(TSX: NFI, OTC: NFYEF, TSX: NFI.DB) NFI Group Inc.

(“

NFI” or the “

Company”), a

leading independent bus and coach manufacturer and a leader in

electric mass mobility solutions, today announced that, as part of

its previously-announced comprehensive refinancing plan, the

Company has entered into an investment agreement (the

“

Investment Agreement”) with Coliseum Capital

Management, LLC, as manager of certain funds and accounts

(collectively, “

Coliseum”), current holder of

12.4% of NFI’s issued and outstanding common shares (the

“

Shares”). Under the terms of the Investment

Agreement, Coliseum has agreed to subscribe for and purchase from

the Company an aggregate of 24,363,702 Shares, on a private

placement basis, at a subscription price of $6.1567 (approximately

C$8.251) per Share (the “

Subscription Price”), for

aggregate gross proceeds to NFI of $150,000,000 (approximately

C$201,000,000) (the “

Private Placement”).

NFI intends to use the proceeds from the Private

Placement to repay outstanding indebtedness under NFI’s existing

credit facilities and for working capital and general corporate

purposes.

Pursuant to the Investment Agreement, Coliseum

is permitted to nominate a member to the board of directors of NFI

(the “Board”) for so long as Coliseum owns,

controls or directs at least 10% of the outstanding Shares. Adam

Gray, managing partner and co-founder of Coliseum, has served on

the Board since March 2012, and was re-elected to the Board at the

Company’s most recent shareholder meeting held on May 4, 2023.

Paul Soubry, President and Chief Executive

Officer, NFI, said, “Coliseum has been a longstanding supporter of

NFI, and we are thrilled that the firm has reinforced its

commitment to our financial recovery. This additional investment by

Coliseum, which builds upon our established long-term partnership,

will help us to execute our refinancing, solidify our leadership

position, and further capitalize upon the unprecedented demand for

our products. Adam has been a valuable resource to the Board and

management team for more than a decade; we are confident his

continued contributions will serve the Company well as we seek to

maximize value for all NFI stakeholders.”

Mr. Gray commented, “We are pleased to support

the Company as the cornerstone investor in its recapitalization,

providing NFI with the runway and flexibility required to allow

Paul and his management team to focus fully upon advancing NFI’s

mission and leadership position. As governments around the world

make record investments into public transit to achieve emission

reduction targets, NFI is well-positioned to leverage its deep

transport experience, unparalleled service, technology innovation

and customized manufacturing, to achieve financial

outperformance.”

The Investment Agreement entitles Coliseum to

pre-emptive rights to purchase additional securities in certain

circumstances to maintain its proportionate interest in the

Company. Coliseum has also agreed to certain disposition and

standstill restrictions, including a requirement to hold the Shares

it acquires through the Private Placement for a period of at least

one year and a restriction on acquisitions of additional NFI

securities (other than under its pre-emptive right) until the later

of May 31, 2024, or nine months after Coliseum no longer has a

representative on the Board. Coliseum will also be entitled to

customary registration rights (which would permit Coliseum to sell

its shares in a broad distribution to investors) pursuant to a

registration rights agreement to be entered into between the

parties on closing of the Private Placement.

In addition, pursuant to the terms of the

Investment Agreement, NFI, in its sole discretion, may choose to

complete an issuance of Shares (or subscription receipts each

convertible into one Share) to investors other than Coliseum, at a

price per security at least equal to the Subscription Price and for

gross proceeds to NFI of no more than $75,000,000 (an

“Alternative Offering”), prior to or concurrently

with closing of the Private Placement. In the event of an

Alternative Offering, the number of Shares to be purchased by

Coliseum will be reduced by an amount equal to the gross proceeds

received by NFI from such Alternative Offering (subject to a

maximum reduction of $50,000,000).

Following completion of the Private Placement,

Coliseum will hold 33,901,102 Shares (or 25,779,868 Shares if

$50,000,000 of gross proceeds are raised from an Alternative

Offering at the Subscription Price), representing approximately

33.39% (or 25.39% if $50,000,000 of gross proceeds are raised from

an Alternative Offering at the Subscription Price) of NFI’s issued

and outstanding Shares, on a post-closing basis.

Mr. Soubry concluded, “While the past three

years have been challenged by the COVID-19 pandemic, associated

supply chain disruption, and heightened inflation impacts, we

believe that the future is extremely bright at NFI. The revised

credit arrangements and this infusion of capital will solidify our

position as we work to deliver upon our record backlog and achieve

our near-term guidance and longer-term outlook.”

