Marathon Asset Management and Webster Bank Provide Senior Secured Financing for Littlejohn’s Acquisition of Sunbelt Modular

21 Novembre 2024 - 11:09PM

Business Wire

Marathon Asset Management (“Marathon”), a leading global credit

manager with more than $23 billion of assets under management, and

Webster Bank, N.A. (“Webster Bank”), a leading commercial bank in

the Northeast with $79 billion in total assets, are pleased to

announce the closing of a senior-secured financing agreement for

Sunbelt Modular, Inc. (“Sunbelt” or the “Company”) to support its

acquisition by funds advised by Littlejohn & Co., LLC

(“Littlejohn”). Sunbelt is a leading designer and manufacturer of

modular building solutions.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241121900814/en/

Founded over 45 years ago, Sunbelt provides a robust suite of

highly engineered structures for custom and fleet applications that

serve a diverse set of commercial end markets. The Company will

continue to be led by CEO Ron Procunier, an executive with more

than 35 years of experience in the modular industry, supported by a

team of 1,300-plus employees.

“Sunbelt’s in-house technical expertise, comprehensive product

offering, and nationwide footprint uniquely position the Company to

capitalize on favorable industry trends and deliver a superior

value proposition to their customers,” said Curtis Lueker,

Marathon’s Head of Direct Lending. “Littlejohn’s decades of

experience investing and scaling businesses in the building

products sector, coupled with Marathon’s dedicated expertise in

building products, creates a compelling partnership in support of

Sunbelt’s strategic plan for future growth.”

The closing of Sunbelt’s financing represents the second

financing transaction completed by Marathon and Webster Bank’s

Private Credit joint venture, which formed earlier this year.

“Marathon's powerful partnership with Webster Bank offers

reliable, tailored, and creative financing solutions to middle

market companies and private equity sponsors,” said Bruce Richards,

Marathon’s CEO and Chairman. “Marathon’s leadership and expertise

across our Private Credit programs – Direct Lending, Capital

Solutions, and Asset-Based Lending – coupled with Webster Bank’s

exceptional middle market sponsor lending program and broader

commercial banking services, offers a highly differentiated suite

of capabilities.”

Marathon’s Private Credit platform is designed as a one-stop

shop offering corporate, asset-based, and capital solutions,

including senior and junior financings that range from $50 million

to $250 million.

About Marathon Asset Management:

Marathon Asset Management, L.P. is a leading global asset

manager specializing in the Public and Private Credit markets with

over $23 billion of assets under management. Marathon has dedicated

investment programs spanning the spectrum of Private Credit: Direct

Lending, Asset-Based Lending and Opportunistic as well as Public

Credit. Marathon was founded in 1998 and is managed by Bruce

Richards (Co-Founder & CEO) and Louis Hanover (Co-Founder &

CIO) and employs more than 180 professionals, with 8 Partners. Its

corporate headquarters are located in New York City, and it has

offices in London, Miami, Los Angeles, and Luxembourg. Marathon is

a Registered Investment Adviser with the Securities Exchange

Commission. For more information, please visit the company's

website at www.marathonfund.com.

About Webster Financial Corporation

Webster Financial Corporation (NYSE:WBS) is the holding company

for Webster Bank, a leading commercial bank in the Northeast that

provides a wide range of digital and traditional financial

solutions across three differentiated lines of business: Commercial

Banking, Consumer Banking and Healthcare Financial Services, one of

the country's largest providers of employee benefits and

administration of medical insurance claim settlements solutions.

Headquartered in Stamford, CT, Webster Bank is a values-driven

organization with $79 billion in assets. Its core footprint spans

the northeastern U.S. from New York to Massachusetts, with certain

businesses operating in extended geographies. Webster Bank is a

member of the FDIC and an equal housing lender. For more

information, including past press releases and the latest annual

report, please visit the company’s website at

www.websterbank.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121900814/en/

Marathon Asset Management Media Inquiries

Prosek Partners Josh Clarkson / Aidan O’Connor

jclarkson@prosek.com / aoconnor@prosek.com 646-818-9283

Webster Financial Corporation Media Inquiries

Alice Ferreira acferreira@websterbank.com 203-578-2610

Webster Financial Corporation Investor Inquiries

Emlen Harmon eharmon@websterbank.com 212-309-7646

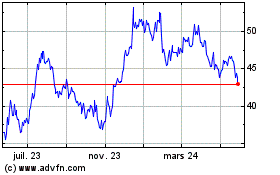

Webster Financial (NYSE:WBS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

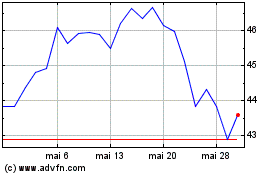

Webster Financial (NYSE:WBS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025