Orezone Gold Corporation (TSX: ORE, OTCQX: ORZCF)

(“Orezone” or “Company”) reported its operational and financial

results for the fourth quarter and full-year ended December 31,

2023. The Company will host a conference call and

webcast on March 27, 2024 commencing at 8:00am PDT to discuss its

2023 results and 2024 guidance. Additional details are provided at

the end of this press release.

All dollar amounts are in USD unless otherwise

stated and abbreviation “M” means million.

Patrick Downey, President and CEO, commented “We

had strong end to the year with the production of 33,916 gold

ounces in the fourth quarter, allowing us to meet our full year

production and cost guidance metrics. In its first full year of

commercial production, the Bomboré mine was successful in producing

141,425 gold ounces, which helped the Company generate $80 million

in operating cashflow and $54 million in adjusted earnings, and pay

down $33.8 million in principal on its senior debt. We expect 2024

to be another profitable year even though guided gold production

will be modestly lower than 2023. We continue to advance

discussions with our senior lender for the financing of our Phase

II hard rock expansion which will pave the way for us to unlock

further value from our Bomboré mine. Additional announcements on

the Company’s financing plans are expected in the second quarter of

2024.”

2023 FOURTH QUARTER AND ANNUAL

HIGHLIGHTS

|

(All mine site figures on a 100% basis) |

|

Q4-2023 |

Q4-20222 |

2023 |

20222 |

|

|

Operating Performance |

|

|

|

|

|

|

Gold production |

oz |

33,916 |

22,258 |

141,425 |

27,831 |

|

|

Gold sales |

oz |

33,782 |

24,676 |

139,696 |

24,676 |

|

|

Average realized gold price |

$/oz |

1,986 |

1,760 |

1,940 |

1,760 |

|

|

Cash costs per gold ounce sold1 |

$/oz |

1,083 |

973 |

972 |

973 |

|

|

All-in sustaining costs1 (“AISC”) per gold ounce sold |

$/oz |

1,246 |

1,075 |

1,127 |

1,075 |

|

|

Financial Performance |

|

|

|

|

|

|

Revenue |

$000s |

67,580 |

43,431 |

271,491 |

43,431 |

|

|

Earnings from mine operations |

$000s |

16,108 |

16,661 |

97,150 |

16,661 |

|

|

Net income attributable to shareholders of Orezone1 |

$000s |

4,012 |

3,763 |

43,146 |

930 |

|

|

Net income per common share attributable to shareholders of

Orezone1 |

|

|

|

|

|

|

|

BasicDiluted |

$$ |

0.010.01 |

0.010.01 |

0.120.12 |

0.000.00 |

|

|

Adjusted EBITDA1 |

$000s |

26,702 |

15,297 |

120,036 |

3,965 |

|

|

Adjusted earnings (loss) attributable to shareholders of

Orezone1 |

$000s |

14,267 |

9,706 |

53,665 |

(1,349 |

) |

|

Adjusted earnings (loss) per share attributable to shareholders of

Orezone1 |

$000s |

0.04 |

0.03 |

0.15 |

(0.00 |

) |

|

Cash and Cash Flow Data |

|

|

|

|

|

|

Operating cash flow before changes in working capital |

$000s |

21,911 |

15,400 |

104,750 |

6,023 |

|

|

Operating cash flow |

$000s |

13,891 |

23,235 |

79,950 |

6,582 |

|

|

Free cash flow1 |

$000s |

682 |

8,943 |

36,172 |

(99,395 |

) |

|

Cash, end of period |

$000s |

19,483 |

9,158 |

19,483 |

9,158 |

|

1 Cash costs, AISC, Adjusted EBITDA, Adjusted

earnings, Adjusted earnings per share, and Free cash flow are

non-IFRS measures. See “Non-IFRS Measures” section below for

additional information.

