Pulse Seismic Inc. (TSX:PSD) (OTCQX:PLSDF) (“Pulse” or “the

Company”) is pleased to report its financial and operating results

for the three and six months ended June 30, 2018. The unaudited

condensed consolidated interim financial statements, accompanying

notes and MD&A are being filed on SEDAR (www.sedar.com) and

will be available on Pulse’s website at www.pulseseismic.com.

HIGHLIGHTS FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2018

- Total revenue, comprised exclusively of data library sales, for

the three months ended June 30, 2018 was $1.9 million, a decrease

of 34 percent from $2.9 million for the three months ended June 30,

2017. Total revenue for the first six months of 2018, also

comprised exclusively of data library sales, decreased by 24

percent to $4.3 million from $5.6 million for the six months ended

June 30, 2017;

- The net loss of $1.0 million ($0.02

per share basic and diluted) for the three months ended June 30,

2018 was 58 percent lower than the net loss of $2.4 million ($0.04

per share basic and diluted) for the three months ended June 30,

2017. The net loss of $1.7 million ($0.03 per share basic and

diluted) for the six months ended June 30, 2018 was 65 percent

lower than the net loss of $4.9 million ($0.09 per share basic and

diluted) for the first six months of 2017. These improvements were

a result of the decrease in data library amortization expense in

2018;

- Cash EBITDA(a) was $482,000 ($0.01 per share basic and diluted)

for the three months ended June 30, 2018, compared to $1.5 million

($0.03 per share basic and diluted) for the three months ended June

30, 2017. Cash EBITDA was $1.4 million ($0.03 per share basic and

diluted) for the six months ended June 30, 2018 compared to $2.9

million ($0.05 per share basic and diluted) for the six months

ended June 30, 2017;

- Shareholder free cash flow(a) was $630,000 ($0.01 per share

basic and diluted) for the second quarter of 2018 compared to $1.6

million ($0.03 per share basic and diluted) for the comparable

period in 2017. Shareholder free cash flow was $1.5 million ($0.03

per share basic and diluted) for the six months ended June 30, 2018

compared to $2.9 million ($0.05 per share basic and diluted) for

the six months ended June 30, 2017;

- In the six-month period ended June 30, 2018 Pulse purchased and

cancelled a total of 169,900 common shares at a total cost of

approximately $534,000 (average cost of $3.15 per common share

including commissions), all of which were purchased in the first

quarter of the year; and

- At June 30, 2018 Pulse was debt-free and had cash of $18.0

million. The Company’s $30.0 million revolving credit facility is

undrawn and fully available.

