Pine Cliff Energy Ltd. (“

Pine Cliff” or the

“

Company”) (

TSX: PNE) is pleased

to announce the filing of its third quarter financial and operating

results. Included in the filings were Pine Cliff's unaudited

interim condensed consolidated financial statements and related

management's discussion and analysis for the three and nine months

ended September 30, 2018 (the "

Q3-Report").

Selected highlights are shown below and should be read in

conjunction with the Q3-Report.

Third Quarter 2018 Highlights

Highlights from the third quarter of 2018 are as

follows:

- realized adjusted funds flow of $1.9 million during the quarter

with realized gas prices of $1.88 per Mcf, despite AECO daily 5A

natural gas pricing only being $1.19 per Mcf;

- achieved average production for the nine months ended September

30, 2018 of 19,721 Boe/d (118,326 Mcfe/d), down from 21,387 Boe/d

(128,322 Mcfe/d) for the nine months ended September 30, 2017,

despite only incurring $3.2 million of drilling and recompletion

capital in the nine months ended September 30, 2018;

- entered into an amended and restated credit agreement with its

banking syndicate for an $11.0 million revolving credit facility;

and

- completed a private placement for gross proceeds of $19.0

million from Alberta Investment Management Corporation to pay down

bank indebtedness and provide additional working capital.

Impact of Pine Cliff’s Diversification

Strategy

The success of Pine Cliff’s 2018 marketing

diversification strategy was highlighted this past quarter. Despite

the AECO daily 5A reference price being 18% lower in the three

months ended September 30, 2018 compared to the same period in

2017, realized natural gas pricing for Pine Cliff in the third

quarter of 2018 was 1% higher at $1.88 per Mcf. This realized

natural gas price was an increase of $0.69 per Mcf, or 58% above

the average daily AECO price.

Balance Sheet Flexibility

This past quarter Pine Cliff better aligned its

balance sheet with its business model by converting shorter term

focused bank debt to longer-term focused term debt. Pine

Cliff exited this past quarter with no bank debt and a positive

cash balance of $4.6 million.

Revised Guidance

Pine Cliff has historically grown by

acquisitions and through these acquisitions, Pine Cliff now owns

the mineral rights on close to two million acres of land. Pine

Cliff’s board of directors has approved an increase in its 2018

capital budget from $10.4 million to $13.4 million, including

abandonments and reclamation and excluding acquisitions and

dispositions. The increase in the capital budget will be used

to drill an oil well in the fourth quarter of 2018.

Pine Cliff is also adjusting its 2018 production

guidance from 20,000 – 20,500 Boe/d (120,000 – 123,000 Mcfe/d) to

19,500 – 20,000 Boe/d (117,000 – 120,000 Mcfe/d), weighted

approximately 94% towards natural gas. The decrease is a

result of short term voluntary shut-ins as a result of lower

natural gas prices and delaying capital expenditures to the fourth

quarter of 2018.

Financial and Operating Results

| |

|

|

Three months ended September 30, |

Nine months ended September 30, |

| |

|

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

| ($000s, unless otherwise indicated) |

|

|

|

|

| Oil and gas

sales (before royalty expense) |

25,625 |

|

25,646 |

|

77,275 |

|

96,355 |

|

| Cash flow

from operating activities |

(309 |

) |

5,517 |

|

7,201 |

|

29,359 |

|

| Adjusted

funds flow1 |

1,920 |

|

2,879 |

|

6,080 |

|

24,946 |

|

| Per share –

Basic and Diluted ($/share)1 |

0.01 |

|

0.01 |

|

0.02 |

|

0.08 |

|

| Loss |

(10,710 |

) |

(30,214 |

) |

(44,199 |

) |

(34,868 |

) |

| Per share –

Basic and Diluted ($/share) |

(0.03 |

) |

(0.10 |

) |

(0.14 |

) |

(0.11 |

) |

| Capital

expenditures |

1,910 |

|

3,318 |

|

6,363 |

|

10,386 |

|

| Net

Debt1 |

56,325 |

|

53,377 |

|

56,325 |

|

53,377 |

|

| Production

(Boe/d) |

19,603 |

|

21,863 |

|

19,721 |

|

21,387 |

|

|

Weighted-average common shares outstanding (000s) |

|

|

|

|

Basic and diluted |

307,076 |

|

307,076 |

|

307,076 |

|

307,076 |

|

| Combined

sales price ($/Boe) |

14.21 |

|

12.75 |

|

14.35 |

|

16.50 |

|

| Operating

netback ($/Boe)1 |

2.34 |

|

2.30 |

|

2.37 |

|

5.56 |

|

| Corporate

netback ($/Boe)1 |

1.06 |

|

1.44 |

|

1.13 |

|

4.27 |

|

| Operating

netback ($ per Mcfe)1 |

0.39 |

|

0.38 |

|

0.40 |

|

0.93 |

|

| Corporate netback ($ per Mcfe)1 |

0.18 |

|

0.24 |

|

0.19 |

|

0.71 |

|

1 This is a non-GAAP measure, see NON-GAAP Measures for

additional information.

