Further to the announcement on November 5, 2020 relating to the

possible offer for RSA by Intact Financial Corporation (TSX: IFC)

(“Intact” or the “Company”) and Tryg A/S (together with Intact, the

“Consortium”) (the “Transaction”), Intact announced today that it

has entered into an agreement with a group of underwriters, led by

CIBC Capital Markets and Barclays Capital Canada Inc., pursuant to

which the underwriters have agreed to purchase, on a bought deal

basis, 9,272,000 subscription receipts of the Company (the

“Subscription Receipts”) at a price of $134.50 per Subscription

Receipt for gross proceeds of $1.25 billion (the “Offering”). The

underwriters intend to arrange for substituted purchasers for the

Subscription Receipts. The Subscription Receipts will be offered by

way of private placement to accredited investors and other exempt

purchasers in all provinces and territories of Canada, The

Subscription Receipts will be subject to a four month hold period

under applicable securities laws in Canada.

Earlier today, Intact announced that it had entered into

subscription agreements with institutional investors for the

aggregate issuance of 23.8 million subscription receipts at a price

of $134.50 per subscription receipt for gross proceeds of $3.2

billion (the “Cornerstone Equity Financing”). The Offering and

Cornerstone Equity Financing together provide Intact with all of

the equity financing it would require to fund its share of the

purchase price for RSA.

The Transaction would generate significant value through loss

ratio and expense ratio improvements across the operations of

Intact. The acquisition of RSA’s Canadian operations is expected to

drive approximately 75% of the value creation, with UK &

International operations accounting for approximately 20% and

specialty lines accounting for approximately 5%. Over $250 million

of pre-tax annual run rate synergies are expected within 36

months, before any risk selection improvements. Intact intends to

apply its expertise in digital, data and AI platforms, pricing and

risk selection, claims management, and investment and capital

management to RSA’s platform to drive profitability.

Should a firm offer be made for RSA, which is subject to,

amongst other things, due diligence and reaching definitive

agreements with various stakeholders, Intact estimates the proposed

Transaction to complete during the second quarter of 2021.

No firm offer has been made, nor can there be any certainty that

an offer will be made, for RSA under the UK Takeover Code.

Each Subscription Receipt will entitle the holder to receive one

common share of Intact upon closing of the Transaction. Completion

of the Offering is conditional upon the Consortium announcing a

firm offer for RSA on or prior to closing. Additional information

on the proposed transaction is available at Intact’s website at

https://www.intactfc.com/English/investors/. The completion of the

Offering is also subject to approval of the Toronto Stock Exchange

and other customary closing conditions. The offering is expected to

close on December 3, 2020

The Subscription Receipts and the common shares of Intact have

not been, and will not be, registered under the U.S. Securities

Act, or the securities laws of any state of the United States and

may not be offered, sold or delivered, directly or indirectly,

within the United States, except in certain transactions exempt

from, or not subject to, the registration requirements of the U.S.

Securities Act and applicable state securities laws. This press

release does not constitute an offer to sell or a solicitation of

an offer to buy any of these subscription receipts within the

United States.

About Intact

Intact Financial Corporation is the largest

provider of property and casualty (P&C) insurance in Canada and

a leading provider of specialty insurance in North America, with

over $11 billion in total annual premiums. The Company has

approximately 16,000 employees who serve more than five million

personal, business and public sector clients through offices in

Canada and the U.S.

In Canada, Intact distributes insurance under

the Intact Insurance brand through a wide network of brokers,

including its wholly-owned subsidiary BrokerLink, and directly to

consumers through belairdirect. Frank Cowan Company, a leading MGA,

distributes public entity insurance programs including risk and

claims management services in Canada.

In the U.S., Intact Insurance Specialty

Solutions provides a range of specialty insurance products and

services through independent agencies, regional and national

brokers, wholesalers and managing general agencies. Products are

underwritten by the insurance company subsidiaries of Intact

Insurance Group USA, LLC.

For further information please contact:

|

Intact Media InquiriesJennifer

BeaudrySenior Consultant, External Communications1 514 282-1914

ext. 87375jennifer.beaudry@intact.net |

Intact Investor InquiriesRyan

PentonDirector, Investor Relations1 416 341-1464 ext.

