Third Quarter Highlights

- For the

three-month period ended September 30, 2023, PHX Energy generated

consolidated revenue of $169.4 million, the highest level of

quarterly revenue in the Corporation’s history. With the first

quarter of 2023 being the second highest level on record, the

2023-year is tracking to be a record year for PHX Energy.

Consolidated revenue in the 2023-quarter included $11.9 million of

motor rental revenue and $6.2 million of motor equipment and parts

sold.

-

Earnings from continuing operations, adjusted EBITDA(1) from

continuing operations, and adjusted EBITDA as a percentage of

consolidated revenue are the best level of quarterly results on

record. Earnings from continuing operations increased to $24.9

million ($0.50 per share), an increase of 85 percent over the third

quarter of 2022, and adjusted EBITDA from continuing operations

increased to $43.5 million ($0.88 per share), which represented 26

percent of consolidated revenue(1). Included in the 2023-quarter’s

adjusted EBITDA is $5 million in cash-settled share-based

compensation expense. Excluding cash-settled share-based

compensation expense, adjusted EBITDA from continuing operations(1)

in the third quarter of 2023 was $48.5 million, 29 percent of

consolidated revenue(1).

- PHX Energy’s US

division revenue in the third quarter of 2023 was $123.8 million,

12 percent higher than the third quarter of 2022 and represented 73

percent of consolidated revenue. This level of revenue is only 1

percent less than the record achieved by the US segment in the

fourth quarter of 2022.

- PHX Energy’s

Canadian division reported $44.4 million of quarterly revenue which

is the highest level since the fourth quarter of 2014.

- In light of the

continued strong demand for the Corporation’s premium technologies,

the Board approved to increase the 2023 capital expenditure budget

to $80 million from the previous $61.5 million. The Board also

approved a preliminary 2024 capital expenditure budget of $70

million.

- As at September

30, 2023, the Corporation had working capital(2) of $101.3 million

and net debt(2) of $3.5 million.

- In November

2023, the Corporation increased the borrowing amounts in the

syndicated facility from CAD $50 million to CAD $80 million and in

the US operating facility from USD $15 million to USD $20 million.

The Corporation also extended the maturity date of the syndicated

loan agreement to December 12, 2026. With the increased borrowing

amounts, the Corporation has approximately CAD $76.5 million and

USD $20 million available to be drawn from its credit facilities.

Currently, debt levels are low and this increase is intended to

provide PHX Energy flexibility to take advantage of lucrative

opportunities when presented in the future.

- In the 2023

three-month period, the Corporation generated excess cash flow(2)

of $25.7 million, after deducting capital expenditures of $18.8

million offset by proceeds on disposition of drilling and other

equipment of $11.7 million.

- During the

2023-quarter, PHX Energy continued to deliver additional returns to

shareholders through its previous and current NCIB, purchasing and

cancelling 2,442,700 common shares for $17.5 million. In the 2023

nine-month period, the Corporation purchased and cancelled

2,710,500 common shares for $19.1 million.

- For the

three-month period ended September 30, 2023, PHX Energy paid $7.6

million in dividends which is double the dividend amount paid in

the same 2022-period. On September 15, 2023, the Corporation

declared a dividend of $0.15 per share(3) or $7.3 million, paid on

October 16, 2023 to shareholders of record on September 30,

2023.

- With three

consecutive quarters of strong financial performance, the Board has

approved an increase to the quarterly dividend to $0.20 per share

effective for the dividend payable to shareholders of record at the

close of business on December 31, 2023. This is 33 percent higher

than the dividend declared on September 15, 2023 and the fifth

dividend increase since the dividend program was reinstated in

December 2020.

Financial Highlights

(Stated in thousands of dollars except per share

amounts, percentages and shares outstanding)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

|

2022 |

|

% Change |

2023 |

|

2022 |

|

% Change |

|

Operating Results – Continuing Operations |

(unaudited) |

(unaudited) |

|

(unaudited) |

(unaudited) |

|

|

Revenue |

169,368 |

|

142,418 |

|

19 |

491,008 |

|

377,987 |

|

30 |

|

|

Earnings |

24,921 |

|

13,475 |

|

85 |

65,447 |

|

23,978 |

|

173 |

|

|

Earnings per share – diluted |

0.50 |

|

0.27 |

|

85 |

1.28 |

|

0.48 |

|

167 |

|

|

Adjusted EBITDA (1) |

43,524 |

|

27,315 |

|

59 |

115,330 |

|

58,845 |

|

96 |

|

|

Adjusted EBITDA per share – diluted (1) |

0.88 |

|

0.53 |

|

66 |

2.17 |

|

1.16 |

|

87 |

|

|

Adjusted EBITDA as a percentage of revenue (1) |

26 |

% |

19 |

% |

|

23 |

% |

16 |

% |

|

|

Cash Flow – Continuing Operations |

|

|

|

|

|

|

|

Cash flows from (used in) operating activities |

33,628 |

|

21,627 |

|

55 |

59,969 |

|

29,367 |

|

104 |

|

|

Funds from operations (2) |

34,166 |

|

22,711 |

|

50 |

91,150 |

|

47,413 |

|

92 |

|

|

Funds from operations per share – diluted (3) |

0.69 |

|

0.44 |

|

57 |

1.71 |

|

0.94 |

|

82 |

|

|

Dividends paid per share (3) |

0.15 |

|

0.075 |

|

100 |

0.45 |

|

0.200 |

|

125 |

|

|

Dividends paid |

7,621 |

|

3,797 |

|

101 |

22,913 |

|

10,069 |

|

128 |

|

|

Capital expenditures |

18,804 |

|

18,631 |

|

1 |

49,458 |

|

52,051 |

|

(5 |

) |

|

Excess cash flow (2) |

25,724 |

|

9,121 |

|

182 |

70,465 |

|

6,843 |

|

n.m. |

|

|

Financial Position |

|

|

|

Sep 30 ‘23 |

|

Dec 31 ‘22 |

|

|

|

Working capital (2) |

|

|

|

101,271 |

|

94,339 |

|

7 |

|

|

Net debt (2) |

|

|

|

3,457 |

|

4,484 |

|

(23 |

) |

|

Shareholders’ equity |

|

|

|

201,043 |

|

176,878 |

|

14 |

|

|

Common shares outstanding |

|

|

|

48,508,438 |

|

50,896,175 |

|

(5 |

) |

n.m. – not meaningful

Outlook

In the third quarter we continued to build off

the strong momentum we have achieved thus far in 2023, setting

all-time records for quarterly revenue, earnings, adjusted EBITDA,

and adjusted EBITDA as a percentage of consolidated revenue.

- Despite the

lower US rig count impacting our directional drilling activity

levels, we have continued to produce strong results, maintain

market share and work for 12 of the top 15 US operators. The

primary drivers of these successes were our technology offering,

particularly our rotary steerable (“RSS”) capabilities, and

expansion of our Atlas rental and sales divisions. We foresee

further growth in both areas for the remainder of 2023 and into

2024 and are directing the new capital expenditures announced

towards these objectives.

- We recently

added a second brand of RSS technology to our US fleet. The iCruise

technology developed by Halliburton will compliment our fleet of

Schlumberger PowerDrive Orbit RSS technology and we are uniquely

positioned as the only provider in North America that can offer two

superior RSS options for owned systems. Additionally, our

Engineering group has commercialized supplementary technologies

that work in conjunction with our RSS and Velocity fleets that are

already in high demand. Both of these technology developments will

continue to differentiate us and further solidify our reputation as

a technology leader.

