Dream Industrial REIT (TSX: DIR.UN) (“Dream Industrial”,

“DIR”, or the “Trust”) today announced that it is in

exclusive and advanced discussions with regards to the acquisition

of shares of a corporation that owns a portfolio of 31

institutional quality, logistics properties across Europe (the

“Acquisition”). The Acquisition would significantly enhance quality

and scale in key industrial markets and establish a comprehensive

pan-European real estate platform, including in-house development

capabilities. The total value of the real estate in connection with

the Acquisition is expected to be approximately €880 million or

$1.3 billion which implies a going in capitalization rate in the

low 4% range, inclusive of excess land. The Trust estimates that

the development potential on the excess land included in the

portfolio is approximately 1.1 million square feet and could

generate a yield on incremental development costs of over 7%. A

majority of the properties have strong income growth potential with

in-place rents estimated to be on average 10% below market.

Including both the development and rent growth potential, the Trust

expects the blended yield on the portfolio to be in the high 4%

range. The vendors include entities controlled by certain funds

managed by Clarion Partners Europe.

The purchase price for the Acquisition is

anticipated to be approximately $850 million, to be paid in cash,

and will be subject to customary closing adjustments. The portfolio

has approximately $500 million of in-place debt which the Trust

will assume by virtue of acquiring the shares of the corporation

that owns the portfolio. A portion of the $850 million purchase

price will be funded by the proceeds of a $250 million bought deal

public offering of subscription receipts (the “Offering”) as

described below. The remaining amount of the purchase price will be

primarily funded through existing liquidity available to the Trust

today, including over $150 million of cash on hand and $350 million

of capacity on the Trust’s revolving line of credit. However, the

Trust intends to issue unsecured bonds, which after swapping to

euros and based on current all-in rates is expected to be

approximately 70 bps on average for terms up to seven years, in

order to complete the Acquisition and optimize the permanent

financing of the portfolio. The Trust is also in advanced

negotiations on various dispositions and joint venture strategies,

primarily involving its U.S. portfolio, and anticipates it will

repatriate over $250 million of equity at values in excess of IFRS

carrying values. The Trust intends to maintain leverage within its

previously communicated target range of mid to high 30%.

“We believe this portfolio would enhance Dream

Industrial REIT’s European industrial platform by adding excellent

assets in our existing markets and entering new target markets.

With increased scale, we would expand our capabilities into new

markets and add more development opportunities. With the larger

asset base and enhanced platform, we can pursue investment and

asset management opportunities that are of higher quality and can

deliver higher returns,” said Brian Pauls, Chief Executive Officer

of Dream Industrial REIT. “We believe the exceptional quality and

location of these properties, paired with an attractive going-in

cap rate, embedded strong organic growth and development pipeline

provide a compelling risk-adjusted return relative to comparable

income producing acquisition opportunities in North America. When

paired with our debt strategy and ability to obtain leverage at

approximately 70 bps on a swapped basis, this acquisition provides

an exceptional opportunity for Dream Industrial REIT to deliver

strong growth in FFO and net asset value per unit for our

unitholders.”

The Trust anticipates that, if an agreement is

entered into, the Acquisition will close in the next 60 days. There

can be no assurance, however, that a definitive agreement will be

reached on the terms described in this press release, or at

all.

Overview of the Acquisition

Portfolio Overview

The Trust announced its expansion strategy into

the European light industrial and logistics market in January 2020

and has since acquired approximately €330 million of high-quality

properties in Germany and the Netherlands. The Acquisition would

add approximately €880 million of institutional quality, logistics

properties to the Trust’s growing presence in Europe.

By value, approximately 90% of the 31 properties

being acquired are located in Germany, the Netherlands, France and

Spain. Additionally, the portfolio includes one property in each of

Slovakia and the Czech Republic. Several of the properties have

various green building and energy efficiency certifications. The

portfolio totals approximately 8.9 million square feet and includes

significant excess land allowing for intensification opportunities

in excess of 1.1 million square feet. The Trust estimates that this

additional gross leasable area (“GLA”) could be developed over the

near to medium term and achieve a yield on incremental development

costs of over 7%.

