weaker-than-expected market conditions and a smaller contribution from backlog reduction in the current period.

APAC: The 11.9% decrease in APAC, which includes China, Australia, Japan and other Asian markets, was primarily due to volume declines in China and Australia, partially offset by price realization in Australia. China is suffering from market saturation and price pressure generating lower demand for our products in the region. In Australia, we are seeing customer caution and a moderating in demand.

Page 3 – Tennant Company Reports Second Quarter 2024 Results

Operating Results

Gross profit margin of 43.1% decreased 30 basis points compared to the second quarter of 2023. The slight margin rate decrease is attributed to higher inflation, while price realization and cost savings activities materially offset inflation during the quarter. Our overall margin rate is supported by a continued shift to industrial equipment and the direct sales channel.

Selling and Administrative ("S&A") expense totaled $92.9 million in the second quarter of 2024, a $5.9 million increase compared to the second quarter of 2023, and included $3.4 million of ERP modernization costs and $1.4 million of transaction and integration costs associated with our investment in Brain Corp and acquisition of TCS EMEA GmbH ("TCS"), Tennant's long-standing distributor serving countries in Europe, Africa, and the Middle East. Excluding non-GAAP costs, Adjusted S&A as a percent of net sales improved to 26.4% in the second quarter of 2024, compared to 26.7% in the second quarter 2023.

Adjusted EBITDA was $58.6 million in the second quarter of 2024, compared to $57.6 million in the prior-year period. The improvement in Adjusted EBITDA was primary due to sales growth in the America's. Adjusted EBITDA margin for the second quarter of 2024 was 17.7%, essentially flat compared to 17.9% in the prior-year period.

Net income was $27.9 million in the second quarter of 2024 compared to $31.3 million in the second quarter of 2023. The decrease was due to ERP modernization costs and transaction and integration costs associated with our investment in Brain Corp and the acquisition of TCS. This was partly offset by lower interest expense driven by a decrease in average debt balances. Adjusted net income was $35.2 million in the second quarter of 2024, an increase of $0.5 million compared to the second quarter of 2023. The increase was primarily driven by lower interest expense noted above, partly offset by an increase in income taxes due to an increase in nondeductible executive compensation and unfavorable changes in the mix in forecasted earnings by country.

Cash Flow, Liquidity and Capital Allocation

Tennant generated $18.6 million in cash flow from operations during the second quarter of 2024, a $20.5 million decrease compared to the prior-year period. The decrease was primarily driven by increases in working capital associated with the timing of sales during the quarter as well as investments in ERP modernization costs totaling $9 million.

Liquidity remained strong with a balance of $84.6 million in cash and cash equivalents as of the end of the second quarter, and approximately $321.8 million of unused borrowing capacity on the Company’s revolving credit facility. On August 7, the Company amended and restructured its existing credit agreement to optimize its debt structure and enhance its flexibility and capability for driving expansion.

The Company continues to deploy cash flow toward operational capital needs and to return capital to shareholders in line with its capital allocation priorities. During the second quarter, the Company invested $4.2 million in capital expenditures and returned $13.3 million to shareholders through dividends and share repurchases. The Company continues to effectively manage debt and maintain a strong balance sheet, keeping its net leverage below its targeted range of 1x to 2x Adjusted EBITDA.

Page 4 – Tennant Company Reports Second Quarter 2024 Results

2024 Guidance

Given the strong first-half results and expectations for the remainder of the year, the Company is updating its full-year 2024 guidance ranges as noted below, including an increased outlook for Net Sales and Adjusted EBITDA:

| | | | | | | | | | | |

| (In millions, except per share data) | Updated 2024

Guidance Ranges | | Original 2024

Guidance Ranges |

| Net sales | $1,280 - $1,305 | | $1,270 - $1,295 |

| Organic net sales growth | 2.5 % - 4.5 % | | 2.0 % - 4.0 % |

| Adjusted diluted net income per share* | $6.15 - $6.55 | | $6.05 - $6.65 |

| Adjusted EBITDA* | $205 - $215 | | $198 - $213 |

| Adjusted EBITDA margin | 16.0 % - 16.5 % | | 15.6 % - 16.4 % |

| Capital expenditures | ~$20 | | $20 - $25 |

| Adjusted effective tax rate* | 22 % - 27 % | | 22 % - 27 % |

*Excludes ERP modernization costs, other certain nonoperational items and amortization expense.