- In Canada, our

marketing team has successfully expanded our client base and our

results show improved activity and revenue in a slightly slower to

flat industry. We expect current activity levels to continue for

the remainder of the year and into the first quarter of 2024. We

may see some incremental increases in revenue per day as a result

of the commercialization of new value added technologies that

supplement the premium fleet and the planned fleet expansion.

- We will continue

to execute on the strategic objective aimed at expanding our Atlas

sales and rental businesses, which allows us to penetrate the

portion of the US market that is not accessible through our full

service offering. The rental division has shown promising growth

thus far in 2023 and we anticipate that it will continue to

generate a similar level of activity and revenue in the near-term.

Additionally, the revenue from the sale of Atlas motors aided the

US division in achieving strong revenue and profitability in the

quarter. Over the next few quarters, we will look to expand our

infrastructure to drive further growth and we plan to dedicate a

portion of the Atlas motors acquired through the 2024 capital

expenditures program to the rental business.

- During the

quarter, the Corporation continued to deliver on its commitment to

our Return of Capital Strategy (“ROCS”) and leveraged our renewed

NCIB to further reduce the shares outstanding. We have bought back

21 percent of our shares since 2017, including the purchase and

cancellation of 2.7 million shares through the NCIBs thus far in

2023. Through our dividend we have paid $44 million to shareholders

since reinstating the program in December 2020 and due to our

strong performance and outlook the Board has approved the fifth

increase to our dividend since its re-instatement. Effective for

the dividend payable to shareholders of record at the close of

business on December 31, 2023 a quarterly dividend to $0.20 per

share will be payable, a 33 percent increase over the current

dividend.

Global concerns around the possibility of a

recession in North America, issues surrounding the economy in China

plus regional conflicts in Europe and the Middle East provide a

backdrop of uncertainty for the near to mid-term. Despite this, we

are optimistic that our operating and financial performance will

remain strong through the deployment of our premium fleet of

technology, particularly RSS. We will remain diligent with

protecting our balance sheet and deliver on our commitment to

continue to reward our shareholders.

Michael Buker,

President November

7, 2023

Financial ResultsIn the third

quarter of 2023, PHX Energy generated an all-time record level of

revenue, earnings from continuing operations, adjusted EBITDA from

continuing operations, and adjusted EBITDA as a percentage of

consolidated revenue.

For the three-month period ended September 30,

2023, PHX Energy’s consolidated revenue was $169.4 million as

compared to $142.4 million in the same 2022-period, an increase of

19 percent. Despite the declining North American rig count, the

Corporation achieved higher revenue by leveraging the increased

capacity in its premium technology fleets and its strong reputation

and operations expertise. In addition, the Corporation’s strong

activity in Canada and growth in its US motor rental and sales

divisions contributed to the record revenue achieved in the

quarter.

In the 2023-quarter, the US rig count continued

to soften. PHX Energy’s US operating days decreased by 13 percent

from 4,653 in the third quarter of 2022 to 4,050 in the third

quarter of 2023. Despite the decline in activity, the Corporation’s

US division’s revenue grew by 12 percent to $123.8 million as

compared to $110.2 million in the same 2022-period. In the 2023

three-month period, RSS services accounted for a larger percentage

of the division’s activity and this growth was a primary driver of

the 17 percent improvement in the average revenue per day(3) for

directional drilling services quarter-over-quarter. Additionally,

the Corporation’s US motor rental and sales divisions generated

$11.6 million and $6.2 million of revenue, respectively in the

third quarter of 2023 (2022-quarter - $7.4 million and nil,

respectively). Revenue from PHX Energy’s US segment represented 73

percent of consolidated revenue in the 2023 three-month period

(2022-quarter – 77 percent).

In the 2023 three-month period, the

Corporation’s Canadian division generated revenue of $44.4 million,

which is the highest level since the fourth quarter of 2014 and is

43 percent greater than the $31 million generated in the same

2022-period. During the 2023-quarter, despite a

quarter-over-quarter decline in Canadian industry activity, PHX

Energy’s Canadian operating days grew by 16 percent to 3,301 days

from the 2,835 operating days in the comparable 2022-quarter.

Average revenue per day realized by the Canadian segment also

improved by 22 percent over the third quarter of 2022.

For the three-month period ended September 30,

2023, earnings from continuing operations was $24.9 million (2022 -

$13.5 million) and adjusted EBITDA from continuing operations(1)

was $43.5 million (2022 - $27.3 million), 26 percent of

consolidated revenue. These levels of earnings from continuing

operations, adjusted EBITDA from continuing operations, and

adjusted EBITDA as a percentage of consolidated revenue, are the

best quarterly results in the Corporation’s history. Higher margins

generated from PHX Energy’s premium technologies, Atlas motor

rentals, and the sale of Atlas motors and parts primarily drove

these record results. Included in the 2023 three-month period

adjusted EBITDA from continuing operations is cash-settled

share-based compensation expense of $5 million (2022 - $5.2

million). For the three-month period ended September 30, 2023,

excluding cash-settled share-based compensation expense, adjusted

EBITDA from continuing operations(1) is $48.5 million, 29 percent

of consolidated revenue (2022 - $32.5 million).

PHX Energy maintained its strong financial

position and had working capital(2) of $101.3 million and net

debt(2) of $3.5 million with available credit facilities in excess

of $61.5 million as at September 30, 2023.

In November 2023, the Corporation increased the

borrowing amounts in the syndicated facility from CAD $50 million

to CAD $80 million and in the US operating facility from USD $15

million to USD $20 million. The Corporation also extended the

maturity date of the syndicated loan agreement to December 12,

2026. With the increased borrowing amounts, the Corporation has

approximately CAD $76.5 million and USD $20 million available to be

drawn from its credit facilities.

Dividends and ROCSOn September

15, 2023, the Corporation declared a dividend of $0.15 per share

payable to shareholders of record at the close of business on

September 30, 2023. An aggregate of $7.3 million was paid on

October 16, 2023. This is 50 percent higher than the dividend of

$0.10 per share declared in the 2022-quarter.

In November 2023, the Board approved an increase

to the quarterly dividend to $0.20 per share effective for the

dividend payable to shareholders of record at the close of business

on December 31, 2023. This is 33 percent higher than the dividend

declared on September 15, 2023 and the fifth dividend increase

since the dividend program was reinstated in December 2020.

The Corporation remains committed to enhancing

shareholder returns through its Return of Capital Strategy (“ROCS”)

that includes multiple options including the dividend program and

the Normal Course Issuer Bid (“NCIB”).

(Stated in thousands of dollars)

|

|

|

Nine-month period ended September 30, 2023 |

|

Excess cash flow |

|

70,465 |

|

| 70% of excess cash flow |

|

49,326 |

|

|

|

|

|

| Deduct: |

|

|

|

Repurchase of shares under the NCIB |

|

(19,102 |

) |

|

Dividends paid to shareholders |

|

(22,913 |

) |

|

Remaining distributable balance under ROCS(2) |

|

7,311 |

|

Normal Course Issuer Bid During

the third quarter of 2023, the TSX approved the renewal of PHX

Energy’s NCIB to purchase for cancellation, from time-to-time, up

to a maximum of 3,552,810 common shares, representing 10 percent of

the Corporation’s public float of Common Shares as at August 2,

2023. The NCIB commenced on August 16, 2023 and will terminate on

August 15, 2024. Purchases of common shares are to be made on the

open market through the facilities of the TSX and through

alternative trading systems. The price which PHX Energy is to pay

for any common shares purchased is to be at the prevailing market

price on the TSX or alternate trading systems at the time of such

purchase.