The portfolio is 100% leased, has an average

construction date of 2006 or later and an average clear height of

34.5 feet. This fully indexed portfolio has a weighted average

lease term of 5.3 years. A majority of the properties have strong

income growth potential with in-place rents estimated to be on

average 10% below market. Those properties with longer term leases

have stable tenants with strong covenants, including multi-national

corporations and investment grade credits. Food distribution and

third-party logistics tenants represent 50% of the portfolio by net

rent.

The Trust believes that the assets in the

portfolio are well located in their respective geographies, benefit

from convenient access to transportation networks and are

well-poised for growth in income and value.

Platform Overview

The Acquisition, if completed, would expand the

Trust’s institutional asset management, leasing and in-house

development platform. This platform expansion would enable the

Trust to source and execute on acquisitions and value-add

opportunities in Europe that are of higher quality and have the

potential to provide higher returns relative to properties in the

Trust’s current markets, as well as capitalize on the significant

intensification potential embedded within the portfolio.

In-Place Financing Overview

The portfolio has approximately $500 million of

in-place debt which the Trust will assume by virtue of acquiring

the shares of the corporation that owns the portfolio. The weighted

average cost of this debt is approximately 1.3% with an average

remaining term of 2.5 years. Based on attractive financing

opportunities currently available in the market, the Trust believes

it has an opportunity to refinance select mortgages with longer

term, unsecured debt, which after swapping to euros and based on

current all-in rates is expected to be approximately 70 bps on

average for terms up to 7 years.

Key Market Overview

The portfolio is located in the most

sought-after markets in Europe, including Germany, the Netherlands

and France. These markets are benefiting from strong occupier

fundamentals, including declining vacancy rates and rental rate

growth, and are experiencing strong investor demand driven by

continuing growth in e-commerce penetration, growth in inventories

and re-shoring of various elements of supply chains.

The table below summarizes some key metrics for

the largest markets of the portfolio as of Q4 2020:

|

As of Q4 2020 |

Netherlands |

France |

Germany |

| Vacancy Rate |

4.7% |

5.8% |

2.6% |

| Prime Rent |

€70 / sqm€6.50 / sf |

€70 / sqm€6.50 / sf |

€84 / sqm€7.80 / sf |

| Prime

Yield |

3.60% |

3.75% |

3.40% |

Source: CBRE, JLL

Pro Forma Combined Portfolio

|

Portfolio Metrics |

As at March 31,2021,

Adjusted2 |

Acquisition Portfolio |

Pro Forma |

| Number of properties |

284 |

31 |

315 |

| Investment properties fair

value (millions of dollars) |

3,627 |

1,305 |

4,933 |

| Gross leasable area (thousands

of square feet – owned share) |

29,160 |

8,903 |

38,063 |

| Number of tenants |

1,127 |

33 |

1,160 |

| Average tenant size (thousands

of square feet) |

26 |

270 |

33 |

| Occupancy rate (including

committed occupancy) |

97.2% |

100.0% |

97.9% |

| Average remaining lease term

(years) |

4.2 |

5.3 |

4.5 |

| Average clear height

(feet) |

25.4 |

34.5 |

27.5 |

| Development pipeline (millions

of square feet) |

~2 |

1.1 |

>3 |

|

|

|

|

|

Subscription Receipt

Offering

To finance a portion of the purchase price, the

Trust has entered into an agreement with a syndicate of

underwriters (the “Underwriters”) led by TD Securities to

sell 18,250,000 Subscription Receipts on a bought deal basis.

The Subscription Receipts will be offered at a price of

$13.70 per Subscription Receipt (the “Offering Price”), for

aggregate gross proceeds to the Trust of $250 million. The Trust

has also granted the Underwriters an over-allotment option to

purchase up to an additional 2,737,500 Subscription Receipts

on the same terms and conditions as the Offering, exercisable not

later than 30 days after the closing of the Offering.