Conference Call

Tennant will host a conference call to discuss its 2024 second quarter results today, August 8, 2024, at 9 a.m. Central Time (10 a.m. Eastern Time). The conference call and accompanying slides will be available via webcast on Tennant's investor website. To listen to the call live and view the slide presentation, go to investors.tennantco.com and click on the link at the bottom of the overview page. A replay of the conference call, with slides, will be available at investors.tennantco.com.

Company Profile

Founded in 1870, Tennant Company (TNC), headquartered in Eden Prairie, Minnesota, is a world leader in the design, manufacture and marketing of solutions that help create a cleaner, safer and healthier world. Its products include equipment for maintaining surfaces in industrial, commercial and outdoor environments; detergent-free and other sustainable cleaning technologies; and cleaning tools and supplies. Tennant's global field service network is the most extensive in the industry. Tennant Company had sales of $1.24 billion in 2023 and has approximately 4,500 employees. Tennant has manufacturing operations throughout the world and sells products directly in more than 15 countries and through distributors in more than 100 countries. For more information, visit www.tennantco.com and www.ipcworldwide.com. The Tennant Company logo and other trademarks designated with the symbol “®” are trademarks of Tennant Company registered in the United States and/or other countries.

Forward-Looking Statements

Certain statements contained in this document are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. These statements do not relate to strictly historical or current facts and provide current expectations or forecasts of future events. Any such expectations or forecasts of future events are subject to a variety of factors. These include factors that affect all businesses operating in a global market as well as matters specific to us and the markets the Company serves. Particular risks and uncertainties presently facing it include: economic uncertainty throughout the world; geopolitical tensions or health epidemics; the Company's ability to comply with global laws and regulations; the Company's ability to adapt pricing to the competitive marketplace and customer pricing sensitivities; the competition in the Company's business; fluctuations in the cost, quality or availability of raw materials and purchased components; increasing cost pressures; unforeseen product liability claims or product quality issues; the Company's ability to attract, retain and develop key personnel and create effective succession planning strategies; the Company's ability to effectively develop and manage strategic planning and growth processes and the related operational plans; the Company's ability to successfully upgrade and evolve its information technology systems; the Company's ability to successfully protect our information technology systems from cybersecurity risks; the occurrence of a significant business interruption; the Company's ability to maintain the health and safety of its workers; the

Page 5 – Tennant Company Reports Second Quarter 2024 Results

Company's ability to integrate acquisitions; and the Company's ability to develop and commercialize new innovative products and services.

The Company cautions that forward-looking statements must be considered carefully and that actual results may differ in material ways due to risks and uncertainties both known and unknown. Information about factors that could materially affect the Company's results can be found in its 2023 Form 10-K. Shareholders, potential investors and other readers are urged to consider these factors in evaluating forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements.

The Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Investors are advised to consult any further disclosures by the Company in its filings with the Securities and Exchange Commission and in other written statements on related subjects. It is not possible to anticipate or foresee all risk factors, and investors should not consider any list of such factors to be an exhaustive or complete list of all risks or uncertainties.

Non-GAAP Financial Measures

This news release and the related conference call include presentation of Non-GAAP measures that include or exclude special items of a nonrecurring and/or nonoperational nature (hereinafter referred to as “special items”). Management believes that the Non-GAAP measures provide useful information to investors regarding the Company’s results of operations and financial condition because they permit a more meaningful comparison and understanding of Tennant Company’s operating performance for the current, past or future periods. Management uses these Non-GAAP measures to monitor and evaluate ongoing operating results and trends and to gain an understanding of the comparative operating performance of the Company.