Pursuant to the previous and current NCIB,

2,442,700 common shares were purchased by the Corporation for $17.5

million and cancelled in the third quarter of 2023. In the 2023

nine-month period, PHX Energy purchased and cancelled 2,710,500

common shares for $19.1 million.

Capital SpendingIn the third

quarter of 2023, the Corporation spent $18.8 million in capital

expenditures, of which $12.5 million was spent on growing the

Corporation’s fleet of drilling equipment, $2.8 million was spent

to replace retired assets, and $3.5 million was spent to replace

equipment lost downhole during drilling operations. With proceeds

on disposition of drilling and other equipment of $11.7 million,

the Corporation’s net capital expenditures(2) for the 2023-quarter

were $7.1 million. Capital expenditures in the 2023-quarter were

primarily directed towards Atlas High Performance motors (“Atlas”),

Velocity Real-Time systems (“Velocity”), and RSS. PHX Energy funded

capital spending primarily using proceeds on disposition of

drilling equipment, cash flows from operating activities, and its

credit facilities when required.

(Stated in thousands of dollars)

|

|

Three-month period ended September 30, 2023 |

Nine-month period ended September 30, 2023 |

|

Growth capital expenditures |

12,471 |

|

27,356 |

|

| Maintenance capital

expenditures from asset retirements |

2,825 |

|

11,543 |

|

|

Maintenance capital expenditures from downhole equipment

losses |

3,508 |

|

10,559 |

|

|

|

18,804 |

|

49,458 |

|

| Deduct: |

|

|

|

Proceeds on disposition of drilling equipment |

(11,682 |

) |

(32,689 |

) |

|

Net capital expenditures(2) |

7,122 |

|

16,769 |

|

In light of the continued strong demand for the

Corporation’s premium technologies, the approved capital

expenditure budget for the 2023-year, excluding proceeds on

disposition of drilling equipment, was increased to $80 million

from the previous $61.5 million. The increase of $18.5 million in

the 2023 capital expenditure budget will be directed mainly towards

growing and maintaining PHX Energy’s RSS and Atlas motor fleets. Of

the total expenditures, $45 million is expected to be allocated to

growth capital and the remaining $35 million is expected to be

allocated towards maintenance of the existing fleet of drilling and

other equipment and replacement of equipment lost downhole during

drilling operations. The maintenance capital amount could

increase throughout the year should there be more downhole

equipment losses than forecasted. These increases would likely be

funded by proceeds on disposition of drilling equipment.

As at September 30, 2023, the Corporation has

capital commitments to purchase drilling and other equipment for

$33.8 million, $20.3 million of which is growth capital and

includes $19.4 million for performance drilling motors and $0.9

million for other equipment. Equipment on order as at September 30,

2023 is expected to be delivered within 2023 and the first quarter

of 2024.

With the outlook that the Corporation’s

2023-momenteum will continue into the upcoming year and that the

declining rig counts in North America will level off, the Board has

approved a preliminary 2024 capital expenditure program of $70

million, of which $42 million is anticipated to be spent on growth.

The growth capital expenditures are expected to be allocated

towards: building larger fleets of recently commercialized

supplementary technologies that create value added capabilities

within the premium fleet and are already in high demand; additional

motor capacity to grow the Atlas rental division; and add required

Velocity systems, RSS and Atlas motors to continue to meet demand

for full service operations. The remaining $28 million is

anticipated to be spent on maintenance of the fleet of drilling and

other equipment and replacement of equipment lost downhole during

drilling operations.

The Corporation currently possesses

approximately 734 Atlas motors, comprised of various configurations

including its 5.13", 5.25", 5.76", 6.63", 7.12", 7.25", 8" and 9"

Atlas motors, and 118 Velocity systems. The Corporation also

possesses the largest independent RSS fleet in North America with

54 RSS tools and the only fleet currently comprised of both the

PowerDrive Orbit and iCruise systems.

Sale and Licensed Use of Atlas

Motors On May 3, 2023, PHX Energy entered into a sales

agreement for the sale and licensed use of its Atlas High

Performance Drilling Motors. PHX Energy will be providing a fleet

of Atlas motors to a purchaser in the US market. Subsequently on

July 27, 2023, PHX Energy agreed upon the sale and licensed use of

its Atlas motors to an existing international client. Under these

agreements, the purchasers must exclusively use components

manufactured by the Corporation for the maintenance of their fleets

of Atlas motors. As of September 30, 2023, $10.1 million of motors

and parts were sold. PHX Energy anticipates ongoing orders for

parts and the purchasers could potentially place subsequent orders

for additional Atlas motors late in 2023 and through the upcoming

year.

Non-GAAP and Other Financial

Measures

Throughout this document, PHX Energy uses

certain measures to analyze financial performance, financial

position, and cash flow. These Non-GAAP and other specified

financial measures do not have standardized meanings prescribed

under Canadian generally accepted accounting principles (“GAAP”)

and include Non-GAAP Financial Measures and Ratios, Capital

Management Measures and Supplementary Financial Measures

(collectively referred to as “Non-GAAP and Other Financial

Measures”). These non-GAAP and other specified financial measures

include, but are not limited to, adjusted EBITDA, adjusted EBITDA

per share, adjusted EBITDA excluding cash-settled share-based

compensation expense, adjusted EBITDA as a percentage of revenue,

gross profit as a percentage of revenue excluding depreciation and

amortization, selling, general and administrative (“SG&A”)

costs excluding share-based compensation as a percentage of

revenue, funds from operations, funds from operations per share,

excess cash flow, net capital expenditures, net debt, working

capital, and remaining distributable balance under ROCS. Management

believes that these measures provide supplemental financial

information that is useful in the evaluation of the Corporation’s

operations and are commonly used by other oil and natural gas

service companies. Investors should be cautioned, however, that

these measures should not be construed as alternatives to measures

determined in accordance with GAAP as an indicator of PHX Energy’s

performance. The Corporation’s method of calculating these measures

may differ from that of other organizations, and accordingly, such

measures may not be comparable. Please refer to the “Non-GAAP and

Other Financial Measures” section of this MD&A for applicable

definitions, rationale for use, method of calculation and

reconciliations where applicable.

Footnotes throughout this document

reference:

(1) Non-GAAP

financial measure or ratio that does not have any standardized

meaning under IFRS and therefore may not be comparable to similar

measures presented by other entities. Refer to Non-GAAP and Other

Financial Measures section of this document.(2) Capital management

measure that does not have any standardized meaning under IFRS and

therefore may not be comparable to similar measures presented by

other entities. Refer to Non-GAAP and Other Financial Measures

section of this document.(3) Supplementary financial measure that

does not have any standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other entities.

Refer to Non-GAAP and Other Financial Measures section of this

document

Revenue The Corporation

generates revenue primarily through the provision of directional

drilling services which includes providing equipment, personnel,

and operational support for drilling a well. Additionally, the

Corporation generates revenue through the rental and sale of

drilling motors and associated parts, particularly Atlas.

