Firm has doubled customer base and assets under

administration since 2020

Empower today announced that it has entered its tenth year of

operations with record earnings achieved through sustained business

growth and sales momentum. The firm’s full-year after-tax base

earnings1,2 in 2023 were $749 million (US) or $1 billion (CAD). The

company now administers more than $1.5 trillion in assets for 18.5

million individuals.

Empower, a leading provider of retirement and wealth

management services, released results as part of a broader

quarterly announcement by its parent company, Winnipeg-based

Great-West Lifeco (TSX: GWO-CA). For more information on Great-West

Lifeco’s fourth-quarter 2023 results, please see the release on the

firm’s website:

- Great-West Lifeco reports record base earnings in the fourth

quarter of 2023; announces 7% dividend increase

(greatwestlifeco.com)

Highlights from Empower’s reported results at the close of 2023

include:

Empower Workplace Solutions (EWS):

- Defined contribution plan assets under administration (AUA)1

increased 17% year over year to $1.5 trillion.

- Participants served: a record 17.9 million.

- Funded sales1 of $54 billion; pipeline1 across all segments at

almost $2 trillion.

Empower Personal Wealth™ (EPW):

- AUA1 was $72 billion, up 31% over the prior year as a result of

both strong net inflows and positive markets.

- Wealth clients are up 268%, or a Compound Annual Growth Rate

(CAGR)1 of 54%, over the three-year period.

With this combination of increased scale and growth, Empower’s

base earnings1 have grown by 400% in three years, and its base

return on equity1 in the U.S. has doubled in that same period.

“We delivered a strong quarter at Empower, with positive cash

flows and strong organic growth across both Workplace Solutions and

Personal Wealth,” said Empower President and CEO Edmund F. Murphy

III. “This continues an extended period of expansion that has been

our hallmark since Empower was created in 2014.”

Acquisitions + organic growth

Since its inception in 2014, Empower has grown through a

combination of strategic acquisitions and organic growth. Today,

Empower Workplace Solutions is the second-largest retirement

services provider in the U.S.3 In 2023, the firm expanded its

business to create a focused wealth management unit called Empower

Personal Wealth, which is composed of its legacy retail unit and

the Personal Capital business it acquired in 2020.

This combination has led to a doubling of assets and

participants since 2020, resulting in higher market share and

material gains in scale. Organic net flows1 in Empower’s defined

contribution business have averaged 4% annually as a percentage of

beginning AUA.1

“Through our investment, Empower has made a significant

commitment to the retirement services market, and our intent is to

build on that through continual service to employers, plan

participants and the advisors who serve them,” said Murphy.

Empower Personal Wealth’s offering, which combines a powerful

and unique digital experience with human advice, has driven annual

net inflows1 of 21% over the last three years (2021-2023). Today,

EPW employs over 1,000 advisors serving individual investors from

across the wealth spectrum, from the mass affluent to

high-net-worth individuals.

“Empower is extending its legacy of being a valued provider of

financial services to more people who want financial advice,

education and investment expertise,” said Murphy. “The last year

proved that we are positioned to grow this business and help our

clients seize opportunities to build the financial security they

want.”

Prudential integration

In 2022, Empower closed on its acquisition of the full-service

retirement business it acquired from Prudential. The integration of

that business is currently underway and slated for completion later

this year. “Retention levels of the clients, participants and

assets from the Prudential business remain high and exceed original

expectations,” said Murphy.

The Prudential integration program achieved pretax run-rate cost

synergies of $80 million at the end of 2023, with the remainder to

be assumed during the first half of 2024.

ABOUT EMPOWER

Recognized as the second-largest retirement services provider in

the U.S.3 by total participants, Empower administers approximately

$1.5 trillion in assets for more than 18.5 million individuals4

through the provision of retirement plans, advice, wealth

management and investments. Connect with us on empower.com,

Facebook, X, LinkedIn, TikTok and Instagram.

1 This is an unaudited non-GAAP financial measure. Refer to the

“Non-GAAP Financial Measures and Ratios” section in the Great-West

Lifeco 2023 Annual Management Discussion and Analysis (MD&A)

for additional details. Please visit Financial reports - Great-West

Lifeco Inc. (greatwestlifeco.com).

2 On January 1, 2024, Great-West Lifeco completed the sale of

substantially all of Putnam Investments to Franklin Resources,

Inc., operating as “Franklin Templeton.” Great-West Lifeco retained

a controlling interest in PanAgora Asset Management, a leading

quantitative asset manager, as well as certain other aspects of the

Putnam business. The 2023 results presented herein include these

results as Empower will assume these retained operations in

2024.

3 Pensions & Investments 2022 Defined Contribution Survey.

Ranking measured by total number of participants as of September

2022.

4 As of December 31, 2023. Information refers to all retirement

business of Empower Annuity Insurance Company of America (EAICA)

and its subsidiaries, including Empower Retirement, LLC; Empower

Life & Annuity Insurance Company of New York (ELAINY); and

Empower Annuity Insurance Company (EAIC), marketed under the

Empower brand. EAICA’s consolidated total assets under

administration (AUA) were $1,544.5B. AUA is a non-GAAP measure and

does not reflect the financial stability or strength of a company.

EAICA’s statutory assets total $72.1B and liabilities total $68.3B.

ELAINY’s statutory assets total $7.2B and liabilities total $6.9B.

EAIC’s statutory assets total $92.0B and liabilities total

$91.0B.

On August 1, 2022, Empower announced that it is changing the

names of various companies within its corporate group to align the

names with the Empower brand. For more information regarding the

name changes, please visit empower.com/name-change.

________________________________________ Empower refers to the

products and services offered by Empower Annuity Insurance Company

of America and its subsidiaries. “EMPOWER” and all associated logos

and product names are trademarks of Empower Annuity Insurance

Company of America.

Advisory services are provided for a fee by Empower Advisory

Group, LLC (EAG). EAG is a registered investment adviser with the

Securities and Exchange Commission (SEC) and subsidiary of Empower

Annuity Insurance Company of America. Registration does not imply a

certain level of skill or training. Investing involves risk. Past

performance is not indicative of future returns. You may lose

money. All visuals are illustrative only. Actors are not EAG

clients.

On April 1, 2022, Empower Annuity Insurance Company of America,

an affiliate of Empower Retirement, LLC (Empower) acquired the

retirement services business of Prudential Financial, Inc.

(Prudential). EAICA acquired Prudential’s retirement services

businesses with both a share purchase and a reinsurance

transaction. EAICA acquired the shares of Empower Annuity Insurance

Company (formerly Prudential Retirement Insurance and Annuity

Company), and business written by The Prudential Insurance Company

of America was reinsured by EAICA and Empower Life & Annuity

Insurance Company of America of New York (for New York business).

Following an initial transition period, EAICA will become the sole

administrator of this business. Empower refers to the products and

services offered by EAICA and its subsidiaries, including Empower

Retirement, LLC. Empower is not affiliated with Prudential or its

affiliates.

©2024 Empower Annuity Insurance Company of America. All rights

reserved. RO-3394746-0224

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240216445702/en/

Stephen Gawlik - Stephen.Gawlik@empower.com Alex Goss -

agoss@stantonprm.com

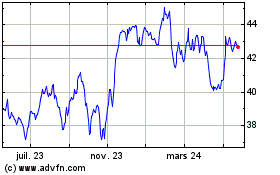

Great West Lifeco (TSX:GWO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

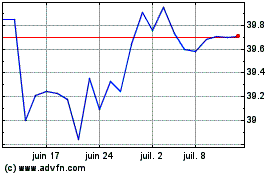

Great West Lifeco (TSX:GWO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024