Closing of the Private Placement is subject to

customary conditions precedent and applicable regulatory approvals,

including (i) receipt of the requisite approvals by the holders of

Shares under applicable securities laws and the policies of the

Toronto Stock Exchange (“TSX”), and (ii) receipt

of requisite regulatory approvals, including under the Competition

Act (Canada) and the United States Hart-Scott-Rodino Antitrust

Improvements Act of 1976. Furthermore, completion of the Private

Placement is conditional upon the concurrent completion of the

previously announced amendments to NFI’s existing credit

facilities. If, among other things, NFI shareholders do not approve

the Private Placement, Coliseum will be entitled to a break fee of

1% of the maximum aggregate Subscription Price per month until

termination and be entitled, subject to applicable regulatory

restrictions, to acquire a certain number of Shares at the

Subscription Price and participate at a level up to 50% in future

equity offerings (at the applicable offering price) until May 31,

2024.

The Private Placement is expected to close on or

prior to June 30, 2023.

The Company intends to seek the requisite

shareholder approval for the Private Placement at a special meeting

of shareholders expected to be held in June 2023. A management

information circular containing details of the Private Placement

and voting instructions for shareholders will be mailed to

shareholders as soon as practicable. This information will also be

available on NFI’s website and filed on SEDAR at www.sedar.com.

Board Recommendation

The negotiation of the Private Placement was

supervised by and with the active involvement of the Board

(excluding Adam Gray), with the assistance of NFI’s legal and

financial advisors. The Private Placement resulted from a process

involving discussions with, and receipt of proposals from, multiple

potential investors. Following the evaluation of alternatives

available to the Company and extensive negotiations, the Board

(excluding Adam Gray) unanimously determined that the Private

Placement is in the best interests of NFI and recommends that the

shareholders of the Company, other than Coliseum, its affiliates,

and other interested parties (the “Minority

Shareholders”), vote in favour of the Private Placement at

the special meeting of shareholders to be held to approve the

Private Placement.

Regulatory Matters

Coliseum, through the funds and accounts that it

manages, owns, controls or directs greater than 10% of the

outstanding Shares. As such, the Private Placement constitutes a

“related party transaction” under Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”) and is subject to approval by the

Minority Shareholders in accordance with MI 61-101. NFI, however,

is relying on the exemption from the formal valuation requirement

of MI 61-101 contained in section 5.5(c) of MI 61-101 in respect of

the Private Placement as the Shares to be issued are being

distributed for cash consideration, neither the Company nor

Coliseum have knowledge of any material undisclosed information

concerning the Company, and the circular to be prepared for

shareholders in connection with the special meeting to approve the

Private Placement will include the requisite disclosure

contemplated by section 5.5(c) of MI 61-101.

Further details will be included in a material

change report to be filed by the Company. Such material change

report has not been filed 21 days before the entering into of the

Investment Agreement as the terms thereof were not finalized and

approved by all parties until immediately prior to the entering

into of such agreement.

Additional Information

A copy of the Investment Agreement will be filed

on the Company's profile on SEDAR at www.sedar.com. The above

description of the terms and conditions of the Investment Agreement

is qualified in its entirety by the full text of the Investment

Agreement. The management information circular will also be filed

on the Company’s profile on SEDAR at www.sedar.com.

BMO Capital Markets is acting as financial

advisor and private placement agent, Torys LLP is acting as legal

counsel to NFI and Norton Rose Fulbright Canada LLP is acting as

legal counsel to Coliseum in connection with the Private

Placement.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act”) and may not be offered or sold in the

United States or to, or for the account or benefit of, U.S. persons

absent registration or an applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

state securities laws.

Adjustment to May 10, 2023 Press

Release

NFI’s press release dated May 10, 2023,

announcing NFI’s comprehensive refinancing plan, had an error

within the covenant table under the “Anticipated Financial

Covenants Under the Amendments” heading. Under the columns with

Senior Secured Net Leverage Ratio and Total Net Leverage Ratio, the

covenant should have read <= (less than or equal to) instead of

the reported >= (greater than or equal to).

About NFI

Leveraging 450 years of combined experience, NFI

is leading the electrification of mass mobility around the world.

With zero-emission buses and coaches, infrastructure, and

technology, NFI meets today’s urban demands for scalable smart

mobility solutions. Together, NFI is enabling more livable cities

through connected, clean, and sustainable transportation.With 7,700

team members in ten countries, NFI is a leading global bus

manufacturer of mass mobility solutions under the brands New Flyer®

(heavy-duty transit buses), MCI® (motor coaches), Alexander Dennis

Limited (single and double-deck buses), Plaxton (motor coaches),

ARBOC® (low-floor cutaway and medium-duty buses), and NFI Parts™.

