goeasy Ltd. Surpasses a $2 Billion Consumer Loan Portfolio

09 Décembre 2021 - 3:00PM

(“goeasy” or the “Company”), one of Canada’s leading non-prime

consumer lenders, announced today that it has surpassed a $2

billion consumer loan portfolio.

The Company began consumer lending in 2006 with

the launch of its easyfinancial division, after opening the first

test kiosk at an easyhome leasing store in Edmonton, Alberta.

goeasy has since grown to become one of the country’s largest

non-prime consumer lenders, with over 400 locations coast-to-coast,

a fully digital lending platform and point-of-sale financing

offered in the retail, power sports, automotive, home improvement

and healthcare verticals, through more than 4,000 merchants

across Canada. The lending division has proudly served nearly

750,000 Canadians, with 1 out of 3 graduating back to prime credit

and over 60% improving their credit score within 12 months of

borrowing.

“While it took nearly 13 years to reach the

first $1 billion in 2019, we are proud to have doubled the

business, reaching $2 billion in consumer loans within two and a

half years,” said Jason Mullins, goeasy’s President & CEO,

“Achieved through a combination of strong organic growth and the

strategic acquisition of LendCare earlier this year, this milestone

reflects the strength and resiliency of our business model, the

passion of our 2,200 team members to support our customers, and the

benefits of scale, supported by a balance sheet and forward

liquidity to fund growth through 2023,” Mr. Mullins continued, “We

also continue to see improving consumer demand, while the benefits

of our product and channel diversification are helping to produce

record originations. We are now confident we will exceed the

high-end of our growth outlook for the fourth quarter, adding over

$110 million to the consumer loan portfolio.”

goeasy continues to pursue a long-term strategy

that includes expanding its product range, developing its channels

of distribution, broadening the geography in which it operates, and

improving the financial wellness of its customers, by helping them

improve their credit score and graduate back to prime. The company

remains well positioned to achieve its long-term growth objectives,

including a consumer loan portfolio of between $2.8 billion and

$3.0 billion by the end of 2023.

About goeasy

goeasy Ltd., a Canadian company, headquartered

in Mississauga, Ontario, provides non-prime leasing and

lending services through its easyhome, easyfinancial and LendCare

brands. Supported by more than 2,200 employees, the Company offers

a wide variety of financial products and services including

unsecured and secured instalment loans. Customers can transact

seamlessly through an omni-channel model that includes an online

and mobile platform, over 400 locations across Canada, and

point-of-sale financing offered in the retail, power sports,

automotive, home improvement and healthcare verticals, through more

than 4,000 merchants across Canada. Throughout the Company’s

history, it has acquired and organically served over 1 million

Canadians and originated over $7.2 billion in loans,

with one in three easyfinancial customers graduating to prime

credit and 60% increasing their credit score within 12 months of

borrowing.

Accredited by the Better Business Bureau,

goeasy is the proud recipient of several awards including

Waterstone Canada’s Most Admired Corporate Cultures, Glassdoor Top

CEO Award, Achievers Top 50 Most Engaged Workplaces in North

America, Greater Toronto Top Employers Award, the Digital Finance

Institute’s Canada’s Top 50 FinTech Companies, ranking on the TSX30

and placing on the Report on Business ranking of Canada’s Top

Growing Companies and has been certified as a Great

Place to Work®. The company is represented by a diverse group

of team members from over 75 nationalities who believe strongly in

giving back to the communities in which it operates. To date,

goeasy has raised and donated over $4.25 million to

support its long-standing partnerships with BGC

Canada, Habitat for Humanity and many other local

charities.

goeasy Ltd.’s. common shares are listed on the

TSX under the trading symbol “GSY”. goeasy is rated BB- with a

stable trend from S&P and Ba3 with a stable trend from Moody’s.

Visit www.goeasy.com.

For further information contact:

Bryan TrittVice President, Communications and Public Relations,

goeasy Ltd.(905) 272-2788

Farhan Ali KhanSenior Vice President and Chief Corporate

Development Officer, goeasy Ltd.(905) 272-2788

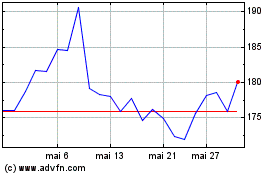

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024