2 The Bomboré mine poured first gold on

September 10, 2022 and entered into commercial production on

December 1, 2022, and produced gold for a partial quarter in

Q4-2022 as the mine did not process any significant quantity of ore

in October 2022 due to insufficient power as the power plant

underwent repairs.

Full Year 2023 Operational Highlights

(100% basis unless otherwise noted)

- Safety: The

Company continued with its strong safety performance in 2023 with

4.4 million hours worked without a lost-time injury. The Company

remains steadfast in promoting worker health through continuous

training and safety resources.

- Gold Production:

Delivered gold production of 141,425 ounces within the guidance

range of 140,000 to 155,000 ounces. Mill throughput was 5.75

million ore tonnes, ahead of nameplate capacity by 10.5%.

- All-in Sustaining

Costs: Achieved AISC per ounce sold of $1,127 per ounce

which is towards the lower-end of the Company’s revised guidance

range of $1,100 to $1,180 per ounce.

- Profitability and Adjusted

EBITDA: The Company reported net income of $43.1 million

and $0.12 per share (basic and diluted) after minority interest.

Adjusted EBITDA was $120.0 million, demonstrating the Bomboré

mine’s strong operating performance in its first full year of

commercial production.

- Cash flow: The

Company generated cash from operating activities of $104.8 million

before working capital changes, and $80.0 million after working

capital changes.

- Sustaining

capital: Sustaining capital totalled $14.0 million,

slightly below the guidance range of $15 to $16 million, as certain

capital projects carried over into 2024 for completion.

- Growth Capital:

- Grid Power: The

installation of the 132 kV transmission line, mine substation, and

switching station to connect Bomboré to Burkina Faso’s national

grid was completed in December 2023 and commissioned in January

2024 with input and guidance from SONABEL, Burkina Faso’s

state-owned electricity company. The line was successfully

energized in late January 2024 to commence delivery of lower-cost

grid power to site. Construction costs in 2023 totalled $18.2

million.

- Resettlement Action Plan

(“RAP”) – Phases II and III: The RAP will help relocate

communities occupying areas in the southern half of the Bomboré

mining permit. The Company significantly advanced construction of

the largest resettlement site (MV3) in 2023 with plans to relocate

households into MV3 in Q2-2024 in order to gain mining access to

the Siga pits in Q3-2024. During 2023, the Company incurred RAP

expenditures totalling $10.4 million.

- Phase II Hard Rock

Expansion Feasibility Study: On October 11, 2023, the

Company released the results of an updated independent feasibility

study for its proposed Phase II expansion (“2023 FS”). The 2023 FS

is based on the construction of a 4.4M tonnes per annum (“tpa”)

hard rock process plant to treat lower transition and fresh rock

ore and would operate alongside the existing Phase I oxide plant to

significantly increase overall gold production of the Bomboré

mine.

Q4-2023 Highlights (100% basis unless

otherwise noted)

- Gold production:

Gold production of 33,916 ounces, a 10% increase from Q3-2024 gold

production, driven by continued strong mill throughput and improved

head grades from greater ore release in the pits and lower effect

of historical artisanal depletion.

- AISC: AISC per

ounce sold was $1,246 per ounce, negatively impacted by higher

Burkina Faso royalty rates that came into effect in October

2023.

- Profitability and Adjusted

EBITDA: The Company reported net income of $4.0 million

and $0.01 per share (basic and diluted) after minority interest.

Adjusted EBITDA was $26.7 million.

- Cash flow: The

Company generated cash from operating activities of $21.9 million

before working capital changes, and $13.9 million after working

capital changes.

2023 Corporate Highlights and Subsequent

Events

- Consolidated cash of $19.5 million

at December 31, 2023, an increase of $10.3 million from December

31, 2022.

- Principal repayment of XOF 20.5

billion ($33.8 million) in 2023 on the Company’s senior loans with

Coris Bank International (“Coris Bank”).