Each Subscription Receipt represents the right

of the holder to receive, upon closing of the Acquisition, without

payment of additional consideration, one unit of the Trust. Holders

of Subscription Receipts will be entitled to distribution

equivalent payments in respect of, and paid concurrently with, any

distributions on the Trust’s units for which the record dates occur

during the period commencing on the closing date of the Offering

to, but excluding, the last day on which the Subscription Receipts

remain outstanding. The record date for each distribution

equivalent payment will be the same as the record date for the

corresponding distribution declared on the units.

In the event that a termination event occurs

after a distribution has been declared on the units but before the

record date for such distribution, holders of Subscription Receipts

will receive a pro rata distribution equivalent payment in respect

of such distribution declared on the units.

The net proceeds from the sale of the

Subscription Receipts will be held by a subscription receipt agent

pending the fulfillment or waiver of all outstanding conditions

precedent to closing of the Acquisition (other than the payment of

the consideration for the Acquisition). There can be no assurance,

however, that a definitive agreement with respect to the

Acquisition will be reached, that the applicable closing conditions

will be met or that the Acquisition will be consummated.

If the Acquisition is not completed as described

above by August 30, 2021 or if the Acquisition is terminated at an

earlier time, the gross proceeds of the Offering and pro rata

entitlement to interest earned or deemed to be earned on the gross

proceeds of the Offering, net of any applicable withholding taxes,

will be paid to holders of the Subscription Receipts and the

Subscription Receipts will be cancelled.

The Subscription Receipts will be offered

pursuant to a prospectus supplement to the Trust’s base shelf

prospectus, which will describe the terms of the Subscription

Receipts. The Offering is expected to close on or about May 31,

2021 and is subject to certain conditions including, but not

limited to, the approval of the Toronto Stock Exchange.

Update on Capital

Repatriation

The Trust is in advanced negotiations on various

dispositions and joint venture strategies, primarily involving its

U.S. portfolio, and anticipates it will repatriate over $250

million of equity at values in excess of IFRS carrying values. The

Trust intends to maintain an industrial platform in the United

States and will continue to allocate capital to high quality

properties and development opportunities in strong markets in the

United States. The Trust believes that this strategy would enhance

its returns on equity invested in the United States going

forward.

Portfolio Overview

An overview of the portfolio is provided on the

Trust’s website at www.dream.ca/investors/industrial and will

also be filed on SEDAR under the Trust’s profile.

About Dream Industrial Real Estate

Investment Trust

Dream Industrial REIT is an unincorporated,

open-ended real estate investment trust. As at March 31, 2021,

Dream Industrial REIT owns and operates a portfolio of 186

industrial assets (280 properties) comprising approximately 28.8

million square feet of gross leasable area in key markets across

North America and a growing presence in strong European industrial

markets. Dream Industrial REIT’s objective is to continue to grow

and upgrade the quality of its portfolio and to provide attractive

overall returns to its unitholders. For more information, please

visit www.dreamindustrialreit.ca

Forward Looking

Information

This news release may contain forward-looking

information within the meaning of applicable securities

legislation. Forward-looking information generally can be

identified by the use of forward-looking terminology such as

“outlook”, “objective”, “may”, “will”, “would”, “could”, “expect”,

“intend”, “estimate”, “anticipate”, “believe”, “should”, “plans”,

or “continue”, or similar expressions suggesting future outcomes or

events. Some of the specific forward-looking information in this

news release may include, among other things, the details, status

and anticipated timing of closing of the acquisitions and potential

acquisitions referred to in this press release; the development and

expansion potential of our properties and the acquisition

properties, including development potential on the excess land

included in the Acquisition; the expectation that the blended yield

on the portfolio will be in the high 4% range; the growth of our

portfolio; statements regarding our development and acquisition

pipelines, including estimated timing for closing future

acquisitions; development of additional GLA and expected yields on

incremental development costs; statements regarding our access to

quality and scale in key industrial markets and expected yields on

incremental development costs; development of a comprehensive

pan-European real estate platform, including institutional asset

management, leasing and in-house development capabilities; the

potential to provide higher returns relative to properties in the

Trust’s current markets; the Trust’s expected acquisition capacity

and leverage levels; the potential issuance of unsecured bonds and

the potential swap to euros thereafter; the repatriation of equity

through various dispositions and joint venture strategies;

