false

0000884614

0000884614

2024-06-25

2024-06-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 25, 2024

UGI Corporation

(Exact Name of Registrant as Specified in Its Charter)

Pennsylvania

(State

or Other Jurisdiction

of Incorporation) |

1-11071

(Commission

File Number) |

23-2668356

(IRS Employer

Identification No.) |

| |

|

|

500 North Gulph Road, King of Prussia, PA 19406

(Address

of Principal Executive Offices) (Zip Code) |

Registrant’s Telephone Number, Including

Area Code: 610 337-1000

Not

Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common

Stock, without par value |

|

UGI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On June 26, 2024, AmeriGas Partners, L.P. (“AmeriGas Partners”)

and AmeriGas Finance Corp. (“Finance Corp.” and, together with AmeriGas Partners, the “Issuers”), indirect, wholly-owned

subsidiaries of UGI Corporation (the “Company”), announced the early tender results for the previously announced cash tender

offer (the “Tender Offer”) for the Issuers’ 5.500% Senior Notes due 2025 (the “Notes”). In connection with

the foregoing, the Issuers have also increased the maximum aggregate principal amount of the Notes that they will accept for purchase

from the previously announced amount of $450,000,000 to $475,000,000 (as amended herein, the “Tender Cap”).

The Tender Offer is being made upon the terms and subject to the conditions

set forth in the offer to purchase, dated June 11, 2024 (as amended herein, the “Offer to Purchase”). The Company refers

investors to the Offer to Purchase for the complete terms and conditions of the Tender Offer. Except as specifically amended in the press

release announcing the early results of, and upsize in, the Tender Offer all other terms of the Tender Offer as previously announced in

the Offer to Purchase remain unchanged. A copy of the press release announcing the early results of, and upsize in, the Tender Offer is

furnished as Exhibit 99.1 to this Current Report on Form 8-K.

As of the previously announced early tender date and time of 5:00 p.m.,

New York City time, on June 25, 2024 (the “Early Tender Deadline”), according to information provided by D.F. King &

Co., Inc., the information and tender agent for the Tender Offer, the aggregate principal amount of the Notes as set forth in the

table below under “Principal Amount Tendered at Early Tender Deadline” has been validly tendered and not validly withdrawn.

Withdrawal rights expired at 5:00 p.m., New York City time, on the Early Tender Deadline.

| Title of Security | |

CUSIP No. | | |

Principal

Amount

Outstanding | | |

Principal

Amount

Tendered at

Early Tender

Deadline | | |

Aggregate

Principal Amount

Accepted for

Purchase | |

| 5.500% Senior Notes due 2025 | |

| 030981AK0 | | |

$ | 693,067,000 | | |

$ | 632,586,000 | | |

$ | 475,000,000 | |

The Issuers have elected to exercise their right to make payment for

the Notes that were validly tendered prior to or at the Early Tender Deadline and that are accepted for purchase on June 27, 2024

(the “Initial Settlement Date”).

The acceptance of tendered Notes was made in accordance with the Tender

Offer terms as described in the Offer to Purchase. As the aggregate principal amount of the Notes validly tendered and not validly withdrawn

as of the Early Tender Deadline exceeds the Tender Cap, any such tendered Notes will be accepted on a pro rata basis as set forth in the

Offer to Purchase, subject to a proration factor of approximately 75.17%. As described further in the Offer to Purchase, any Notes tendered

and not accepted for purchase will be promptly credited to the tendering holder’s account. Since the Tender Offer for the Notes

is fully subscribed at the Early Tender Deadline, the Issuers will not accept for purchase any Notes tendered after the Early Tender Deadline.

The information included in this Current Report on Form 8-K under

this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section. It may be incorporated by reference in a registration

statement or filing by the Company under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”),

only if and to the extent such subsequent filing specifically references the information herein as being incorporated by reference in

such filing.

This Current Report on Form 8-K shall not constitute an offer

to purchase or a solicitation of an offer to sell with respect to any Notes. Any offer to purchase the Notes will be made by means of

the Offer to Purchase, nor shall there be any offer to purchase in any jurisdiction in which such an offer to purchase would be unlawful.

On June 26, 2024, the Company issued a press release announcing

the early results of, and upsize in, the Tender Offer. A copy of the press release announcing the early results of, and upsize in, the

Tender Offer is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information included in this Current Report on Form 8-K under

this Item 8.01 (including Exhibit 99.1) shall not be deemed “filed” for the purposes of Section 18 of the Exchange

Act, or otherwise subject to the liabilities of that section. It may be incorporated by reference in a registration statement or filing

by the Company under the Exchange Act or the Securities Act only if and to the extent such subsequent filing specifically references the

information herein as being incorporated by reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

UGI

Corporation |

| |

|

|

| June 26,

2024 |

By: |

/s/

Jessica A. Milner |

| |

Name: |

Jessica

A. Milner |

| |

Title: |

Secretary |

Exhibit 99.1

AmeriGas Partners, L.P. and AmeriGas Finance Corp. Announce Early

Results and Upsize of Previously Announced Cash Tender Offer.

