Worthington Steel, Inc. (NYSE: WS) (“Worthington Steel” or the

“Company”) announced today that it has reached an agreement to

acquire through its subsidiary, Tempel Steel Company, LLC

(“Tempel”), a controlling equity stake in Italy-based Sitem S.p.A.

(together with its subsidiaries, Stanzwerk AG, Decoup S.A.S. and

Sitem Slovakia spol. s r.o., “Sitem Group”). Sitem Group produces

electric motor laminations and accessory products for automotive

and industrial applications in Europe. Worthington Steel will

acquire, through the acquisition of shares from existing

shareholders of Sitem Group, the contribution of Worthington

Steel’s Nagold, Germany, facility and the subscription of reserved

share capital increases, an approximately 52% stake in Sitem Group

with the option to increase ownership in the future. The

transaction is expected to close in early 2025, subject to the

receipt of applicable regulatory approvals and customary closing

conditions.

“This investment aligns with our strategic goal to grow our

electrical steel lamination business and expand our customer

reach,” said Geoff Gilmore, Worthington Steel president and CEO.

“Sitem Group brings 50 years of experience and is one of the

largest producers of electric motor laminations in Europe. The

Worthington Steel and Sitem Group leadership teams bring valuable

expertise and relationships to spearhead the expansion of our

global automotive programs in the production of electric vehicles

and hybrids.”

Establishing a strong presence in Europe, a key and rapidly

growing region for the electric vehicle market, is a vital

component of the Company's strategy to leverage this emerging

global trend. This investment marks another significant step in

Worthington Steel’s plan while meeting customer expectations for

comprehensive global manufacturing and technical support.

Sitem Group operates six facilities in Europe including Italy

(three), Switzerland, Slovakia and France. Sitem’s leadership,

including Chairman Fabrizio Scarca, CEO Marco Bartoloni and Chief

Purchasing Officer Gabriella Scarca, will continue to lead the

business from the Sitem Group headquarters in Trevi, Italy.

“We are excited to partner with Worthington Steel,” said Sitem

Group CEO Marco Bartoloni. “This investment and partnership will

enable us to better serve global automotive and industrial motor

customers. Their philosophy aligns with our values and is a great

fit for our employees.”

Latham & Watkins LLP served as legal counsel to Worthington

Steel on the transaction. Sitem was advised by UniCredit as

financial advisor, Antonello Marcucci as senior advisor and Bird

& Bird as legal counsel.

About Sitem S.p.A.

Founded in 1974, Sitem Group is headquartered and has one of its

manufacturing facilities in Trevi, Perugia, Italy with two

additional manufacturing facilities of Sitem S.p.A. in Milan,

Italy, of Stanzwerk AG in Unterentfelden, Switzerland, of Sitem

Slovakia spol. s r.o in Spišská Nová Ves, Slovakia and of Decoup

S.A.S. in Villenaux-La-Grande, France.

About Worthington Steel

Worthington Steel (NYSE:WS) is a metals processor that partners

with customers to deliver highly technical and customized

solutions. Worthington Steel’s expertise in carbon flat-roll steel

processing, electrical steel laminations and tailor welded

solutions are driving steel toward a more sustainable future.

As one of the most trusted metals processors in North America,

Worthington Steel and its approximately 5,000 employees harness the

power of steel to advance our customers’ visions through

value-added processing capabilities including galvanizing,

pickling, configured blanking, specialty cold reduction,

lightweighting and electrical lamination. Headquartered in

Columbus, Ohio, Worthington Steel operates 32 facilities in seven

states and six countries. Following a people-first Philosophy,

commitment to sustainability and proven business system,

Worthington Steel’s purpose is to generate positive returns by

providing trusted and innovative solutions for customers, creating

opportunities for employees and strengthening its communities.

Safe Harbor Statement

This press release includes forward-looking statements,

including forward-looking statements within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to,

statements regarding the Company’s proposed acquisition of a

controlling equity stake in Sitem Group, the expected timeline for

completing the transaction, the anticipated benefits of the

transaction to the Company’s business and financial results,

strategies, outlook, prospects, plans, objectives, expectations,

future events and other statements that are not historical or

current fact. Forward-looking statements are based on the Company’s

current expectations and involve risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied in such forward-looking statements. Factors that could

cause the Company’s results to differ materially from current

expectations include, but are not limited to, risks and

uncertainties regarding the Company’s and Sitem Group’s respective

businesses and the proposed acquisition, and actual results may

differ materially. These risks and uncertainties include, but are

not limited to, (i) the ability of the parties to successfully

complete the proposed acquisition on the anticipated terms and

timing, including obtaining required regulatory approvals and other

conditions to the completion of the acquisition, (ii) the financing

arrangements relating to the acquisition, (iii) the effects of the

transaction on the Company’s and Sitem Group’s operations,

including on the combined company’s future financial condition and

performance, operating results, strategy and plans, including

anticipated tax treatment, unforeseen liabilities, future capital

expenditures, revenues, expenses, earnings, synergies, economic

performance, indebtedness, losses, future prospects, and business

and management strategies for the management, expansion and growth

of the new combined company’s operations, (iv) the potential impact

of the announcement or consummation of the proposed acquisition on

relationships with customers, suppliers and other third parties,

and (v) the other factors detailed in the Company’s reports filed

with the U.S. Securities and Exchange Commission (the “SEC”),

including its most recent Annual Report on Form 10-K and subsequent

Quarterly Reports on Form 10-Q under the caption “Risk Factors,” as

well as the other risks discussed in the Company’s filings with the

SEC. In addition, these statements are based on assumptions that

are subject to change. This press release speaks only as of the

date hereof. The Company disclaims any duty to update the

information herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202502135/en/

Melissa Dykstra Vice President Corporate Communications

and Investor Relations Phone: 614-840-4144

Melissa.Dykstra@worthingtonsteel.com

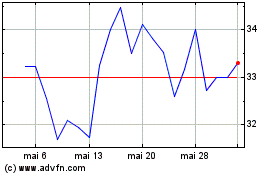

Worthington Steel (NYSE:WS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Worthington Steel (NYSE:WS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024