NFI currently offers the widest range of sustainable drive systems

available, including zero-emission electric (trolley, battery, and

fuel cell), natural gas, electric hybrid, and clean diesel. In

total, NFI supports its installed base of over 100,000 buses and

coaches around the world. NFI’s Shares trade on the TSX under the

symbol NFI and its convertible debentures (“Debentures”) trade on

the TSX under the symbol NFI.DB. News and information is available

at www.nfigroup.com, www.newflyer.com, www.mcicoach.com,

www.nfi.parts, www.alexander-dennis.com, www.arbocsv.com, and

www.carfaircomposites.com.

Forward-Looking Statements

This press release contains “forward-looking

information” and “forward-looking statements” within the meaning of

applicable Canadian securities laws, which reflect the expectations

of management regarding the Private Placement and the intended use

of proceeds thereof, the Company’s future growth, financial

performance, and liquidity and objectives and the Company’s

strategic initiatives, plans, business prospects and opportunities,

including the duration, impact of and recovery from the COVID-19

pandemic, supply chain disruptions and plans to address them, and

the Company's expectation of obtaining long-term credit

arrangements and sufficient liquidity. The words “believes”,

“views”, “anticipates”, “plans”, “expects”, “intends”, “projects”,

“forecasts”, “estimates”, “guidance”, “goals”, “objectives” and

“targets” and similar expressions of future events or conditional

verbs such as “may”, “will”, “should”, “could”, “would” are

intended to identify forward-looking statements. These

forward-looking statements reflect management’s current

expectations regarding future events (including the temporary

nature of the supply chain disruptions and operational challenges,

production improvement, labour supply shortages, the recovery of

the Company’s markets and the expected benefits to be obtained

through its “NFI Forward” initiatives) and the Company’s financial

and operating performance and speak only as of the date of this

press release. By their very nature, forward-looking statements

require management to make assumptions and involve significant

risks and uncertainties, should not be read as guarantees of future

events, performance or results, and give rise to the possibility

that management’s predictions, forecasts, projections, expectations

or conclusions will not prove to be accurate, that the assumptions

may not be correct and that the Company’s future growth, financial

condition, ability to generate sufficient cash flow and maintain

adequate liquidity, and complete the financing transactions in

accordance with the Company’s previously announced refinancing plan

(including the Private Placement), and the Company’s strategic

initiatives, objectives, plans, business prospects and

opportunities, including the Company’s plans and expectations

relating to the duration, impact of and recovery from the COVID-19

pandemic, supply chain disruptions, operational challenges, labour

supply shortages and inflationary pressures, will not occur or be

achieved. There can be no assurance that the Private Placement or

the other financing transactions would be completed.

A number of factors that may cause actual

results to differ materially from the results discussed in the

forward-looking statements include: the Company’s business,

operating results, financial condition and liquidity may be

materially adversely impacted by the ongoing COVID-19 pandemic and

related supply chain and operational challenges, inflationary

effects and labour supply challenges; the Company’s business,

operating results, financial condition and liquidity may be

materially adversely impacted by the ongoing Russian invasion of

Ukraine due to factors including but not limited to further supply

chain disruptions, inflationary pressures and tariffs on certain

raw materials and components; funding may not continue to be

available to the Company’s customers at current levels or at all;

the Company’s business is affected by economic factors and adverse

developments in economic conditions which could have an adverse

effect on the demand for the Company’s products and the results of

its operations; currency fluctuations could adversely affect the

Company’s financial results or competitive position; interest rates

could change substantially, materially impacting the Company’s

revenue and profitability; an active, liquid trading market for the

Shares and/or the Debentures may cease to exist, which may limit

the ability of security holders to trade Shares and/or Debentures;

the market price for the Shares and/or the Debentures may be

volatile; if securities or industry analysts do not publish

research or reports about the Company and its business, if they

adversely change their recommendations regarding the Shares or if

the Company’s results of operations do not meet their expectations,

the Share price and trading volume could decline, in addition, if

securities or industry analysts publish inaccurate or unfavorable

research about the Company or its business, the Share price and

trading volume of the Shares could decline; competition in the

industry and entrance of new competitors; current requirements

under U.S. “Buy America” regulations may change and/or become more

onerous or suppliers’ “Buy America” content may change; failure of

the Company to comply with the U.S. Disadvantaged Business

Enterprise (“DBE”) program requirements or the failure to have its

DBE goals approved by the U.S. FTA; absence of fixed term customer

contracts, exercise of options and customer suspension or

termination for convenience; local content bidding preferences in

the United States may create a competitive disadvantage;

