AGF Investments Launches AGF Enhanced U.S. Equity Income Fund

21 Août 2023 - 1:45PM

AGF Investments Inc. (AGF Investments) (TSX:AGF.B) today

announced that it is expanding its line-up with the launch of AGF

Enhanced U.S. Equity Income Fund, which effective today is

available as a mutual fund with an ETF series option.

|

Fund |

Fund Series Available |

ETF Series Ticker |

Risk Rating |

|

AGF Enhanced U.S. Equity Income Fund |

Series F |

AENU (NEO Exchange) |

Medium |

“This fund seeks to provide investors long-term

capital appreciation while mitigating volatility and generating

consistent income through the use of a dynamic option overlay

strategy,” said Karrie Van Belle, Chief Marketing & Innovation

Officer, AGF Investments. “Further, as we take a more vehicle

agnostic approach, this is the first in a series of strategies we

expect to launch, allowing investors to access our capabilities in

a mutual fund with ETF series.”

AGF Enhanced U.S. Equity Income Fund provides

exposure to a diversified portfolio of dividend-paying U.S. equity

securities combined with an actively managed option writing

strategy that seeks to provide enhanced income potential and

mitigate volatility. The fund will pay a tax-efficient, fixed

monthly distribution.

In the future, AGF Investments intends to expand

its ETF series line-up and expects to initially list ETF series

later this fall of its existing mutual funds AGF Total Return Bond

Fund, AGF Global Real Assets Fund and AGF U.S. Small Mid Cap

Fund.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an

independent and globally diverse asset management firm. Our

companies deliver excellence in investing in the public and private

markets through three distinct business lines: AGF Investments, AGF

Private Capital and AGF Private Wealth.

AGF brings a disciplined approach focused on

providing an exceptional client experience and incorporating sound

responsible and sustainable practices across its businesses. The

firm’s collective investment solutions, driven by its fundamental,

quantitative and private investing capabilities, extends globally

to a wide range of clients, from financial advisors and their

clients to high-net worth and institutional investors including

pension plans, corporate plans, sovereign wealth funds, endowments

and foundations.

Headquartered in Toronto, Canada, AGF has

investment operations and client servicing teams on the ground in

North America and Europe. With over $42 billion in total

assets under management and fee-earning assets, AGF serves more

than 800,000 investors. AGF trades on the Toronto Stock Exchange

under the symbol AGF.B.

About AGF Investments

AGF Investments is a group of wholly owned

subsidiaries of AGF Management Limited, a Canadian reporting

issuer. The subsidiaries included in AGF Investments are AGF

Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF

Investments LLC (AGFUS) and AGF International Advisors Company

Limited (AGFIA). The term AGF Investments may refer to one or more

of these subsidiaries or to all of them jointly. This term is used

for convenience and does not precisely describe any of the separate

companies, each of which manages its own affairs.

AGF Investments Inc. is a wholly-owned subsidiary

of AGF Management Limited and conducts the management and advisory

of mutual funds in Canada.

This information is not intended to provide legal,

accounting, tax, investment, financial, or other advice, and should

not be relied upon for providing such advice. Commissions,

trailing commissions, management fees and expenses all may be

associated with investment fund investments. Please read the

prospectus before investing. Investment funds are not guaranteed,

their values change frequently, and past performance may not be

repeated.

Media Contact

Amanda MarchmentDirector, Corporate

Communications416-865-4160amanda.marchment@agf.com

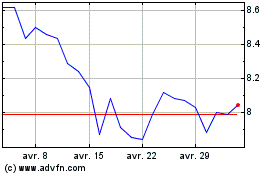

AGF Management (TSX:AGF.B)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

AGF Management (TSX:AGF.B)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024