Aecon Group Inc. (TSX: ARE) (“Aecon” or the “Company”) announced

today that its subsidiary, Aecon Utilities Group Inc. (“Aecon

Utilities”), has acquired a majority interest in Xtreme Powerline

Construction (“Xtreme”), an electrical distribution utility

contractor headquartered in Port Huron, Michigan for a base

purchase price of approximately US$73 million, with the potential

for additional contingent proceeds (the “Transaction”). The

Transaction is being financed through Aecon Utilities’ standalone

committed revolving credit facility. Xtreme management are

committed to supporting Aecon Utilities’ expansion in the U.S. and

will retain a minority ownership in Xtreme as well as leadership

responsibilities in the Xtreme business in partnership with Aecon

Utilities’ management team.

A privately-owned company founded in 2007,

Xtreme is a full-service powerline constructor with approximately

300 employees. Xtreme specializes in overhead distribution line

repair, maintenance and expansion services throughout the Eastern

United States, and provides emergency restoration services for over

20 utility clients across the U.S. Xtreme has held a long-time

overhead distribution Master Service Agreement (“MSA”) with DTE

Energy (“DTE”).

“By expanding our self-perform electrical

distribution capabilities in the U.S., Aecon Utilities is enhancing

its diverse service offering and key strategic initiative to

strengthen relationships with U.S. utility clients in target

markets and with significant requirements to repair, upgrade, and

expand grid infrastructure,” said Jean-Louis Servranckx, President

and Chief Executive Officer, Aecon Group Inc. “Through Xtreme and

its talented leadership team, we look forward to continuing to

strengthen our partnership with DTE and other key clients while

diversifying our portfolio of U.S. utility services.”

“The acquisition of Xtreme creates opportunities

to harness our collective utility infrastructure expertise and

drive continued growth in priority markets,” said Eric MacDonald,

Executive Vice President, Aecon Utilities. “Xtreme’s experienced

team and strong client relationships are aligned with our business,

and we, along with our strategic partner Oaktree, are pleased to

welcome the Xtreme team to help advance our continued growth across

North America with a focus on the energy transition.”

“We are excited for the opportunities for both

our customers and employees in joining the Aecon Utilities team,”

said Scott Sheldon, President of Xtreme. “Aecon Utilities provides

a strong and diverse platform to allow us to accelerate our growth

by offering new services to our existing customers while continuing

to expand our footprint and capabilities in new markets.”

Toronto Dominion Bank and Canadian Imperial Bank

of Commerce acted as co-lead agents on behalf of a syndicate of

lenders on Aecon Utilities’ standalone committed revolving credit

facility. Davies Ward Phillips & Vineberg LLP served as legal

counsel to Aecon Utilities. The Transaction was also supported by

advisory services provided by Stifel.

About Aecon

Aecon Group Inc. is a North American

construction and infrastructure development company with global

experience. Aecon delivers integrated solutions to private and

public-sector clients through its Construction segment in the

Civil, Urban Transportation, Nuclear, Utility, and Industrial

sectors, and provides project development, financing, investment,

management, and operations and maintenance services through its

Concessions segment. Join our online community on X, LinkedIn,

Facebook, and Instagram @AeconGroupInc.

About Aecon Utilities

Aecon Utilities is a leading provider of utility

infrastructure solutions in Canada, with a growing presence in the

U.S., operating in four end markets: electrical transmission and

distribution, renewables and in-home services, telecommunications,

and pipeline distribution. A significant portion of Aecon

Utilities’ revenues are generated from recurring revenue programs

for public and leading private utility-sector clients. Funds

managed by Oaktree Capital Management, L.P., through its Power

Opportunities strategy, invested in a net $150 million convertible

preferred equity investment in October 2023 that is convertible

into a 27.5% ownership interest in Aecon Utilities.

Statement on Forward-Looking

Information

The information in this press release includes

certain forward-looking statements which may constitute

forward-looking information under applicable securities laws. These

forward-looking statements are based on currently available

competitive, financial and economic data and operating plans but

are subject to risks and uncertainties. Forward-looking statements

may include, without limitation, statements regarding the

operations, business, financial condition, expected financial

results, performance, prospects, ongoing objectives, strategies and

outlook for Aecon, including statements regarding: the potential

for additional contingent proceeds payable under the Transaction,

the ability of Aecon Utilities and Xtreme to integrate successfully

following the Transaction, the expansion in the U.S. utility

services market and driving continued growth in priority markets,

and the effective collaboration with Xtreme management.

Forward-looking statements may in some cases be identified by words

such as "may," "will," "expects," "target," "future," "plans,"

"believes," "anticipates," "estimates," "projects," "intends,"

"should" or the negative of these terms, or similar

expressions.

In addition to events beyond Aecon's control,

there are factors which could cause actual or future results,

performance or achievements to differ materially from those

expressed or inferred herein including, but not limited to: the

risk of not being able to meet contractual schedules and other

performance requirements, the risk of not being able to meet its

labour needs, the risk of costs or difficulties related to the

integration of Aecon Utilities and Xtreme being greater than

expected, the risk of the anticipated benefits and synergies from

the Transaction not being fully realized or taking longer than

expected to realize, the risk of being unable to retain key

personnel, including Xtreme management, and the risk of being

unable to maintain relationships with customers, suppliers or other

business partners of Xtreme. These forward-looking statements are

based on a variety of factors and assumptions including, but not

limited to that: none of the risks identified above materialize,

there are no unforeseen changes to economic and market conditions

and no significant events occur outside the ordinary course of

business. These assumptions are based on information currently

available to Aecon, including information obtained from third-party

sources. While Aecon believes that such third-party sources are

reliable sources of information, Aecon has not independently

verified the information. Aecon has not ascertained the validity or

accuracy of the underlying economic assumptions contained in such

information from third-party sources and hereby disclaims any

responsibility or liability whatsoever in respect of any

information obtained from third-party sources.

Risk factors are discussed in greater detail in

Section 13 - "Risk Factors" in Aecon’s 2023 Management’s Discussion

and Analysis for the fiscal year ended December 31, 2023 and

Aecon’s Management’s Discussion and Analysis for the fiscal quarter

ended March 31, 2024, each filed on SEDAR+ (www.sedarplus.ca).

Except as required by applicable securities laws, forward-looking

statements speak only as of the date on which they are made and

Aecon undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

For further information:

Adam BorgattiSVP, Corporate Development and

Investor Relations416-297-2600ir@aecon.com

Nicole CourtVice President, Corporate

Affairs416-297-2600corpaffairs@aecon.com

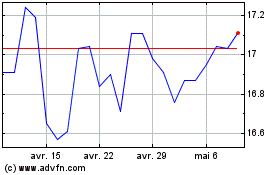

Aecon (TSX:ARE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

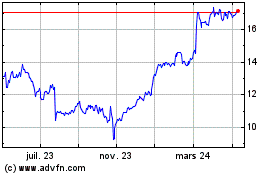

Aecon (TSX:ARE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024