SELECTED FINANCIAL AND OPERATING

INFORMATION

| |

|

|

|

|

|

| |

Three months ended June 30, |

Six months ended June 30, |

Year

ended |

| (thousands of dollars

except per share data, |

2018 |

|

2017 |

|

2018 |

|

2017 |

|

December 31, |

| numbers of shares and

kilometres of seismic data) |

(unaudited) |

(unaudited) |

2017 |

|

|

|

|

|

|

|

| Revenue –

Data library sales |

1,941 |

|

2,929 |

|

4,269 |

|

5,648 |

|

43,525 |

| |

|

|

|

|

|

| Amortization of seismic

data library |

1,836 |

|

4,638 |

|

3,714 |

|

9,273 |

|

15,870 |

| Net earnings

(loss) |

(1,016 |

) |

(2,426 |

) |

(1,712 |

) |

(4,928 |

) |

15,087 |

| Per share

basic and diluted |

(0.02 |

) |

(0.04 |

) |

(0.03 |

) |

(0.09 |

) |

0.27 |

| Cash provided by (used

in) operating activities |

213 |

|

833 |

|

(8,379 |

) |

4,131 |

|

38,755 |

| Per share

basic and diluted |

0.00 |

|

0.02 |

|

(0.16 |

) |

0.07 |

|

0.70 |

| Cash EBITDA (a) |

482 |

|

1,542 |

|

1,416 |

|

2,872 |

|

37,070 |

| Per share

basic and diluted (a) |

0.01 |

|

0.03 |

|

0.03 |

|

0.05 |

|

0.67 |

| Shareholder free cash

flow (a) |

630 |

|

1,605 |

|

1,510 |

|

2,859 |

|

29,729 |

| Per share

basic and diluted (a) |

0.01 |

|

0.03 |

|

0.03 |

|

0.05 |

|

0.54 |

| Capital

expenditures |

|

|

|

|

|

| Seismic

data purchases, digitization and related costs |

- |

|

60 |

|

62 |

|

125 |

|

1,575 |

| Property

and equipment |

2 |

|

10 |

|

4 |

|

37 |

|

48 |

| Total capital

expenditures |

2 |

|

70 |

|

66 |

|

162 |

|

1,623 |

| Special

dividend |

- |

|

- |

|

- |

|

- |

|

10,915 |

| |

|

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

| Basic and

diluted |

53,850,917 |

|

55,337,560 |

|

53,868,998 |

|

55,539,541 |

|

55,135,035 |

| Shares outstanding at

period-end |

|

|

53,850,917 |

|

55,337,560 |

|

54,020,817 |

| Seismic

library |

|

|

|

|

|

| 2D in

kilometres |

|

|

450,000 |

|

447,000 |

|

447,000 |

| 3D in

square kilometres |

|

|

28,956 |

|

28,647 |

|

28,956 |

| |

|

|

|

|

|

|

FINANCIAL POSITION AND RATIO |

|

|

|

|

| |

|

|

June 30, |

June 30, |

December 31, |

|

(thousands of dollars except ratio) |

|

|

2018 |

|

2017 |

|

2017 |

| Working capital |

|

|

22,586 |

|

11,811 |

|

22,486 |

| Working capital

ratio |

|

|

15.3:1 |

11.2:1 |

3.1:1 |

| Cash and cash

equivalents |

|

|

18,040 |

|

8,263 |

|

27,422 |

| Total assets |

|

|

39,246 |

|

36,632 |

|

51,693 |

|

Shareholders’ equity |

|

|

35,305 |

|

32,338 |

|

37,810 |

| |

|

|

|

|

|

(a) The Company’s continuous disclosure

documents provide discussion and analysis of “cash EBITDA”, “cash

EBITDA per share”, “shareholder free cash flow” and “shareholder

free cash flow per share”. These financial measures do not have

standard definitions prescribed by IFRS and, therefore, may not be

comparable to similar measures disclosed by other companies. The

Company has included these non-GAAP financial measures because

management, investors, analysts and others use them as measures of

the Company’s financial performance. The Company’s definition of

cash EBITDA is cash available for interest payments, cash taxes,

repayment of debt, purchase of its shares, discretionary capital

expenditures and the payment of dividends, and is calculated as

earnings (loss) from operations before interest, taxes,

depreciation and amortization less participation survey revenue,

plus any non-cash and non-recurring expenses. Cash EBITDA excludes

participation survey revenue as these funds are directly

used to fund specific participation surveys and this revenue is not

available for discretionary capital expenditures. The Company

believes cash EBITDA assists investors in comparing Pulse’s results

on a consistent basis without regard to participation survey

revenue and non-cash items, such as depreciation and amortization,

which can vary significantly depending on accounting methods or

non-operating factors such as historical cost. Cash EBITDA per

share is defined as cash EBITDA divided by the weighted average

number of shares outstanding for the period. Shareholder free cash

flow further refines the calculation of capital available to invest

in growing the Company’s 2D and 3D seismic data library, to repay

debt, to purchase its common shares and to pay dividends by

deducting non-discretionary expenditures from cash EBITDA.

Non-discretionary expenditures are defined as debt financing costs

(net of deferred financing expenses amortized in the current

period) and current tax provisions. Shareholder free cash flow per

share is defined as shareholder free cash flow divided by the

weighted average number of shares outstanding for the period.

These non-GAAP financial measures are defined,

calculated and reconciled to the nearest GAAP financial measures in

the Management’s Discussion and Analysis.

OUTLOOK

With second-quarter and first-half 2018 sales considerably lower

than in the comparable periods of 2017, Pulse continues to look

ahead cautiously to the rest of the year. Visibility as to Pulse’s

traditional sales remains poor and transaction-based sales are

innately unpredictable.

