Relating to the $600,000,000 3.750% Senior

Notes due 2025 (the “2025 Notes”)

$750,000,000 4.650% Senior Notes due 2026

(the “2026 Notes”)

$500,000,000 3.375% Senior Notes due 2027

(the “2027 Notes”)

$600,000,000 4.000% Senior Notes due 2028

(the “2028 Notes”)

and

$750,000,000 4.900% Senior Notes due 2029

(the “2029 Notes”, and together with the 2025 Notes, the 2026

Notes, the 2027 Notes and the 2028 Notes, the “Notes”)

WestRock Company (“WestRock”) announced today that its

wholly-owned subsidiary WRKCo Inc. (the “Issuer”) commenced

a consent solicitation through which it is soliciting consents

(“Consents”) from registered holders (“Holders”) of

the Notes (the “Consent Solicitation”) to amend certain

terms of the indentures governing the respective Notes (each, an

“Indenture” and together, the “Indentures”). The

terms and conditions of the Consent Solicitation are set forth in a

consent solicitation statement dated as of September 20, 2023 (as

it may be amended and supplemented from time to time, the

“Consent Solicitation Statement”). Adoption of the proposed

amendments with respect to the applicable Indenture for each series

of Notes requires the Consent of the Holders of at least a majority

in aggregate principal amount of the then outstanding Notes of such

series.

The purpose of the Consent Solicitation is to obtain Consents

from the Holders to (i) amend the definition of “Change of Control”

applicable for the relevant series of the Notes under the

Indentures to add an exception for the previously disclosed

proposed business combination of WestRock and the Smurfit Kappa

group (the “Merger”) announced by WestRock on September 12,

2023, pursuant to the transaction agreement entered into on

September 12, 2023, by and among, inter alios, Smurfit Kappa Group

plc, a public limited company incorporated in Ireland

(“SKG”), and WestRock (the “Transaction Agreement”);

and (ii) make any other changes of a technical or conforming nature

to the Indentures necessary or desirable for the implementation of

the proposed amendment above.

The Consent Solicitation will expire at 5:00 p.m., New York

time, on September 26, 2023, unless the Consent Solicitation is

extended or earlier terminated by the Issuer for any or all series

of the Notes in its sole discretion (the “Expiration Time”).

The proposed amendments will be effected by way of supplemental

indentures to the relevant Indentures. A Holder may validly revoke

its Consent with respect to a series of Notes prior to the earlier

of the Expiration Time and the time of execution of the relevant

supplemental indenture, as described in the Consent Solicitation

Statement (the “Revocation Deadline”). If the proposed

amendments become effective with respect to any series of Notes,

they will be binding on all Holders of such series of Notes and

their transferees whether or not such Holders have consented to the

proposed amendments.

Holders who have validly delivered their Consent for any series

of Notes prior to the Expiration Time, and who have not validly

revoked such Consent prior to the Revocation Deadline, will be

eligible to receive a payment equal to $1.50 per $1,000 aggregate

principal amount of the relevant series of Notes with respect to

which such Consent has been delivered (the “Consent

Payment”). The Consent Payment will only be made if the

conditions precedent applicable to the Consent Solicitation with

respect to the relevant Notes are satisfied or waived. SKG shall be

responsible for the payment of the Consent Payment and for any

other fees and expenses in connection with the Consent

Solicitation.

Holders who have validly delivered their Consents prior to the

Expiration Time but who have validly revoked their Consents prior

to the Revocation Deadline will not be eligible to receive the

Consent Payment unless they validly deliver their Consents again

prior to such Expiration Time, and do not validly revoke their

Consents again prior to the Revocation Deadline.

The Issuer with respect to any or all series of its Notes may,

in its sole discretion, terminate, extend or amend the Consent

Solicitation and the deadlines thereunder. The Issuer has retained

Citigroup Global Markets Inc. to act as solicitation agent. Kroll

Issuer Services Limited will act as tabulation agent and

information agent for the Consent Solicitation. Requests for

documents may be directed to Kroll Issuer Services Limited at +44

20 7704 0880 or by email to smurfit@is.kroll.com. Questions

regarding the Consent Solicitation may be directed to Citigroup

Global Markets Inc. at +1 (800) 558-3745 or by email to

ny.liabilitymanagement@citi.com.

This announcement is for information purposes only and does not

constitute an offer to purchase any of the Notes or a solicitation

of an offer to sell any of the Notes and shall not be deemed to be

an offer to purchase or a solicitation of an offer to sell any

securities of the Issuer, or its respective subsidiaries or

affiliates. The Consent Solicitation is only being made pursuant to

the terms of the Consent Solicitation Statement. No recommendation

is being made as to whether Holders should consent to the proposed

amendments. The Consent Solicitation is not being made in any

jurisdiction in which, or to or from any person to or from whom, it

is unlawful to make such solicitation under applicable state or

foreign securities or “blue sky” laws.

Information Regarding Forward-Looking Statements

This communication contains forward-looking statements as that

term is defined in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995.

