WisdomTree, Inc. (NYSE: WT) (“WisdomTree”), a global financial

innovator, today announced its intention to offer, subject to

market conditions and other factors, $300 million aggregate

principal amount of convertible senior notes due 2029 (the “notes”)

in a private offering (the “offering”) to qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933, as

amended (the “Securities Act”). WisdomTree also expects to grant

the initial purchaser of the notes an option to purchase up to an

additional $45 million aggregate principal amount of the notes to

be settled during a period of 13 days from, and including, the date

the notes are first issued.

WisdomTree intends to use a portion of the net proceeds from the

offering to repurchase approximately $104 million in aggregate

principal amount of its 5.75% convertible senior notes due 2028

(the “2028 notes”) as described below. WisdomTree also intends to

use a portion of the net proceeds from the offering to repurchase

shares of WisdomTree’s common stock from certain purchasers of the

notes as described below and a portion of the net proceeds from the

offering, along with cash and securities on hand, if necessary, to

finance WisdomTree’s repurchase of all 14,750 shares of

WisdomTree’s issued and outstanding Series A Non-Voting Convertible

Preferred Stock (equivalent to 14.75 million shares of WisdomTree’s

common stock) from ETFS Capital Limited for an aggregate purchase

price equal to the product of 14.75 million and the simple average

of the closing prices of WisdomTree’s common stock on the New York

Stock Exchange during the four consecutive trading days ended

August 8, 2024 (the “Series A preferred stock repurchase”). The

consummation of the Series A preferred stock repurchase is

contingent upon the closing of the offering of the notes and the

2028 notes repurchases described below. WisdomTree intends to use

the remainder of the net proceeds from the offering, if any, for

working capital and other general corporate purposes.

Prior to May 15, 2029, the notes will be convertible at the

option of the holders of the notes only upon the satisfaction of

certain conditions and during certain periods, and thereafter, at

any time until the close of business on the second scheduled

trading day immediately preceding the maturity date. Upon

conversion, WisdomTree will pay cash up to the aggregate principal

amount of the notes to be converted and pay or deliver, as the case

may be, cash, shares of its common stock or a combination of cash

and shares of its common stock, at WisdomTree’s election, in

respect of the remainder, if any, of WisdomTree’s conversion

obligation in excess of the aggregate principal amount of the notes

being converted. The notes will also be redeemable, in whole or in

part, for cash at WisdomTree’s option at any time, and from time to

time, on or after August 20, 2026 in certain circumstances. The

redemption price will be equal to the principal amount of the notes

to be redeemed, plus accrued and unpaid interest, if any, to, but

excluding, the redemption date. The interest rate, conversion rate

and other terms of the notes are to be determined upon pricing of

the offering.

Contemporaneously with the pricing of the notes in the offering,

WisdomTree intends to enter into separate privately negotiated

transactions with certain holders of the 2028 notes to repurchase

approximately $104 million in aggregate principal amount of the

2028 notes on terms to be negotiated with such holders (each a

“note repurchase” and collectively the “2028 notes repurchases”).

The terms of each note repurchase are anticipated to be negotiated

with certain holders of 2028 notes on an individual basis and will

depend on several factors, including the market price of

WisdomTree’s common stock and the trading price of the 2028 notes

at the time of each such note repurchase. No assurance can be given

as to how much, if any, of the 2028 notes will be repurchased or

the terms on which they will be repurchased. The consideration for

any such note repurchases will be cash financed with a portion of

the net proceeds from the offering. Any remaining 2028 notes

outstanding will be settled no later than maturity.

WisdomTree expects that certain holders of 2028 notes that sell

their 2028 notes in negotiated transactions with WisdomTree may

enter into or unwind various derivatives with respect to

WisdomTree’s common stock and/or purchase shares of its common

stock in the market. The amount of WisdomTree’s common stock that

such holders purchase may be substantial in relation to the

historic average daily trading volume of the common stock. In

addition, WisdomTree expects that certain purchasers of the notes

offered in the offering may establish a short position with respect

to its common stock by short selling the common stock or by

entering into short derivative positions with respect to the common

stock, in each case, in connection with the offering. The net

effect of the above market activities by holders of 2028 notes and

purchasers of the notes offered in the offering could increase (or

reduce the size of any decrease in) or decrease (or reduce the size

of any increase in) the market price of WisdomTree’s common stock

and/or the market price of the notes offered in the offering, and

WisdomTree cannot predict the magnitude of such market activities

or the overall effect they will have on the market price of the

notes and/or the market price of its common stock.