- Two new director appointments: (a)

Matthew Quinlan was elected as a new director on June 15, 2023 as

an independent nominee of Resource Capital Fund VII L.P., replacing

Steve Axcell who did not stand for re-election; and (b) Sean Harvey

was appointed as a new member on January 11, 2024 after recently

retiring as Chair of Perseus Mining Limited.

2024 GUIDANCE FOR BOMBORÉ

MINE

|

Operating Guidance (100% basis) |

Unit |

2024 Guidance |

|

Gold production |

Au oz |

110,000 – 125,000 |

|

All-In Sustaining Costs1 |

$/oz Au sold |

$1,300 - $1,375 |

|

Sustaining capital |

$M |

$14 - $15 |

|

Growth capital (excluding Phase II Expansion) |

$M |

$16 - $17 |

|

Growth capital – Phase II Expansion |

$M |

no guidance yet |

- AISC is a non-IFRS measure. See

“Non-IFRS Measures” section below for additional information.

- Foreign exchange rates used to

forecast cost metrics include XOF/USD of 600 and CAD/USD of

1.30.

- Government royalties included in AISC

assume an average gold price of $2,000 per oz.

Gold production in 2024 is forecasted to range

between 110,000 to 125,000 gold ounces with quarterly production

expected to be higher in the first and last quarters of the year.

Mining will remain confined to the northern zone of the mining

permit until better grade oxide ore can be accessed in the southern

zone. Staged access to higher-grade southern pits will become

available as RAP Phases II and III progresses. The 2024 mine plan

anticipates the start of mining in the Siga pits in Q3-2024 after

families are relocated to their new homes at the MV3 resettlement

site currently under construction. Gold production will decline

from 2023 output levels as the prior year benefitted from the

processing of higher-grade stockpiles accumulated during the

construction phase and the sequencing of higher-grade pits in

earlier periods of the mine plan in the northern zone. Restrictions

in accessing all areas of the southern zone from the finalization

of the ongoing RAP construction will delay the mining of some

higher grade pits in this zone from 2024 into 2025.

AISC per ounce sold is estimated to fall within

the range of $1,300/oz to $1,375/oz for 2024. AISC per ounce is

expected to increase from 2023 due to a combination of lower

forecasted head grades and production, higher unit mining costs and

strip ratio as mining deepens and more transition material is

encountered, and higher royalty rates and assumed gold price,

partially offset by lower processing costs as the mine switches to

lower-cost grid power as the primary power source in early

2024.

Sustaining capital is expected to range between

$14M to $15M with $5M to $6M dedicated towards the tailings storage

facility expansion (stage 3 and stage 4 lifts). Other areas of

sustaining capital cover mine and mine infrastructure, process

plant improvements, security, and camp. Planned expenditures for

mining and mine infrastructure is budgeted at over $6.0M and

include the purchase of two new RC drill rigs and spares for grade

control (replacing more expensive contractor drills), construction

of a new explosives magazine (to reduce the frequency of explosives

deliveries and associated costs), southern extension of the main

haul road, and additional perimeter fencing to restrict public

access to new active mining areas.

Growth capital consists of two carryover

projects from 2023:

- Power connection to Burkina Faso’s

national grid ($1.0M)System commissioning of the newly installed

transmission line and substations with SONABEL.

- Resettlement Action Plan – Phases

II and III ($15M to $16M)RAP Phases II and III commenced in 2023

and will see the construction of over 2,200 private and public

structures in three new resettlement communities (MV3, MV2, and

BV2) to help relocate communities occupying areas in the southern

half of the Bomboré mining permit. For 2024, construction costs of

$10.0M to $10.5M are forecasted to carry out the completion of MV3

and for the start and expected completion of MV2. RAP costs of

$5.0M to $5.5M are estimated for compensation, consultants,

relocation allowances, and livelihood restoration programs.

The Phase II Hard Rock

Expansion

The Company is the early engineering stage of

the Phase II hard rock expansion as contemplated in the 2023 FS.