VALLEY FORGE, Pa.—(BUSINESS WIRE)—June 26, 2024—UGI

Corporation (NYSE: UGI) (the “Company”) announced today the early tender results for the previously announced cash tender

offer (the “Offer”) by its subsidiaries, AmeriGas Partners, L.P. (“AmeriGas Partners”) and AmeriGas Finance Corp.

(together with AmeriGas Partners, the “Offerors”) for the Offerors’ 5.500% Senior Notes due 2025 (the “Notes”).

In connection with the foregoing, the Offerors are also increasing the maximum aggregate principal amount of the Notes that they will

accept for purchase from the previously announced amount of $450,000,000 to $475,000,000 (as amended herein, the “Tender Cap”).

The Offer is being made upon the terms and subject to the conditions

set forth in the Offer to Purchase, dated June 11, 2024 (as amended herein, the “Offer to Purchase”). The Company refers

investors to the Offer to Purchase for the complete terms and conditions of the Offer. Except as specifically amended in this press release,

all other terms of the Offer as previously announced in the Offer to Purchase remain unchanged.

As of the previously announced early tender date and time of 5:00 p.m.,

New York City time, on June 25, 2024 (the “Early Tender Deadline”), according to information provided by D.F. King &

Co., Inc., the information and tender agent for the Offer, the aggregate principal amount of the Notes as set forth in the table

below under “Principal Amount Tendered at Early Tender Deadline” has been validly tendered and not validly withdrawn. Withdrawal

rights expired at 5:00 p.m., New York City time, on the Early Tender Deadline.

| Title of Security | |

CUSIP No. | | |

Principal Amount

Outstanding | | |

Principal Amount

Tendered at Early

Tender Deadline | | |

Aggregate Principal

Amount Accepted for

Purchase | |

| 5.500% Senior Notes due 2025 | |

| 030981AK0 | | |

$ | 693,067,000 | | |

$ | 632,586,000 | | |

$ | 475,000,000 | |

The Offerors have elected to exercise their right to make payment for

the Notes that were validly tendered prior to or at the Early Tender Deadline and that are accepted for purchase on June 27, 2024

(the “Initial Settlement Date”).

The acceptance of tendered Notes was made in accordance with the Offer

terms as described in the Offer to Purchase. As the aggregate principal amount of the Notes validly tendered and not validly withdrawn

as of the Early Tender Deadline exceeds the Tender Cap, any such tendered Notes will be accepted on a pro rata basis as set forth in the

Offer to Purchase, subject to a proration factor of approximately 75.17%. As described further in the Offer to Purchase, any Notes tendered

and not accepted for purchase will be promptly credited to the tendering holder’s account. Since the Offer for the Notes is fully

subscribed at the Early Tender Deadline, the Offerors will not accept for purchase any Notes tendered after the Early Tender Deadline.

Information Relating to the Offer

BNP Paribas Securities Corp. is the dealer manager for the Offer. Questions

regarding the Offer should be directed to BNP Paribas Securities Corp. by calling collect at (212) 841-3059 or toll free at (888) 210-4358.

Requests for copies of the Offer to Purchase and related documents should be directed to D.F. King & Co., Inc., the information

and tender agent for the Offer, at (800) 207-3159 (toll free) or 212-269-5550.

The Offer is being made solely by means of the Offer to Purchase. This

press release shall not constitute an offer to purchase or a solicitation of an offer to purchase any securities, nor shall it constitute

an offer, solicitation or sale of any securities in any state or jurisdiction in which, or to any persons to whom, such offering, solicitation

or sale would be unlawful.

Cautionary Statements:

This press release contains “forward-looking statements”

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, Section 27A of the Securities Act of 1933,

as amended, and the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding the Offerors’ intention

to purchase any Notes. Readers are cautioned not to place undue reliance on these forward-looking statements and any such forward-looking

statements are qualified in their entirety by reference to the following cautionary statements. All forward-looking statements speak only

as of the date of this press release and are based on current expectations and involve a number of assumptions, risks, and uncertainties

that could cause the actual results to differ materially from such forward-looking statements. Readers are strongly encouraged to read

the full cautionary statements contained in AmeriGas Partners’ most recent annual report and in UGI’s filings with the Securities

and Exchange Commission, and in UGI’s and the Offerors’ other communications with investors. UGI and the Offerors disclaim

any obligation to update or revise any forward-looking statements.

About AmeriGas Partners

AmeriGas Partners is the largest retail propane marketer in the United

States, with approximately 940 million gallons of propane sold annually to 1.2 million customers in all 50 states from approximately 1,380

locations.

About UGI

UGI Corporation (NYSE: UGI) is a distributor and marketer of energy

products and services in the US and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions to customers through

its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution, midstream services, propane

distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

INVESTOR

RELATIONS

610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

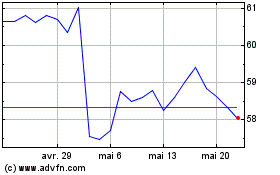

UGI (NYSE:UGIC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

UGI (NYSE:UGIC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024