WisdomTree intends to use a portion of the net proceeds from the

offering to repurchase shares of its common stock from certain

purchasers of the notes in privately negotiated transactions

effected through the initial purchaser of the notes, as its agent,

concurrently with the pricing of the offering. The price per share

of WisdomTree’s common stock repurchased in such transactions is

expected to equal the last reported price per share of its common

stock as of the date of the pricing of the notes. These repurchases

could increase (or reduce the size of any decrease in) the market

price of WisdomTree’s common stock and/or the market price of the

notes offered in the offering. WisdomTree cannot predict the

magnitude of such market activity or the overall effect it will

have on the price of the notes offered hereby or WisdomTree’s

common stock.

The notes will only be offered to qualified institutional buyers

pursuant to Rule 144A under the Securities Act. The notes and the

common stock issuable upon conversion of the notes, if any, have

not been and will not be registered under the Securities Act, or

any state securities laws, and unless so registered, may not be

offered or sold in the United States except pursuant to an

applicable exemption from such registration requirements.

This announcement is neither an offer to sell nor a solicitation

of an offer to buy any of these securities and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful.

About WisdomTree

WisdomTree is a global financial innovator, offering a

well-diversified suite of exchange-traded products (ETPs), models,

solutions and products leveraging blockchain technology. We empower

investors and consumers to shape their future and support financial

professionals to better serve their clients and grow their

businesses. WisdomTree is leveraging the latest financial

infrastructure to create products that provide access, transparency

and an enhanced user experience. Building on our heritage of

innovation, we are also developing and have launched

next-generation digital products, services and structures,

including digital or blockchain-enabled mutual funds and tokenized

assets, as well as our blockchain-native digital wallet, WisdomTree

Prime®.*

* The WisdomTree Prime digital wallet and digital asset services

are made available through WisdomTree Digital Movement, Inc., a

federally registered money services business, state-licensed money

transmitter and financial technology company (NMLS ID: 2372500) or

WisdomTree Digital Trust Company, LLC, in select U.S. jurisdictions

and may be limited where prohibited by law. WisdomTree Digital

Trust Company, LLC is chartered as a limited purpose trust company

by the New York State Department of Financial Services to engage in

virtual currency business.

WisdomTree currently has approximately $106.0 billion in assets

under management globally.

WisdomTree® is the marketing name for WisdomTree, Inc. and its

subsidiaries worldwide.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements that are

based on WisdomTree’s management’s beliefs and assumptions and on

information currently available to management. Although WisdomTree

believes that the expectations reflected in these forward-looking

statements are reasonable, these statements relate to future events

or WisdomTree’s future financial performance, and involve known and

unknown risks, uncertainties and other factors that may cause

actual results, levels of activity, performance or achievements to

be materially different from any future results, levels of

activity, performance or achievements expressed or implied by these

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential,” “continue” or the negative of

these terms or other comparable terminology. These statements are

only predictions. You should not place undue reliance on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which are, in some cases,

beyond WisdomTree’s control and which could materially affect

results. Factors that may cause actual results to differ materially

from current expectations include, among other things, the risks

described below. If one or more of these or other risks or

uncertainties occur, or if WisdomTree’s underlying assumptions

prove to be incorrect, actual events or results may vary

significantly from those implied or projected by the

forward-looking statements. No forward-looking statement is a

guarantee of future performance. You should read this press release

completely and with the understanding that WisdomTree’s actual

future results may be materially different from any future results

expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this press release

may include statements about the proposed terms of the notes, the

size of the notes offering, including the option to purchase

additional notes to be granted to the initial purchaser, the

expected use of the proceeds from the sale of the notes, the

closing of the Series A preferred stock repurchase and the

potential effects of the 2028 notes repurchases and the share

repurchases on WisdomTree’s common stock and the market price of

the notes, and other statements contained in this press release

that are not historical facts. Forward-looking statements are

subject to many risks and uncertainties, including without

limitation, risks related to or associated with whether WisdomTree

will consummate the offering of the notes on the expected terms, or

at all, which could differ or change based upon market conditions

or other reasons, and the other risks set forth under the caption

“Risk Factors” in WisdomTree’s Annual Report on Form 10-K for the

year ended December 31, 2023 and Quarterly Reports on Form 10-Q for

the quarters ended March 31, 2024 and June 30, 2024.

Category: Business Update

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808068291/en/

Investor Relations Jeremy Campbell +1.917.267.3859

jeremy.campbell@wisdomtree.com

Corporate Communications Jessica Zaloom +1.917.267.3735

jzaloom@wisdomtree.com

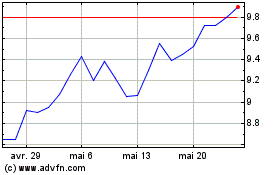

WisdomTree (NYSE:WT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

WisdomTree (NYSE:WT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024