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

2022 |

% Change |

2023 |

2022 |

% Change |

|

Directional drilling services |

151,241 |

134,725 |

12 |

448,302 |

358,244 |

25 |

|

Motor rental |

11,919 |

7,693 |

55 |

32,588 |

19,743 |

65 |

|

Sale of motor equipment and parts |

6,208 |

- |

n.m. |

10,118 |

- |

n.m. |

|

Total revenue |

169,368 |

142,418 |

19 |

491,008 |

377,987 |

30 |

n.m. – not meaningful

In the third quarter of 2023, PHX Energy

generated its highest level of quarterly revenue on record,

surpassing the previous records set in the first quarter of 2023.

For the three-month period ended September 30, 2023, the

Corporation’s consolidated revenue was $169.4 million, a 19 percent

increase compared to the $142.4 million in the third quarter of

2022. For the nine-month period ended September 30, 2023, the

Corporation generated consolidated revenue of $491 million, an

increase of 30 percent as compared to the $378 million generated in

the same 2022-period.

Average consolidated revenue per day(3)

increased 13 percent to $20,343 in the 2023 three-month period from

$18,008 in the same 2022-period and in the 2023 nine-month period

increased 17 percent to $20,457 from $17,421 in the same

2022-period. In both 2023-periods, PHX Energy increased capacity

and utilization in its fleet of premium technologies, particularly

additional RSS systems that were acquired in the fourth quarter of

2022, and this, along with the cumulative impact of previous

pricing increases to mitigate the effects of inflationary costs,

greatly contributed to the stronger average consolidated revenue

per day(3) realized in both periods. The favorable impact of the

strong US dollar also supported the increases in average

consolidated revenue per day.

The US industry rig count continued to soften in

the third quarter of 2023, averaging 632 horizontal and directional

rigs operating per day, which is a 14 percent decrease from the

average of 733 rigs in the third quarter of 2022 and 10 percent

lower compared to the average of 700 rigs in the second quarter of

2023. In Canada, the average rig count for the 2023 three-month

period decreased 6 percent to 188 rigs from 199 rigs in the third

quarter of 2022 (Source: Baker Hughes, North American Rotary Rig

Count, Jan 2000 – Current,

https://rigcount.bakerhughes.com/na-rig-count). In comparison, the

Corporation’s consolidated operating days slightly decreased by 2

percent to 7,435 days in the third quarter of 2023 compared to

7,578 days in the same 2022-quarter. For the nine-month period

ended September 30, 2023, consolidated operating days increased by

5 percent to 21,915 from 20,859 days in the corresponding

2022-period.

Throughout 2023, the Corporation continued to

increase capacity in its Atlas motor fleet and as a result, in the

2023 three and nine-month periods, revenue generated from PHX

Energy’s motor rental division grew by 55 percent and 65 percent,

respectively. Motor rental revenue increased to $11.9 million in

the 2023 three-month period from $7.7 million in the same

2022-period and increased to $32.6 million in the 2023 nine-month

period from $19.7 million in the same 2022-period. PHX Energy

remains focused on marketing Atlas technology as a stand-alone

product line. With additional Atlas motors on order, the

Corporation expects this business line to continue to grow in

future periods.

For the three and nine-month periods ended

September 30, 2023, revenue of $6.2 million and $10.1 million,

respectively, were generated from the sale of Atlas motors and

parts under PHX Energy’s two existing sales agreements. As the

Corporation continues to support its customers’ owned fleet of

Atlas motors, a steady stream of revenue is expected to continue

for this business line.

Operating Costs and

Expenses

(Stated in thousands of dollars except

percentages)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

|

2022 |

|

% Change |

2023 |

|

2022 |

|

% Change |

|

Direct costs |

125,138 |

|

111,734 |

|

12 |

376,996 |

|

304,200 |

|

24 |

|

|

Depreciation & amortization drilling and other equipment

(included in direct costs) |

9,867 |

|

8,143 |

|

21 |

28,805 |

|

23,243 |

|

24 |

|

|

Depreciation & amortization right-of-use asset (included in

direct costs) |

822 |

|

745 |

|

10 |

2,057 |

|

2,430 |

|

(15 |

) |

|

Gross profit as a percentage of revenue excluding depreciation

& amortization(1) |

32 |

% |

28 |

% |

|

30 |

% |

26 |

% |

|

Direct costs are comprised of field and shop

expenses, costs of motors and parts sold, and include depreciation

and amortization of the Corporation’s equipment and right-of-use

assets. For the three-month period ended September 30, 2023, direct

costs increased by 12 percent to $125.1 million from $111.7 million

in the 2022-period. For the 2023 nine-month period, direct costs

increased by 24 percent to $377 million from $304.2 million in the

same 2022-period.

In both 2023-periods, higher direct costs are

partly attributable to greater servicing costs and equipment rental

expenses associated with increased RSS activity. Growth in Atlas

motor rental activity also resulted in higher motor repairs. In

addition, there were greater depreciation and amortization expenses

on drilling and other equipment in both 2023-periods due to the

volume of fixed assets acquired as part of PHX Energy’s 2023

capital expenditure program. The Corporation’s depreciation and

amortization on drilling and other equipment increased by 21

percent and 24 percent, respectively, in the 2023 three and

nine-month periods. Additionally, overall costs related to

personnel, repair parts, and equipment rentals increased partly as

a result of inflation.

In the 2023 three and nine-month periods, gross

profit as a percentage of revenue excluding depreciation and

amortization improved to 32 percent and 30 percent, respectively,

compared to 28 percent and 26 percent in the corresponding

2022-periods. Greater profitability in both periods was largely

driven by the higher margins from the Corporation’s premium

technologies as well as increased profits from PHX Energy’s growing

Atlas motor rental and sales divisions. In addition, the

Corporation remained diligent in executing various strategies to

gain cost efficiencies and mitigate the impact of higher costs

caused by inflation and this continued to have a positive impact on

the Corporation’s margins.

(Stated in thousands of dollars except

percentages)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

|

2022 |

|

% Change |

2023 |

|

2022 |

|

% Change |

|

Selling, general and administrative (“SG&A”) costs |

19,833 |

|

15,589 |

|

27 |

|

50,911 |

|

49,536 |

|

3 |

|

|

Cash-settled share-based compensation (included in SG&A

costs) |

4,969 |

|

5,178 |

|

(4 |

) |

8,899 |

|

17,630 |

|

(50 |

) |

|

Equity-settled share-based compensation (included in SG&A

costs) |

144 |

|

133 |

|

8 |

|

431 |

|

393 |

|

10 |

|

|

SG&A costs excluding share-based compensation as a percentage

of revenue(1) |

9 |

% |

7 |

% |

|

8 |

% |

8 |

% |

|

For the three-month period ended September 30,

2023, SG&A costs were $19.8 million, an increase of 27 percent

as compared to $15.6 million in the corresponding 2022-period. In

the 2023 nine-month period, SG&A costs were $50.9 million, an

increase of 3 percent as compared to $49.5 million in the

corresponding 2022-period. Higher SG&A costs in both 2023

periods were primarily due to greater costs associated with

increasing revenue and activity and rising personnel-related

costs.

Cash-settled share-based compensation relates to

the Corporation’s retention awards and are measured at fair value.