Currently, it is planned that this expansion will be fully financed

through operating cashflows and additional senior debt from Coris

Bank. Discussions with Coris Bank are ongoing.

The Company intends to provide 2024 guidance for

the Phase II hard rock expansion later this year once a binding

debt commitment and Board approval have been received.

Liquidity

The Company had cash of $19.5 million and a net

working capital deficiency of $30.5 million on December 31, 2023.

Significant amounts contributing to the deficiency in working

capital include $20.2 million in scheduled monthly repayments on

its senior debt, $8.0 million accrual to Genser Energy that is

under dispute, and $10.9 million in VAT receivable reclassified

from current to non-current due to the timing uncertainty of VAT

refunds in Burkina Faso.

The Company is currently negotiating for a

bridge loan with Coris Bank to strengthen the Company’s cash

position as it works towards gaining access to Siga East by Q3-2024

to mine better grade oxide ore. The Company expects loan closing

and first drawdown in April 2024.

BOMBORÉ GOLD MINE (100% BASIS) –

OPERATING HIGHLIGHTS

|

|

|

Q4-2023 |

Q3-20233 |

Q4-20222 |

2023 |

|

20222 |

|

|

Safety |

|

|

|

|

|

|

|

Lost-time injuries frequency rate (LTIFR) |

per 1M hours |

0.00 |

|

0.00 |

|

0.00 |

0.00 |

|

0.00 |

|

|

Personnel-hours worked |

000s hours |

1,301 |

|

1,128 |

|

958 |

4,394 |

|

4,276 |

|

|

Mining Physicals |

|

|

|

|

|

|

|

Ore tonnes mined |

tonnes |

2,883,006 |

|

2,231,360 |

|

1,526,949 |

9,247,175 |

|

4,818,474 |

|

|

Waste tonnes mined |

tonnes |

3,048,669 |

|

2,654,010 |

|

3,087,950 |

11,237,079 |

|

8,695,210 |

|

|

Total tonnes mined |

tonnes |

5,931,675 |

|

4,885,370 |

|

4,614,899 |

20,484,254 |

|

13,513,684 |

|

|

Strip ratio |

waste:ore |

1.1 |

|

1.2 |

|

2.0 |

1.2 |

|

1.8 |

|

|

Processing Physicals |

|

|

|

|

|

|

|

Ore tonnes milled |

tonnes |

1,449,769 |

|

1,453,541 |

|

806,875 |

5,749,163 |

|

1,019,465 |

|

|

Head grade milled |

Au g/t |

0.82 |

|

0.74 |

|

0.93 |

0.85 |

|

0.92 |

|

|

Recovery rate |

% |

88.9 |

|

88.9 |

|

91.9 |

90.4 |

|

91.9 |

|

|

Gold produced |

Oz |

33,916 |

|

30,726 |

|

22,258 |

141,425 |

|

27,831 |

|

|

Unit Cash Cost |

|

|

|

|

|

|

|

Mining cost per tonne |

$/tonne |

3.05 |

|

3.19 |

|

2.57 |

3.01 |

|

2.54 |

|

|

Mining cost per ore tonne processed |

$/tonne |

6.31 |

|

7.79 |

|

6.58 |

6.77 |

|

6.53 |

|

|

Processing cost |

$/tonne |

10.84 |

|

9.80 |

|

12.47 |

10.14 |

|

11.86 |

|

|

Site general and admin (“G&A”) cost |

$/tonne |

4.85 |

|

3.98 |

|

4.87 |

3.95 |

|

5.32 |

|

|

Cash cost per ore tonne processed |

$/tonne |

22.00 |

|

21.57 |

|

23.92 |

20.86 |

|

23.71 |

|

|

Cash Costs and AISC Details |

|

|

|

|

|

|

|

Mining cost (net of stockpile movements) |

$000s |

9,146 |

|

11,319 |

|

5,306 |

38,932 |

|

6,653 |

|

|

Processing cost |

$000s |

15,719 |

|

14,238 |

|

10,062 |

58,285 |

|

12,091 |

|

|

Site G&A cost |

$000s |

7,036 |

|

5,787 |

|

3,928 |

22,707 |

|

5,425 |

|

|

Refining and transport cost |

$000s |

141 |

|

66 |

|

92 |

519 |

|

92 |

|

