Pulse Seismic Inc. Reports Preliminary Unaudited 2018 Results

30 Janvier 2019 - 1:28AM

Pulse Seismic Inc. (TSX:PSD) (OTCQX:PLSDF) (“Pulse” or “the

Company”) is pleased to report its preliminary selected unaudited

financial results for the year ended December 31, 2018.

These financial results are based on

management’s estimates and have not yet been approved by the

Company’s Audit Committee or Board of Directors, nor reviewed by

the Company’s auditors, and are subject to change.

HIGHLIGHTS FOR THE FOURTH QUARTER AND

YEAR ENDED DECEMBER 31, 2018

- Seismic data library sales of $4.3

million in the fourth quarter and $10.2 million for the year;

- Net earnings of $944,000 or $0.02

per share for the fourth quarter, and a net loss of $1.8 million or

$0.03 per share for 2018;

- Cash EBITDA(a) of $3.2 million or

$0.06 per share for the fourth quarter, and $5.0 million or $0.09

per share for 2018;

- Shareholder free cash flow(a) of

$2.6 million or $0.05 per share in the fourth quarter, and $4.7

million or $0.09 per share in 2018; and

- At December 31, 2018, the Company had a cash balance of $23.0

million.

“Despite the ongoing downturn in Western Canada’s oil and

natural gas sector, Pulse generated positive cash EBITDA and

shareholder free cash flow in each quarter of 2018, and completed

the year with considerably solid fourth quarter sales,” stated Neal

Coleman, Pulse’s President and CEO. “More importantly, Pulse took

advantage of these conditions to undertake one of the largest

transformative acquisitions in its history, at a valuation that

reflects a cyclical low in the industry.”

ACQUISITION UPDATE

As previously announced, on January 15, 2019

Pulse acquired 100 percent of the shares of Seitel Canada Ltd.

(“Seitel”). Pursuant to the acquisition agreement terms, purchase

consideration included an initial cash consideration of $53.6

million at closing plus potential additional payments of up to $5

million, in the aggregate, within two years of closing. The

acquisition of Seitel more than doubled Pulse’s 3D and 2D seismic

coverage, increasing Pulse’s revenue-generating potential by adding

unique, complementary, high-quality seismic data over areas that

Pulse’s library did not previously cover.

“With our counter-cyclical acquisition of

Seitel, Pulse is now much better-positioned for a range of future

business conditions,” continued Coleman. “While integration costs

will be incurred over the next year with this acquisition, Pulse

will maintain its low cost structure, enabling Pulse to continue

generating cash EBITDA and shareholder free cash flow should

industry weakness persist. At the same time, we are much better

positioned to any recovery scenario. Having doubled our opportunity

sets, Pulse will be able to capitalize not only on a larger range

of regular seismic data sales, but on a greater number of industry

transactions that generate relicensing fees, driving our future

growth. We are truly excited with opportunities this acquisition

presents.”

Please see Pulse’s January 15, 2019 news

release, which is available on the Pulse website, for more details

related to the Seitel acquisition.

CORPORATE PROFILE

Pulse is a market leader in the acquisition,

marketing and licensing of 2D and 3D seismic data to the western

Canadian energy sector. Pulse owns the largest licensable seismic

data library in Canada, currently consisting of approximately

65,310 square kilometres of 3D seismic and 829,207 kilometres of 2D

seismic. The library extensively covers the Western Canada

Sedimentary Basin where most of Canada’s oil and natural gas

exploration and development occur.

For further information, please contact:Neal

Coleman, President and CEOOrPamela Wicks,

Vice President Finance and CFOTel.: 403-237-5559Toll-free:

1-877-460-5559E-mail: info@pulseseismic.com.Please visit our

website at www.pulseseismic.com.

Forward Looking Information

This news release contains information that

constitutes “forward-looking information” or “forward-looking

statements” (collectively, “forward-looking information”) within

the meaning of applicable securities legislation.

This forward-looking information includes, among

other things, statements regarding;

- Integration costs will be incurred over the next year but Pulse

will maintain its low cost structure;

- Pulse expects to continue generating cash EBITDA and

shareholder free cash-flow.

Undue reliance should not be placed on

forward-looking information. Forward-looking information is based

on current expectations, estimates and projections that involve a

number of risks and uncertainties, which could cause actual results

to vary and in some instances to differ materially from those

anticipated in the forward-looking information. Pulse does not

publish specific financial goals or otherwise provide guidance, due

to the inherently poor visibility of seismic revenue.

The material risk factors include, without

limitation:

- Oil and natural gas prices;

- The demand for seismic data and participation surveys;

- The pricing of data library license sales;

- Relicensing (change-of-control) fees and partner copy

sales;

- Cybersecurity;

- The level of pre-funding of participation surveys, and the

Company’s ability to make subsequent data library sales from such

participation surveys;

- The Company’s ability to complete participation surveys on time

and within budget;

- Environmental, health and safety risks;

- Federal and provincial government laws and regulations,

including those pertaining to taxation, royalty rates,

environmental protection and safety;

- Competition;

- Dependence on qualified seismic field contractors;

- Dependence on key management, operations and marketing

personnel;

- The loss of seismic data;

- Protection of intellectual property rights;

- The introduction of new products; and

- Climate change.

The foregoing list is not exhaustive. Additional

information on these risks and other factors which could affect the

Company’s operations and financial results is included under “Risk

Factors” of the Company’s MD&A for the most recent calendar

year and interim periods. Forward-looking information is based on

the assumptions, expectations, estimates and opinions of the

Company’s management at the time the information is presented.

Non-GAAP financial measures

(a) This news release makes reference to certain non-GAAP

financial measures that do not have a standardized meaning or

definition as prescribed by IFRS and therefore may not be

comparable with the calculation of similar measures by other

entities, including “Cash EBITDA” and “shareholder free cash flow”.

Readers are referred to definitions, advisories and further

discussion on non-GAAP financial measures and reconciliations

contained in the Company’s MD&A for the most recent calendar

year and interim periods.

PDF

available: http://resource.globenewswire.com/Resource/Download/be8df2a4-4d56-4b11-8bda-399c3402d937

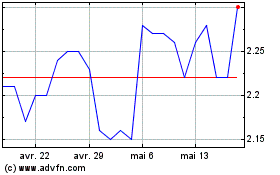

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025