Chorus Aviation announces closing of $75 million bought deal offering of 5.75% Senior Unsecured Debentures

06 Décembre 2019 - 2:29PM

Chorus Aviation Inc. ('Chorus') (TSX: CHR) is pleased to announce

that it has closed its previously announced bought deal offering of

$75 million aggregate principal amount of senior unsecured

debentures (the ‘Debentures’) at a price of $1,000 per Debenture

(the ‘Offering’). The net proceeds of the Offering will be

used to fund the growth of Chorus Aviation Capital (Chorus’

aircraft leasing business), including the acquisition of aircraft

intended for or currently on lease to third parties, as well as for

working capital requirements and general corporate purposes.The

Debentures bear interest at a rate of 5.75% per annum, payable

semi-annually in arrears on June 30 and December 31 of each year,

commencing June 30, 2020, and will mature on December 31, 2024. The

Debentures will commence trading today on the Toronto Stock

Exchange under the symbol ‘CHR.DB.A’.Subject to any required

regulatory approval and provided no event of default has occurred

and is continuing under the terms of the indenture governing the

Debentures, Chorus will have the option to satisfy its obligation

to pay the principal amount of the Debentures due at redemption or

maturity (together with any applicable premium) by delivering

freely tradeable Class B Voting Shares (‘Class B Shares’) to

holders of the Debentures (‘Debentureholders’) who are Canadians

(as defined in the Canada Transportation Act (‘Qualified

Canadians’) or Class A Variable Voting Shares (‘Class A Shares’

and, together with the Class B Shares, the ‘Voting Shares’) to

Debentureholders who are not Qualified Canadians. The Debentures

are not convertible into Voting Shares by Debentureholders at any

time.A syndicate co-led by CIBC Capital Markets and RBC Capital

Markets, and including Scotiabank, National Bank Financial Inc., TD

Securities Inc., BMO Capital Markets, Canaccord Genuity Corp.,

Cormark Securities Inc. and Paradigm Capital Inc. (collectively,

the ‘Underwriters’) acted as underwriters for the Offering. Chorus

has granted the Underwriters an option to purchase up to an

additional $11.25 million aggregate principal amount of Debentures,

on the same terms and conditions, exercisable in whole or in part,

for a period of 30 days following the closing of the Offering. The

Debentures have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration or an applicable exemption

from the registration requirements of such Act. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

About Chorus

Chorus Aviation is a global provider of

integrated regional aviation solutions. Chorus’ vision is to

deliver regional aviation to the world. Headquartered in Halifax,

Nova Scotia, Chorus comprises Chorus Aviation Capital, a leading,

global lessor of regional aircraft, and Jazz Aviation and Voyageur

Aviation, companies that have long histories of safe operations

with excellent customer service. Chorus provides a full suite

of regional aviation support services that encompasses every stage

of an aircraft’s lifecycle, including: aircraft acquisitions and

leasing; aircraft refurbishment, engineering, modification,

repurposing and preparation; contract flying; aircraft and

component maintenance, disassembly, and parts provisioning.

Chorus Class A Variable Voting Shares and Class

B Voting Shares trade on the Toronto Stock Exchange under the

trading symbol ‘CHR’.

Forward-Looking Information

This news release contains 'forward-looking

information'. Forward-looking information is identified by the use

of terms and phrases such as "anticipate", "believe", "could",

"estimate", "expect", "intend", "may", "plan", "predict",

"potential", "pending", "project", "will", "would", and similar

terms and phrases. In particular, this news release includes

forward-looking information relating to the anticipated use of the

net proceeds of the Offering. Forward-looking information involves

known and unknown risks, uncertainties and other factors that may

cause actual results, performance or achievements to differ

materially from those indicated in the forward-looking information.

These risks include, but are not limited to, the potential

reallocation by Chorus of all or a portion of the net proceeds of

the Offering for business reasons, including among others, due to

the results of operations or as a result of other business

opportunities that may become available, as well the risk factors

identified in Chorus' Annual Information Form dated February

21, 2019, in Chorus' public disclosure record available

at www.sedar.com and in the short form prospectus filed in

connection with the Offering. Statements containing forward-looking

information in this news release represent Chorus' expectations as

of the date of this news release (or as of the date they are

otherwise stated to be made) and are subject to change after such

date. Chorus disclaims any intention or obligation to update or

revise such statements to reflect new information, subsequent

events or otherwise, unless required by applicable securities

laws.Chorus Media Contacts:Manon Stuart, Halifax,

Nova Scotia (902) 873-5054 manon.stuart@chorusaviation.com

Debra Williams, Toronto, Ontario (905) 671-7769

debra.williams@chorusaviation.com

Analyst Contact:

Nathalie Megann, Halifax, Nova Scotia, (902)

873-5094 nathalie.megann@chorusaviation.com

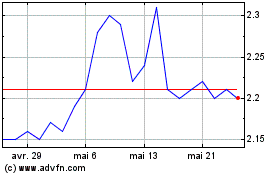

Chorus Aviation (TSX:CHR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Chorus Aviation (TSX:CHR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024