|

Government royalty cost |

$000s |

5,163 |

|

3,503 |

|

2,608 |

17,508 |

|

2,608 |

|

|

Gold inventory movements |

$000s |

(606 |

) |

(1,303 |

) |

2,010 |

(2,190 |

) |

(2,863 |

) |

|

Cash costs1 on a sales

basis |

$000s |

36,599 |

|

33,610 |

|

24,006 |

135,761 |

|

24,006 |

|

|

Sustaining capital |

$000s |

3,558 |

|

2,606 |

|

1,550 |

14,002 |

|

1,550 |

|

|

Sustaining leases |

$000s |

73 |

|

41 |

|

- |

301 |

|

- |

|

|

Corporate G&A cost |

$000s |

1,874 |

|

1,837 |

|

959 |

7,325 |

|

959 |

|

|

All-In Sustaining Costs1

on a sales basis |

$000s |

42,104 |

|

38,094 |

|

26,515 |

157,389 |

|

26,515 |

|

|

Gold sold |

oz |

33,782 |

|

29,167 |

|

24,676 |

139,696 |

|

24,676 |

|

|

Cash costs per gold ounce

sold1 |

$/oz |

1,083 |

|

1,152 |

|

973 |

972 |

|

973 |

|

|

All-In Sustaining Costs per gold ounce

sold1 |

$/oz |

1,246 |

|

1,306 |

|

1,075 |

1,127 |

|

1,075 |

|

1 Non-IFRS measure. See “Non-IFRS Measures”

section for additional details.2 The Bomboré mine poured first gold

on September 1, 2022 and entered into commercial production on

December 1, 2022, and produced gold for a partial quarter in

Q4-2022 as the mine did not process any significant quantity of ore

in October 2022 due to insufficient power as the power plant

underwent repairs.3 For a more pertinent overview of the mine’s

operating performance in the current quarter, Q4-2023 operating

results have also been compared against those for Q3-2023.

Bomboré Production Results

Gold production in Q4-2023 was 33,916 ounces, an

increase of 52% from the 22,258 ounces produced in Q4-2022. The

increase in gold production is attributable to an 80% increase in

tonnes processed partially offset by a 12% decrease in head grades

and a 3% decline in process recoveries. Higher tonnes processed was

due to only a partial quarter of production in Q4-2022 while the

lower grades and recoveries are attributable to the processing of

high-grade stockpiles accumulated during construction and the

non-presence of transition ore in Q4-2022.

Gold production in Q4-2023 increased by 10% from

the 30,726 ounces produced in Q3-2023. The increase in gold

production is primarily attributable to an 11% increase in head

grades from mine sequencing and greater ore release as mining

volumes improved by 21% in Q4-2023, benefiting from the deployment

of a second mining contractor for the full quarter and the end of

the rainy season.

As mining deepens in certain pits, the quantity

of transition ore has started to increase. The presence of

transition ore results in slightly lower metallurgical recovery and

greater consumption of grinding power.

Bomboré Operating Costs

AISC per gold ounce sold in Q4-2023 was $1,246,

an increase of 16% from the $1,075 per ounce sold in Q4-2022. The

increase in AISC is attributable to higher royalty costs from the

new royalty rates that took effect in October 2023 and from a

higher realized selling price, and more sustaining capital due to

timing.

AISC per gold ounce sold in Q4-2023 decreased by

5% from the $1,306 per ounce sold in Q3-2023. The decrease in AISC

is explained primarily by higher gold sales and production as a

result of improved head grades.

