false

0000107687

0000107687

2025-02-03

2025-02-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 3, 2025

| Winnebago

Industries, Inc. |

| (Exact name of registrant as specified in its charter) |

| Minnesota |

|

001-06403 |

|

42-0802678 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

13200 Pioneer Trail

Eden Prairie, MN 55347

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

(952) 829-8600

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.50 par value per share |

|

WGO |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

On February 3, 2025,

Winnebago Industries, Inc. (the “Company”) issued a press release announcing the commencement of a cash tender offer

for up to $75.0 million of the Company’s 6.25% Senior Secured Notes due 2028, exclusive of any applicable premiums paid in connection

with such tender offer and accrued and unpaid interest. A copy of the press release is attached as Exhibit 99.1 and the information

set forth therein is incorporated herein by reference and constitutes a part of this report.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 3, 2025

| |

WINNEBAGO INDUSTRIES, INC. |

| |

|

|

| |

By: |

/s/

Stacy L. Bogart |

| |

Name: |

Stacy L. Bogart |

| |

Title: |

Senior

Vice President, General Counsel, Secretary and Corporate Responsibility |

Exhibit 99.1

Winnebago

Industries, Inc. Announces Cash Tender Offer for 6.25% SENIOR SECURED Notes

DUE 2028

EDEN PRAIRIE, MINNESOTA, Feb. 3, 2025—Winnebago Industries, Inc.

(NYSE: WGO) (the “Company”), a leading manufacturer of outdoor recreation products, today announced that it commenced a cash

tender offer (the “Tender Offer”) to purchase its 6.250% Senior Secured Notes due 2028 (CUSIP No. 974637AC4 / U9701TAA4)

(the “Notes”) in a principal amount of up to $75,000,000, exclusive of any applicable premiums paid in connection with the

Tender Offer and accrued and unpaid interest. The terms and conditions of the Tender Offer are set forth in an Offer to Purchase dated

February 3, 2025 (the “Offer to Purchase”), which is being sent to all registered holders (collectively, the “Holders”)

of Notes.

Title of

Security | |

Issuer | |

CUSIP

Numbers(1) | |

Principal

Amount

Outstanding | | |

Tender Cap | | |

Base

Consideration(2)(3) | | |

Early

Tender

Premium(2) | | |

Total

Consideration(2)(3) | |

| 6.250% Senior Secured Notes due 2028 | |

Winnebago Industries, Inc. | |

974637AC4/ U9701TAA4 | |

$ | 300,000,000 | | |

$ | 75,000,000 | | |

$ | 975.00 | | |

$ | 30.00 | | |

$ | 1,005.00 | |

|

| (1) | No representation

is made as to the correctness or accuracy of the CUSIP numbers listed in this press release,

the Offer to Purchase or printed on the Notes. They are provided solely for the convenience

of Holders of the Notes. |

| (2) | Per $1,000 principal amount of Notes. |

| (3) | Excludes Accrued Interest, which will be paid in addition to

the Base Consideration or the Total Consideration, as applicable. |

“This tender offer reflects our commitment to enhancing long-term

shareholder value through a disciplined capital allocation strategy," said Michael Happe, President and Chief Executive Officer of

Winnebago Industries. “By leveraging our strong liquidity position, we can optimize our capital structure while continuing to drive

innovation through strategic organic and inorganic investments.”

Bryan Hughes, the Company’s Chief Financial Officer, added, “This

tender offer exemplifies our proactive strategy to effectively manage leverage through the cycle via our strong cash flow generation and

accumulation. We have generated strong free cash flow over time enabling us to fund organic and inorganic investments, while also returning

cash to shareholders. This tender reduces our higher-cost debt and reaffirms our commitment to executing on our capital priorities in

a balanced manner.”

Holders of Notes must validly tender and not validly withdraw their

Notes on or before 5:00 p.m., New York City time, on February 14, 2025, unless extended (such date and time, as the same may be extended,

the “Early Tender Date”) in order to be eligible to receive the Total Consideration. Holders of Notes who validly tender their

Notes after the Early Tender Date and on or before the Expiration Date (as defined below) will be eligible to receive only the applicable

Base Consideration, which is equal to the Total Consideration minus the Early Tender Premium, as set forth in the table above. In addition

to the applicable consideration, Holders whose Notes are accepted for purchase in the Tender Offer will receive accrued and unpaid interest

to, but excluding, the date on which the Tender Offer is settled. The settlement date for Notes validly tendered and accepted for purchase

before the Early Tender Date (if the Company elects to do so) is currently expected to be on or about February 20, 2025, and the

final settlement date, if any, is expected to be March 7, 2025.

The Tender Offer will expire at 5:00 p.m., New York City time, on March 4,

2025, unless extended (such date and time, as the same may be extended, the “Expiration Date”). As set forth in the Offer

to Purchase, validly tendered Notes may be validly withdrawn at any time on or before 5:00 p.m., New York City time, on February 14,

2025, unless extended (the “Withdrawal Deadline”).

The consummation of the Tender Offer is subject to the satisfaction

of certain conditions as set forth in the Offer to Purchase. The Company reserves the right, in its sole discretion, to waive any and

all conditions to the Tender Offer with respect to the Notes.

If any Notes are validly tendered and the principal amount of such

tendered Notes exceeds the Tender Cap as set forth in the table above, any principal amount of the Notes accepted for payment and purchased,

on the terms and subject to the conditions of the Tender Offer, will be prorated based on the principal amount of validly tendered Notes,

subject to the Tender Cap and any prior purchase of Notes on any day following the Early Tender Date and prior to the Expiration Date.