The Company believes that disclosing selling and administrative (“S&A”) expense – as adjusted, S&A expense as a percent of net sales – as adjusted, operating income – as adjusted, operating margin – as adjusted, income before income taxes – as adjusted, income tax expense – as adjusted, net income – as adjusted, net income per diluted share – as adjusted, EBITDA – as adjusted, and EBITDA margin – as adjusted (collectively, the “Non-GAAP measures”), excluding the impacts from special items, is useful to investors as a measure of operating performance. The Company uses these measures to monitor and evaluate operating performance. The Non-GAAP measures are financial measures that do not reflect United States Generally Accepted Accounting Principles (GAAP). The Company calculates the Non-GAAP measures by adjusting for ERP modernization costs, transaction-related costs and amortization expense. The Company calculates income tax expense – as adjusted by adjusting for the tax effect of these Non-GAAP measures. The Company calculates net income per diluted share – as adjusted by adjusting for the after-tax effect of these Non-GAAP measures and dividing the result by the diluted weighted average shares outstanding. The Company calculates EBITDA margin – as adjusted by dividing EBITDA – as adjusted by net sales.

INVESTOR RELATIONS CONTACT:

Lorenzo Bassi

Vice President, Finance and Investor Relations

investors@tennantco.com

763-540-1242

FINANCIAL TABLES FOLLOW

Page 6 – Tennant Company Reports Second Quarter 2024 Results

TENNANT COMPANY

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except shares and per share data) | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 331.0 | | | $ | 321.7 | | | $ | 642.0 | | | $ | 627.5 | |

| Cost of sales | 188.3 | | | 182.2 | | | 361.8 | | | 362.5 | |

| Gross profit | 142.7 | | | 139.5 | | | 280.2 | | | 265.0 | |

| Selling and administrative expense | 92.9 | | | 87.0 | | | 182.8 | | | 168.7 | |

| Research and development expense | 11.2 | | | 9.0 | | | 21.3 | | | 16.9 | |

| Operating income | 38.6 | | | 43.5 | | | 76.1 | | | 79.4 | |

| Interest expense, net | (2.5) | | | (4.0) | | | (4.8) | | | (7.7) | |

| Net foreign currency transaction gain | 0.7 | | | 1.0 | | | 0.5 | | | 0.9 | |

| Other income (expense), net | 0.1 | | | (0.6) | | | 0.2 | | | (0.7) | |

| Income before income taxes | 36.9 | | | 39.9 | | | 72.0 | | | 71.9 | |

| Income tax expense | 9.0 | | | 8.6 | | | 15.7 | | | 16.3 | |

| Net income | $ | 27.9 | | | $ | 31.3 | | | $ | 56.3 | | | $ | 55.6 | |

| | | | | | | |

| Net income per share | | | | | | | |

| Basic | $ | 1.47 | | | $ | 1.70 | | | $ | 2.99 | | | $ | 3.02 | |

| Diluted | $ | 1.45 | | | $ | 1.68 | | | $ | 2.94 | | | $ | 2.98 | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 18,896,361 | | 18,436,367 | | 18,780,995 | | 18,442,862 |

| Diluted | 19,206,801 | | 18,713,455 | | 19,141,274 | | 18,691,736 |

GEOGRAPHICAL NET SALES(1) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Americas | $ | 227.8 | | | $ | 216.6 | | | 5.2 | % | | $ | 443.4 | | | $ | 421.0 | | | 5.3 | % |

| Europe, Middle East and Africa | 81.5 | | | 80.0 | | | 1.9 | % | | 158.3 | | | 162.1 | | | (2.3) | % |

| Asia Pacific | 21.7 | | | 25.1 | | | (13.5) | % | | 40.3 | | | 44.4 | | | (9.2) | % |

| Total | $ | 331.0 | | | $ | 321.7 | | | 2.9 | % | | $ | 642.0 | | | $ | 627.5 | | | 2.3 | % |

(1) Net of intercompany sales.

