Hudbay Minerals Inc. (“Hudbay”) (TSX, NYSE: HBM) is pleased to

announce that it has closed its previously announced court-approved

plan of arrangement with Copper Mountain Mining Corporation

(“Copper Mountain”), pursuant to which Hudbay has acquired all of

the issued and outstanding common shares of Copper Mountain

effective as of today’s date (the “Transaction”). Copper Mountain

is now a wholly-owned subsidiary of Hudbay and, in accordance with

the terms of the Transaction, former Copper Mountain shareholders

received 0.381 of a Hudbay share for each Copper Mountain share

previously held.

The Transaction creates a premier

Americas-focused copper mining company that is well-positioned to

deliver sustainable cash flows from an operating portfolio of three

long-life mines, as well as compelling organic growth from a

world-class pipeline of copper expansion and development projects.

All assets in the combined portfolio are located in the tier-one

mining-friendly jurisdictions of Canada, Peru and the United

States. The combined company represents the third largest copper

producer in Canada based on 2023 estimated copper productioni.

Peter Kukielski, Hudbay’s President and Chief

Executive Officer, commented, “We look forward to the formal

integration of Copper Mountain into our complementary portfolio of

operating assets. By applying our technical expertise, we expect to

unlock significant annual operating efficiencies and synergies at

the mine to drive further value for shareholders. This transaction

creates a larger, more resilient operating platform that enhances

our copper exposure, accelerates our deleveraging efforts, and

positions us to more efficiently allocate capital to prudently

advance our enviable organic growth pipeline.”

Leadership Additions

In connection with the closing of the

Transaction, Hudbay has appointed Jeane Hull and Paula Rogers to

its board of directors.

Jeane Hull has over 35 years of operational

leadership and engineering experience, most notably holding the

positions of Executive Vice President and Chief Technical Officer

of Peabody Energy Corporation and Chief Operating Officer for

Kennecott Utah Copper Mine, a subsidiary of Rio Tinto plc.

Paula Rogers has over 25 years of experience

working for Canadian-based international public companies in the

areas of corporate governance, treasury, mergers and acquisitions,

financial reporting and tax. Ms. Rogers has been an officer of

several public companies including Vice-President, Treasurer of

Goldcorp Inc. and Treasurer of Wheaton River Minerals Ltd.

The experience, skills and perspectives of each

of the new directors will complement the composition of Hudbay’s

board and provide strengthened stewardship for the combined

company.

Hudbay has also further bolstered the strength

of its management team with the addition of Letitia Wong who will

lead integration and Richard Klue as Vice President, Engineering

Studies, in addition to benefiting from other members of the Copper

Mountain team that are continuing with the combined company. As

previously planned, Gil Clausen, Copper Mountain’s President and

Chief Executive Officer, has retired and will transition to an

advisory role for the combined company for the next year.

Strengthened Position as a Result of the

Transaction

The combination of Hudbay and Copper Mountain is

on-strategy with strong industrial logic that is expected to

deliver compelling benefits, as highlighted below:

- Scale – a

larger-scale platform with three long-life operating mines with

exploration and expansion upside, three large-scale development

projects and one of the largest mineral resource bases among

intermediate copper producers;

- Diversification –

a geographically balanced portfolio in tier-one mining

jurisdictions with approximately 55% of net asset value (“NAV”)ii

estimated to be from North American assets and 45% of NAV estimated

to be from South American assets;

- Copper-Focused – a

copper-focused portfolio with expected 2023 copper production of

more than 150,000 tonnes in the second quartile position on the

copper cost curveiii, complemented by meaningful gold

production;

- Efficiencies – an

estimated US$30 millioniv per year of operating efficiencies and

corporate synergies, including approximately US$20 million per year

from operating cost reductions through the application of Hudbay’s

operating efficiency practices to the Copper Mountain mine;

- Deleveraging –

well-positioned for accelerated deleveraging in the near-term from

increased diversification of cash flows and enhanced exposure to

rising copper prices;

- Capital Allocation

– an ability to maximize value from a larger organic

growth pipeline by more efficiently allocating capital to projects

that yield the highest risk-adjusted returns; the combined

company’s greater cash flow generation and strong balance sheet

will enhance the ability to advance brownfield expansion

opportunities and prudently develop Hudbay’s Copper World project

in Arizona, which is expected to deliver meaningful growth to the

combined company; and

- Valuation Re-rating

Potential – the strategic and financial benefits from the

Transaction is expected to position the combined company for a

valuation re-rating.