For the three and nine-month periods ended September 30, 2023, the

related compensation expense recognized by PHX Energy was $5

million (2022 - $5.2 million) and $8.9 million (2022 - $17.6

million), respectively. Changes in cash-settled share-based

compensation expense in the 2023-periods were mainly driven by

fluctuations in the Corporation’s share price, the number of awards

granted in the period, and changes in the estimated payout

multiplier for performance awards. There were 2,135,283 retention

awards outstanding as at September 30, 2023 (2022 – 3,293,538).

Excluding share-based compensation, SG&A costs as a percentage

of revenue in the 2023 three and nine-month periods were 9 percent

and 8 percent, respectively, as compared to 7 percent and 8 percent

in the corresponding 2022 periods.

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

2022 |

% Change |

2023 |

2022 |

% Change |

|

Research and development expense |

1,246 |

909 |

37 |

3,817 |

2,539 |

50 |

PHX Energy’s research and development

(“R&D”) expenditures for the three and nine-month periods ended

September 30, 2023, were $1.2 million (2022 - $0.9 million) and

$3.8 million (2022 - $2.5 million), respectively. Higher R&D

expenditures in both 2023 periods were mainly due to increased

prototype expenses and greater personnel-related costs. The

Corporation remained focused on supporting new and ongoing

initiatives to continuously improve the reliability of equipment

and reduce costs of operations. In addition, new technologies are

continually being developed, particularly projects that are

critical in sustaining operational growth and create value added

capabilities within the premium fleet to further profitability.

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

2022 |

% Change |

2023 |

2022 |

% Change |

| Finance

expense |

598 |

499 |

20 |

1,974 |

873 |

126 |

| Finance

expense lease liabilities |

554 |

498 |

11 |

1,695 |

1,507 |

12 |

Finance expenses mainly relate to interest

charges on the Corporation’s credit facilities. For the three and

nine-month periods ended September 30, 2023, finance expenses

increased to $0.6 million (2022 - $0.5 million) and $2 million

(2022 - $0.9 million), respectively, mainly due to increased

drawings on the credit facilities to fund PHX Energy’s capital

spending. In both 2023 periods, higher finance expenses also

resulted from rising variable interest rates on the Corporation’s

operating and syndicated facilities.

Finance expense lease liabilities relate to

interest expense incurred on lease liabilities. For the three and

nine-month periods ended September 30, 2023, finance expense lease

liabilities increased by 11 percent and 12 percent respectively,

primarily due to new premise leases entered in the fourth quarter

of 2022 and first quarter of 2023 for a new facility in Midland,

Texas and additional head office space in Calgary, Alberta.

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Net gain on disposition of drilling equipment |

8,354 |

|

4,157 |

|

23,903 |

|

10,799 |

|

|

Foreign exchange gains (losses) |

(347 |

) |

(205 |

) |

574 |

|

(281 |

) |

|

Recovery of (provision for) bad debts |

1,106 |

|

2 |

|

(117 |

) |

2 |

|

|

Other |

- |

|

- |

|

- |

|

512 |

|

|

Other income |

9,113 |

|

3,954 |

|

24,360 |

|

11,032 |

|

For the three and nine-month periods ended

September 30, 2023, the Corporation recognized other income of $9.1

million and $24.4 million, respectively (2022 - $4 million and $11

million, respectively). In both periods, other income was mainly

comprised of net gain on disposition of drilling equipment.

Net gain on disposition of drilling equipment is

comprised of gains on disposition of drilling equipment and

proceeds from insurance programs. The recognized gain is net of

losses, which typically result from asset retirements that were

made before the end of the equipment’s useful life. In both 2023

periods, a larger percentage of PHX Energy’s activity involved

utilizing premium technologies, particularly RSS. As a result, more

instances of high dollar valued downhole equipment losses occurred

as compared to the corresponding 2022 periods which resulted in

higher proceeds and gains. The Corporation will use capital

expenditure funds, including the proceeds from disposition of

drilling equipment, to replace this equipment and these amounts

will be added to the capital expenditures for the remainder of 2023

and for 2024.

For the three-month period ended September 30,

2023, the Corporation recognized foreign exchange losses of $0.3

million (2022 - $0.2 million) which primarily resulted from the

revaluation of CAD-denominated intercompany receivables in the US.

In the 2023 nine-month period, foreign exchange gains of $0.6

million (2022 - $0.3 million foreign exchange losses) was primarily

due to the settlement of a USD-denominated receivable as a result

of a reorganization in Luxembourg.

In the third quarter of 2023, PHX Energy

reversed the amounts previously provisioned for bad debt in the

amount of $1.1 million (2022 – $2 thousand recovery) which relates

mainly to one client.

(Stated in thousands of dollars except

percentages)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

| Provision

for income taxes |

6,191 |

|

3,667 |

|

14,529 |

|

6,384 |

|

|

Effective tax rates(3) |

20 |

% |

21 |

% |

18 |

% |

21 |

% |

For the three-month period ended September 30,

2023, the Corporation reported income tax provision of $6.2 million

(2022 - $3.7 million), of which, $5.6 million was current and $0.6

million was deferred. For the nine-month period ended September 30,

2023, PHX Energy recognized provision for income taxes of $14.5

million (2022 - $6.4 million), of which, $13.6 million was current

and $0.9 million was deferred. Increased current taxes in both 2023

periods mainly resulted from higher taxable income in the US. PHX

Energy’s effective tax rate was 20 percent in the 2023-quarter and

18 percent in the 2023 nine-month period which is lower than the

combined US federal and state corporate income tax rate of 21

percent and the combined Canadian federal and provincial corporate

income tax rate of 23 percent, due to the recognition of previously

unrecognized deferred tax assets that were applied to income for

tax purposes in Canada.

Segmented Information

The Corporation reports three operating segments

on a geographical basis throughout the Gulf Coast, Northeast and

Rocky Mountain regions of the US; throughout the Western Canadian

Sedimentary Basin, and internationally in Albania

United States

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

2022 |

% Change |

2023 |

2022 |

% Change |

|

Directional drilling services |

105,980 |

102,806 |

3 |

333,123 |

278,440 |

20 |

| Motor rental |

11,636 |

7,422 |

57 |

31,204 |

18,950 |

65 |

| Sale of

motor equipment and parts |

6,208 |

- |

n.m. |

10,118 |

- |

n.m. |

|

Total US revenue |

123,824 |

110,228 |

12 |

374,445 |

297,390 |

26 |

|

Reportable segment profit before tax (i) |

25,494 |

17,056 |

49 |

65,453 |

40,387 |

62 |

(i) Includes adjustments to intercompany

transactions.n.m. – not meaningful

For the three-month period ended September 30,

2023, total US revenue increased by 12 percent to $123.8 million as

compared to $110.2 million in the 2022-quarter. The increase in

revenue was primarily driven by increased RSS activity, motor

rental growth, and Atlas motor and parts sales, and was achieved

despite the slowdown in US industry activity. With three

consecutive strong quarters in 2023, US revenue for the nine-month

period ended September 30, 2023 increased 26 percent to $374.4

million from $297.4 million in the 2022-period.