Cash cost per ore tonne processed in Q4-2023 was

$22.00 per tonne, a decrease of 8% from the $23.92 per tonne in

Q4-2022. The higher unit cash cost in Q4-2022 was due to processing

and G&A costs being absorbed over fewer tonnes as the Bomboré

mine had not yet ramped up beyond nameplate capacity until after

declaring commercial production on December 1, 2022.

Cash cost per ore tonne processed in Q4-2023

increased by 2% from the $21.57 per tonne in Q3-2023. The higher

unit cash cost is attributable to greater reagent consumption to

treat more transition ore, higher security spending as the phased

deployment of additional security personnel was established for the

full quarter, and the recognition of a year-end inventory

adjustment partially offset by the benefit of a lower strip ratio

and unit mining cost for each ore tonne processed.

Bomboré Growth Capital

Projects

Grid Power Connection

The connection of Bomboré to Burkina Faso’s

national energy grid involved the installation of a 19-km 132kV

transmission line, switching station, and mine substation. The

construction of these facilities were completed in December 2023

and commissioning of this system began in January 2024 when SONABEL

personnel became available after the holiday period. The line was

successfully energized in late January 2024 to commence the

delivery of low-cost grid power to site. The Company estimates that

power generation costs will be reduced by more than 60% or over

$3.00/tonne in processing oxide ore when compared to the cost of

power generation using on-site diesel gensets.

RAP Phases II and III

RAP Phases II and III involve the construction

of three new resettlement communities (MV3, MV2, and BV2) in order

to relocate households currently residing within the southern half

of the Bomboré mining permit. The Company has sequenced MV3 as the

first community to construct in order to gain access to mining

areas that are currently contemplated in the 2024 mine plan. MV3 is

the largest of the resettlement communities and requires the

erection of over 1,200 private homes and public structures.

RAP construction started behind schedule as the

construction of MV3 was delayed for two months in 2023 as community

members conducted sacred ceremonies for the new resettlement

grounds. The Company has engaged several local contractors to

construct homes on distinct lots within the MV3 site. In addition,

the Company has recruited an owner’s team to assist with

procurement and construction activities to maintain schedule. The

Company is now forecasting completion of the MV3 resettlement site

including relocation of households in Q2-2024.

NON-IFRS MEASURES

The Company has included certain terms or

performance measures commonly used in the mining industry that is

not defined under IFRS, including “cash costs”, “AISC”, “EBITDA”,

“adjusted EBITDA”, “adjusted earnings”, “adjusted earnings per

share”, and “free cash flow”. Non-IFRS measures do not have any

standardized meaning prescribed under IFRS, and therefore, they may

not be comparable to similar measures presented by other companies.

The Company uses such measures to provide additional information

and they should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with IFRS. For a

complete description of how the Company calculates such measures

and reconciliation of certain measures to IFRS terms, refer to

“Non-IFRS Measures” in the Management’s Discussion and Analysis for

the year ended December 31, 2023 which is incorporated by reference

herein.

CONFERENCE CALL AND WEBCAST

The consolidated financial statements and

Management’s Discussion and Analysis are available at

www.orezone.com and on the Company’s profile on SEDAR+ at

www.sedarplus.ca. Orezone will host a conference call and audio

webcast to discuss 2023 year-end and fourth quarter results on

March 27, 2024 at 8:00am PT (11:00am ET).

| Webcast |

| Date: |

Wednesday,

March 27, 2024 |

| Time: |

8:00 am Pacific time (11:00 am Eastern time) |

| Please register for the webcast

here: Orezone Year-End Results and 2024

Guidance Webcast |

Conference CallToll-free in

U.S. and Canada: 1-800-715-9871International callers:

+646-307-1963Event ID: 3374829

QUALIFIED PERSONS

The scientific and technical information in this

news release was reviewed and approved by Dr. Pascal Marquis, Geo.,

Senior Vice President of Exploration and Mr. Rob Henderson, P. Eng,

Vice President of Technical Services, both of whom are Qualified

Persons as defined under NI 43-101 Standards of Disclosure for

Mineral Projects.