These forward-looking statements generally include statements

regarding the Merger between WestRock and SKG, including any

statements regarding the Consent Solicitation, the Merger and the

listing of the combined company (“Smurfit WestRock”), the rationale

and expected benefits of the Merger (including, but not limited to,

synergies), and any other statements regarding WestRock’s and SKG’s

future expectations, beliefs, plans, objectives, results of

operations, financial condition and cash flows, or future events or

performance. Forward-looking statements can sometimes be identified

by the use of forward-looking terms such as “believes,” “expects,”

“may,” “will,” “shall,” “should,” “would,” “could,” “potential,”

“seeks,” “aims,” “projects,” “predicts,” “is optimistic,”

“intends,” “plans,” “estimates,” “targets,” “anticipates,”

“continues” or other comparable terms or negatives of these terms

or other variations or comparable terminology or by discussions of

strategy, plans, objectives, goals, future events or intentions,

but not all forward-looking statements include such identifying

words.

Forward-looking statements are based upon current plans,

estimates and expectations that are subject to risks, uncertainties

and assumptions. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or

anticipated by such forward-looking statements. We can give no

assurance that such plans, estimates or expectations will be

achieved and therefore, actual results may differ materially from

any plans, estimates or expectations in such forward-looking

statements. Important factors that could cause actual results to

differ materially from such plans, estimates or expectations

include: a condition to the closing of the Merger may not be

satisfied; the occurrence of any event that can give rise to

termination of the Merger; a regulatory approval that may be

required for the Merger is delayed, is not obtained in a timely

manner or at all or is obtained subject to conditions that are not

anticipated; SKG is unable to achieve the synergies and value

creation contemplated by the Merger; Smurfit WestRock’s

availability of sufficient cash to distribute to its shareholders

in line with current expectations; SKG is unable to promptly and

effectively integrate WestRock’s businesses; management’s time and

attention is diverted on issues related to the Merger; disruption

from the Merger makes it more difficult to maintain business,

contractual and operational relationships; credit ratings decline

following the Merger; legal proceedings are instituted against SKG,

WestRock or Smurfit WestRock are unable to retain or hire key

personnel; the announcement or the consummation of the Merger has a

negative effect on the market price of the capital stock of SKG or

WestRock or on SKG or WestRock’s operating results; evolving legal,

regulatory and tax regimes; changes in economic, financial,

political and regulatory conditions, in Ireland, the United

Kingdom, the United States and elsewhere, and other factors that

contribute to uncertainty and volatility, natural and man-made

disasters, civil unrest, pandemics (e.g., the coronavirus

(COVID-19) pandemic (the “COVID-19 pandemic”)), geopolitical

uncertainty, and conditions that may result from legislative,

regulatory, trade and policy changes associated with the current or

subsequent Irish, U.S. or U.K. administrations; the ability of SKG

or WestRock to successfully recover from a disaster or other

business continuity problem due to a hurricane, flood, earthquake,

terrorist attack, war, pandemic, security breach, cyber-attack,

power loss, telecommunications failure or other natural or man-made

event, including the ability to function remotely during long-term

disruptions such as the COVID-19 pandemic; the impact of public

health crises, such as pandemics (including the COVID-19 pandemic)

and epidemics and any related company or governmental policies and

actions to protect the health and safety of individuals or

governmental policies or actions to maintain the functioning of

national or global economies and markets; actions by third parties,

including government agencies; the risk that disruptions from the

Merger will harm SKG’s or WestRock’s business, including current

plans and operations; certain restrictions during the pendency of

the Merger that may impact SKG’s or WestRock’s ability to pursue

certain business opportunities or strategic transactions; SKG’s or

WestRock’s ability to meet expectations regarding the accounting

and tax treatments of the Merger; the risks and uncertainties

discussed in the “Risks and Uncertainties” section in SKG’s reports

available on the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism and on its

website at https://www.smurfitkappa.com/investors; and the risks

and uncertainties discussed in the “Risk Factors” and “Information

Regarding Forward-Looking Statements” sections in WestRock’s

reports filed with the Securities and Exchange Commission (the

“SEC”). These risks, as well as other risks associated with the

Merger, will be more fully discussed in the proxy

statement/prospectus, the shareholder circular, the UK listing

prospectus and the other relevant materials filed with the SEC and

applicable securities regulators in the United Kingdom. The list of

factors presented here should not be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realization of forward-looking statements. We caution you not to

place undue reliance on any of these forward-looking statements as

they are not guarantees of future performance or outcomes and that

actual performance and outcomes, including, without limitation, the

actual results of operations, financial condition and liquidity,

and the development of new markets or market segments in which we

operate, may differ materially from those made in or suggested by

the forward-looking statements contained in this communication.

Except as required by law, none of SKG, WestRock or Smurfit

WestRock assume any obligation to update or revise the information

contained herein, which speaks only as of the date hereof.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN, ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE

THIS DOCUMENT.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230919464828/en/

Investors: Robert Quartaro Senior Vice President, Investor

Relations T: +1 470 328 6979 E: robert.quartaro@westrock.com Media:

Robby Johnson Senior Manager, Corporate Communications T: +1 470

328 6397 E: robby.b.johnson@westrock.com

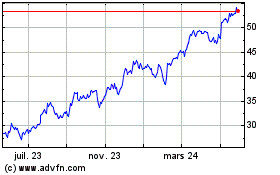

WestRock (NYSE:WRK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

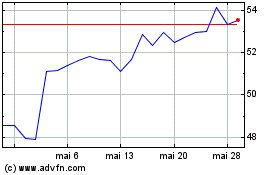

WestRock (NYSE:WRK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025