Throughout the year, the demand for PHX Energy’s

premium technologies was robust and with the additional RSS systems

added in the fourth quarter of 2022 and third quarter of 2023, RSS

services accounted for a larger percentage of the US segment’s

activity. This greater volume of RSS activity, along with increased

capacity and utilization in the Corporation’s premium technologies,

primarily drove improvements in the US division’s average revenue

per day(3). For the three-month period ended September 30, 2023,

average revenue per day for directional drilling services rose to

$26,168 from $22,425 in the third quarter of 2022, a 17 percent

increase. In the 2023 nine-month period, average revenue per day

for directional drilling services increased 18 percent to $25,173

from $21,324 in the same 2022-period. The strong US dollar in both

2023 periods also supported the increase in the average revenue per

day. Omitting the impact of foreign exchange, the average revenue

per day for directional drilling services increased by 9 percent

and 13 percent, respectively, in the 2023 three and nine-month

periods.

In the third quarter of 2023, the Corporation’s

US directional drilling activity decreased by 13 percent to 4,050

operating days compared to 4,653 days in the third quarter of 2022

and has decreased by 7 percent as compared to the 4,364 days in the

second quarter of 2023. In comparison, the US industry horizontal

and directional rig count in the third quarter of 2023 decreased 14

percent with 632 active rigs per day as compared to 733 rigs per

day in the third quarter of 2022 and decreased by 10 percent when

compared to an average of 700 active horizontal and directional

rigs per day in the second quarter of 2023. (Source: Baker Hughes,

North American Rotary Rig Count, Jan 2000 – Current,

https://rigcount.bakerhughes.com/na-rig-count). For the nine-month

period ended September 30, 2023, PHX Energy’s US drilling activity

was relatively flat at 13,234 operating days as compared to 13,405

days in the same 2022-period which is in line with the industry

trend over the same period.

Horizontal and directional drilling continued to

represent the majority of rigs running on a daily basis in both

2023 periods. Phoenix USA was active in the Permian, Scoop/Stack,

Marcellus, Utica, Bakken, and Niobrara basins in the nine-month

period ended September 30, 2023.

In the 2023 three-month period, PHX Energy

increased the capacity of its motor rental fleet which allowed the

business to grow its revenue 57 percent to $11.6 million from $7.4

million in the same 2022-period. In the nine-month period ended

September 30, 2023, US motor rental revenue was $31.2 million, a 65

percent increase compared to $19 million in the same 2022-period.

During the 2023-quarter, PHX Energy also sold Atlas motor equipment

and parts to certain customers and generated $6.2 million of

revenue from this line of business. In the 2023 nine-month period,

$10.1 million of Atlas motors and parts have been sold.

For the three and nine-month periods ended

September 30, 2023, the US segment realized reportable segment

income before tax of $25.5 million and $65.5 million, respectively,

which are 49 percent and 62 percent higher than the corresponding

2022-periods. Greater margins from premium technologies and growth

in the rental and sale of Atlas motors largely contributed to

increased profitability in both 2023 periods.

Canada

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

2022 |

% Change |

2023 |

2022 |

% Change |

|

Directional drilling services |

44,145 |

30,725 |

44 |

111,716 |

77,046 |

45 |

| Motor

rental |

283 |

271 |

4 |

1,384 |

793 |

75 |

|

Total Canadian revenue |

44,428 |

30,996 |

43 |

113,100 |

77,839 |

45 |

|

Reportable segment profit before tax (i) |

8,263 |

4,479 |

84 |

17,828 |

7,930 |

125 |

(i) Includes adjustments to intercompany

transactions.

In the third quarter of 2023, PHX Energy’s

Canadian operations generated revenue of $44.4 million, its highest

level of quarterly revenue since the fourth quarter of 2014 and 43

percent higher compared to $31 million generated in the

2022-quarter. In the 2023 nine-month period, Canadian division

revenue was $113.1 million, an increase of 45 percent as compared

to $77.8 million in the same 2022-period. Strong quarterly revenue

generated throughout 2023 was largely driven by higher average

revenue per day(3) for directional drilling services which

increased by 22 percent to $13,375 in the 2023-quarter from $10,926

in the corresponding 2022-quarter and increased by 24 percent to

$13,257 in the 2023 nine-month period compared to $10,733 in the

same 2022-period. Targeted marketing efforts, strong operational

expertise, and increased deployment of premium technologies

primarily contributed to the improved average revenue per day

realized in both 2023-periods.

For the three and nine-month periods ended

September 30, 2023, operating days improved by 16 percent in both

periods to 3,301 and 8,427, respectively, compared to 2,835 days

and 7,252 days in the corresponding 2022-periods. In comparison,

industry horizontal and directional drilling activity (as measured

by drilling days) declined by 4 percent to 16,261 days in the third

quarter of 2023, and slightly increased by 1 percent to 44,093 days

in the first three quarters of 2023 (Source: Daily Oil Bulletin,

hz-dir days 230331). PHX Energy’s activity far exceeding that of

the industry is a testament to the Corporation’s strong reputation

and presence in the Canadian market. During the 2023-quarter, the

Corporation was active in the Duvernay, Montney, Glauconite,

Frobisher, Cardium, Viking, Bakken, Torquay, Colony, Clearwater,

Deadwood, Ellerslie, and Scallion basins.

For the three and nine-month periods ended

September 30, 2023, the Corporation’s Canadian division recognized

reportable segment profit before tax of $8.3 million (2022 – $4.5

million) and $17.8 million (2022 - $7.9 million), respectively. The

greater volume of activity and higher average revenue per day drove

the improvements in profitability in both 2023 periods.

International – Continuing

Operations

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

2022 |

% Change |

2023 |

2022 |

% Change |

|

Revenue |

1,116 |

1,194 |

(7 |

) |

3,463 |

2,758 |

26 |

|

Reportable segment profit before tax |

351 |

420 |

(16 |

) |

1,248 |

781 |

60 |

The Corporation’s international segment revenue

is comprised of revenue from Albania. For the three and nine-month

periods ended September 30, 2023, the international segment’s

revenue was $1.1 million (2022 - $1.2 million) and $3.5 million

(2022 - $2.8 million), respectively. Albania operations remain

consistent with one rig which resumed operations in the first

quarter of 2022.

The international segment generated reportable

segment profit before tax of $0.4 million in the 2023 three-month

period, same level as the corresponding 2022-period, and $1.2

million in the 2023 nine-month period, almost double compared to

the same 2022-period.

Investing Activities

Net cash used in investing activities for the

three-month period ended September 30, 2023 was $3.9 million as

compared to $12.8 million in the 2022-period. During the third

quarter of 2023, the Corporation spent $12.5 million (2022 - $10.2

million) to grow the Corporation’s fleet of drilling equipment and

$6.3 million (2022 - $8.4 million) was used to maintain capacity in

the Corporation’s fleet of drilling and other equipment and replace

equipment lost downhole during drilling operations. With proceeds

on disposition of drilling and other equipment of $11.7 million

(2022 - $6.3 million), the Corporation’s net capital

expenditures(2) for the 2023-quarter were $7.1 million (2022 -

$12.4 million).

(Stated in thousands of dollars)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

2023 |

2022 |

2023 |

2022 |

|

Growth capital expenditures |

12,471 |

10,191 |

27,356 |

33,205 |

|

Maintenance capital expenditures |

6,333 |

8,440 |

22,102 |

18,846 |

|

Total capital expenditures |

18,804 |

18,631 |

49,458 |

52,051 |

|

Deduct: |

|

|

|

|

|

Proceeds on disposition of drilling equipment |

11,682 |

6,274 |

32,689 |

15,454 |

|

Net capital expenditures(2) |

7,122 |

12,357 |

16,769 |

36,597 |

The 2023-period capital expenditures comprised

of:

- $6.8 million in

downhole performance drilling motors;

- $11.5 million in

MWD systems and spare components and RSS; and

- $0.5 million in machinery and

equipment and other assets.