Page 7 – Tennant Company Reports Second Quarter 2024 Results

TENNANT COMPANY

CONSOLIDATED BALANCE SHEETS (Unaudited)

| | | | | | | | | | | |

| (In millions, except shares and per share data) | June 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Cash, cash equivalents, and restricted cash | $ | 84.6 | | | $ | 117.1 | |

Receivables, less allowances of $6.7 and $7.2, respectively | 268.8 | | | 247.6 | |

| Inventories | 189.7 | | | 175.9 | |

| Prepaid and other current assets | 34.7 | | | 28.5 | |

| Total current assets | 577.8 | | | 569.1 | |

Property, plant and equipment, less accumulated depreciation of $303.1 and $304.0, respectively | 179.4 | | | 187.7 | |

| Operating lease assets | 44.2 | | | 41.7 | |

| Goodwill | 191.0 | | | 187.4 | |

| Intangible assets, net | 67.5 | | | 63.1 | |

| Other assets | 107.6 | | | 64.4 | |

| Total assets | $ | 1,167.5 | | | $ | 1,113.4 | |

| LIABILITIES AND EQUITY | | | |

| Current portion of long-term debt | $ | 7.8 | | | $ | 6.4 | |

| Accounts payable | 128.7 | | | 111.4 | |

| Employee compensation and benefits | 51.7 | | | 67.3 | |

| Other current liabilities | 78.0 | | | 88.6 | |

| Total current liabilities | 266.2 | | | 273.7 | |

| Long-term debt | 205.6 | | | 194.2 | |

| Long-term operating lease liabilities | 29.7 | | | 27.4 | |

| Employee benefits | 13.4 | | | 13.3 | |

| Deferred income taxes | 7.9 | | | 5.0 | |

| Other liabilities | 18.8 | | | 21.5 | |

| Total long-term liabilities | 275.4 | | | 261.4 | |

| Total liabilities | $ | 541.6 | | | $ | 535.1 | |

Common Stock, $0.375 par value; 60,000,000 shares authorized; 18,950,661 and 18,631,384 shares issued and outstanding, respectively | 7.1 | | | 7.0 | |

| Additional paid-in capital | 80.7 | | | 64.9 | |

| Retained earnings | 593.1 | | | 547.4 | |

| Accumulated other comprehensive loss | (56.3) | | | (42.3) | |

| Total Tennant Company shareholders' equity | 624.6 | | | 577.0 | |

| Noncontrolling interest | 1.3 | | | 1.3 | |

| Total equity | 625.9 | | | 578.3 | |

| Total liabilities and total equity | $ | 1,167.5 | | | $ | 1,113.4 | |

Page 8 – Tennant Company Reports Second Quarter 2024 Results

TENNANT COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) | | | | | | | | | | | |

| (In millions) | Six Months Ended

June 30, |

| 2024 | | 2023 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 56.3 | | | $ | 55.6 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation expense | 19.5 | | | 17.2 | |

| Amortization expense | 7.8 | | | 7.5 | |

| Deferred income tax benefit | (1.2) | | | (5.6) | |

| Share-based compensation expense | 5.3 | | | 3.9 | |

| Bad debt and returns expense | 0.6 | | | 1.7 | |

| Other, net | 0.3 | | | 0.4 | |

| Changes in operating assets and liabilities: | | | |

| Receivables | (22.8) | | | (10.9) | |

| Inventories | (22.9) | | | (1.3) | |

| Accounts payable | 20.8 | | | (10.5) | |

| Employee compensation and benefits | (14.9) | | | 7.0 | |

| Other assets and liabilities | (27.3) | | | 5.2 | |

| Net cash provided by operating activities | 21.5 | | | 70.2 | |

| INVESTING ACTIVITIES | | | |

| Purchases of property, plant and equipment | (7.2) | | | (11.8) | |

| Purchase of investment | (32.1) | | | — | |

| Payments made in connection with business acquisition, net of cash acquired | (25.7) | | | — | |

| Investment in leased assets | (0.3) | | | (0.5) | |

| Cash received from leased assets | 0.4 | | | 0.3 | |

| Net cash used in investing activities | (64.9) | | | (12.0) | |

| FINANCING ACTIVITIES | | | |

| Proceeds from borrowings | 40.0 | | | 20.0 | |

| Repayments of borrowings | (27.5) | | | (42.5) | |

| Proceeds from exercise of stock options, net of employee tax withholdings obligations | 19.6 | | | 4.2 | |

| Repurchases of common stock | (9.1) | | | (10.0) | |

| Dividends paid | (10.6) | | | (9.8) | |

| Net cash provided by (used) in financing activities | 12.4 | | | (38.1) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (1.5) | | | (1.7) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (32.5) | | | 18.4 | |

| Cash, cash equivalents and restricted cash at beginning of period | 117.1 | | | 77.4 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 84.6 | | | $ | 95.8 | |