requirements under Canadian content policies may change and/or

become more onerous; the Company’s business may be materially

impacted by climate change matters, including risks related to the

transition to a lower-carbon economy; operational risk resulting

from inadequate or failed internal processes, people and/or systems

or from external events, including fiduciary breaches, regulatory

compliance failures, legal disputes, business disruption,

pandemics, floods, technology failures, processing errors, business

integration, damage to physical assets, employee safety and

insurance coverage; international operations subject the Company to

additional risks and costs and may cause profitability to decline;

compliance with international trade regulations, tariffs and

duties; dependence on unique or limited sources of supply (such as

engines, components containing microprocessors or, in other cases,

for example, the supply of transmissions, batteries for

battery-electric buses, axles or structural steel tubing) resulting

in the Company’s raw materials and components not being readily

available from alternative sources of supply, being available only

in limited supply, or creating challenges where a particular

component may be specified by a customer, the Company’s products

have been engineered or designed with a component unique to one

supplier or a supplier may have limited or no supply of such raw

materials or components or sells such raw materials or components

to the Company on less than favorable commercial terms; the

Company’s vehicles and certain other products contain electrical

components, electronics, microprocessors control modules, and other

computer chips, for which there has been a surge in demand,

resulting in a worldwide supply shortage of such chips in the

transportation industry, and a shortage or disruption of the supply

of such microchips could materially disrupt the Company’s

operations and its ability to deliver products to customers;

dependence on supply of engines that comply with emission

regulations; a disruption, termination or alteration of the supply

of vehicle chassis or other critical components from third-party

suppliers could materially adversely affect the sales of certain of

the Company’s products; the Company’s profitability can be

adversely affected by increases in raw material and component

costs; the Company may incur material losses and costs as a result

of product warranty costs, recalls, failure to comply with motor

vehicle manufacturing regulations and standards and the remediation

of transit buses and motor coaches; production delays may result in

liquidated damages under the Company’s contracts with its

customers; catastrophic events, including those related to impacts

of climate change, may lead to production curtailments or

shutdowns; the Company may not be able to successfully renegotiate

collective bargaining agreements when they expire and may be

adversely affected by labour disruptions and shortages of labour;

the Company’s operations are subject to risks and hazards that may

result in monetary losses and liabilities not covered by insurance

or which exceed its insurance coverage; the Company may be

adversely affected by rising insurance costs; the Company may not

be able to maintain performance bonds or letters of credit required

by its contracts or obtain performance bonds and letters of credit

required for new contracts; the Company is subject to litigation in

the ordinary course of business and may incur material losses and

costs as a result of product liability and other claims; the

Company may have difficulty selling pre-owned coaches and realizing

expected resale values; the Company may incur costs in connection

with regulations relating to axle weight restrictions and vehicle

lengths; the Company may be subject to claims and liabilities under

environmental, health and safety laws; dependence on management

information systems and cyber security risks; the Company’s ability

to execute its strategy and conduct operations is dependent upon

its ability to attract, train and retain qualified personnel,

including its ability to retain and attract executives, senior

management and key employees; the Company may be exposed to

liabilities under applicable anti-corruption laws and any

determination that it violated these laws could have a material

adverse effect on its business; the Company’s risk management

policies and procedures may not be fully effective in achieving

their intended purposes; internal controls over financial

reporting, no matter how well designed, have inherent limitations;

there are inherent limitations to the effectiveness of any system

of disclosure controls and procedures, including the possibility of

human error and the circumvention or overriding of the controls and

procedures; ability to successfully execute strategic plans and

maintain profitability; development of competitive or disruptive

products, services or technology; development and testing of new

products or model variants; acquisition risk; reliance on

third-party manufacturers; third-party distribution/dealer

agreements; availability to the Company of future financing; the

Company may not be able to generate the necessary amount of cash to

service its existing debt, which may require the Company to

refinance its debt; the Company’s substantial consolidated

indebtedness could negatively impact the business; the restrictive

covenants in the Company’s credit facilities could impact the

Company’s business and affect its ability to pursue its business

strategies; in December 2022, the Board made the decision to

suspend the payment of dividends given credit agreement constraints

and to support the Company’s focus on improving its liquidity and

financial position and the resumption of dividends is not assured

or guaranteed; a significant amount of the Company’s cash may be

distributed, which may restrict potential growth; the Company is

dependent on its subsidiaries for all cash available for

distributions; the Company may not be able to make principal

payments on the Debentures; redemption by the Company of the

Debentures for Shares will result in dilution to holders of Shares;