expansion of the Trust’s capabilities into new markets; our ability

to refinance select mortgages with longer term, unsecured debt at

favorable rates; our expectation to generate rental rate growth;

the opportunity for us to deliver strong growth in FFO and net

asset value per unit for our unitholders; the strength of the

income growth potential of the properties included in the

Acquisition and estimated in-place rents; the Trust’s growth

outlook for 2021 and future years; anticipated purchase price for

the Acquisition; funding of the purchase price for the Acquisition;

completion of the Acquisition; the intended use of proceeds of the

Offering; the entitlement of holders of Subscription Receipts to

distribution equivalent payments; and the anticipated timing for

the closing of the Offering. Forward looking information is based

on a number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond Dream Industrial REIT’s

control that could cause actual results to differ materially from

those that are disclosed in or implied by such forward-looking

information. These risks and uncertainties include, but are not

limited to, global and local economic and business conditions;

uncertainties surrounding the COVID-19 pandemic; fulfillment or

waiver of all outstanding conditions precedent to closing of the

Acquisition; completion of the Acquisition; the financial condition

of tenants; our ability to refinance maturing debt; leasing risks,

including those associated with the ability to lease vacant space;

interest and currency rate fluctuations; competition; and the risk

that there may be unforeseen events that cause the Trust’s actual

capital structure, overall cost of debt and results of operations

to differ from what the Trust currently anticipates. Our objectives

and forward-looking statements are based on certain assumptions

with respect to each of our markets, including that the general

economy remains stable, the gradual recovery and growth of the

general economy continues over the remainder of 2021, interest

rates remain stable, conditions within the real estate market

remain consistent, competition for and availability of acquisitions

remains consistent with the current climate, the capital markets

continue to provide ready access to equity and/or debt, the timing

and ability to sell certain properties remains in line with the

Trust’s expectations, valuations to be realized on property sales

will be in line with current IFRS values, occupancy levels remain

stable, and the replacement of expiring tenancies will remain

consistent. All forward-looking information in this news release

speaks as of the date of this news release. Dream Industrial REIT

does not undertake to update any such forward-looking information

whether as a result of new information, future events or otherwise

except as required by law. Additional information about these

assumptions and risks and uncertainties is contained in Dream

Industrial REIT’s filings with securities regulators, including its

latest annual information form and MD&A. These filings are also

available at Dream Industrial REIT’s website at

www.dreamindustrialreit.ca.

For further information, please contact:

DREAM INDUSTRIAL REAL ESTATE INVESTMENT

TRUST

|

Brian Pauls |

Lenis Quan |

Alexander Sannikov |

|

Chief Executive Officer |

Chief Financial Officer |

Chief Operating Officer |

|

(416) 365-2365 |

(416) 365-2353 |

(416) 365-4106 |

|

bpauls@dream.ca |

lquan@dream.ca |

asannikov@dream.ca |

1All figures are presented in Canadian dollars,

unless otherwise noted. If applicable, converted at the respective

foreign exchange rate as at May 18, 2021.

2 Inclusive of four previously announced

acquisitions that closed subsequent to March 31, 2021

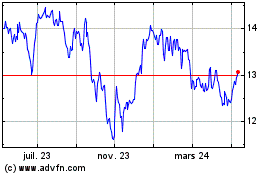

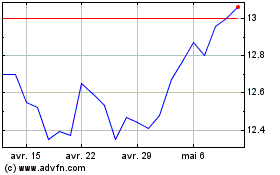

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025