For further information, please contact:

Philip B. Hodge – President and CEOCheryne Lowe

– CFO and Corporate SecretaryTelephone: (403) 269-2289Fax: (403)

265-7488Email: info@pinecliffenergy.com

NON-GAAP Measures

This press release uses the terms “adjusted

funds flow”, “operating netbacks”, “corporate netbacks” and “net

debt” which are not recognized under International Financial

Reporting Standards (“IFRS”) and may not be

comparable to similar measures presented by other companies.

These measures should not be considered as an alternative to, or

more meaningful than, IFRS measures including earnings (loss), cash

flow from operating activities, or total liabilities. The

Company uses these measures to evaluate its performance, leverage

and liquidity. Adjusted funds flow is a non-Generally

Accepted Accounting Principles (“non-GAAP”)

measure that represents the total cash flow from operating

activities, before adjusting for changes in non-cash working

capital, and decommissioning obligations settled. Net debt is

a non-GAAP measure calculated as the sum of bank debt, subordinated

promissory notes at the principal amount, amounts due to related

party and trade and other payables less trade and other

receivables, cash, prepaid expenses and deposits and

investments. Operating netback is a non-GAAP measure

calculated as the Company’s total revenue, less operating and

transportation expenses, divided by the Boe production of the

Company. Corporate netback is a non-GAAP measure calculated

as the Company’s operating netback, less general and administrative

expenses, interest and bank charges plus finance and dividend

income, divided by the Boe production of the Company. Please

refer to the Q3-Report for additional details regarding non-GAAP

measures and their calculation.

Cautionary Statements

Certain statements contained in this news

release include statements which contain words such as

“anticipate”, “could”, “should”, “expect”, “seek”, “may”, “intend”,

“likely”, “will”, “believe” and similar expressions, statements

relating to matters that are not historical facts, and such

statements of our beliefs, intentions and expectations about

developments, results and events which will or may occur in the

future, constitute “forward-looking information” within the meaning

of applicable Canadian securities legislation and are based on

certain assumptions and analysis made by us derived from our

experience and perceptions. Forward-looking information in

this news release includes, but is not limited to: expected

production levels, expected operating cost, royalty and general

& administrative expense levels; future capital expenditures,

including the amount and nature thereof; future acquisition

opportunities including Pine Cliff’s ability to execute on those

opportunities; future drilling opportunities and Pine Cliff’s

ability to generate reserves and production from the undrilled

locations; oil and natural gas prices and demand; expansion and

other development trends of the oil and natural gas industry;

business strategy and guidance; expansion and growth of our

business and operations; maintenance of existing

customer, supplier and partner relationships; supply channels;

accounting policies; risks; Pine Cliff’s ability to generate cash

flow from operating activities and adjusted funds flow; and other

such matters.

All such forward-looking information is based on

certain assumptions and analyses made by us in light of our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors we

believe are appropriate in the circumstances. The risks,

uncertainties and assumptions are difficult to predict and may

affect operations, and may include, without limitation: foreign

exchange fluctuations; equipment and labour shortages and

inflationary costs; general economic conditions; industry

conditions; changes in applicable environmental, taxation and other

laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas

companies to raise capital; the effect of weather conditions on

operations and facilities; the existence of operating risks;

volatility of oil and natural gas prices; oil and gas product

supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future

obligations; increased competition; stock market volatility;

opportunities available to or pursued by us; and other factors,

many of which are beyond our control. The foregoing factors are not

exhaustive.

Actual results, performance or achievements

could differ materially from those expressed in, or implied by,

this forward-looking information and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking

information will transpire or occur, or if any of them do, what

benefits will be derived there from. Except as required by

law, Pine Cliff disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

Natural gas liquids and oil volumes are recorded

in barrels of oil (“Bbl”) and are converted to a

thousand cubic feet equivalent (“Mcfe”) using a

ratio of one (1) Bbl to six (6) thousand cubic feet. Natural gas

volumes recorded in thousand cubic feet (“Mcf”)

are converted to barrels of oil equivalent (“Boe”)

using the ratio of six (6) thousand cubic feet to one (1) Bbl. This

conversion ratio is based on energy equivalence primarily at the

burner tip and does not represent a value equivalency at the

wellhead. The terms Boe or Mcfe may be misleading, particularly if

used in isolation.

Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly

different from the energy equivalency of oil, utilizing a

conversion on a 6:1 basis may be misleading as an indication of

value.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement.

The TSX does not accept responsibility for the

accuracy of this release.

PDF

available: http://resource.globenewswire.com/Resource/Download/8b144de9-913d-40a1-9bc1-4b426b280028

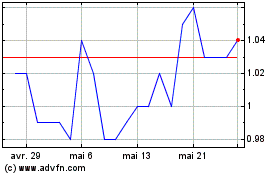

Pine Cliff Energy (TSX:PNE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Pine Cliff Energy (TSX:PNE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025