Early Warning Report Issued Pursuant to National Instrument 62‐103

26 Octobre 2021 - 3:20PM

This press release is being disseminated as required by National

Instrument 62‐103 - The Early Warning System and Related Take Over

Bids and Insider Reporting Issuers in connection with the filing of

an early warning report (the “Early Warning Report”) regarding the

disposition of securities of Andlauer Healthcare Group Inc. (TSX:

AND) (“AHG”) by Andlauer Management Group Inc. (“AMG”), a private

corporation owned and controlled by Michael Andlauer.

On October 26, 2021, AMG and AHG, completed a

“bought deal” offering of 3,500,000 subordinate voting shares of

AHG (“Subordinate Voting Shares”) at a price of $48.20 per

Subordinate Voting Shares for gross proceeds of $168,700,000 (the

“Offering”), which consisted of (a) a treasury offering of

2,000,000 Subordinate Voting Shares for gross proceeds to AHG of

$96,400,000, and (b) a secondary offering from AMG of 1,500,000

Subordinate Voting Shares for gross proceeds of $72,300,000. The

Offering was made through a syndicate of underwriters consisting of

CIBC World Markets Inc., RBC Dominion Securities Inc., Scotia

Capital Inc., TD Securities Inc., Stifel Nicolaus Canada Inc., and

National Bank Financial Inc. (collectively, the “Underwriters”),

pursuant to an underwriting agreement dated October 12, 2021 among

the Underwriters, AHG and AMG. The Offering was made by way of a

short form prospectus dated October 19, 2021 filed in each of the

provinces and territories of Canada. Upon closing of the Offering

on October 26, 2021, AMG disposed of 1,500,000 Subordinate Voting

Shares.

Prior to the Offering, AMG owned all of the

25,100,000 issued and outstanding multiple voting shares in the

capital of AHG (the “Multiple Voting Shares”, and together with the

Subordinate Voting Shares, the “Shares”) and 10,200 Subordinate

Voting Shares (representing approximately 0.08% of the issued and

outstanding Subordinate Voting Shares, 65.3% of all issued and

outstanding Shares and 88.2% of the voting power attached to all of

the issued and outstanding Shares, in each case outstanding prior

to the Offering).

Following the Offering, AMG owns all of the

23,600,000 issued and outstanding Multiple Voting Shares and 10,200

Subordinate Voting Shares (representing approximately 0.06% of the

issued and outstanding Subordinate Voting Shares, 58.3% of all

issued and outstanding Shares and 84.8% of the voting power

attached to all of the issued and outstanding Shares, in each case

outstanding following the Offering).

AMG has granted to the Underwriters an option

(the “Over-Allotment Option”), exercisable in whole or in part, for

a period of 30 days after the closing of the Offering, to purchase

up to an additional 525,000 Subordinate Voting Shares on the same

terms as the Offering to cover over-allotments, if any, and for

market stabilization purposes.

On October 5, 2021, AHG announced that it had

entered into definitive agreements to acquire 100% of T.F. Boyle

Transportation, Inc. (the “Boyle Acquisition”) and the remaining

51% of Skelton USA Inc. (the “Skelton Acquisition” and, together

with the Boyle Acquisition, the “Acquisitions”). A portion of the

purchase price for the Boyle Acquisition will be satisfied by the

issuance of 522,116 Subordinate Voting Shares from treasury and a

portion of the Skelton Acquisition will be satisfied by the

issuance of 518,672 Subordinate Voting Shares from treasury. The

Acquisitions are expected to close in the fourth quarter of 2021.

Following closing of the Acquisitions, and assuming no exercise of

the Over-Allotment Option, AMG will hold approximately 0.06% of the

issued and outstanding Subordinate Voting Shares, 56.9% of all

issued and outstanding Shares and 84.1% of the voting power

attached to all of the issued and outstanding Shares (0.06%, 55.6%

and 83.4% respectively if the Over-Allotment Option is exercised in

full).

In addition to the foregoing, it is expected

that from time to time, AMG will transfer Subordinate Voting Shares

to independent owner-operators engaged by AHG, consistent with the

disclosure set out in AHG’s initial public offering prospectus.

A copy of the Early Warning Report to be filed

by Michael Andlauer in connection with the transactions described

above will be available on the Company’s SEDAR profile at

www.sedar.com.

The head office of the Company is located at 100

Vaughan Valley Blvd., Vaughan, Ontario, Canada L4H 3C5. Michael

Andlauer’s address is c/o Andlauer Management Group Inc., 100

Vaughan Valley Blvd., Vaughan, Ontario, Canada L4H 3C5.

To obtain a copy of the Early Warning Report

filed under National Instrument 62-103, please contact:

| Peter Bromley |

Bruce Wigle |

| Chief Financial Officer |

Investor Relations |

|

Tel: (416) 744-4900 |

Tel: (647) 496-7856 |

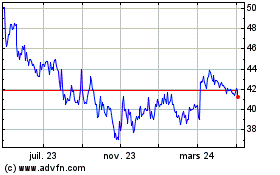

Andlauer Heathcare (TSX:AND)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

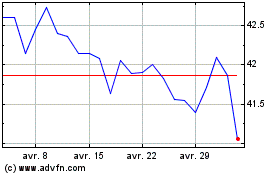

Andlauer Heathcare (TSX:AND)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025