As in Pulse’s first-quarter 2018 Outlook, traditional industry

indicators remain contradictory. Among these are:

- Crude oil prices have continued to strengthen since the last

Outlook, with benchmark West Texas Intermediate remaining close to

or above US$70 per barrel throughout the first half of July,

maintaining this benchmark’s highest prices since the steep decline

of world crude oil prices in late 2014;

- Weakening the benefits of this trend, the West Texas

Intermediate to western Canada Select oil price differential has

remained even higher so far in 2018 than in 2017, averaging $28.34

per barrel from January 1 through July 18, according to the

Petroleum Services Association of Canada, and is forecast to remain

relatively high, which reduces revenue for producers in western

Canada;

- Alberta natural gas prices remain extremely weak, having fallen

since the last Outlook, with the AECO daily benchmark fluctuating

between $1.09 and $1.64 per GJ in the first third of July, with a

monthly index price of only $1.45 per GJ as of July 11;

- In the United States:

-

- Use of natural gas has increased sharply, with overall

consumption averaging 11 percent higher in the first half of 2018

than in the first half of 2017, according to the Energy Information

Administration;

- Supply, however, also continues to grow strongly, having

increased by 10 percent year-over-year in the same period;

- On the other hand, exports in the form of LNG send-out and

pipeline shipments to Mexico have grown by 23 percent in the same

period. LNG exports are averaging approximately 3 bcf per week,

with additional liquefaction trains and new export facilities

nearing completion;

- Natural gas storage in the U.S. has remained well below the

five-year weekly average since the start of the injection season in

late April. In early July, natural gas storage levels were 19

percent below the five-year weekly average;

- The U.S. active drilling rig count was approximately 1,050 rigs

in early July, according to Baker Hughes, suggesting the past

year’s continual increase in rig activity has reached a

plateau;

- On balance, these factors are conducive to higher prices and

increasing gas imports from Canada;

- Mineral lease auctions or “land sales” in Western Canada in the

first half of 2018 are on par with the comparable period of 2017,

totalling approximately $273 million compared to $277 million by

the end of June last year. This is much stronger than in 2016 and

2015, when the first half-year’s land sales were $50 million and

$205 million, respectively;

- Capital spending in Western Canada’s conventional oil and gas

sector (excluding the oil sands), as forecast in the first quarter

of the year by the Alberta Energy Regulator, is moderately

positive, with an expectation that spending will be similar to 2017

and will gradually increase from $19.4 billion this year to $20.9

billion in 2027;

- The industry continues to expect significant

merger-and-acquisition activity, which has the potential to trigger

transaction-based seismic data library sales, but activity to date

in 2018 has been low;

- The Canadian Association of Oilwell Drilling Contractors’

drilling forecast for 2018 remains unchanged at 6,138 wells, up

slightly from 2017. To date in 2018, rig utilization and total

drilling days are roughly comparable to 2017; and

- The Petroleum Services Association of Canada is forecasting

7,400 wells across Canada this year, up from 7,100 last year but

down from its initial forecast for 2018.

Western Canada’s oil and gas producing sector continues to

struggle to achieve a solid recovery from its extremely difficult,

three-and-a-half-year-long downturn. The industry has not benefited

from the virtually across-the board strengths driving U.S. industry

activity. Pulse anticipates the Canadian sector’s slower recovery

will continue.

Further barriers to accelerated field activity are ongoing

takeaway pipeline constraints, weak intra-Alberta gas demand,

strong productivity from newly drilled wells in the Montney,

Duvernay, Deep Basin and other unconventional plays, fluctuating

gas exports to the U.S., and Canada’s failure to move forward with

large LNG export projects. These are significant handicaps for a

gas-focused supply basin.

Government policies at all levels in Canada remain, on balance,

less supportive of oil and gas industry capital investment than in

the past (or in the U.S. at present). The ongoing nationwide

controversy over the politically-driven holdup of the National

Energy Board-approved expansion of the Trans-Mountain Pipeline from

Alberta to tidewater in Burnaby, B.C., is an example.