The change in non-cash working capital balances

of $3.2 million (source of cash) for the three-month period ended

September 30, 2023, relates to the net change in the Corporation’s

trade payables that are associated with the acquisition of capital

assets. This compares to $0.4 million (use of cash) for the

three-month period ended September 30, 2022.

Financing Activities

For the three-month period ended September 30,

2023, net cash used in financing activities was $35.3 million as

compared to $0.3 million in the 2022-period. In the

2023-period:

- dividends of

$7.6 million were paid to shareholders;

- $9.4 million net

repayments were made towards the Corporation’s syndicated credit

facility;

- 2,442,700 common

shares were purchased by the Corporation for $17.5 million and

cancelled under the NCIB;

- payments of $0.8

million were made towards lease liabilities; and

- 150,000 common

shares were issued from treasury for proceeds of $0.4 million upon

the exercise of share options.

Capital Resources

As of September 30, 2023, the Corporation had

CAD $18.3 million drawn on its Canadian credit facilities, nothing

drawn on its US operating facility, and a cash balance of $14.8

million. As at September 30, 2023, the Corporation had CAD $46.5

million and USD $15 million available from its credit facilities.

The credit facilities are secured by substantially all of the

Corporation’s assets and mature in December 2025.

As at September 30, 2023, the Corporation was in

compliance with all its financial covenants.

In November 2023, the Corporation increased the

borrowing amounts in the syndicated facility from CAD $50 million

to CAD $80 million and in the US operating facility from USD $15

million to USD $20 million. The Corporation also extended the

maturity date of the syndicated loan agreement to December 12,

2026. With the increased borrowing amounts, the Corporation has

approximately CAD $76.5 million and USD $20 million available to be

drawn from its credit facilities.

Cash Requirements for Capital

Expenditures

Historically, the Corporation has financed its

capital expenditures and acquisitions through cash flows from

operating activities, proceeds on disposition of drilling

equipment, debt and equity. The Board approved an increase of the

2023 capital expenditure program to $80 million. Of the 2023

capital expenditures, $35 million is expected to be allocated to

maintain capacity in the existing fleet of drilling and other

equipment and replace equipment lost downhole during drilling

operations, and $45 million is expected to be allocated to growth

capital. The amount expected to be allocated towards replacing

equipment lost downhole could increase should more downhole

equipment losses occur throughout the year.

As demand for the Corporation’s premium

technologies continues to grow, and the outlook that the declining

rig counts in North America will level off, the Board has approved

a preliminary 2024 capital expenditure program of $70 million, of

which $42 million is anticipated to be spent on growth. The growth

capital expenditures are expected to be allocated towards: building

larger fleets of recently commercialized supplementary technologies

that create value added capabilities within the premium fleet and

are already in high demand; additional motor capacity to grow the

Atlas rental and sales division; and add required Velocity systems,

RSS and Atlas motos to continue to meet demand for full service

operations. The remaining $28 million is anticipated to be spent on

maintenance of the fleet of drilling and other

equipment.

These planned expenditures are expected to be

financed from cash flow from operating activities, proceeds on

disposition of drilling equipment, cash and cash equivalents, and

the Corporation’s credit facilities, if necessary. However, if a

sustained period of market uncertainty and financial market

volatility persists in 2023, the Corporation's activity levels,

cash flows and access to credit may be negatively impacted, and the

expenditure level would be reduced accordingly where possible.

Conversely, if future growth opportunities present themselves, the

Corporation would look at expanding this planned capital

expenditure amount.

As at September 30, 2023, the Corporation has

commitments to purchase drilling and other equipment for $33.8

million. Deliveries are expected to occur throughout the rest of

the 2023-year and into the first quarter of 2024.

About PHX Energy Services

Corp.

PHX Energy is a growth-oriented, public oil and

natural gas services company. The Corporation, through its

directional drilling subsidiary entities provides horizontal and

directional drilling services and technologies to oil and natural

gas exploration and development companies principally in Canada and

the US. In connection with the services it provides, PHX Energy

engineers, develops and manufactures leading-edge technologies. In

recent years, PHX Energy has developed various new technologies

that have positioned the Corporation as a technology leader in the

horizontal and directional drilling services sector.

PHX Energy’s Canadian directional drilling

operations are conducted through Phoenix Technology Services LP.

The Corporation maintains its corporate head office, research and

development, Canadian sales, service and operational centers in

Calgary, Alberta. In addition, PHX Energy has a facility in

Estevan, Saskatchewan. PHX Energy’s US operations, conducted

through the Corporation’s wholly-owned subsidiary, Phoenix

Technology Services USA Inc. (“Phoenix USA”), is headquartered in

Houston, Texas. Phoenix USA has sales and service facilities in

Houston, Texas; Midland, Texas; Casper, Wyoming; and Oklahoma City,

Oklahoma. Internationally, PHX Energy has sales offices and service

facilities in Albania, and an administrative office in Nicosia,

Cyprus. The Corporation also supplies technology to the Middle East

regions.

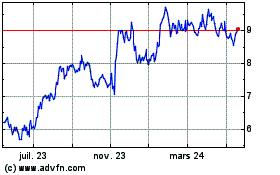

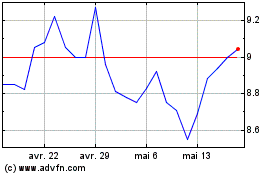

The common shares of PHX Energy trade on the

Toronto Stock Exchange under the symbol PHX.

For further information please contact:John

Hooks, CEO; Michael Buker, President; or Cameron Ritchie, Senior

Vice President Finance and CFO

PHX Energy Services Corp.Suite 1600, 215 9th

Avenue SW, Calgary Alberta T2P 1K3Tel: 403-543-4466 Fax:

403-543-4485 www.phxtech.com

Condensed Consolidated Interim

Statements of Financial Position(unaudited)

|

|

|

September 30, 2023 |

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

14,845,393 |

|

|

$ |

18,247,376 |

|

|

|

Trade and other receivables |

|

|

128,588,190 |

|

|

|

125,836,273 |

|

|

|

Inventories |

|

|

63,569,528 |

|

|

|

63,119,489 |

|

|

|

Prepaid expenses |

|

|

2,989,717 |

|

|

|

3,024,166 |

|

|

|

Total current assets |

|

|

209,992,828 |

|

|

|

210,227,304 |

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

Drilling and other long-term assets |

|

|

127,753,169 |

|

|

|

115,945,060 |

|

|

|

Right-of-use assets |

|

|

27,978,171 |

|

|

|

29,336,163 |

|

|

|

Intangible assets |

|

|

14,111,652 |

|

|

|

15,668,180 |

|

|

|

Investments |

|

|

3,000,500 |

|

|

|

3,000,500 |

|

|

|

Other long-term assets |

|

|

1,645,473 |

|

|

|

993,112 |

|

|

|

Deferred tax assets |

|

|

53,869 |

|

|

|

53,869 |

|

|

|

Total non-current assets |

|

|

174,542,834 |

|

|

|

164,996,884 |

|

|

Total assets |

|

$ |

384,535,662 |

|

|

$ |

375,224,188 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Trade and other payables |

