Form 8-K - Current report

05 Mars 2024 - 11:12PM

Edgar (US Regulatory)

0000036104falseUS BANCORP DE00000361042024-03-052024-03-050000036104us-gaap:CommonStockMember2024-03-052024-03-050000036104us-gaap:SeriesAPreferredStockMember2024-03-052024-03-050000036104us-gaap:SeriesBPreferredStockMember2024-03-052024-03-050000036104usb:SeriesKPreferredStockMember2024-03-052024-03-050000036104usb:SeriesLPreferredStockMember2024-03-052024-03-050000036104usb:SeriesMPreferredStockMember2024-03-052024-03-050000036104usb:SeriesOPreferredStockMember2024-03-052024-03-050000036104usb:SeriesXMember2024-03-052024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 5, 2024

U.S. BANCORP

(Exact name of registrant as specified in its charter)

1-6880

(Commission File Number)

| | | | | |

| Delaware | 41-0255900 |

| (State or other jurisdiction | (I.R.S. Employer Identification |

| of incorporation) | Number) |

800 Nicollet Mall

Minneapolis, Minnesota 55402

(Address of principal executive offices and zip code)

(651) 466-3000

(Registrant’s telephone number, including area code)

(not applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 Under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, $.01 par value per share | USB | New York Stock Exchange |

| Depositary Shares (each representing 1/100th interest in a share of Series A Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrA | New York Stock Exchange |

| Depositary Shares (each representing 1/1,000th interest in a share of Series B Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrH | New York Stock Exchange |

| Depositary Shares (each representing 1/1,000th interest in a share of Series K Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrP | New York Stock Exchange |

| Depositary Shares (each representing 1/1,000th interest in a share of Series L Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrQ | New York Stock Exchange |

| Depositary Shares (each representing 1/1,000th interest in a share of Series M Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrR | New York Stock Exchange |

| Depositary Shares (each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrS | New York Stock Exchange |

| 0.850% Medium-Term Notes, Series X (Senior), due June 7, 2024 | USB/24B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule l2b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section l3(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

As previously announced, John C. Stern, U.S. Bancorp’s Senior Executive Vice President and Chief Financial Officer, and Gunjan Kedia, U.S. Bancorp’s Vice Chair, Wealth, Corporate, Commercial and Institutional Banking, made a presentation at the RBC Capital Markets Global Financial Institutions Conference in New York at 8:40 a.m. Eastern time on Tuesday, March 5, 2024. As announced in a press release issued by U.S. Bancorp earlier today, due to a vendor error during the presentation, the live audio webcast of the presentation was temporarily not available in full.

During the presentation, Mr. Stern generally confirmed that, as of today, there was no change to previously disclosed guidance for the first quarter or the full year 2024. Specifically, Mr. Stern confirmed full year net interest income guidance expectations of $16.6 billion, to up slightly, fee revenue being up mid-single digits for the full year, and core expenses being flat on a year-over-year basis. He also confirmed first quarter net interest income expectations of between $4.0 billion and $4.1 billion. For more information, investors should listen to the full replay of the audio webcast of the presentation, which can be accessed by clicking on “Webcasts & Presentations” from the Investor Relations section of U.S. Bancorp’s website at ir.usbank.com and will remain posted for one year.

The information in this Item 7.01 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing.

Item 8.01 Other Events.

U.S. Bancorp acquired MUFG Union Bank N.A. (“MUB”) in December 2022. Prior to the acquisition, MUB entered into a consent order in September 2021 with the Office of the Comptroller of the Currency (the “OCC”) relating to deficiencies in MUB’s technology and operational risk management (the “MUB Consent Order”). The OCC’s conditional approval to merge MUB with and into U.S. Bank National Association (“U.S. Bank”) required U.S. Bank to succeed to the terms and obligations of the MUB Consent Order and comply with the other conditions described therein. On March 5, 2024, U.S. Bank was notified by the OCC that the MUB Consent Order has been terminated.