Page 9 – Tennant Company Reports Second Quarter 2024 Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Reported to Adjusted Net Income and Net Income Per Share

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except per share data) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income - as reported | $ | 27.9 | | | $ | 31.3 | | | $ | 56.3 | | | $ | 55.6 | |

| Adjustments: | | | | | | | |

| Amortization expense | 2.9 | | | 2.6 | | | 5.8 | | | 5.4 | |

| Restructuring-related charge (S&A expense) | 0.4 | | | 0.8 | | | 0.4 | | | 0.8 | |

| ERP modernization costs (S&A expense) | 2.6 | | | — | | | 4.5 | | | — | |

| Transaction and integration-related costs (S&A expense) | 1.4 | | | — | | | 2.9 | | | — | |

| Net income - as adjusted | $ | 35.2 | | | $ | 34.7 | | | $ | 69.9 | | | $ | 61.8 | |

| | | | | | | |

| Net income per share - as reported: | | | | | | | |

| Diluted | $ | 1.45 | | | $ | 1.68 | | | $ | 2.94 | | | $ | 2.98 | |

| Adjustments: | | | | | | | |

| Amortization expense | 0.15 | | | 0.14 | | | 0.30 | | | 0.29 | |

| Restructuring-related charge (S&A expense) | 0.02 | | | 0.04 | | | 0.02 | | | 0.04 | |

| ERP modernization costs (S&A expense) | 0.14 | | | — | | | 0.24 | | | — | |

| Transaction and integration-related costs (S&A expense) | 0.07 | | | — | | | 0.15 | | | — | |

| Net income per diluted share - as adjusted | $ | 1.83 | | | $ | 1.86 | | | $ | 3.65 | | | $ | 3.31 | |

Reported Net Income to Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income - as reported | $ | 27.9 | | | $ | 31.3 | | | $ | 56.3 | | | $ | 55.6 | |

| Less: | | | | | | | |

| Interest expense, net | 2.5 | | | 4.0 | | | 4.8 | | | 7.7 | |

| Income tax expense | 9.0 | | | 8.6 | | | 15.7 | | | 16.3 | |

| Depreciation expense | 9.9 | | | 8.9 | | | 19.5 | | | 17.2 | |

| Amortization expense | 3.9 | | | 3.6 | | | 7.8 | | | 7.5 | |

| EBITDA | 53.2 | | | 56.4 | | | 104.1 | | | 104.3 | |

| Adjustments: | | | | | | | |

| Restructuring-related charge (S&A expense) | 0.6 | | | 1.2 | | | 0.6 | | | 1.2 | |

| ERP modernization costs (S&A expense) | 3.4 | | | — | | | 5.9 | | | — | |

| Transaction and integration-related costs (S&A expense) | 1.4 | | | — | | | 2.9 | | | — | |

| EBITDA - as adjusted | $ | 58.6 | | | $ | 57.6 | | | $ | 113.5 | | | $ | 105.5 | |

| EBITDA margin - as adjusted | 17.7 | % | | 17.9 | % | | 17.7 | % | | 16.8 | % |

Page 10 – Tennant Company Reports Second Quarter 2024 Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Reported to Adjusted Selling and Administrative Expense (S&A expense) and Operating Income

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| S&A expense - as reported | $ | 92.9 | | | $ | 87.0 | | | $ | 182.8 | | | $ | 168.7 | |

| S&A expense as a percent of net sales - as reported | 28.1 | % | | 27.0 | % | | 28.5 | % | | 26.9 | % |

| Adjustments: | | | | | | | |

| Restructuring-related charge (S&A expense) | (0.6) | | | (1.2) | | | (0.6) | | | (1.2) | |

| ERP modernization costs (S&A expense) | (3.4) | | | — | | | (5.9) | | | — | |

| Transaction and integration-related costs (S&A expense) | (1.4) | | | — | | | (2.9) | | | — | |