Forward-Looking Information

This release contains certain “forward looking

statements” and certain “forward-looking information” as defined

under applicable Canadian and U.S. securities laws. Forward-looking

statements and information can generally be identified by the use

of forward-looking terminology such as “may”, “will”, “should”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”,

“continue”, “plans” or similar terminology. The forward-looking

information contained herein is provided for the purpose of

assisting readers in understanding management’s current

expectations and plans relating to the future. Readers are

cautioned that such information may not be appropriate for other

purposes.

Forward-looking statements relate to future

events or future performance and reflect Hudbay’s expectations or

beliefs regarding future events. Forward-looking statements

include, but are not limited to, statements with respect to the

strengths, characteristics and potential of the Transaction; the

impact of the Transaction on shareholders of Hudbay and other

stakeholders and other anticipated benefits of the Transaction. By

their very nature, forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Forward-looking information is based on

management of the parties’ reasonable assumptions, estimates,

expectations, analyses and opinions, which are based on such

management’s experience and perception of trends, current

conditions and expected developments, and other factors that

management believes are relevant and reasonable in the

circumstances, but which may prove to be incorrect. Such factors,

among other things, include: business integration risks;

fluctuations in general macroeconomic conditions; fluctuations in

securities markets; fluctuations in spot and forward prices of

copper or certain other commodities; change in national and local

governments, legislation, taxation, controls, regulations and

political or economic developments; risks and hazards associated

with the business of mineral exploration, development and mining

(including environmental hazards, industrial accidents, unusual or

unexpected formations pressures, cave-ins and flooding);

discrepancies between actual and estimated metallurgical

recoveries; inability to obtain adequate insurance to cover risks

and hazards; the presence of laws and regulations that may impose

restrictions on mining; employee relations; relationships with and

claims by local communities and Indigenous populations;

availability of increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development (including the risks of obtaining necessary licenses,

permits and approvals from government authorities); and title to

properties.

Hudbay undertakes no obligation to update

forward-looking information except as required by applicable law.

Such forward-looking information represents management’s best

judgment based on the information currently available. No

forward-looking statement can be guaranteed and actual future

results may vary materially. Accordingly, readers are advised not

to place undue reliance on forward-looking statements or

information.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused

mining company with three long-life operations and a world-class

pipeline of copper growth projects in tier-one mining-friendly

jurisdictions of Canada, Peru and the United States.

Hudbay’s operating portfolio includes the

Constancia mine in Cusco (Peru), the Snow Lake operations in

Manitoba (Canada) and the Copper Mountain mine in British Columbia

(Canada). Copper is the primary metal produced by the company,

which is complemented by meaningful gold production. Hudbay’s

growth pipeline includes the Copper World project in Arizona, the

Mason project in Nevada (United States), the Llaguen project in La

Libertad (Peru) and several expansion and exploration opportunities

near its existing operations.

The value Hudbay creates and the impact it has

is embodied in its purpose statement: “We care about our people,

our communities and our planet. Hudbay provides the metals the

world needs. We work sustainably, transform lives and create better

futures for communities.” Hudbay’s mission is to create sustainable

value and strong returns by leveraging its core strengths in

community relations, focused exploration, mine development and

efficient operations. Further information about Hudbay can be found

on www.hudbay.com.

For further information, please

contact:

Candace BrûléVice President, Investor

Relations(416) 814-4387candace.brule@hudbay.com

____________________________________i Sourced from company

filings and Wood Mackenzie research. ii NAV is based on analyst

consensus estimates. iii Based on Wood Mackenzie’s 2023 by-product

C1 copper cost curve (Q4 2022 dataset).iv Pre-tax annual synergies

achieved over the course of 3 years.

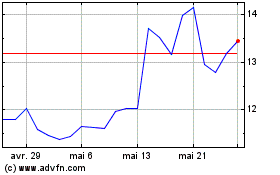

Hudbay Minerals (TSX:HBM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Hudbay Minerals (TSX:HBM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024