45112ryan.penton@intact.net |

Forward-looking statements

Certain of the statements included in this press

release about the Offering and the Cornerstone Equity Financing,

the proposed acquisition of RSA (the “Acquisition”) or any other

future events or developments constitute forward-looking

statements. The words “may”, “will”, “would”, “should”, “could”,

“expects”, “plans”, “intends”, “trends”, “indications”,

“anticipates”, “believes”, “estimates”, “predicts”, “likely”,

“potential” or the negative or other variations of these words or

other similar or comparable words or phrases, are intended to

identify forward-looking statements. Unless otherwise indicated,

all forward-looking statements in this press release are made as of

November 12, 2020, and are subject to change after that date.

Forward-looking statements are based on estimates

and assumptions made by management based on management’s experience

and perception of historical trends, current conditions and

expected future developments, as well as other factors that

management believes are appropriate in the circumstances. In

addition to other estimates and assumptions which may be identified

herein, estimates and assumptions have been made regarding, among

other things, the receipt of all requisite approvals in a timely

manner and on terms acceptable to the Company, the realization of

the expected strategic, financial and other benefits of the

Acquisition, and economic and political environments and industry

conditions. However, the completion of the Acquisition is expected

to be subject to customary closing conditions, termination rights

and other risks and uncertainties, including, without limitation,

regulatory approvals, and there can be no assurance that the

Acquisition will be completed. There can also be no assurance that

if the Acquisition is completed, the strategic and financial

benefits expected to result from the Acquisition will be

realized. Many factors could cause the Company’s

actual results, financial performance or condition, or achievements

to differ materially from those expressed or implied by the

forward-looking statements herein, including, without limitation,

the following factors:

- expected regulatory processes and

outcomes in connection with the Company’s business;

- the Company’s ability to implement its

strategy or operate its business as management currently

expects;

- the Company’s ability to accurately

assess the risks associated with the insurance policies it

writes;

- unfavourable capital market

developments or other factors, including the impact of the COVID-19

pandemic and related economic conditions, which may affect the

Company’s investments, floating rate securities and funding

obligations under its pension plans;

- the cyclical nature of the P&C

insurance industry;

- management’s ability to accurately

predict future claims frequency and severity, including in the high

net worth and personal auto lines of business;

- government regulations designed to

protect policyholders and creditors rather than investors;

- litigation and regulatory actions,

including with respect to the COVID-19 pandemic;

- periodic negative publicity regarding

the insurance industry;

- intense competition;

- the Company’s reliance on brokers and

third parties to sell its products to clients and provide services

to the Company and the impact of COVID-19 and related economic

conditions on such brokers and third parties;

- the Company’s ability to successfully

pursue its acquisition strategy;

- the Company’s ability to execute its

business strategy;

- the uncertainty of obtaining in a

timely manner, or at all, the regulatory approvals required to

complete the Acquisition, the issuance of the subscription receipts

and the issuance of the common shares issuable pursuant to the

subscription agreements;

- unfavourable capital markets

developments or other factors that may adversely affect the

Company’s ability to finance the Acquisition;

- the Company’s ability to improve its

combined ratio, retain business and achieve synergies and maintain

market position arising from successful integration plans relating

to the Acquisition, as well as management's estimates and

expectations in relation to future economic and business conditions

and other factors in relation to the Acquisition and resulting

impact on growth and accretion in various financial metrics;

- its ability to otherwise complete the

integration of the business acquired within anticipated time

periods and at expected cost levels;

- the Company’s dependence on key

employees and its ability to attract and retain key employees in

connection with the Acquisition;

- the Company’s ability to achieve

synergies arising from successful integration plans relating to

acquisitions generally;

- the Company’s profitability and

ability to improve its combined ratio in the United States;

- the Company’s ability to retain and

attract new business in connection with the Acquisition;

- the Company’s participation in the

Facility Association (a mandatory pooling arrangement among all

industry participants) and similar mandated risk-sharing

pools;

- terrorist attacks and ensuing

events;

- the occurrence and frequency of

catastrophe events, including a major earthquake;