Debentures may be redeemed by the Company prior to maturity; the

Company may not be able to repurchase the Debentures upon a change

of control as required by the trust indenture under which the

Debentures were issued (the “Indenture”); conversion of the

Debentures following certain transactions could lessen or eliminate

the value of the conversion privilege associated with the

Debentures; future sales or the possibility of future sales of a

substantial number of Shares or Debentures may impact the price of

the Shares and/or the Debentures and could result in dilution;

payments to holders of the Debentures are subordinated in right of

payment to existing and future Senior Indebtedness (as described

under the Indenture) and will depend on the financial health of the

Company and its creditworthiness; if the Company is required to

write down goodwill or other intangible assets, its financial

condition and operating results would be negatively affected; and

income and other tax risk resulting from the complexity of the

Company’s businesses and operations and income and other tax

interpretations, legislation and regulations pertaining to the

Company’s activities being subject to continual change.

Factors relating to the global COVID-19 pandemic

include: the magnitude and duration of the global, national and

regional economic and social disruption being caused as a result of

the pandemic; the impact of national, regional and local

governmental laws, regulations and “shelter in place” or similar

orders relating to the pandemic which may materially adversely

impact the Company’s ability to continue operations; partial or

complete closures of one, more or all of the Company’s facilities

and work locations or the reduction of production rates (including

due to government mandates and to protect the health and safety of

the Company’s employees or as a result of employees being unable to

come to work due to COVID-19 infections with respect to them or

their family members or having to isolate or quarantine as a result

of coming into contact with infected individuals); production rates

may be further decreased as a result of the pandemic; ongoing and

future supply delays and shortages of parts and components, and

shipping and freight delays, and disruption to or shortage of

labour supply as a result of the pandemic; the pandemic will likely

adversely affect operations of suppliers and customers, and reduce

and delay, for an unknown period, customers’ purchases of the

Company’s products and the supply of parts and components by

suppliers; the anticipated recovery of the Company’s markets in the

future may be delayed or increase in demand may be lower than

expected as a result of the continuing effects of the pandemic; the

Company’s ability to obtain access to additional capital if

required; and the Company’s financial performance and condition,

obligations, cash flow and liquidity and its ability to maintain

compliance with the covenants under its credit facilities. There

can be no assurance that the Company will be able to maintain

sufficient liquidity for an extended period, obtain long-term

credit arrangements, or access to additional capital or access to

government financial support or as to when production operations

will return to previous production rates. There is also no

assurance that governments will provide continued or adequate

stimulus funding during or after the pandemic for public transit

agencies to purchase transit vehicles or that public or private

demand for the Company’s vehicles will return to pre-pandemic

levels in the anticipated period of time. The Company cautions that

due to the dynamic, fluid and highly unpredictable nature of the

pandemic and its impact on global and local economies, supply

chains, businesses and individuals, it is impossible to predict the

severity of the impact on the Company’s business, operating

performance, financial condition and ability to generate sufficient

cash flow and maintain adequate liquidity and any material adverse

effects could very well be rapid, unexpected and may continue for

an extended and unknown period of time.

Factors relating to the Company’s financial

guidance and targets and its “NFI Forward” initiatives are

described in its most recently filed annual information form and

management’s discussion and analysis, which are available under the

Company’s profile on SEDAR.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that could

cause actions, events or results not to be as anticipated,

estimated or intended or to occur or be achieved at all. Specific

reference is made to “Risk Factors” in the Company’s Annual

Information Form for a discussion of the factors that may affect

forward-looking statements and information. Should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements and information.

The forward-looking statements and information contained herein are

made as of the date of this press release (or as otherwise

indicated) and, except as required by law, the Company does not

undertake to update any forward-looking statement or information,

whether written or oral, that may be made from time to time by the

Company or on its behalf. The Company provides no assurance that

forward-looking statements and information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers and investors should not place undue reliance on

forward-looking statements and information.

_____________________

1 USD/CAD exchange rate of $1.34 utilized for

share price and estimated gross proceeds calculations.

For media inquiries, please contact:

Melanie McCreath

P: 204.224.6496

Melanie.McCreath@nfigroup.com

For inquiries, please contact:

Stephen King

P: 204.224.6382

Stephen.King@nfigroup.com

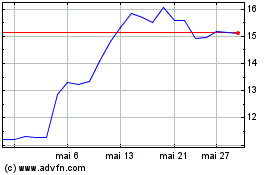

NFI (TSX:NFI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

NFI (TSX:NFI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025