Brompton Funds Announces ETF Name Change

07 Janvier 2025 - 12:00AM

(TSX: BREA) Brompton Funds (“Brompton”) today

announced that it is proposing to change the name of Brompton

Sustainable Real Assets Dividend ETF (the “ETF”) to “Brompton

Global Infrastructure ETF” (the “Name Change”).

There are no material changes to the ETF’s

investment objectives or investment strategies as a result of the

Name Change. The ETF’s ticker will be changed from BREA to BGIE,

concurrently with the Name Change, both of which are scheduled to

take effect on January 21, 2025, subject to regulatory

approval.

Since inception on April 30, 2020, the ETF has

delivered an 11.6% per annum total return, outperforming its

benchmark Infrastructure and Real Estate Index by 4.0% per annum

.(1)

About Brompton FundsFounded in

2000, Brompton is an experienced investment fund manager with

income and growth focused investment solutions including

exchange-traded funds (ETFs) and other Toronto Stock Exchange

traded investment funds. For further information, please contact

your investment advisor, call Brompton’s investor relations line at

416-642-6000 (toll-free at 1-866-642-6001), email

info@bromptongroup.com or visit our website at

www.bromptongroup.com.

(1) See Performance table below.

|

Compound Annual Returns to December 31, 2024 |

1-Yr |

3-Yr |

SinceInception |

|

Brompton Sustainable Real Assets Dividend ETF(to

be renamed Brompton Global Infrastructure ETF) |

24.1% |

6.9% |

11.6% |

|

Infrastructure and Real Estate Index |

8.7% |

1.5% |

7.6% |

Returns are for the periods ended December 31,

2024 and are unaudited. Inception date April 30, 2020. The table

shows the ETF’s compound returns for each period indicated compared

with the “Infrastructure and Real Estate Index”. The Infrastructure

and Real Estate Index consists of a 75% Dow Jones Brookfield Global

Infrastructure Composite Total Return Index (“Global Infrastructure

Index”) and 25% Dow Jones Global Select Real Estate Securities

Total Return Index (“Select Real Estate Index”). The Global

Infrastructure Index is designed to measure the performance of

pure-play infrastructure companies domiciled globally. The index

covers all sectors of the infrastructure market and includes Master

Limited Partnerships in addition to other equity securities. To be

included in the index, a company must derive at least 70% of cash

flows from infrastructure lines of business. The Select Real Estate

Index tracks the performance of equity real estate investment

trusts and real estate operating companies traded globally. The

index is designed to serve as a proxy for direct real estate

investment, in part by excluding companies whose performance may be

driven by factors other than the value of real estate. The ETF is

actively managed; therefore, its performance is not expected to

mirror that of the Infrastructure and Real Estate Index which has a

more diversified portfolio and includes a substantially larger

number of companies. Furthermore, the Infrastructure and Real

Estate Index performance is calculated without the deduction of

management fees, fund expenses and trading commissions, whereas the

performance of the ETF is calculated after deducting such fees and

expenses. The performance information shown is based on net asset

value per unit and assumes that cash distributions made by the ETF

during the periods shown were reinvested at net asset value per

unit in additional units of the ETF. Past performance does not

necessarily indicate how the ETF will perform in the future.

Commissions, trailing commissions, management

fees and expenses all may be associated with exchange-traded fund

investments. The indicated rates of return are the historical

annual compounded total returns including changes in unit value and

reinvestment of all distributions and do not take into account

sales, redemption, distribution or optional charges or income taxes

payable by any securityholder that would have reduced returns.

Please read the prospectus before investing. Exchange-traded

funds are not guaranteed, their values change frequently and past

performance may not be repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the ETF, to the future outlook of the

ETF and anticipated events or results and may include statements

regarding the future financial performance of the ETF. In some

cases, forward-looking information can be identified by terms such

as “may”, “will”, “should”, “expect”, “plan”, “anticipate”,

“believe”, “intend”, “estimate”, “predict”, “potential”, “continue”

or other similar expressions concerning matters that are not

historical facts. Actual results may vary from such forward-looking

information. Investors should not place undue reliance on

forward-looking statements. These forward-looking statements are

made as of the date hereof and we assume no obligation to update or

revise them to reflect new events or circumstances.

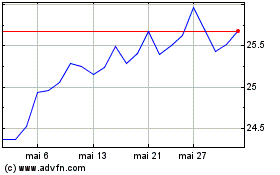

Brompton Sustainable Rea... (TSX:BREA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Brompton Sustainable Rea... (TSX:BREA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025