Any Notes that are validly tendered at or prior to the Early Tender

Date (and not validly withdrawn at or prior to the Withdrawal Deadline) will have priority over any Notes that are validly tendered after

the Early Tender Date. Accordingly, if the principal amount of any Notes validly tendered at or prior to the Early Tender Date (and not

validly withdrawn at or prior to the Withdrawal Deadline) and accepted for purchase equals or exceeds the Tender Cap, no Notes validly

tendered after the Early Tender Date will be accepted for purchase.

The Company’s obligations to accept any Notes tendered and to

pay the applicable consideration for them are set forth solely in the Offer to Purchase. This press release is neither an offer to purchase

nor a solicitation of an offer to sell any Notes. The Tender Offer is made only by, and pursuant to the terms of, the Offer to Purchase,

and the information in this press release is qualified by reference to the Offer to Purchase. Subject to applicable law, the Company may

amend, extend, waive conditions to or terminate the Tender Offer.

J.P. Morgan Securities LLC is the Dealer Manager for the Tender Offer.

Persons with questions regarding the Tender Offer should contact J.P. Morgan Securities LLC at (866) 834-4666 (toll-free) or (212) 834-4818

(collect). Requests for copies of the Offer to Purchase should be directed to D.F. King & Co., Inc., the Tender and Information

Agent for the Tender Offer, at (212) 269-5550 (banks and brokers), (800) 848-2998 (toll-free) or email at winnebago@dfking.com.

About Winnebago Industries, Inc.

Winnebago Industries, Inc. is a leading North American manufacturer

of outdoor lifestyle products under the Winnebago, Grand Design, Chris-Craft, Newmar and Barletta Boat brands, which are used primarily

in leisure travel and outdoor recreation activities. The Company builds high-quality motorhomes, travel trailers, fifth-wheel products,

outboard and sterndrive powerboats, pontoons, and commercial community outreach vehicles. Committed to advancing sustainable innovation

and leveraging vertical integration in key component areas, Winnebago Industries has multiple facilities in Iowa, Indiana, Minnesota,

and Florida. The Company’s common stock is listed on the New York Stock Exchange and traded under the symbol WGO.

Forward-Looking Statements

This press release may contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that forward-looking statements are inherently

uncertain. A number of factors could cause actual results to differ materially from these statements, including, but not limited to risks

relating to general economic uncertainty in key markets and a worsening of domestic and global economic conditions or low levels of economic

growth; availability of financing for RV and marine dealers and retail purchasers; competition and new product introductions by competitors;

ability to innovate and commercialize new products; ability to manage the Company’s inventory to meet demand; risk related to cyclicality

and seasonality of the Company’s business; risk related to independent dealers; risk related to dealer consolidation or the loss

of a significant dealer; significant increase in repurchase obligations; ability to retain relationships with the Company’s suppliers

and obtain components; business or production disruptions; inadequate management of dealer inventory levels; increased material and component

costs, including availability and price of fuel and other raw materials; ability to integrate mergers and acquisitions; ability to attract

and retain qualified personnel and changes in market compensation rates; exposure to warranty claims and product recalls; ability to protect

the Company’s information technology systems from data security, cyberattacks, and network disruption risks and the ability to successfully

upgrade and evolve the Company’s information technology systems; ability to retain brand reputation and related exposure to product

liability claims; governmental regulation, including for climate change; increased attention to environmental, social, and governance

matters, and the Company’s ability to meet its commitments; impairment of goodwill and trade names; risks related to the Company’s

outstanding convertible notes and senior secured notes, including the Company’s ability to satisfy its obligations under such notes;

changes in recommendations or a withdrawal of coverage by third party security analysts; and other risks and uncertainties as may be described

in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”). These forward-looking statements

should be considered in light of the discussion of risks and uncertainties described under the heading “Risk Factors” contained

in the Company’s most recent annual report on Form 10-K, as well as any amendments to such filings, and in other filings with

the SEC. The Company disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements

contained in this release or to reflect any changes in the Company's expectations after the date of this release or any change in events,

conditions or circumstances on which any statement is based, except as required by law.

Contacts

Investors: Ray Posadas

ir@winnebagoind.com

Media: Dan Sullivan

media@winnebagoind.com

v3.25.0.1

Cover

|

Feb. 03, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 03, 2025

|

| Entity File Number |

001-06403

|

| Entity Registrant Name |

Winnebago

Industries, Inc.

|

| Entity Central Index Key |

0000107687

|

| Entity Tax Identification Number |

42-0802678

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity Address, Address Line One |

13200 Pioneer Trail

|

| Entity Address, City or Town |

Eden Prairie,

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55347

|

| City Area Code |

952

|

| Local Phone Number |

829-8600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.50 par value per share

|

| Trading Symbol |

WGO

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

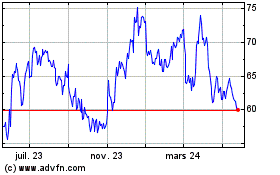

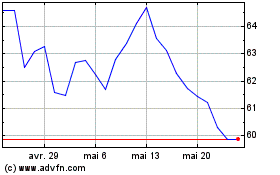

Winnebago Industries (NYSE:WGO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Winnebago Industries (NYSE:WGO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025