Forward-Looking Statements

THE FOLLOWING INFORMATION APPEARS IN ACCORDANCE WITH THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995: This current report contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, U.S. Bancorp’s future guidance expectations described herein. Forward-looking statements involve inherent risks and uncertainties that could cause actual results to differ materially from those set forth in forward-looking statements.

For discussion of these and other risks that may cause actual results to differ from those described in forward-looking statements, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2023, on file with the Securities and Exchange Commission, including the section entitled “Risk Factors,” and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. In addition, factors other than these risks also could adversely affect U.S. Bancorp’s results, and the reader should not consider these risks to be a complete set of all potential risks or uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| U.S. BANCORP |

|

| By /s/ James L. Chosy |

| James L. Chosy |

Senior Executive Vice President and General Counsel |

DATE: March 5, 2024

v3.24.0.1

Cover Page

|

Mar. 05, 2024 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 05, 2024

|

| Entity Registrant Name |

US BANCORP DE

|

| Entity File Number |

1-6880

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

41-0255900

|

| Entity Address, Address Line One |

800 Nicollet Mall

|

| Entity Address, City or Town |

Minneapolis

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55402

|

| City Area Code |

651

|

| Local Phone Number |

466-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000036104

|

| Amendment Flag |

false

|

| 0.850% Medium-Term Notes, Series X (Senior), due June 7, 2024 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

0.850% Medium-Term Notes, Series X (Senior), due June 7, 2024

|

| Trading Symbol |

USB/24B

|

| Security Exchange Name |

NYSE

|

| Common Stock, $.01 par value per share |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $.01 par value per share

|

| Trading Symbol |

USB

|

| Security Exchange Name |

NYSE

|

| Depositary Shares (each representing 1/100th interest in a share of Series A Non-Cumulative Perpetual Preferred Stock, par value $1.00) |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing 1/100th interest in a share of Series A Non-Cumulative Perpetual Preferred Stock, par value $1.00)

|

| Trading Symbol |

USB PrA

|

| Security Exchange Name |

NYSE

|

| Depositary Shares (each representing 1/1,000th interest in a share of Series B Non-Cumulative Perpetual Preferred Stock, par value $1.00) |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing 1/1,000th interest in a share of Series B Non-Cumulative Perpetual Preferred Stock, par value $1.00)

|

| Trading Symbol |

USB PrH

|

| Security Exchange Name |

NYSE

|

| Depositary Shares (each representing 1/1,000th interest in a share of Series K Non-Cumulative Perpetual Preferred Stock, par value $1.00) |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing 1/1,000th interest in a share of Series K Non-Cumulative Perpetual Preferred Stock, par value $1.00)

|

| Trading Symbol |

USB PrP

|

| Security Exchange Name |

NYSE

|

| Depositary Shares (each representing 1/1,000th interest in a share of Series L Non-Cumulative Perpetual Preferred Stock, par value $1.00) |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing 1/1,000th interest in a share of Series L Non-Cumulative Perpetual Preferred Stock, par value $1.00)

|

| Trading Symbol |

USB PrQ

|

| Security Exchange Name |

NYSE

|

| Depositary Shares (each representing 1/1,000th interest in a share of Series M Non-Cumulative Perpetual Preferred Stock, par value $1.00) |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing 1/1,000th interest in a share of Series M Non-Cumulative Perpetual Preferred Stock, par value $1.00)

|

| Trading Symbol |

USB PrR

|

| Security Exchange Name |

NYSE

|

| Depositary Shares (each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock, par value $1.00) |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock, par value $1.00)

|

| Trading Symbol |

USB PrS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_DebtInstrumentAxis=usb_SeriesXMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usb_SeriesKPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usb_SeriesLPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usb_SeriesMPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usb_SeriesOPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

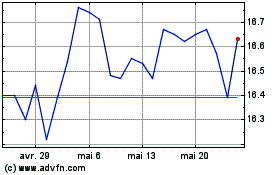

US Bancorp (NYSE:USB-Q)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

US Bancorp (NYSE:USB-Q)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025