Fortunately, Pulse’s business has been grown, enlarged and

fine-tuned to be resilient against industry volatility, negative

market forces and unpredictable government policies. The Company’s

strong balance sheet, with effectively zero cash financing costs,

its low cash operating costs and the absence of other spending

commitments make Pulse cash-flow positive at annual revenue of

approximately $6 million. Despite poor sales in the first and

second quarters, Pulse’s first-half sales are approaching that

level. Pulse’s lowest annual sales in the depths of the energy

industry’s downturn were $14.3 million. Even with weaker first- and

second-quarter sales, Pulse generated positive cash EBITDA and

shareholder free cash flow in each quarter.

For the rest of 2018, Pulse remains cautious about the level of

traditional sales. Large or small transaction-based sales can occur

at any time, creating potential upside to Pulse’s quarterly and

annual revenues. The strength or weakness of transaction-based

sales will determine whether 2018 financial results exceed or

underperform historical averages.

CORPORATE PROFILE

Pulse is a market leader in the acquisition,

marketing and licensing of 2D and 3D seismic data to western

Canada’ energy sector. Pulse owns the second-largest licensable

seismic data library in Canada, currently consisting of

approximately 28,956 square kilometres of 3D seismic and 450,000

kilometres of 2D seismic. The library extensively covers the

Western Canada Sedimentary Basin where most of Canada’s oil and

natural gas exploration and development occur.

For further information, please contact:Neal

Coleman, President and CEOOrPamela Wicks,

Vice President Finance and CFOTel.: 403-237-5559Toll-free:

1-877-460-5559E-mail: info@pulseseismic.com.Please visit our

website at www.pulseseismic.com.

This document contains information that

constitutes “forward-looking information” or “forward-looking

statements” (collectively, “forward-looking information”) within

the meaning of applicable securities legislation.

The Outlook section contains forward-looking

information which includes, among other things, statements

regarding:

- Pulse continues to look ahead cautiously to the rest of the

year;

- Pulse anticipates the Canadian sector’s slower recovery will

continue;

- For the rest of 2018, Pulse remains cautious about the level of

traditional sales;

- Pulse’s capital allocation strategy;

- Pulse’s dividend policy;

- Oil and natural gas prices;

- Oil and natural gas drilling activity and land sales

activity;

- Oil and natural gas company capital budgets;

- Future demand for seismic data;

- Future seismic data sales;

- Future demand for participation surveys;

- Pulse’s business and growth strategy; and

- Other expectations, beliefs, plans, goals, objectives,

assumptions, information and statements about possible future

events, conditions, results and performance.

Undue reliance should not be placed on

forward-looking information. Forward-looking information is based

on current expectations, estimates and projections that involve a

number of risks and uncertainties, which could cause actual results

to vary and in some instances to differ materially from those

anticipated in the forward-looking information. Pulse does not

publish specific financial goals or otherwise provide guidance, due

to the inherently poor visibility of seismic revenue.

The material risk factors include, without

limitation:

- Oil and natural gas prices;

- The demand for seismic data and participation surveys;

- The pricing of data library license sales;

- Relicensing (change-of-control) fees and partner copy

sales;

- Cybersecurity;

- The level of pre-funding of participation surveys, and the

Company’s ability to make subsequent data library sales from such

participation surveys;

- The Company’s ability to complete participation surveys on time

and within budget;

- Environmental, health and safety risks;

- Federal and provincial government laws and regulations,

including those pertaining to taxation, royalty rates,

environmental protection and safety;

- Competition;

- Dependence on qualified seismic field contractors;

- Dependence on key management, operations and marketing

personnel;

- The loss of seismic data;

- Protection of intellectual property rights;

- The introduction of new products; and

- Climate change.

The foregoing list is not exhaustive. Additional

information on these risks and other factors which could affect the

Company’s operations and financial results is included under “Risk

Factors” of the Company’s MD&A for the year ended December 31,

2017. Forward-looking information is based on the assumptions,

expectations, estimates and opinions of the Company’s management at

the time the information is presented.

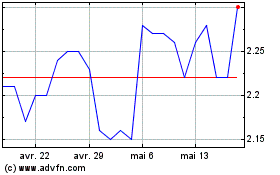

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025