|

$ |

92,021,042 |

|

|

$ |

104,688,901 |

|

|

|

Dividends payable |

|

|

7,276,760 |

|

|

|

7,636,085 |

|

|

|

Lease liability |

|

|

3,229,737 |

|

|

|

2,906,708 |

|

|

|

Current tax liabilities |

|

|

6,194,933 |

|

|

|

656,499 |

|

|

|

Total current liabilities |

|

|

108,722,472 |

|

|

|

115,888,193 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

Lease liability |

|

|

34,909,196 |

|

|

|

36,768,003 |

|

|

|

Loans and borrowings |

|

|

18,302,454 |

|

|

|

22,731,389 |

|

|

|

Deferred tax liability |

|

|

18,719,720 |

|

|

|

18,496,619 |

|

|

|

Other |

|

|

2,838,630 |

|

|

|

4,461,531 |

|

|

|

Total non-current liabilities |

|

|

74,770,000 |

|

|

|

82,457,542 |

|

|

Equity: |

|

|

|

|

|

|

|

|

Share capital |

|

|

233,646,892 |

|

|

|

251,344,809 |

|

|

|

Contributed surplus |

|

|

7,178,466 |

|

|

|

7,044,317 |

|

|

|

Deficit |

|

|

(69,376,356 |

) |

|

|

(112,120,484 |

) |

|

|

Accumulated other comprehensive income |

|

|

29,594,188 |

|

|

|

30,609,811 |

|

|

|

Total equity |

|

|

201,043,190 |

|

|

|

176,878,453 |

|

|

Total liabilities and equity |

|

$ |

384,535,662 |

|

|

$ |

375,224,188 |

|

Condensed Consolidated Interim

Statements of Comprehensive Earnings

(unaudited)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

|

$ |

169,367,911 |

|

$ |

142,418,326 |

|

$ |

491,008,431 |

|

$ |

377,986,582 |

|

|

Direct costs |

|

|

125,137,605 |

|

|

111,734,015 |

|

|

376,995,672 |

|

|

304,200,177 |

|

|

Gross profit |

|

|

44,230,306 |

|

|

30,684,311 |

|

|

114,012,759 |

|

|

73,786,405 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

19,832,791 |

|

|

15,589,015 |

|

|

50,911,033 |

|

|

49,536,435 |

|

|

Research and developmentexpenses |

|

|

1,245,826 |

|

|

909,169 |

|

|

3,816,601 |

|

|

2,538,935 |

|

|

Finance expense |

|

|

597,898 |

|

|

499,461 |

|

|

1,974,058 |

|

|

873,445 |

|

|

Finance expense lease liability |

|

|

554,405 |

|

|

498,239 |

|

|

1,694,550 |

|

|

1,506,640 |

|

|

Other income |

|

|

(9,113,282 |

) |

|

(3,953,620 |

) |

|

(24,359,774 |

) |

|

(11,031,501 |

) |

|

|

|

|

|

13,117,638 |

|

|

13,542,264 |

|

|

34,036,468 |

|

|

43,423,954 |

|

|

Earnings from continuing operations before income taxes |

|

|

31,112,668 |

|

|

17,142,047 |

|

|

79,976,291 |

|

|

30,362,451 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

Current |

|

|

5,616,371 |

|

|

625,922 |

|

|

13,591,604 |

|

|

396,650 |

|

|

Deferred |

|

|

575,118 |

|

|

3,041,401 |

|

|

937,818 |

|

|

5,987,492 |

|

|

|

|

|

|

6,191,489 |

|

|

3,667,323 |

|

|

14,529,422 |

|

|

6,384,142 |

|

|

Earnings from continuing operations |

|

|

24,921,179 |

|

|

13,474,724 |

|

|

65,446,869 |

|

|

23,978,309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations |

|

|

|

|

|

|

|

|

|

|

Net loss from discontinued operations, net of taxes |

|

- |

|

|

- |

|

|

- |

|

|

(14,558,032 |

) |

|

Net earnings |

|

|

24,921,179 |

|

|

13,474,724 |

|

|

65,446,869 |

|

|

9,420,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

|

3,613,465 |

|

|

8,739,048 |

|

|

(1,015,623 |

) |

|

10,563,631 |

|

|

|

Reclassification of foreign currency translation loss on

disposition |

|

|

- |

|

|

- |

|

|

- |

|

|

10,560,954 |

|

|

Total comprehensive earnings for the period |

|

$ |

28,534,644 |

|

$ |

22,213,772 |

|

$ |

64,431,246 |

|

$ |

30,544,862 |

|

|

Earnings (loss) per share – basic |

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

0.50 |

|

$ |

0.27 |

|

$ |

1.29 |

|

$ |

0.48 |

|

|

Discontinued operations |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

(0.29 |

) |

|

Net earnings |

|

$ |

0.50 |

|

$ |

0.27 |

|

$ |

1.29 |

|

$ |

0.19 |

|

|

Earnings (loss) per share – diluted |

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

0.50 |

|

$ |

0.27 |

|

$ |

1.28 |

|

$ |

0.48 |

|

|

Discontinued operations |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

(0.29 |

) |

|

Net earnings |

|

$ |

0.50 |

|

$ |

0.27 |

|

$ |

1.28 |

|

$ |

0.19 |

|

Condensed Consolidated Interim

Statements of Cash Flows(unaudited)

|

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

| Earnings from continuing

operations |

$ |

24,921,179 |

|

$ |

13,474,724 |

|

$ |

65,446,869 |

|

$ |

23,978,309 |

|

| Adjustments for: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

9,866,881 |

|

|

8,143,257 |

|

|

28,804,904 |

|

|

23,242,730 |

|

|

Depreciation and amortization right-of-use asset |

|

822,190 |

|

|

744,876 |

|

|

2,057,025 |

|

|

2,429,603 |

|

|

Provision for income taxes |

|

6,191,489 |

|

|

3,667,323 |

|

|

14,529,422 |

|

|

6,384,142 |

|

|

Unrealized foreign exchange gain |

|

427,482 |

|

|

155,128 |

|

|

391,554 |

|

|

36,602 |

|

|

Net gain on disposition of drilling equipment |

|

(8,353,639 |

) |

|

(4,157,247 |

) |

|

(23,903,064 |

) |

|

(10,798,870 |

) |

|

Equity-settled share-based payments |

|

144,193 |

|

|

133,034 |

|

|

431,109 |

|

|

393,042 |

|

|

Finance expense |

|

597,898 |

|

|

499,461 |

|

|

1,974,058 |

|

|

873,445 |

|

|

Finance expense lease liability |

|

554,405 |

|

|

498,239 |

|

|

1,694,550 |

|

|

1,506,640 |

|

|

Provision for (recovery of) bad debts |

|

(1,106,245 |

) |

|

(1,501 |

) |

|

116,519 |

|

|

(1,501 |

) |

|

Provision for inventory obsolescence |

|

653,716 |

|

|

51,868 |

|

|

1,301,822 |

|

|

876,524 |

|

|

Interest paid on lease liability |

|

(554,405 |

) |

|

(498,239 |

) |

|

(1,694,550 |

) |

|

(1,506,640 |

) |

|

Interest paid |

|

(472,654 |

) |

|

(413,530 |

) |

|

(1,506,251 |

) |

|