- catastrophe losses caused by severe

weather and other weather-related losses, as well as the impact of

climate change;

- the occurrence of and response to

public health crises including epidemics, pandemics or outbreaks of

new infectious diseases, including most recently, the coronavirus

(COVID-19) pandemic and ensuing events;

- the Company’s ability to maintain its

financial strength and issuer credit ratings;

- the Company’s access to debt and

equity financing;

- the Company's ability to compete for

large commercial business;

- the Company’s ability to alleviate

risk through reinsurance;

- the Company’s ability to successfully

manage credit risk (including credit risk related to the financial

health of reinsurers);

- the Company’s ability to contain fraud

and/or abuse;

- the Company’s reliance on information

technology and telecommunications systems and potential failure of

or disruption to those systems, including in the context of the

impact on the ability of our workforce to perform necessary

business functions remotely, as well as in the context of evolving

cybersecurity risk;

- the impact of developments in

technology and use of data on the Company’s products and

distribution;

- changes in laws or regulations,

including those adopted in response to COVID-19 that would, for

example, require insurers to cover business interruption claims

irrespective of terms after policies have been issued, and could

result in an unexpected increase in the number of claims and have a

material adverse impact on the Company’s results;

- COVID-19 related coverage issues and

claims, including certain class actions and related defence costs

could negatively impact our claims reserves;

- general economic, financial and

political conditions;

- the Company’s dependence on the

results of operations of its subsidiaries and the ability of the

Company’s subsidiaries to pay dividends;

- the volatility of the stock market and

other factors affecting the trading prices of the Company’s

securities, including in the context of the COVID-19 crisis;

- the Company’s ability to hedge

exposures to fluctuations in foreign exchange rates;

- future sales of a substantial number

of the Company’s common shares; and

- changes in

applicable tax laws, tax treaties or tax regulations or the

interpretation or enforcement thereof.

All of the forward-looking statements included in

this press release are qualified by these cautionary statements and

those made in the section entitled Risk Management (Sections 22-27)

of our MD&A for the year ended December 31, 2019, the section

entitled Risk Management (sections 17-18) of our MD&A for the

quarter ended September 30, 2020 and elsewhere in this press

release. These factors are not intended to represent a complete

list of the factors that could affect the Company. These factors

should, however, be considered carefully. Although the

forward-looking statements are based upon what management believes

to be reasonable assumptions, the Company cannot assure investors

that actual results will be consistent with these forward-looking

statements. Investors should not rely on forward-looking statements

to make decisions, and investors should ensure the preceding

information is carefully considered when reviewing forward-looking

statements contained herein. The Company and management have no

intention and undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Disclaimer

This press release does not constitute or form part

of any offer for sale or solicitation of any offer to buy or

subscribe for any securities nor shall it or any part of it form

the basis of or be relied on in connection with, or act as any

inducement to enter into, any contract or commitment

whatsoever.

The information contained in this press release

concerning the Company does not purport to be all-inclusive or to

contain all the information that an investor may desire to have in

evaluating whether or not to make an investment in the Company. The

information is qualified entirely by reference to the Company’s

publicly disclosed information and the cautionary note regarding

forward-looking statements included in this press release.

No representation or warranty, express or implied,

is made or given by or on behalf of the Company or any of its the

directors, officers or employees as to the accuracy, completeness

or fairness of the information or opinions contained in this press

release and no responsibility or liability is accepted by any

person for such information or opinions. In furnishing this press

release, the Company does not undertake or agree to any obligation

to provide investors with access to any additional information or

to update this press release or to correct any inaccuracies in, or

omissions from, this press release that may become apparent. The

information and opinions contained in this press release are

provided as at the date of this press release. The contents of this

press release are not to be construed as legal, financial or tax

advice. Each investor should contact his, her or its own legal

adviser, independent financial adviser or tax adviser for legal,

financial or tax advice.

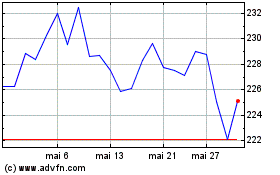

Intact Financial (TSX:IFC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Intact Financial (TSX:IFC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025