Enterprise Group Announces Results for First Quarter 2018

10 Mai 2018 - 2:30PM

Enterprise Group, Inc. (the “

Company” or

“

Enterprise”) (TSX:E), a consolidator of services

to the energy sector; focused primarily on specialized equipment

rental; today released its Q1 2018 results.

|

Consolidated: |

Three months ended March 31, 2018 |

|

Three months ended March 31, 2017 restated(2) |

|

Change |

|

|

Revenue |

$ |

6,810,906 |

|

$ |

7,015,278 |

|

($ |

204,372 |

) |

|

Gross margin |

$ |

2,126,160 |

|

$ |

2,695,739 |

|

($ |

569,579 |

) |

|

Gross margin % |

|

31 |

% |

|

38 |

% |

|

(7 |

%) |

|

EBITDA(1) |

$ |

1,487,253 |

|

$ |

1,835,990 |

|

($ |

348,737 |

) |

|

Income before tax |

$ |

290,616 |

|

$ |

210,495 |

|

$ |

80,121 |

|

|

Net income (loss) and comprehensive income (loss) |

$ |

3,190,242 |

|

($ |

50,627 |

) |

$ |

3,240,869 |

|

|

EPS |

$ |

0.06 |

|

$ |

0.00 |

|

$ |

0.06 |

|

(1) Identified and defined under “Non-IFRS

Measures”.(2) In March 2018, the Company closed a transaction to

divest substantially all the assets of CTHA. The net operations of

CTHA, including the prior period, are presented as a single amount

in the consolidated statements of income (loss) and comprehensive

income (loss).

- Revenue for the three months ended March 31, 2018 of $6,810,906

is relatively consistent with the prior period with a slight

decrease of $204,372 or 3%. The Company continues to see

increased activity. However, with no construction work completed in

the first quarter of 2018 on a major construction project in

Northeastern B.C., the increased activity experienced with other

customers did not fully offset the loss of revenue earned in the

first quarter of 2017 associated with that project. Although

this project has received government approval to continue, no

construction work was completed in the first quarter of 2018.

Enterprise recently responded to bids for the supply of specialized

equipment to support construction work that will take place in

2018.

- Gross margin for the three months ended March 31, 2018 of

$2,126,160 or 31%, decreased compared to the prior period and

EBITDA for the same period decreased by $348,737 to

$1,487,253. The decreases in gross margin and EBITDA are

consistent with decreased revenue associated with the major

construction project described above. Also, as explained

above, the revenue earned from increased customer activity that

partially offset the lost revenue from that project, was at lower

margins compared to the prior period.

- In March 2018, the Company closed a transaction to divest

substantially all the assets of Calgary Tunnelling & Horizontal

Augering Ltd. (“CTHA”). CTHA provided specialized trenchless

solutions for the energy, utility and infrastructure industries.

Gross cash proceeds from the transaction was $20,694,992.

Enterprise will utilize tax assets and tax losses to offset the

gain on this transaction to minimize cash tax payable. All

proceeds from the transaction were deployed towards reducing the

Company’s debt.

- During 2017, the Company integrated and upgraded its financial

and reporting systems along with its rental fleet tracking and

deployment system. Immediate efficiencies and cost savings

were experienced after implementing these systems. Further

enhancements to these systems continue and during the first quarter

of 2018 the Company deployed a proprietary asset tracking and

dispatch software called “Star”. The software is comprised of

multiple components that work together and exchange information

over a central data base. Star allows the fleet manager the

ability to ensure the highest level of service to the client, while

lowering costs and delivering maximum equipment performance.

- Over the last 2 years, the Company has made significant

improvements to its statement of financial position and overall

total debt. At March 31, 2018, after adjusting for goodwill

and deferred taxes, the Company has assets in excess of total debt

of approximately $54,000,000. Enterprise will continue to

look for opportunities to improve its financial position and

opportunities that will allow the Company to diversify and

expand.

StarChain Update

Development on the StarChain technology

continues. Enterprise’s technology development group is

currently performing infield testing with success. Management

expects to offer its customers specialized equipment capable of

several remote controllable features in H2 of 2018. The

Company’s equipment offerings will enable its customers to automate

and/or schedule the performance of the equipment which optimizes

usage, delivering several benefits such as; reduced fuel expenses,

lowering onsite maintenance costs, real-time reporting among many

others.

About Enterprise Group,

Inc.

Enterprise Group, Inc. is a consolidator of

services to the energy sector. The Company’s focus is

primarily on specialized equipment rental. The Company’s strategy

is to acquire complementary service companies in Western Canada,

consolidating capital, management, and human resources to support

continued growth. More information is available at the Company’s

website www.enterprisegrp.ca. Corporate filings can be found

on www.sedar.com.

For questions or additional information, please

contact:Leonard Jaroszuk, President & CEO, or Desmond

O’Kell, Senior Vice-President 780-418-4400

contact@enterprisegrp.ca

Forward Looking InformationCertain statements

contained in this news release constitute forward-looking

information. These statements relate to future events or the

Company’s future performance. The use of any of the words "could",

"expect", "believe", "will", "projected", "estimated" and similar

expressions and statements relating to matters that are not

historical facts are intended to identify forward-looking

information and are based on the Company's current belief or

assumptions as to the outcome and timing of such future events.

Actual future results may differ materially. The Company's Annual

Information Form and other documents filed with securities

regulatory authorities (accessible through the SEDAR website

www.sedar.com) describe the risks, material assumptions and other

factors that could influence actual results and which are

incorporated herein by reference. The Company disclaims any

intention or obligation to publicly update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, except as may be expressly

required by applicable securities laws.

Non-IFRS MeasuresThe Company uses International

Financial Reporting Standards (“IFRS”). EBITDA is not a

measure that has any standardized meaning prescribed by IFRS and is

therefore referred to as a non-IFRS measure. This news

release contains references to EBITDA. This non-IFRS measure

used by the Company may not be comparable to a similar measure used

by other companies. Management believes that in addition to

net income, EBITDA is a useful supplemental measure as it provides

an indication of the results generated by the Company’s principal

business activities prior to consideration of how those activities

are financed or how the results are taxed. EBITDA is

calculated as net income excluding depreciation, amortization,

interest, taxes and stock based compensation.

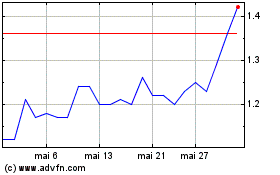

Enterprise (TSX:E)

Graphique Historique de l'Action

De Déc 2024 à Déc 2024

Enterprise (TSX:E)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024