About Orezone Gold

Corporation

The Company is listed on the Toronto Stock

Exchange under the symbol “ORE” and trades on the OTCQX market

under the symbol “ORZCF”.

The Company is a West African gold producer

engaged in mining, developing, and exploring its 90%-owned flagship

Bomboré gold mine in Burkina Faso. The Bomboré mine achieved

commercial production on its Phase I oxide operations on December

1, 2022, and is now focussed on its staged Phase II hard rock

expansion that is expected to materially increase annual and

life-of-mine gold production from the processing of hard rock

mineral reserves. The Company published the results of an updated

feasibility study for the Phase II expansion in October 2023, and

is currently in advanced negotiations with its senior lender for

additional financing to fund the construction of this brownfield

expansion.

Patrick DowneyPresident and Chief Executive

Officer

Vanessa PickeringManager, Investor Relations

Tel: 1 778 945 8977 / Toll Free: 1 888 673

0663info@orezone.com / www.orezone.com

For further information please contact

Orezone at +1 (778) 945-8977 or visit the Company’s

website at

www.orezone.com.

The Toronto Stock Exchange neither approves nor

disapproves the information contained in this news release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain information

that constitutes “forward-looking information” within the meaning

of applicable Canadian Securities laws and “forward-looking

statements” within the meaning of applicable U.S. securities laws

(together, “forward-looking statements”). Forward-looking

statements are frequently characterized by words such as “plan”,

“expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”,

“potential”, “possible” and other similar words, or statements that

certain events or conditions “may”, “will”, “could”, or “should”

occur.

All forward-looking statements are subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking statements including, but not

limited to, terrorist or other violent attacks, the failure of

parties to contracts to honour contractual commitments, unexpected

changes in laws, rules or regulations, or their enforcement by

applicable authorities; social or labour unrest; changes in

commodity prices; unexpected failure or inadequacy of

infrastructure, the possibility of project cost overruns or

unanticipated costs and expenses, accidents and equipment

breakdowns, political risk, unanticipated changes in key management

personnel, the spread of diseases, epidemics and pandemics

diseases, market or business conditions, the failure of exploration

programs, including drilling programs, to deliver anticipated

results and the failure of ongoing and uncertainties relating to

the availability and costs of financing needed in the future, and

other factors described in the Company's most recent annual

information form and management’s discussion and analysis filed on

SEDAR+ on www.sedarplus.ca. Readers are cautioned not to place

undue reliance on forward-looking statements.

Forward-looking statements are based on the

applicable assumptions and factors management considers reasonable

as of the date hereof, based on the information available to

management at such time. These assumptions and factors include, but

are not limited to, assumptions and factors related to the

Company’s ability to carry on current and future operations,

including: development and exploration activities; the timing,

extent, duration and economic viability of such operations,

including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts,

studies and assessments; the Company’s ability to meet or achieve

estimates, projections and forecasts; the availability and cost of

inputs; the price and market for outputs, including gold; foreign

exchange rates; taxation levels; the timely receipt of necessary

approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and

political conditions; and other assumptions and factors generally

associated with the mining industry.

Although the forward-looking statements

contained in this press release are based upon what management of

the Company believes are reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this press release and are expressly

qualified in their entirety by this cautionary statement. Subject

to applicable securities laws, the Company does not assume any

obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this press release.

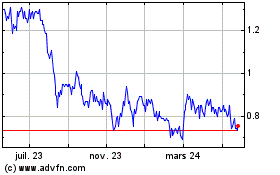

Orezone Gold (TSX:ORE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

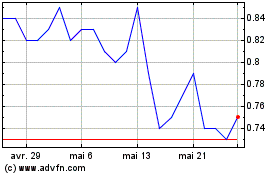

Orezone Gold (TSX:ORE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025