| S&A expense - as adjusted | $ | 87.5 | | | $ | 85.8 | | | $ | 173.4 | | | $ | 167.5 | |

| S&A expense as a percent of net sales - as adjusted | 26.4 | % | | 26.7 | % | | 27.0 | % | | 26.7 | % |

| | | | | | | |

| Operating income - as reported | $ | 38.6 | | | $ | 43.5 | | | $ | 76.1 | | | $ | 79.4 | |

| Operating margin - as reported | 11.7 | % | | 13.5 | % | | 11.9 | % | | 12.7 | % |

| Adjustments: | | | | | | | |

| Restructuring-related charge (S&A expense) | 0.6 | | | 1.2 | | | 0.6 | | | 1.2 | |

| ERP modernization costs (S&A expense) | 3.4 | | | — | | | 5.9 | | | — | |

| Transaction and integration-related costs (S&A expense) | 1.4 | | | — | | | 2.9 | | | — | |

| Operating income - as adjusted | $ | 44.0 | | | $ | 44.7 | | | $ | 85.5 | | | $ | 80.6 | |

| Operating margin - as adjusted | 13.3 | % | | 13.9 | % | | 13.3 | % | | 12.8 | % |

Page 11 – Tennant Company Reports Second Quarter 2024 Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Reported to Adjusted Income Before Income Taxes and Income Tax Expense

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income before income taxes - as reported | $ | 36.9 | | | $ | 39.9 | | | $ | 72.0 | | | $ | 71.9 | |

| Adjustments: | | | | | | | |

| Amortization expense | 3.9 | | | 3.6 | | | 7.8 | | | 7.5 | |

| Restructuring-related charge (S&A expense) | 0.6 | | | 1.2 | | | 0.6 | | | 1.2 | |

| ERP modernization costs (S&A expense) | 3.4 | | | — | | | 5.9 | | | — | |

| Transaction and integration-related costs (S&A expense) | 1.4 | | | — | | | 2.9 | | | — | |

| Income before income taxes - as adjusted | $ | 46.2 | | | $ | 44.7 | | | $ | 89.2 | | | $ | 80.6 | |

| | | | | | | |

| Income tax expense - as reported | $ | 9.0 | | | $ | 8.6 | | | $ | 15.7 | | | $ | 16.3 | |

| Effective tax rate - as reported | 24.4 | % | | 21.6 | % | | 21.8 | % | | 22.7 | % |

Adjustments(1): | | | | | | | |

| Amortization expense | 1.0 | | | 1.0 | | | 2.0 | | | 2.1 | |

| Restructuring-related charge (S&A expense) | 0.2 | | | 0.4 | | | 0.2 | | | 0.4 | |

| ERP modernization costs (S&A expense) | 0.8 | | | — | | | 1.4 | | | — | |

| Income tax expense - as adjusted | $ | 11.0 | | | $ | 10.0 | | | $ | 19.3 | | | $ | 18.8 | |

| Effective tax rate - as adjusted | 23.8 | % | | 22.4 | % | | 21.6 | % | | 23.3 | % |

(1) In determining the tax impact, we applied the statutory rate in effect for each jurisdiction where income or expenses were generated.

Reported to Free Cash Flows

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash provided by operating activities - as reported | $ | 18.6 | | | $ | 39.1 | | | $ | 21.5 | | | $ | 70.2 | |

| Less: | | | | | | | |

| Capitalized expenditures | (4.2) | | | (5.0) | | | (7.2) | | | (11.8) | |

| Free cash flows | $ | 14.4 | | | $ | 34.1 | | | $ | 14.3 | | | $ | 58.4 | |

| Adjustments: | | | | | | | |

| ERP modernization spend | 9.0 | | | — | | | 16.2 | | | — | |

| Free cash flows - as adjusted | $ | 23.4 | | | $ | 34.1 | | | $ | 30.5 | | | $ | 58.4 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

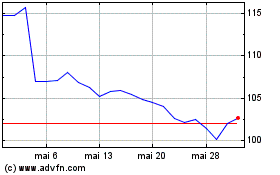

Tennant (NYSE:TNC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Tennant (NYSE:TNC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024